Google’s (Alphabet’s) Interpolated Self Assembly and Self-Similar Fractal Interpolation into the 1790-2073 284 Year US Great Hegemonic (18)/36/90/89/54 Year :: 0.5x/x/2.5x/2.5x/1.5x Fractal Series

Individual composite asset valuation Fractal units are defined by their easily identifiable composite nadir valuations. Nadir US Asset valuations in 1790, 1807, 1842-43, July 1932 and in July 2020 define the yearly demarcations of the respective 18/36/90 and 89 year fractal units. Self similar quarterly, monthly, weekly, daily, hourly, and minutely fractal series units compose the sub-fractal series that compose these yearly US Hegemonic Great Fractals. The 18 year fractal from 1790 to 1807 was an ‘initiating’ fractal sequence which has a self similarity and correlation to Google’s (now alphabet’s) emergence as an IPO entity on 19 August 2004.

Composite and individual asset valuation growth is dependent on debt expansion creation; hence the appropriate descriptive terminology of the Asset-Debt macroeconomic system.

When the leveraging bad debt is no longer repayable (US corporate debt in 2020), the valuation growth undergoes devolution to a nadir point with counter growth activity in the deterministic march to a yearly low.

The Asset-Debt Macroeconomic system follows simple mathematical fractal patterns whose exact counterbalancing growth and decay fractal repetitions elevate Macroeconomics to a science.

Reducing these patterned ‘laws’ to the two most inclusive and most basic self similar fractal series :

x/2-2.5x/2-2.5x/1.5-1.6x

*(the 3rd 2-2.5x sub-fractal in this 3 phase growth and one phase decay fractal series represents a peak valuation followed by 1.5-1.6x decay)

and

x/2-2.5x/1.5-2.5x.

*(the ideal third fractal length is the observed length of the second fractal divided by 2.5)

*(in the July 1932 89 year third fractal both peak growth valuation is closely followed by nonlinear decay occur near the terminal portion of the portion of 1.5-2.5x third sub fractal specifically the final months of the 89th year)

The final weekly fractal sequence ending the 1932 89 year US Great Third Fractal started in December 2018. The final weekly Fractal Crash Series: 11/28/28/18 weeks :: x/2-2.5x/2-2.5x/1.5-1.6x

The final 17-18 week fractal series is composed of a 3/7/6/1 of 5 weekly fractal series :: 2/2-2.5x/2-2.5x/1.5-1.6x series.

The final devolution ending in July 2020 will take the composite global equity indices, commodities denominated in US dollars, including gold and cryptocurrencies to a low 85 per cent below their 2020 peak valuations.

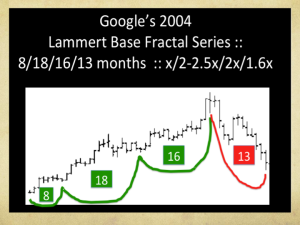

Google’s initial 8/18/16/13 month fractal starting on 19 August followed the x/2-2.5x/2-2.5x/1.5-6x pattern.

The 19 August 2004 8 month base fractal was composed of two 17 and 15 weekly sub-series or 31 weeks.

The first 17 week fractal sub-series was composed of 15/30/38 days :: x/2-2.5x/1.5-2.5x. The 15 week second of the two was composed of a 10/21/20/15 day :: x/2-2.5x/2-2.5x/1.5-1.6x fractal series. The total 31 week base fractal is composed of 133 days.

Self similar to the US 18 year 1790-1807 initiating fractal and its the US Base fractal of 36 years from 1807-1842-3 would have been a 4 month initiating fractal (66 days) starting on 17-18 May 2004. The ‘e’ funding based IPO was announced by its founders on 30 April 2004.

The monthly count for the first fractal was (4)/8/18/16/13 = 55 with 2.5x or 138 months as the expected maximum second fractal monthly length .

The 137 of 138 monthly second fractal is composed of 4 sub-series: 43//32/32/33 of 34 month series

a) 43 months = 5/11/7 + 3/8/8 + 2/4/5 (base subfractal of second 138 month fractal)

b1) 32 months = 6/12/10/7

b2)32 months = 6/13/15

b3) 34 months =5/12/12/ 7 of 8 (ending July 2020)

b1, b2, and b3 are the components of second sub fractal to the first 43 month sub fractal base. Notice that the 43/95 of 96 months second fractal is also of a configuration of a first and second x/2-2.5x fractal subsidies. Second fractal nonlinearity between 2-2.5 x characterizes second fractals. (See blog main page). The 55/138 month and 43/96 month nonlinearity are synergistic and timed with end of the 89 year end of the 1932 US Third Fractal in July 2020.

Google’s expected 138 month second fractal will end in July 2020. Google’s 55 month 5 year ‘first’ fractal served as the initiating base fractal for a 2.5x 13 year ‘second’ fractal which, like the US 1807 36 year first first fractal to its 1790 18 year initiating fractal series, is the ‘true’ first fractal for Google’s valuation growth ascent.

A 13/28/27 year :: x/2-2.5x/2-2.5x series (or 54 more years) would coincide with the end of the US Hegemonic Asset-Debt Fractal Series of (18)36/90/89/54 years in 2073 :: x/2-2.5x/2-2.5x/1.5-1.6x.

From the SPX March 2020 lows the weekly 3/7/6/1 of 4-5 :: x/2-2.5x/2-2.5x/1.5-1.6x fractal series corresponds to a final SPX daily fractal sequence of (1)3/7/4(13)//(29)//(26)//(1of 19)days :: x/2-2.5x/2-2.5x/1.5-1.6x.

The terminal low for composite equities, the CRB index, gold in US dollars and bitcoin in US dollars will occur on 18 July 2020 if trading halts don’t extend the final low valuations to a later July 2020 date.

This will end the 89 year US Hegemonic Asset-Debt Macroeconomic Third Fractal beginning in July 1932 and commence the 54 year US 4th Fractal.