Monthly Archives: February 2015

Is Fractal Asset Debt Saturation Macroeconomics the New Patterned Quantitative Science of Global Economics? …. “Musings about an Economic Fractalist.”

Musings about an Economic Fractalist and Today’s Credit Implosion

admin | October 10, 2008 11:24 am

By Stormy

Gary Lammert’s prediction of a great crash may have been off by two plus years. Nonetheless, this economic fractalist, kept telling us to “expect the unexpected.”

While he spoke of vast fractals about to culminate in one great macroeconomic implosion and while his fractals seemed strangely divorced from anything I could understand, when he departed from fractal-mania, he was absolutely on target regarding the problem: Debt, debt, debt.

Here is his latest:

This nonlinear transformation will correspond to and represent a sudden implosion of the money supply. It will correspond to the timing of a credit collapse of debt that cannot be repaid, cannot be rolled over, cannot be remedied by further federal government debt, and will correspond to the realization that state governmental services that can not be maintained in the face of collapsing property values and property taxes and in the face of a rapidly collapsing private sector of the real economy. 9/22-23/22-23 is the daily fractal decay sequence that will rapidly introduce a realization that the Word’s greatest macroeconomic depression has arrived.

“Debt that cannot be repaid, cannot be rolled over, cannot be remedied by further federal government debt…”

I admire a good writer–and Gary’s baroque, yet balanced phrasing, is always a delight. I must confess that I am partial to those who handle the language with exquisite precision–a mark of a fine mind, I always thought.

Whatever you think about fractals or whatever you think about Gary’s making predictions two years too early, you should look carefully at his substance; forget the fractal-mania. Here is Gary three years ago:

The underperformance of the premiere summation American Index, the Wilshire 5000(TMWX), reflects the disproportionally negative integrative burden on the US macroeconomy of its valuation fractal determining elements – total quantitative personal, governmental, and corporate debt, the latter of which has become much more expensive to service under some behemoth’s new junk bond status; unpayable private pension funds soon to assumed by American taxpayers- of formerly great, soon to be bankrupt, US corporations; expensive war cost which have historically withered every prior major overextended world power, record lack of US collective personal savings used as a base for fractional lending, exhausted consumer discretionary spending running up against near record energy costs; outsourced high paying jobs and current wages not maintaining pace with inflation and debt servicing; siren enticing and predatory unregulated lending practices leading to asset consumption by a new group of extremely marginal buyers; rising short term interest rates; the cresting of valuations of the US ATM – equivalent asset, i.e., housing overvaluation; and recent massive forward consumption of corporate profitless US automobiles akin to a python eating its semiannual one time big pig bolus meal.

I would be the first to say that his fractals need a lot of work if they are going to be really predictive. But what economist is ever predictive? Only God could write an equation accurately predicting economic events. Strip out the fractals.

In one mighty baroque sentence, each item in the series hanging delicately and clearly after the last and each appositive carefully crafted, he manages to collect almost all the issues that have now bubbled to the surface. Perhaps the very exercise of doing fractal economics gave him insight, however murky.

In December, 2005, he warned that a crash might be coming:

Macroeconomic turning points are not caused by changes in mass psychology. Rather mass psychology is a dependent variable that is causally changed by the transitioning major economic conditions that exist and characterize the asymptotic saturation level and the money creation peak area of the cyclical complex debt-money-asset macroeconomic system. It is at this peak transition saturation and inflection area that the collective ongoing wages of the masses of earners can no longer support additional debt load to acquire overvalued and overproduced assets. It is at this point that retrenchment and devaluation occurs. It is here where fractal growth levels off or reaches a zenith point ….and thereafter decays usually with an incipient nonlinear deflationary crash….. Mass psychology then follows the macroeconomic mechanistic debt liquidation – asset deflation optimal fractal decay evolution.

On April 21, 2006, he issued his first of what were to be the first many warning: “More Than Ever… Expect The,,,, Very Unexpected …. The Unbalanced Global Macroeconomy …… And The US Long Term Debt Market.”

Gary nailed the problem, put it up there for everyone to see.

Unfortunately, many suspected that Gary saw fractals as causative, not merely descriptive.

Commentators laughed at his warnings, scorned his fractals, and finally left him to work alone and undisturbed. Put a comment up on his website and you will get no reply. (He did change websites.)

Although he framed the picture perfectly, I think finally he himself had to question whether even fractals could be perfectly predictive. (Off by a couple of years…oops.) In truth, I am not sure what he privately thinks about the fractal science he relentlessly pursues.

If publicly he had omitted the fractals–kept them on his working bench, using them only as his private tools–and then offered more conventional rationales of why the big picture he saw was so dangerous, he might have done better.

Instead, he pushed the core argument back to fractals, a mistake, I think. In trying to prove a mathematical point, he failed to deliver his message. Sometimes I suspect he sees the world as one giant mechanism, rolling along fractally-governed, predetermined lines. While this may be true, that vast fractal has to be beyond comprehension.

Be all this as it may. I find him to be one of the most fascinating and most interesting minds on the Internet.

Too many of us sound like each other. Gary stands brilliantly apart. Unlike many of our leaders, I am sure recent events have not surprised him.

Comments (6) | Digg Facebook Twitter | Share

More From Us

Angry Bear » Unemployment Rate: Clinton v. Bush43

Angry Bear » Amity Shlaes: Sarah Palin with puffed up academic credentials

Angry Bear » The Cactus Theory of Development

Angry Bear » EconTalk Jumps the Shark

Angry Bear » Engaging voters in assunptions…

Angry Bear » Competing GOP Tax proposals Graphic

Angry Bear » The Taper Tantrum

Angry Bear » Monetary Policy: Abandoning a Gold Standard for an Oil Standard

Recommended by

From Our Partners

Men Having Sex With Life-Like Female Robots: The End Of Human Relationships? (Market Daily News)

Santelli & Schiff: “A Messy Exit Is A Given… Ending QE Will Plunge US Into Severe Recession” (Investing Channel)

27 Facts About The Middle Class In America After 6 Years With Obama In Office (Market Daily News)

From Around the Web

A Third Grader and Obama in the Oval Office (Goodnet)

3 Companies Poised To Explode When Cable Dies (The Motley Fool)

This New Investment Firm Lets You Pay Whatever You Want For Its Service (Business Insider)

Recommended by

Comments (6)

Anonymous

December 19, 2009 5:46 pm

document.write(‘Your request is being processed…’); Your request is being processed… T

faqFAQs photo theeconomicfractalist

Posts on Huffington identifying the 11 October 2007 millenium Wilshire high

Member Since October 2005

Smart Advice for the HuffPost Investor

The Great Wilshire Saturation Fractal Pattern The current Wilshire fractal pattern…… On 11 October 2007 the Wilshire gapped in a minutely fashion at the day’s opening above its previous day’s closing high and to a new record high. At its close it was near the low of the trading day and below the preceding day’s close. This exhaustion gap activity for the Great Wilshire occurred on 40th or 2x day of the defined 20/49/40 day saturation fractal series. From the lows on day 40 on 11 October, a perfect 6/14/12 x/2.5x/2x 15-minute unit fractal can be easily observed taking the Wilshire to its close on 12 October 2007. Even with the pricing aberration and fractal caricaturization associated with the largely unanticipated 0.5 per cent Fed Funds rate cut, if the Wilshire’s price-volume-time multiple and area under the curve for July 2007 ultimately exceeds that of its recent October price-volume-time integration, the 11/27/22 monthly Wilshire high will maintain its position as the price-volume-time composite valuation high for the asymptotic area of Wilshire’s saturation curve – proxy for the global macroeconomic system. Will the 20/49 40 day fractal series proceed further …. to 20/49/49-50? Not likely.

posted Oct 14, 2007 at 10:34:17

Australian Dollar Hits 23-Year High Against US

Generational US Consumer Saturation Macroeconomics – 11 October 2007: the Top Valuation Day for the Wilshire ?; near the final weekly low for the US dollar? Watch for an opening day trading gap to the all time high for the Wilshire on 11 October with a closing at the low of the day. While the US dollar will likely be lower against other fiats and gold, it is near its multiweekly nadir.

posted Oct 10, 2007 at 22:23:35

g lammert

May 26, 2011 8:06 pm

The Great Silver Crash of 2011 26 May 2011: completion of the Second Fractal 16 Days Lower High

Both equities and Silver will crash starting Friday 27 May 2011. Both are following the same decay pattern.

Silver is useful because of the very defined fractal pattern of its 2x or 16 day second fractal of its 8 day base.

Observe the fractal pattern within the 16 day 2x pattern to its secondary high: 2/5/4 days and 2-/4/4 days its 26 May lower high.

An 8/16 day pattern was completed on 26 May 2011.

The 2x-2,5x 17 to 19-20 day crash begins.

g lammert

November 12, 2011 8:20 am

The Saturated Debt-Money-Asset Macroeconomic System’s Patterned 1982 First and Second Fractal Series Patterned Historical Nonlinear Crash.

The Macroeconomic debt-money-asset system: an operating empirically patterned science….

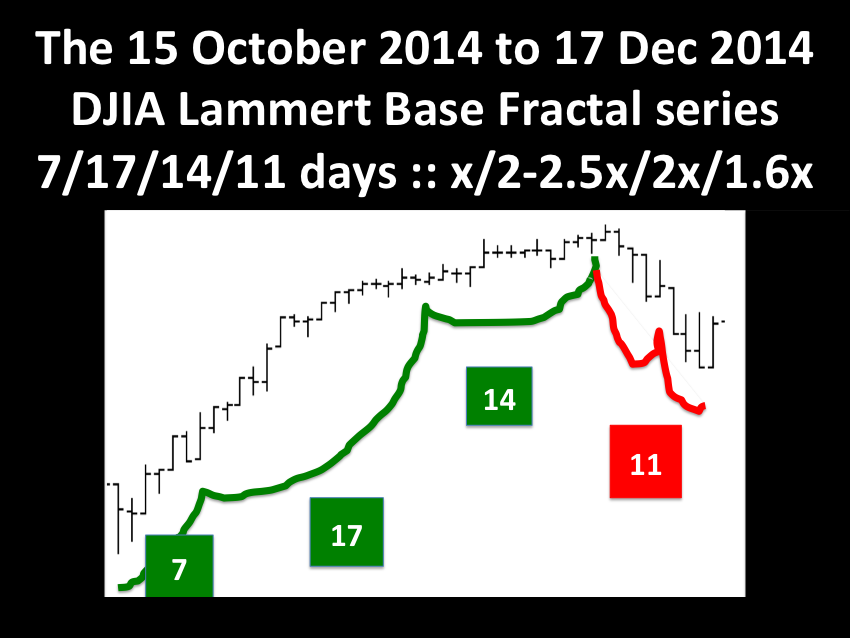

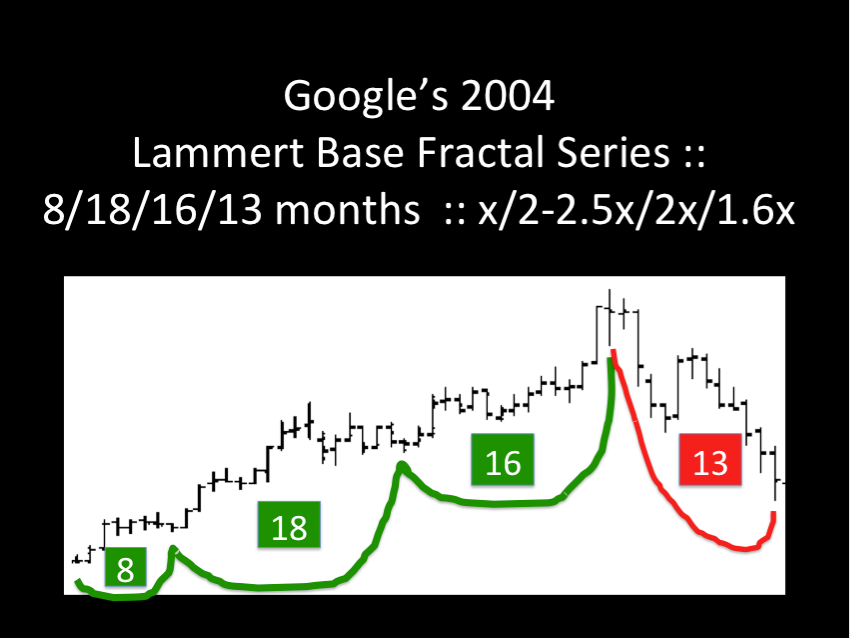

The Wilshire: March 2003: 18/44/45 of 45 months :: y/2.5y/2.5y; Aug 2004: 15/37/38 of 38 months :: y/2.5y/2.5y; March 2009: 5/12/10/8 of 8 months :: x/2.5x/2x/1.6x; Feb-Mar 2011: 7/17/14 of 17 weeks :: y/2.5y/2.5y; Aug 2011: 3/7/6 of 5-7 /1-2 of 4-5 weeks:: x/2.5x/2x/1.5- 1.6x.

theeconomicfractalist.blogspot.com/

The greatest collapse of asset prices in the history of the world is coming. Retrospectively, it will be viewed in terms of the collapse of Euro system for 500 million people and that system’s interconnectivity with the world currency, debt, and asset valuation systems.

But the rules of the system – partially corrected in the early 1930′s with Glass Steagall and less than two decades after Wall Street’s puppeteers had linked forces with a few politicians and created a privately held, incredibly lucrative ‘United States labeled’ central bank for the purposes price stability and full employment .. whose manipulations in debt market rapidly resulted in a caricature of capital markets with overproduction of assets, overvaluation of derivative of assets, system fostered easy citizen credit creation, asset over ownership, financial scheming …. and finally collapse into deflationary depression – the 1930′s Glass Steagall corrective rules of the system were again overturned in the 1990′s by lobbied well greased politicians, by an imprudent, over powerful central bank chairman, and by the unimaginably avaricious financial-banking industry who because of its sole laundership and management of United States debt have become indispensable – absolutely indispensable- to the international US bond holders and dollar holders: owners of the greastest virtual IOU asset class on the globe.

With the repeal of Glass Steagall, the financial industry once again was empowered to make money out of nothing recreating the roaring twenties with computerized leverage and manipulation of the monetary system, easy credit thru the GSA’a, creating the current historical mess and grotesque gross equilibrium of too too many assets, too many enserfed underwater mortgage owners, and unimagible unrepayable debt … all sitting on a five mile high November 2011 unstable crumbling mountain ledge about to break with resultant unimagible nonlinear collapse of asset prices (except US long term debt).

The 1982 34/85 of 85 quarter Wilshire first and second fractal series ends October – December 2011 and will reduce the bad debt leverage of the last 29 years for the Wilshire and reduce it nonlinearly over a period of less than 3-4 weeks.

Are these recurring patterns for the Wilshire concluding the 1982 34/85 of 85 quarter :: x/2.5x first and second fractal with expected 85th quarter nonlinearity in November -December… occurring by chance and by chance alone?

March 2003: 18/44/45 of 45 months :: y/2.5y/2.5y

August 2004: 15/37/38 of 38 months :: y/2.5y/2.5y

March 2009: 5/12/10/8 of 8 months :: x/2.5x/2x/1.6x

Feb-Mar 2011: 7/17/14 of 17 weeks :: y/2.5y/2.5y

Aug 2011: 3/7/6/1 of 4 to 5 weeks:: x/2.5x/2x/1.5 -1.6x

Are these patterns an hourly, daily, weekly, monthly, quarterly, yearly self assembly self organizing integration of the debt-money-asset itself, […]

the economc fractalist

February 19, 2012 2:40 pm

24 February 2012 and 11 October 2007 :: The Wilshire’s identical x/2.5x/2x reflexic Peak Fractal Patterns And Valuation Days?

Validation of Nonstochastic Stauration Macroeconomics

http://www.economicfractalist.com/

From monthly nodal low to nodal low the Wilshire’s March 2009 to October 2011 fractal pattern conformed to the x/2.5x/2x/1.5-1.6x pattern :: 5/13/10/7 months as described in the 2005 Main Page of the Economic Fractalist.

The composite Wilshire’s decline to the March 2009 low was a pre-event to the nonlinear event predicted in the first paragraph of the 2005 Main Page of the Economic Fractalist.

From 2008 through 2012 the US and the world have reached a debt saturation asymptote and have reached a depletion condition in the pool of potential borrowers.

Is there a relationship between the equity, commodity, and debt markets to the total accumulated debt of the system?

The short answer is yes in terms of absolute quantitative valuation gains during asset valuation growth periods and losses during decay periods.

Is there a timing relationship between the market’s asset valuation progression and total accumulated debt?

The interesting answer is, empirically, likely not.

Valuation growth and decay are integrative, interpolative, and continuous processes. Fractal valuation growth incorporates terminal valuation decay. The larger the time units, for instance, years verses months, the more accurate the fractal pattern as, for instance, the nodal low for a year will often incorporate several of months of declining valuation.

From monthly nodal low to nodal low the Wilshire’s March 2009 to October 2011 fractal pattern conformed to the x/2.5x/2x/1.5-1.6x pattern :: 5/13/10/7 months described in the 2005 Main Page of the Economic Fractalist.

The hallmark of the patterned science of saturation macroeconomics is second fractal sudden nonlinearity. The Wilshire flash crash of 6 May 2010 was a second fractal nonlinear event of a March 2009 – August 2011 19/47/38/27 week :: x/2.5x/2x/1.5x. Second fractal nonlinearity occurred near the terminal portion of the second fractal between 2x and 2.5x and on the 44th week of the 47 week second fractal. The second fractal 47 weeks had a lower low on week 52.

Observe the integrative function of the larger fractal time units i.e. months verse weeks using the the March 2009 to October 2011 low to low. A 5/13/10/7 month fractal x/2.5x/2x/1.5x is observed and has its 13 month second fractal low on week 52 cited in the paragraph above.

Finally a further monthly interpolation is observed with the Wilshire 31 August 2010 second fractal nodal low. The March 2009 5/13/10/7 month Wilshire fractal is interpolated in a February 2009 6/15/12/8 of 9 to 10 month fractal which can be observed easily in the Nikkei composite. This correlates to a 24/60-61/48-49/30-31 of 36-40 week fractal for the Wilshire.

The ideal daily 2009 to 2012 interpolated 4 phase Wilshire fractal daily series (defined by the length of the second fractal) is:

1st interpolated fractal 23 Jan 09 31 + 86 days = 116 days (ideal 2.5x = 290 days)

2nd fractal fractal 2.5 x = 1-3 + 221 + 69 = 289-291 days (8-10 July 2009 to 31 August 2010)

3rd fractal fractal 2x = 232 days = ending 1 August 2011

4th decay fractal 1.5-1.6x = 174 -187 days expected starting from 1 August 2011 […]

G Lammert

March 17, 2012 6:32 pm

Before The 19-20 March 2012 Crash: The Nikkei’s Integrative March 2003 20/50/40 Month :: X/2.5x/2x Lammert Fractal Growth Series

Part 1

Mar 17, 2012 2:55 PM

Before the 19-20 March 2012 Crash: The Nikkei’s integrative March 2003 20/50/40 month:: x/2.5x/2x Fractal Growth Series

The Absolutely Integratively Mathematically Elegantly Interpolated Ideally Time Fractally Patterned Asset Valuation Self Organizing Debt-Money-Asset Macroeconomic System

Terms:

Absolutely:

an adverb describing something that is so well empirically defined that doubt recedes, approximating zero

Integratively Mathematically Elegantly Interpolated:

Long adverbial series describing the nature of Fractal Interpolation whereby the system self organized and averages growth in terminal decay and decay in terminal growth. Nodal valuation lows define fractal groups; Two adjacent groups may share adjacent nodal lows and hence be interpolated with the nodal low to nodal low shared and averaged between the fractal groupings.

Time Fractally:

fractally, an adverb used to describe an entity where the shape of smaller scale units compose serially larger scale units which have the same shape of the smaller scale unit and of each other. In the asset valuation money-debt-asset macroeconomic system, trading time is the entity with trading fractal patterns in minutes similar to days to weeks to months to years.

Ideally Fractally Patterned.

ideal four phase Lammert fractal pattern

The ideal Lammert asset valuation curve denominated in fractal time pattern is a four phase time fractal evolution: x/2x-2.5x/2x-2.5x/1.5-1.6x.

The first three time fractals are asset valuation growth patterns reaching asymptotic highs before final decay within the fractal time unit and the last fractal (4th fractal) is a decay fractal reaching an asymptotic asset low valuation after 1.5-1.6x of time. The debt-money-asset macroeonomic system is characterized by a nonlinear asset valuation decline in the terminal portion of the second fractal between time 2x and 2.5x. (bolded and underlined in the following: x/2x-2.5x/2x-2.5x/1.5-1.6x).

Lammert second fractal terminal nonlinearity

The debt-money-asset macroeonomic system is characterized by a nonlinear asset valuation decline in the terminal portion of the second fractal between time 2x and 2.5x. (bolded and underlined in the following: x/2x-2.5x/2x-2.5x/1.5-1.6x). The May 6 2010 flash crash represented terminal second fractal nonlinearity, now viewed in a larger scale perspective od the Nikkei and Wilshire march 2003 20/50/40 month integrative fractal sequence. The Wilshire is in the terminal portion of a 23 year second fractal of a 1982 9/23 year :: x/2.5xfirst and second fractal series and in the terminal portion of a 155 year second fractal pf a US Wilshire and progenitor 1789 70/154 year first and second fractal series. On a much smaller time scale the Wilshire is in the terminal second fractal area of a 4 October 2011 38/77 day :: x/2x first and second fractal series,

ideal Lammert decay fracal patterns

The Ideal Lammert time decay patterns are A. y/2y-2.5y/2y-2.5y with the third fractal 2.5y reaching a lower limit asymptotic valuation.

As well decay can occur in a B. deteriorating x/2.5x/2x/1.5-1.6x fractal pattern.

Special rule advantaged assets:

Equities within the debt-money-asset system have been provided special tax advantaged rules that draw in speculative money from the asset-money-debt system more than any other convertible asset; money, debt, and assets are all assets in the system.

Because of their […]

G Lammert

March 17, 2012 6:37 pm

Before The 19-20 March 2012 Crash: The Nikkei’s Integrative March 2003 20/50/40 Month :: X/2.5x/2x Lammert Fractal Growth Series

The causal debt-money-asset macroeconomic system… at a historical saturation – daily, weekly monthly, yearly. decadely – time area. The unexpected phase transitionfor the masses is nigh……

http://www.economicfractalist.com/

Mar 17, 2012 2:55 PM

Part 2

Before the 19-20 March 2012 Crash: the weekly integrative interpolated sequence of the third 40 month fractal of the Wilshire’s March 2003 averaged 20/50/40 month fractal series.

The Wilshire’s third 40 month fractal is composed of a

x/2.5/2.5x/1.5-1.6x :: 25/62/62/37 of 38-40 weeks

First fractal: 25 weeks

Initiating base first fractal 4/10/8/6 weeks ::x/2.5x/2x/1.5x or 25 weeks

Second fractal: 62 weeks

Composed of 19/44 :: x/2.5x weeks

the flash crash occurred in the 44th week

Third fractal 62

composed of 18/45 :: x/2.5x with a high on week 62 . (part of a x/2.5x/2.5x reflexic growth fractal)

4th fractal of currently 37 weeks is composed of a reflexic fractal series of 7(6)/17(16)/(17)

The Wilshire’s 25/62/62/37 week :: x/2.5x/2.5x/1.5x 4 phase series is a weekly reflexic fractal series that completes the March 2003 20/50/40 monthly fractal series and has taken the Wilshire to a 11 October 2007 secondary high.

While the Wilshire’s Sept 2008 25/62/62/37 week reflexic fractal series matching a 27 June 2011 31/77/77 day :: x/2.5x/2.5x has nearly all speculators maximally committed to the rule advantaged equity market, the larger March 2003 Wilshire and Nikkei averaged and interpolated

20/5040 month x/2.5/2x Lammert fractal, composed of these psychologically misleading terminal interpolative reflexic fractal, is complete.

For the nonscientists, expect the unexpected.

Qualitatively consider the world debt that is an asset and soon will undergo default and vanish from the the asset-debt-money system. Remembering that debt is a part and an asset of the system, the system wealth denominator is on the verge of a sharp contraction with rippling deflation of all assets except printed money and high quality debt(US superpower debt.)

.

This will be historical nonlinearity and the system’s empirical fractal time quantum patterns have so predicted the collapse.

For the scientists, who look for the patterns that describe and are the universe, expect the expected.

Post Comment

Featured Stories

US 76, EU 6

Kenneth Thomas

Stock Buybacks and the Equity Premium

Robert Waldmann

Federal Reserve SOMA Holdings of the Long Bond

Bruce Webb

An Honest Guess about G and GDP in 2014q4

Robert Waldmann

Contributors

Beverly Mann

Bruce Webb

Dan Crawford

Daniel Becker

Edward Lambert

JazzBumpa

Ken Houghton

Kenneth Thomas

Linda Beale

Rebecca Wilder

Robert Waldmann

Bill H

Spencer England

Steve Roth

Doug Higgins

Subscribe

– See more at: http://angrybearblog.com/2008/10/musings-about-economic-fractalist-and.html#sthash.MYTHgK1k.dpuf

https://mustnotkill.bandcamp.com/releases

Qualitatively … Very Near the March 2009 210 Year US Second Fractal Low…..

http://www.ritholtz.com/blog/2009/03/robert-shiller-on-animal-spirits-how-psychology-drives-the-economy/