Global Debt which cannot be repaid on the the basis of new demand and related jobs in an asset over-produced and over-valued saturated macroeconomy – will inevitably undergo default.

All assets are dependent on this bad debt for part of their valuation. Growth and decay of asset valuations within the self balancing asset-debt system undergo quantum time based growth and quantum time based decay.

The asset debt macroeconomic system made its transitional peak valuation day on 14 September 2012, the Wilshire’s secondary peak to its nominal high on 11 October 2007.

The Wilshire’s secondary high on 14 September 2012 was supported by competing US sovereign Ten Year Notes 280 basis point below those associated with the 11 October 2007 nominal high.

The Wilshire, representing only 15 trillion of the Global Asset Debt Macroeconomy’s 1000 trillion total wealth is an accurate proxy for the Total System in terms of directional asset valuation growth or directional asset decay.

13 September vice 14 September 2012 was prospectively picked as the Wilshire’s final high based on the Asset-Debt system’s countervailing asset : sovereign long term US Ten Year Note debt and its recurrent fractal x/2.5x/1.5-1.6x growth pattern since the early 1980’s.

14 September was in fact an exact x/2.5x/1.5x pattern of 4/10/6 days.

Intuitively, continuous growth in valuation of Hegemonic US Sovereign Debt (lower and lower trending interest rates and higher and higher trending valuations for US held bonds and US debt futures) is a natural occurrence as the Asset-Debt System’s total bad debt load becomes greater and greater.

This bad debt load which will not be repaid has been previously borrowed and spent in over producing assets such as real estate and causing overvaluation of existing assets. As well the facilitated creation of bad debt temporarily produces more demand and wage earners than the system would produce if more prudent 1930’s global rules were in place with regards to debt creation and speculation.

The temporary wage earners then become a targeted albeit temporary population of new borrowers – new borrowers in an excessively debt leveraged temporary economy with long term debt.

The system is inherently unstable because it is the primary business of the international Financial Industry to compete with each other for the population of debtors and to accumulate the maximum number and market share of counter party borrowers.

As the bad debt load of the system increases over time, Hegemonic US Sovereign Held Debt, which carries a 100 percent guarantee of repayment, increases in value with lower and lower interest rates

This is the end of a great US bad debt credit cycle starting in 1858. The time dependent evolution of the asset-debt system’s asset valuations are dependent in part upon the presumed value of the underlying bad debt load. Eventually with a slowing real economy and fewer wage dollars to support the bad debt load, incipient net default occurs where net credit expansion slows, reaches a critical zero velocity level, and thereafter contracts in an accelerating nonlinear fashion.

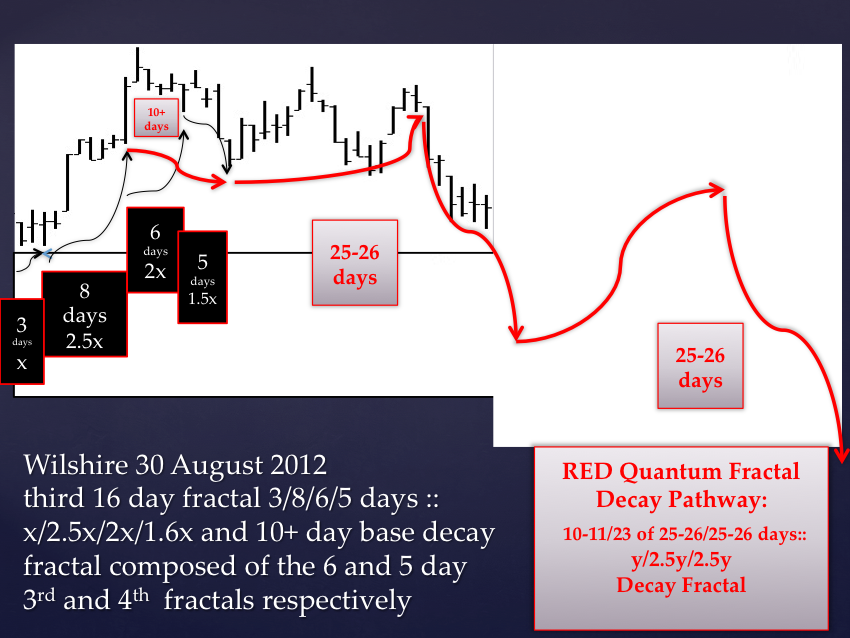

While this growing level of default of bad debt is either not accurately measurable or is but not well reported, the system’s proxy’s marker’s such as the world equities composite values, CRB, XAU, and TNX provide the integrated asset debt system’s summary data in the daily valuation band valuations and more exactly in their deterministic quantum self assembly fractal growth and decay patterns over their daily, weekly, and monthly self-assembly evolving fractal patterns.

These predictable growth and decay patterns afford the asset-debt macroeconomic system the qualities of a hard science. Perhaps fractal growth and decay is the nature of harmonic self assembly energy elements within the apparent void that is the observable physical universe.

During asset-debt system collapsed based on default of bad debt, the use of sovereign currency, directly traded for essential sovereign work and useful projects, is absolutely essential to moderate the consequence of collapse on the lives of the sovereign’s citizens. Use of sovereign currency directly traded for the sovereign’s citizen’s useful work has the exact effect of credit creation of good debt, i.e., that which will be circulated in the system and that which will be repaid.

Use of the sovereign’s currency traded for services offsets massive deflation and replaces a part of the massively vanishing bad credit and moderates the pathway of resultant debt-asset system’s asset devaluations.

A US Governmental, Central Bank , and Treasury 21st century modified Real Bills Doctrine whereby sovereign currency is traded for services is exactly what is needed to dampen the nonlinear contraction of bad debt load, exiting asset valuation collapse, and economic collapse.