As part of a 1807 US hegemony x/2.5x/2.5x/1.5x :: 36/90/90/54 year great fractal progression with nadirs in 1842/43 and 1932, and a peak valuation in November 2021, the valuation of the US progenitor and composite Wilshire has risen with post World War II US global money/credit expansion and with initially its enormous geopolitical and manufacturing dominance. Since the Volcker US peak interest rates in 1982, the Wilshire has been propelled by money and debt expansion from both the gradual 45 year lowering of US (and global) interest rates and later from direct central bank creation and ownership of debt and 2020 MBS’s and from historically low corporate and private debt interest rates tied to near zero fed funds rates whose combined QE effect fueled the post Covid equity boom.

While the US 3 month Treasury minus Ten Year Note has been inverted to a depth and monthly duration similar to the pre1929 equity crash, the SPX, ( but not the Wilshire which includes small cap equities), has peaked on 19 January 2024 to a new high. It is both the combination of end phase creation of service-based economy jobs associated with new debt creation and money dis-proportionally pouring into the SPX’s big 7 tech companies which have supported the SPX’s recent bubble peak valuation.

The 1807 36 year Wilshire progenitor First Fractal ended in 1842/43. The 90 year Second Fractal peaked in 1929 and nadir-ed in 1932. The 90 year 8 July 1932 Wilshire composite Third Fractal peaked on 8 November 2021 with a 54 year 4th Fractal expected to end in 2074.

The US 90 year Third Fractal and 54 year Third Fractal are composed of two interpolated sub-series: a 51 year fractal sub-series 1932 to 1982 of 10-11/22/21 years and a 1982 13/31-32/31-32/18-20 year fractal series ending in 2074.

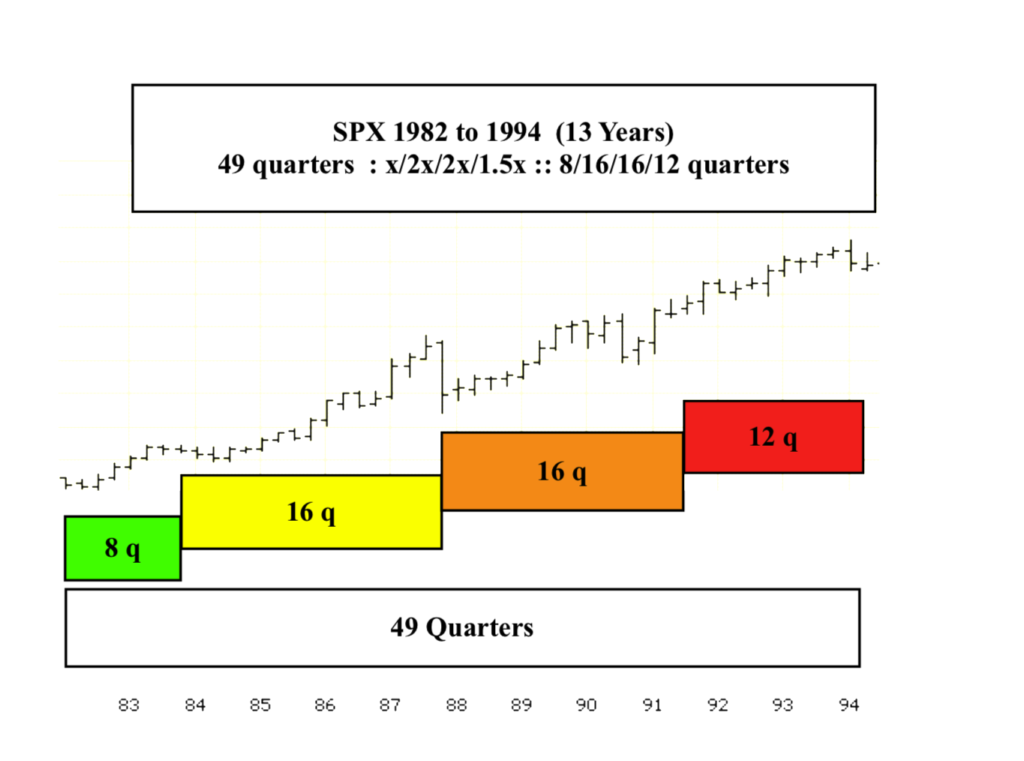

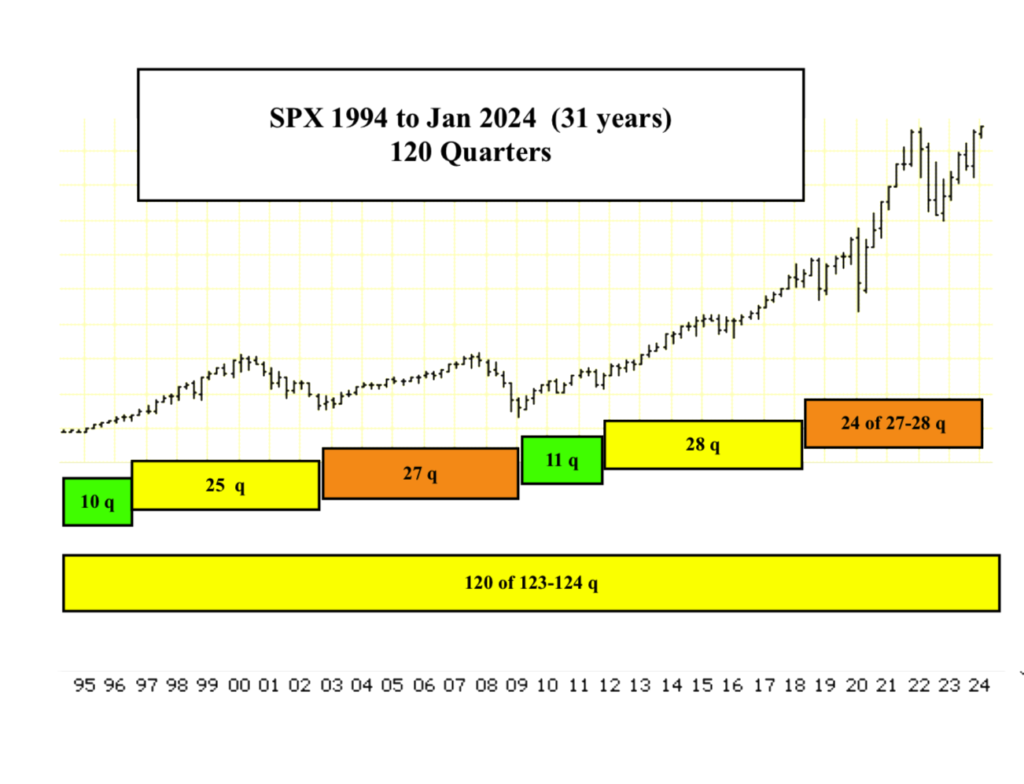

The graphs below show the quarterly fractal progression from 1982 of 49/120 of 123-5 quarters.

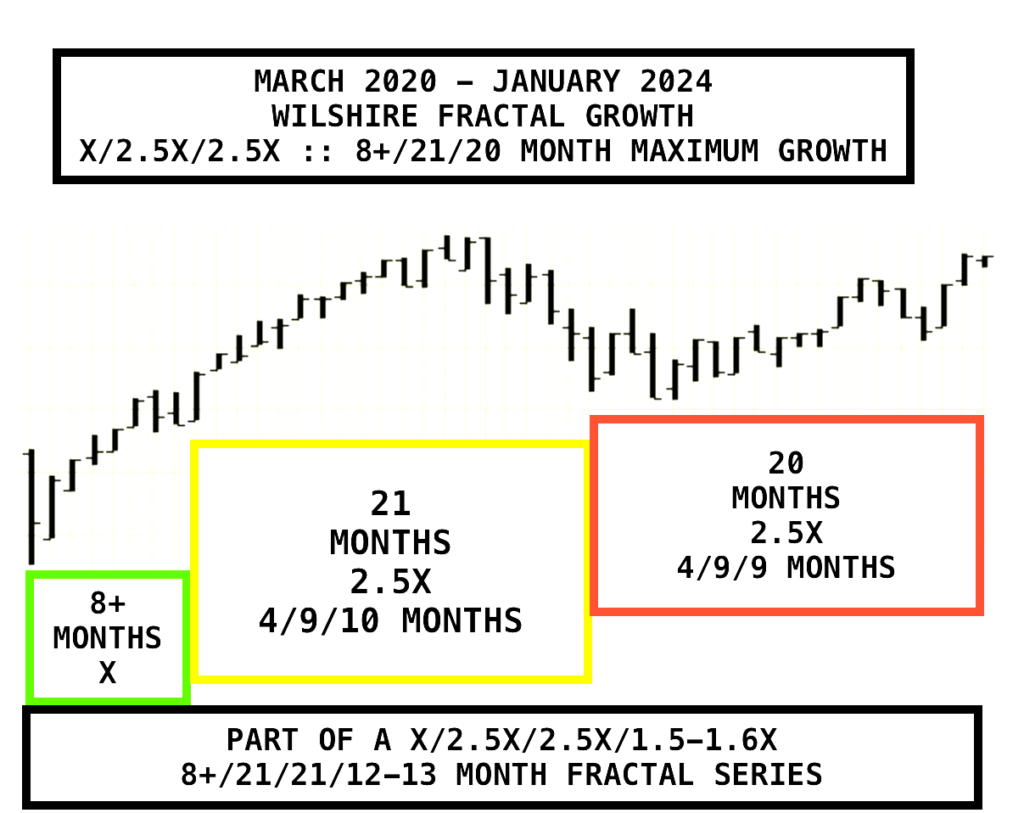

The monthly progression from March 2020 is 8-9/21/20 of 20-21/12-13 months :: x/2.5x/2.5x/1.5-1.6x