The construct of a Global Macroeconomic System operating and self-assembling in a time based mathematical fractal progression of maximum asset valuation and debt growth and, thereafter at peak valuation, necessary and deterministic asset devaluation and debt default, which the elegantly simple Lammert quantitative fractal system provides, represents a useful tool for characterizing and understanding the complex integrative system.

Topics:

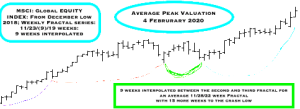

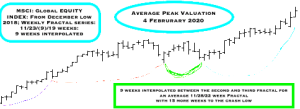

- 4 February 2020 : The average MSCI World Equity Index valuation high, MSCI in monthly, weekly, and daily fractals from the beginning of the final1982 second subfractal series 2009 third fractal

- The 1932 US Hegemonic Great Third Fractal Final peak bubble

- A comparison of the terminal 1921 and 2009 respective third fractal portions of the 90 Year Great US Hegemonic 1843 Second Fractal and 1932 Third Fractal Fractal

4 February 2020 : The average world equity Index valuation high (MSCI)current MSCI Lammert daily fractal series from its 2 October 2019 average daily low was 16/40/32 days :: x/2.5x/2x. The 32nd day of third fractal 4 February 2020 represents the current average peak high valuation for the index.

For MSCI, the world equity index, 4 and 5 February 2020 were the all time average and absolute peak valuation days of this index.

The monthly terminal fractal series from the adjusted nonQE supported and non troubled assets federal acquisition time frame in September 2009 is 26(orange)/53(purple)/49(green) months :: x/2x/2x. The third 49 month third subfractal is composed of 11/25/15 months with the 15 month third subfractal of this final 2009 subfractal series composed of 3/7/7 months :: x/2-2.5x/2-2.5x

The 3/7/7 months terminal third fractal represent a weekly fractal pattern since the December 2018 low of 11/23/(9)/19 weeks where (9) is a shared interpolated fractal between the second and third subfractal for a current third of a third of a third of 1932 US hegemonic 90 year third fractal series of 11/28/22 weeks : x/2.5x/2x. The terminal 22 weeks represents the third fractal subseries of this 11/28/22 weeks subfractal series.

By the simple saturation fractal math of the asset debt macroeconomic system, 4 and 5 Februrary 2020 appear to be peak saturation days for the global system.

The 1932 US Hegemonic Great Third Fractal Final Peak Bubble:

The final equity bubble of the 1932 US Hegemonic Great Third Fractal was created during the time period of 2008-2020 with a combination of illiquid trouble assets federal acquisition, Central Bank Quantitative Easing, Sovereign Money Printing, and Corporate Tax Slashing resulting in corporate buybacks of their own stocks. Part of the debt explosion has trickled down to the base population, who have then leveraged mostly newly created service jobs to incur citizen debt for student loans, automobiles and credit card purchases.

Very telling is that only 1.5 million US jobs have been added since 2000 averaging 75,000 a year with about 30 million boomers retiring since 2010. The system is a Ponzi scheme with the poignant exception that developed countries have the power to print money and honor their 90 year old social contracts with their working and tax paying citizens.

A visit to US Federal Debt clock provides perspective.

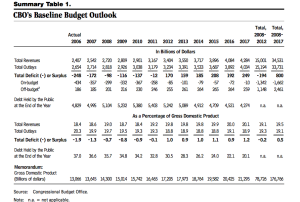

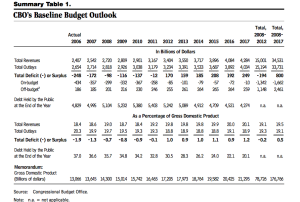

The CBO does not factor in its calculations expected fractal nonlinearities, bad debt liquidation, asset devaluation and expected recessions. A review of the 2006 CBO budget outlook (below) shows the disparity between projected deficits and ones that occurred with the collapse of the housing bubble. The 2008-2020 propelled bubble will be worse than this is the expected degree of nonlinear asset devaluation occurs.

The Great 1932 US Hegemonic Third 89 year Fractal series: is elegantly simple.

The US 90 year third fractal dating from the low in 1932 is composed of two subfractal series

- From the 1932 low ending on 12 August 1982 : 51 years

- And from the August 1982 low to present : 39 years

From 1932 to 1982: a x/2x/2x fractal series defined by valuation lows : 10-11/21-22/21-22 years is easily observable.

From the August 1982 low: 9/20/12 years

1982-1990 : 9 years

1990-2009. : 20 years

2009-2020 : 11+ years

The 4 and 5 February peak valuation days for the MSCI global index fell in the third 19 week fractal of a 24 December 2018 low 12/30/19 week :: x/2.5x/1.5-1.6x fractal series. A final 1.6x Fibonacci proportionality growth peak with a 12 week base lies in the terminal portion of a 18/36/90/89 year series and is a reasonable maximal growth terminus. This 11/20/19 week fractal series represents the terminal third portion of a 11 February 2016 low three phase subfractal series which is the third terminal portion for the 6 March2009 low which began the terminal major third fractal subseries and ended a 20 year second subfractal dating from 1990 to 2009 with a 9 year fractal base starting from the August 12 1982 valuation low and ending 1990. 12 August 1982 again concluded a 51 year 1932 to 1982 first fractal subseries of 10-11/21-22/21-22 years. 12 August 1982 began the second yearly subfractal series of 9/20/12 years of the 90 year third fractal of a 36/90/89 year series beginning in 1807 with a 18 year initiating fractal starting in about 1790.

The third of the third of the third of the … Lammert growth fractal

1932 : begins the US hegemonic Great Third Fractal (First US Great Fractal 1807 to 1842-43: 36 years; Second US Great Fractal 1843-1932)

1982: ends of first 51 year subfractal series starting in 1932: 10-11/21-22/21-22 years)and begins the second 39-40 year subfractal series.

1982 -1990 … first fractal of the second and final subseries : 9 years

1990-2009 … second fractal: 20 years

2009 to present … third fractal series: 11 years

A comparison of the terminal 1921 and 2009 respective third fractal portions of the 90 Year Great US Hegemonic 1843 Second and 1932 Third Fractals

The 11 + year terminal portion of the 1843 US Hegemonic Second Fractal as compared to the 11 + year terminal portion of the 1932 89 year US hegemonic Third Fractal.

1919–1921: Bear market. The Dow lost 46.6% of its value in just over 21 months, before reaching a low of 63.90 on August 24, 1921.

What was the stock market increase from 1921 to peak 1929?

Between 1921 and 1929 the stock market grew by 600% with the Dow Jones Industrial Average rising from 63 points to 381 points. This rapid growth was based on cosumer credit to purchase newly manufactured items and the practice of ten percent margin purchase of equities.

Great Depression’s DJIA maximum devaluation occurred on July 8, 1932; 32 months after its 1929 peak. On this day in 1932, the Dow Jones Industrial Average fell to its lowest point during the Great Depression, closing at 41.22. From its highest level in 1929, the Dow had a devaluation of nearly 90 percent.

The sharp stock market decline in the wake of the 1929 crash not only affected Wall Street. It also undermined consumer consumption as foreign trade, industrial production and employment fell precipitously for the ensuing decade. In political terms, it led to the 1932 victory of Franklin D. Roosevelt, the first Democrat to be elected president since 1916.

Aug 24 1921 to 8 July 1932 11 years – 2/12 months

6 Mar 2009 to current 7 Feb 2020 11 years – 1 month

6 March 2009: On this day, the Dow Jones Industrial Average hit its lowest point of the financial crisis of 2008 and 2009. The S&P 500 was trading at 683.38 and the Dow dipped as low as 6,469.95.

In March 2009, it seemed as if nothing could stop the plummeting stock market as U.S. investors feared the entire banking industry was on the brink of collapse. The largest U.S. banks had been bailed out by the government via the Troubled Assets Relief Program, and investors struggled to understand just how bad the situation was.

The current SPX high: 29,286.92. From its 2009 683 low, this represents a 450% rise.

The construct of the Macroeconomic System operating and self assembling in a time based mathematical fractal progression of maximum asset valuation and debt growth and, thereafter at peak valuation, necessary and deterministic asset devaluation and debt default which the Lammert quantitative system provides represents a useful tool for characterizing and understanding the system.