The Asset-Debt Macroeconomic system is deterministic in its time-based fractal self assembly of its composite asset valuation growth and decay.

There are two observable time based self-ordering simple mathematical fractal series: a 3 phase fractal series of x/2-2.5x/1.5-2.5x and a 4 phase fractal series of x/2-2.5x/2-2.5x/1.5-1.6x. The fractal subunits are defined by nadir valuations with the exception of the 4 phase fractal series whose 3 subunit terminus is defined by a peak valuation or lower high valuation.

For the US Hegemony, a 4 phase long term fractal series undergoing self-assembly is observable as an 1807 series of x/2.5x/2.5x/1.5x with the value x equal to 36 years. Nadir valuations occurred in 1807, 1842/43, and 1932. The 2.5x 90 year third subunit high occurred in November 2021 with an expected low in 2074 for a completed 1807 series of 36/90/90/54 years.

Interpolated in this large 1807 series is an 1981 13/32/32/20 year series ending in 2074. An abrupt ending in the 32 year second fractal of this series is expected.

QE and money printing since 2009 with enormous acceleration in March 2020 and thereafter unprecedented money supply contraction in March 2022 has set the asset grossly-overvalued system for a colossal abrupt 31-32 year second fractal nonlinear devaluation.

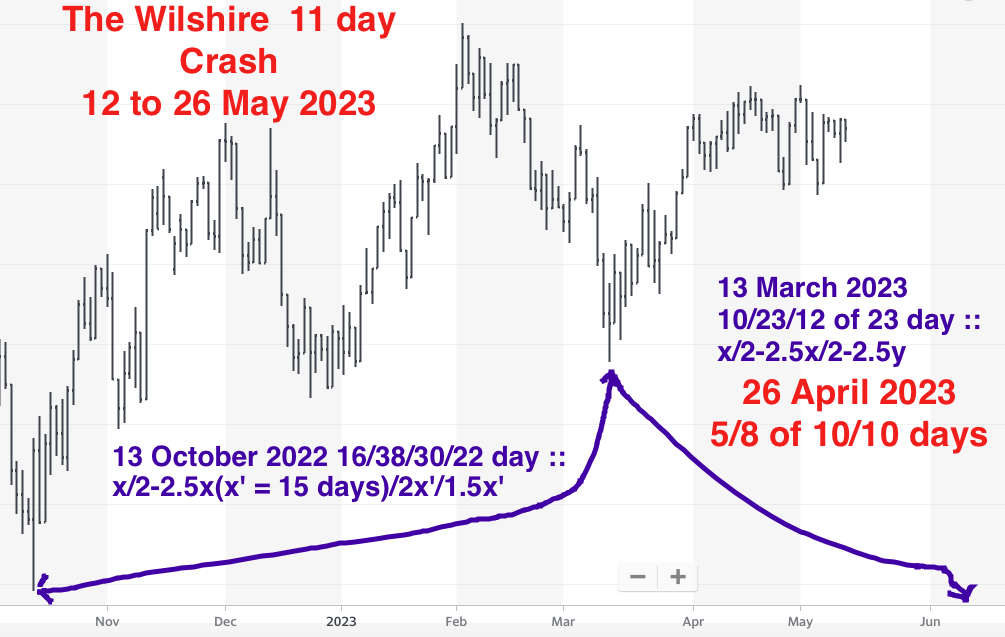

The Wilshire is following a 23 March 2020 28/71/68 of 70 week growth and decay fractal pattern with an expected crash devaluation in the next 11 trading days and ending on Friday 26 May 2023. The nadir devaluation dates defining the 28 week first and 71 week second fractals are 9/24/20 and 1/24/2022, respectively. The third fractal of 70 weeks starts on 24 January 2022 and is composed of three subseries: 7/15/18 weeks; 4/9/8/6 weeks and 2/5/3 of 5 weeks, The 4/9/8/6 week series starts on 10/13/22 and is composed of 16/38/30/22 days ::x/2-2.5x/2x/1.5x.

The final 2/5/5 weeks series starts on 3/13/2023 and is composed of 10/23/23 days. The final 23 day third fractal starts on 4/26/2023 and ends on 26 May 2023.

An additional 42 week lower low series would complete a 1993 – 2024 32 year second fractal and a March 2020 28/71/70/42 week series. Rapid lowering of fed fund rates are expected after the crash devaluation.

The WILSHIRE 5000 daily below