Do the valuation of assets under the QE/QT parameters set by the central bank in response to recessions, asset valuation collapses, and countervailing consumer inflation, self assemble into defined time-based fractal patterns?

The argument for this proposition is contained under an identifiable US 1807 36/90/90/54 year ongoing umbrella quantitative x/2.5x/2.5x/1.5-1.6 fractal pattern with valuation lows in 1842/43 after the valuation asset high Panic of 1837, with the 90 year low in 1932 after the valuation high in 1929, and with the 1932 to 2021 90 year high valuation in (November) 2021.

The asset-debt valuation system’s two quantitative self-assembly patterns are composed of either one: a four phase pattern: x/2-2.5x/2-2.5x/1.5-1.6x which represents the big picture 1807 36/90/90/54-56 year US hegemony pattern or two: a x/2-2.5x/1.5x-2.5x three phase pattern. The nomenclature in identying the subunits of the 4 phase pattern are arbitrarily named as the first, second, third, and fourth fractal of the fractal series and for the three phase phase pattern, the first, second, and third fractal. Hence the 4 phase fractal is composed of 4 fractals (subfractals) and the three phase fractal is composed of 3 fractals(subfractals). With the central bank’s QT response to consumer inflation, the length of the second fractal of each series determines the ideal length of the first base fractal and hence the ideal length of the third (and fourth) fractal.

Since 1932, the third 90 year and fourth 54-56 year fractals are composed of two interpolated fractal patterns which also conform to the two patterns defined above. The first is a 10-11/20-21/20-21 year fractal series :: x/2x/2x ending in 1981-82 and the second series a 13/31-33/31-33/20 year pattern ending in about 2074. The 1981-1982 13 year base fractal is composed of a 3/7/5 year fractal series followed by two subseries: the first a 3/7/7 year fractal series ending in 2009 and a second 4/10/6-7 year fractal series ending in 2025 or 2026. The second yearly fractal series is composed of a series of interpolated monthly fractal series: the sequential monthly fractal series since 2009 have been 5/12/10/7; 3/8/6; 8/17/17; 10/26/16; and 7/17/14 of 17 ending in May 2023. A super-bubble second fractal nonlinear devaluation is expected in the 13/31-33 year time frame, whose second fractal nonlinearity is described in the 2005 web site opening page,

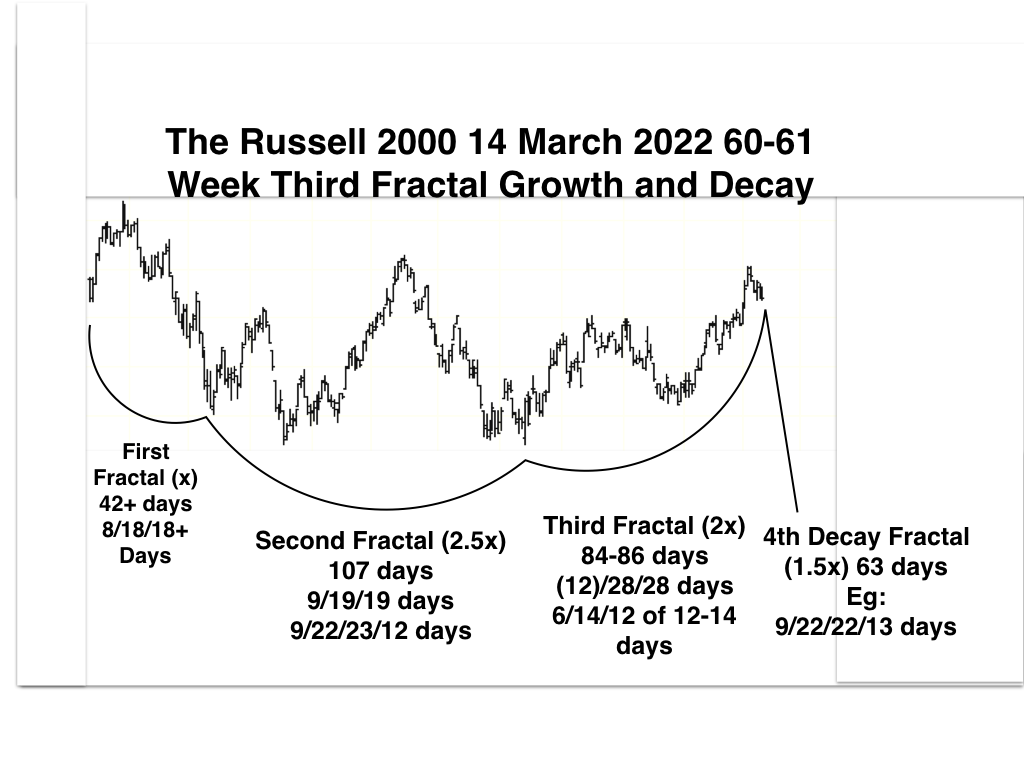

Since the March 2020 low valuation, the weekly fractal series is 33/72/49 of 60-61 weeks. With the historical QT to contain consumer inflation, the ideal base of the second 72 week second fractal was shortened to 29 weeks, which became the determinant base time period for the third decay fractal. The third decay fractal for the March 2020 three phase series started on 14 March 2022 and is composed of a 10/23/18 of 18/12-13 week series ending in May 2023. A global hard landing crash economic recession will generate another monthly fractal series ending in 2025 to 2026.

Using the the Russell 2000, from 14 March 2022, the 60-61 week third fractal is composed of 42+/107/84 of 84-86/63 days :: x/2.5x/2x/1.5x.

Over the next 63 trading days and ending in May 2023 expected a nonlinear crash in the 2009 US asset Super Bubble created by the US central bank through extraordinary QE and ex nihilo money creation activity.