The Mathematical Deterministic Fractal Science of the Global Asset-Debt Macroeconomy

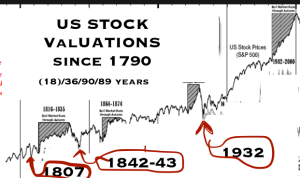

In 1790, organized auctioneering and trading in New York began forming the US progenitor NY stock exchange. With the Buttonwood agreement in 1792, trading was formalized with simple rules. Thus began the deterministic fractal progression of debt assisted US asset valuation growth, overvaluation, over-ownership and inevitable deterministic decay.

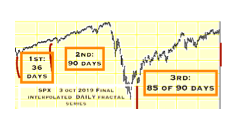

The 18 year 1790-1807-08 initiating fractal series ending in the US depression of 1808 to 1810, preceded the current 1807-1808 US Hegemonic 36/90/89 year fractal series and is self similar to a 9 September 2019 18 day fractal sequence preceding the current 3 October 2019 36/90/90/58 day sequence.

28 October 2020 concluding a daily (18)/36/90/90/58 :: x/2.5x/2.5x/1.6x 4 phase fractal series will self similarly conclude the third 89 year fractal of a US Hegemonic 1790(18)/ 36/90/89/58 year four phase fractal series.

Friday 7 August 2020 was the 90th day of 2.5x third fractal growth of a 3 October 2019 36/90/90/ 58 day : ;x/2.5x/2.5x/1.6 x fractal series terminating the self similar 1932 89 year third fractal of a 1807-08 36/90/89/58 year US Hegemonic fractal series.

Above depicts the SPX on 2 August 2020. Friday 7 August 2020 was the 90th peak growth valuation day.

The peak growth to day 90 occurring on 7 August 2020 for the SPX resulting in a lower high valuation to its 19 February 2020 peak valuation was deterministically created by gross money fabrication and globally and historical lower sovereign interest rates with , for example, the German 30 year bond yielding a negative 0.09 interest on Friday 7 August 2020.

The ideal 1.6x 58th day low would occur on Wednesday 28 October 2020.

This 58th day 4th decay fractal ending the 1932 89 year US Hegemonic Third Fractal is quantitatively self similar (time wise) to a 1807 US Hegemonic 58 year expected Fourth Fractal ending in 2077 transpiring with historically low and negative rates for sovereign debt instruments; financial engineering by sovereigns, central banks, financial industries, and corporations; and further equity and commodity bubbles, elevated by the debt creation by those named entities.

The Fourth US Hegemonic Fractal from 2020 to 2077 will be an Asset Debt Macroeconomic era marked by historically disproportionate money and debt creation.