(Updated 26 February 2023) Contained within the US Hegemony’s 1807-2074 36/90/90 /54 Year Great Fractal Series :: x/2.5x/2.5x/1.5x with lows in 1842/43 and 1932 and a 90 year high in (November) 2021 is an interpolated first and second fractal series of 13 (minus)/31 years :: x/2-2.5x starting in 1981. The first 13 year base fractal was composed of a 3/7/5 years series and the second 31 year fractal composed of two sub fractals: 3/7-8/7-8 years and 3/6/6/4 of 4 years.

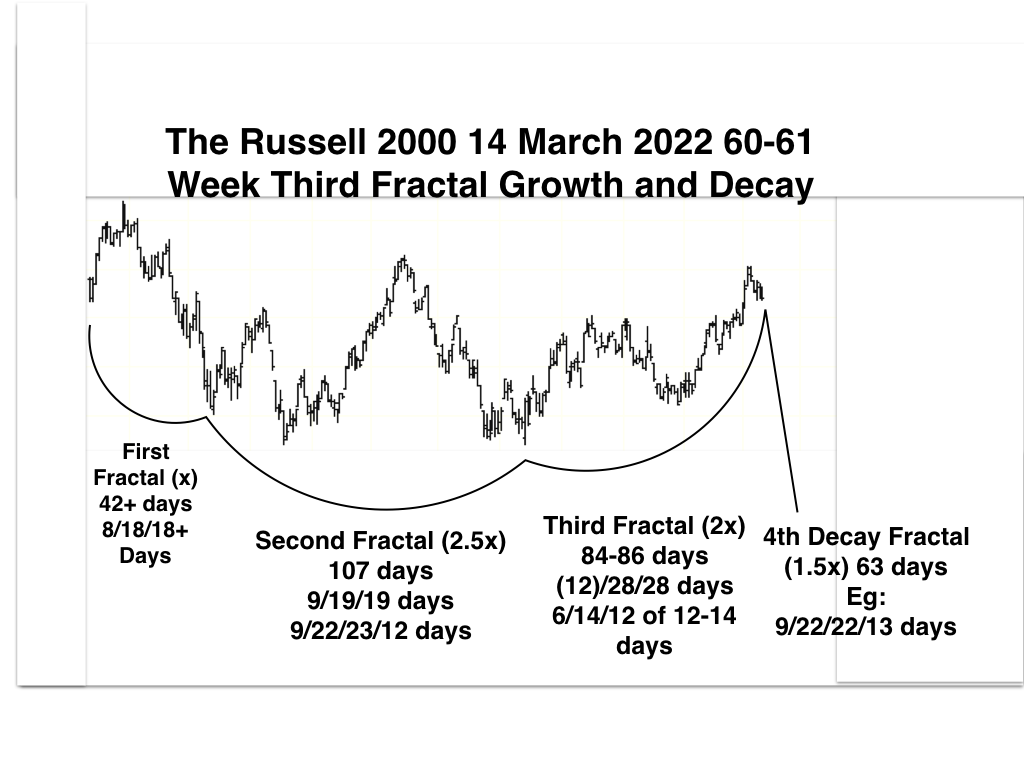

It is the assertion of this website that the asset-debt macroeconomic system self-organizes its nadir/peak valuation points into two elegantly simple and highly efficient mathematical valuation growth and decay time-based fractal patterns, either a three phase pattern or a four phase pattern. Nadir valuations define the time length of all fractal (subunit) in the three phase fractal series. For the four phase fractal series, nadir points define the time lengths of first, second, and fourth fractal subunits with a peak valuation point defining the third fractal subunit. The fourth decay fractal starts at the peak valuation of the third fractal. Cycles of debt and the money supply expansion grows asset variety and asset valuations until an intrinsic maximum production and maximum valuation peak is reached under prevailing interest rates conditions and consumer saturation; thereafter asset valuations decline as bad debt liquidation and asset overproduction, asset over-ownership, and asset over valuation causally result in a devaluation, (often nonlinear) of asset prices to a natural nadir valuation. The second fractal subunit of both the three phase and fourth phase fractal series is associated with nonlinear lower gap devaluations.

All of asset-debt macroeconomic system’s cycles described in the first paragraph represent large time scale yearly cycles falling into the macroeconomic system’s two ubiquitously observable, self-organizing, elegantly simple, time-based fractal patterns: either a four phase fractal series: x/2-2.5x/2-2.5x/1.5-1.6x or a three phase fractal series: x/2-2.5x/1.5-1.6x to 2.5x . Each subunit, i.e. , x, 2-2.5x, et.al., is described as a ‘fractal’ with four individual fractals in the four phase fractal series and three fractals in the three phase fractal series. Each yearly fractal can be subdivided in shorter time scale subunits , ie, quarterly or monthly, weekly, daily, hourly, and minutely with transient shorter time scale saturation buying peak valuations and saturation selling nadir valuations.

Large time scale qualitative money and debt expansion cycles occur via fractional banking lending, financial engineering via derivatives, CMO’s, CDO’s, et. al., lowered interest rates, recent QE programs associated with near zero to negative interest rates and outright money printing recently associated with central bank MBS’s. These money debt expansion modalities support cyclical asset creation and asset valuation. Central bank interest rate increases then contract debt and money growth. Fed funds rate increases have preceded the 2000 and 2008 bubble collapses. Unprecedented money growth during Covid is now being QT’ed in a historically unprecedented and accelerated fashion to combat consumer inflation. Whipsaw QE/QT operations wlll continue during the US’s 54 year Fourth Great Fractal from its November 2021 90 year (2.5x) high in response to the system’s asset valuation declines counterbalanced by the system’s interest rate, labor shortage, and commodity shortage dependent countervailing associated consumer inflation.

The interpolated 1981 13/30-31 year first and second fractals (interpolated among the larger 1807 US hegemonic Great Four Fractal Series) described in the first paragraph represent a period starting with US interest rates in the 17-20 % range with a ratcheting-down of interest rates to nearly zero (negative in Europe) associated with general asset growth and valuation appreciation for over 40 years. The 30-31 year second fractal of the 1981 interpolated 13/30-31 year two fractal series is expected to undergo a historical terminal second fractal nonlinear devaluation as described in the 2005 main page of this website.

Look to Gold in USD for the conclusion of the 13/31 year first and second fractal cycle with similar nonlinear devaluations in global equities, commodities, and crypto.

Gold from its monthly low: 13/32/26/ 19 of 20 months.

From gold in USD’s recent 29 day base fractal 29(x)//(19/46 = 64 = 2.5x’, ideal base x’ = 26 days)//1.5x’ = 39 days.

From gold’s peak 12 day base fractal 3/7/4 days; 12//(9/18 =26)//15 :: x/2-2.5x’/1.5x’ ending 31 March 2023 …

For US equities a March 2020 x/2.5x/2x ::28/70/56 week peak is being concluded by an interpolated 4/10/10/1 of 6 week :: x/2.5x/2-2.5x/1.5x fractal series ending 31 March 2023 with an equivalent daily series of 19/48/38/28 days :: x/2.5x/2x/1.5x.

Bitcoin in USD starting trading in Sept 2014. Its first fractal series is 30 months in length and is composed of two fractal subseries: (4)/8/8 months and 3/6/6 months. The second fractal is composed of two recurrent monthly fractal patterns 7/17/15 months and 7/17/14 of 15 months or 30/73 months and is following the same daily pattern as US composite equities with an expected low valuation on 31 March 2023.

Expect historical asset nonlinear devaluation.