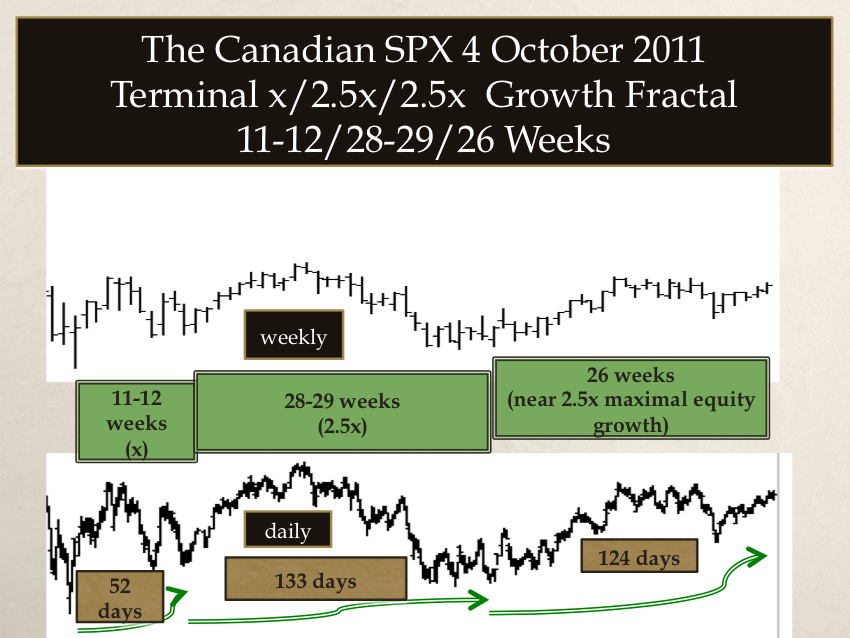

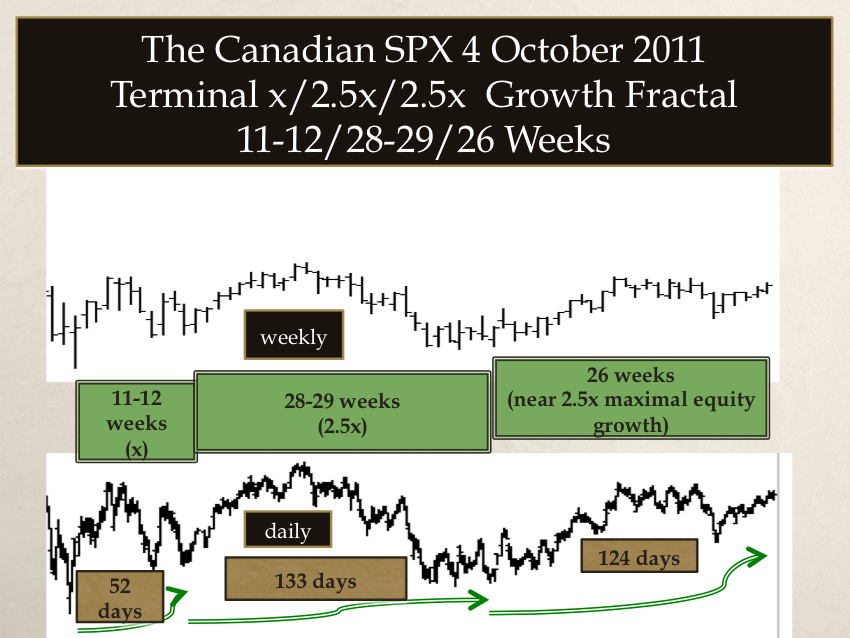

The Canadian SPX growth pattern integratively is 52/133/133 days :: x/2.5x/2.5x

The 4 October 2011 growth in the Canadian SPX Equity Composite is a proxy for the quadrillion dollar asset debt system. The internal fractal self assembly progression is so elegant and remarkable, it will be studied for many years to come.

As an example compare its terminal May-Aug 2012 second fractal evolution and initiation of its third fractal with the self assembly initiation of the US SPX on 4 June 2011.

Note the characteristic gap between day 23 and 24 of the Canadian SPX 28 day second fractal. This nonlinearity characterizes the 2x-2.5x terminal portion of second fractals in the Asset Debt System.

The Canadian SPX 53 day 18 May-2 August 2012 ‘secondary base fractal’ includes the 133rd day (2.5x) finale of the Canadian SPX second fractal with its 52 day (x) 1 October 2011 base fractal which is two days shorter than the US SPX’s 54 day 11/28/17 day :: x/2.5x/1.5x base fractal.

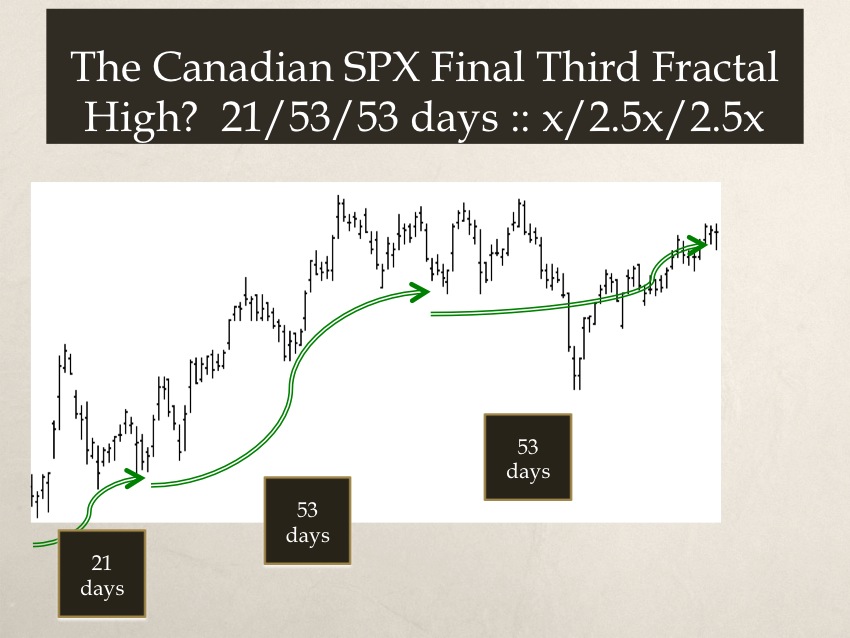

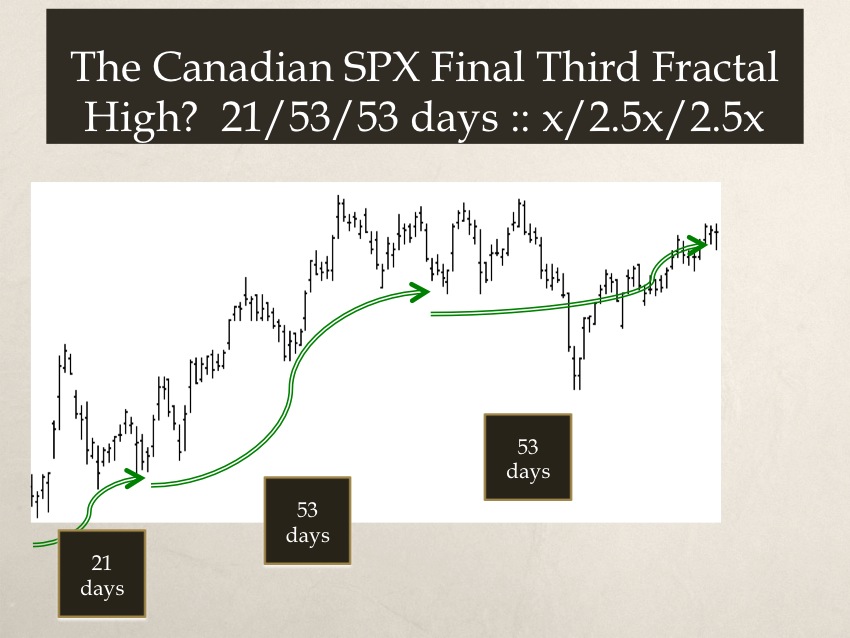

At the 133 day Canadian SPX second fractal low, a 21/53/53 day final fractal growth progression is observed.

The Asset Debt Macroeconomic System’s Real Cliff: A Final extended Equity pattern of 21/53/53 days :: x/2.5x/2.5x and ending on 21 December 2012.

Second and third fractal mathematical integration and sharing (9)/21/53/53 days :133 days

In the preceding two figures, the 21 day base for the 21/53/53 day figure is formed by a 9 day initiating fractal which is integratively shared by the second and third fractals completing a 4 October 52/133/133 day :: x/2.5x/2.5x maximal equity growth fractal series on 21 December 2012.

December 21 2011 is exactly at the Macroeconomic Asset-Debt System’s Nonlinear Equity asset valuation devolution time area, the latter dependent on the underlying accumulation of of bad private, that is, while hidden to the public, at the point of inevitable and necessary massive and synchronous default.

It would be interesting to see exactly what interests proposed this specific time period for the US to have its impasse conflict resolution regarding tax revenue increases vice expenditure decreases. The Tea Party had its origins in Santelli’s Wall Street – perhaps that’s the money trail to this chosen time..

At any rate linear thinkers will attribute the Asset-Debt Macroeconomic system’s natural collapse – which is again inevitable and causally secondary to private non sustainable debt accumulation and default collapse, asset overproduction, asset over valuation, and system depletion saturation of new debtor’s in a forward consumption based economy with historically low interest rates- linear thinkers will again attribute the asset-debt system’s natural collapse to its current political leaders. While politicians have been funded by and colluded with the Financial Industry and private Central Bank for the last 30 years, the principal beneficiaries and the cause of this greatest ever real economy dysequilibrium has been the Financial Industry.

US Sovereign Debt Instruments

A Patterned (and Scientific) Argument For The Asset Debt System’s Real Global Cliff: The Quadrillion Dollar Self Assembly Asset -Debt Macroeconomic System’s 18-21 December 2012 Nonlinear Bad Debt Liquidation Turning Point

What about US Debt Instruments, the Asset Debt System’s countervailing appreciation asset during private debt default and asset valuation collapse? US debt will see historical low interest rates in the coming weeks with gains for those holding US debt and for speculators in US debt futures.

The political timing of the current US fiscal cliff was man-made.

Debt is likewise man-made.

But unlike the older conservative US traditional banking practices, the 1990’s Nobel Prize winners’ new leveraged debt vehicles and complex derivatives of the Financial Industry have distorted asset valuations and asset supply in the asset-debt system to a historically unprecedented dysequilibrium state.

Occam’s Razor

Tax Laws and and the lawless landscape of derivatives grossly favor speculative equity and commodity trading activity over savings activity have caused further price distortions and ‘malinvestment.’

But in particular the reason for the Equity Composites self assembly to the maximum Asset Debt system saturation time extension ie x/2.5x/2.5x timed with Asset-Debt system private debt default is precisely because of the legislated favored tax rules which were ultimately sponsored and paid for in political leverage by the financial houses who directly benefit from the recipient trading activity.

At the foundation of the Asset Debt forward consumption based system, US citizen-consumers have suffered from the competition with global lower wages. This have undermined the US citizen’s ability to maintain his relative inflation adjusted ability to acquire new debt and honor outstanding debt.

Too much debt has been produced by too easy of terms ultimately spawned by the basic greed of the Financial Houses; too much bad debt has been accumulated; too many malinvestments have been made, too many assets have been over produced, and asset prices are too overvalued compared to the immediate and short term borrowing capability of the US citizen.

18-21 December 2012 was the natural tipping point of global debt default. Global Equity Composites so advantaged by tax laws over savings reached near their natural end apogees or secondary apogees and maximal fractal time extension.

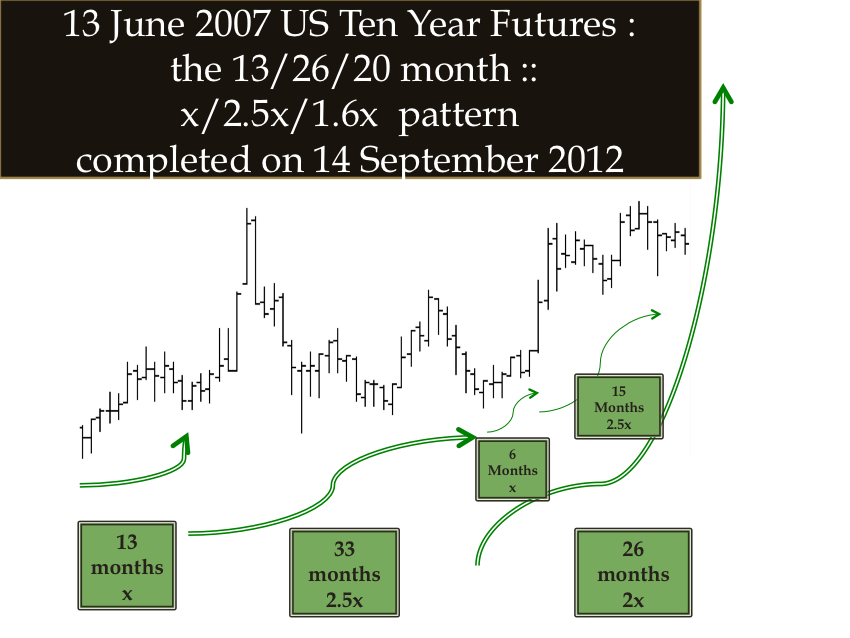

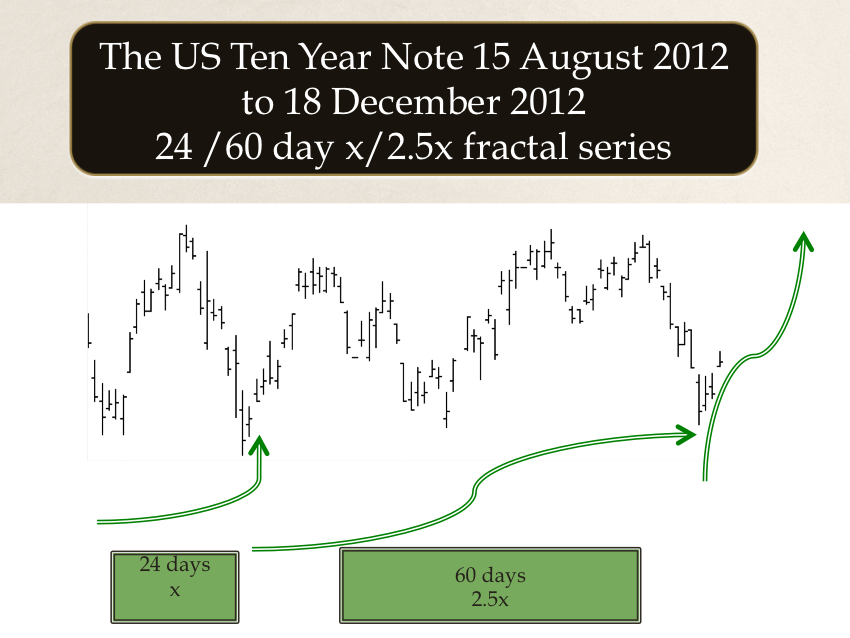

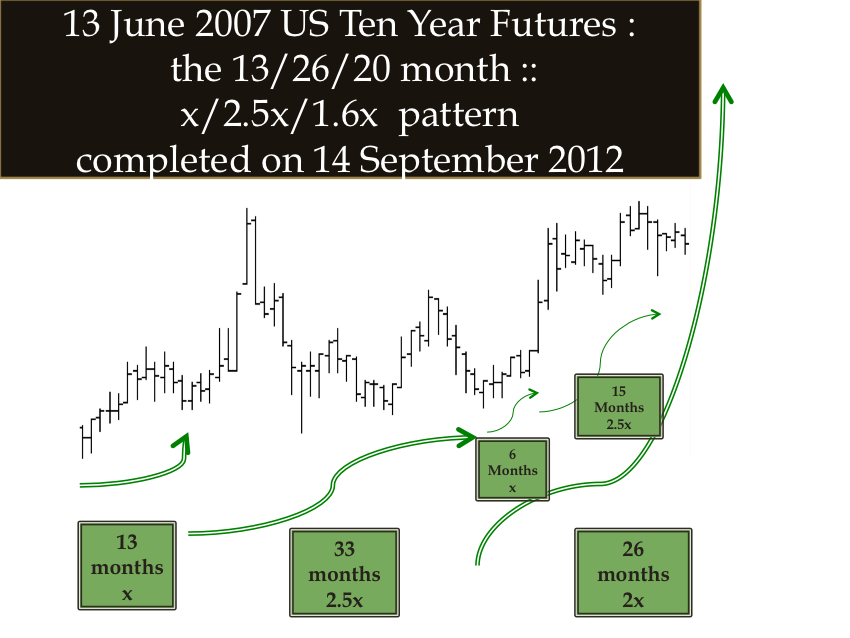

Countervailing to US Equities, Commodity, and the illiquid real estate market, US Ten Year Notes began a blow-off on 18 December 2012 which will complete a 13 June 2007 13/33/23 of 26+ month fractal series with US Ten Year rates ending below 1 percent.

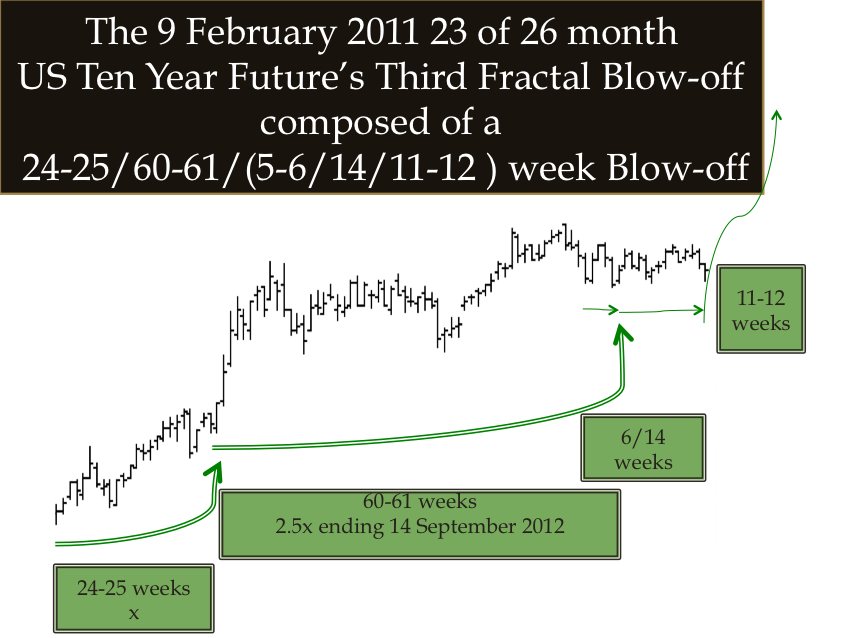

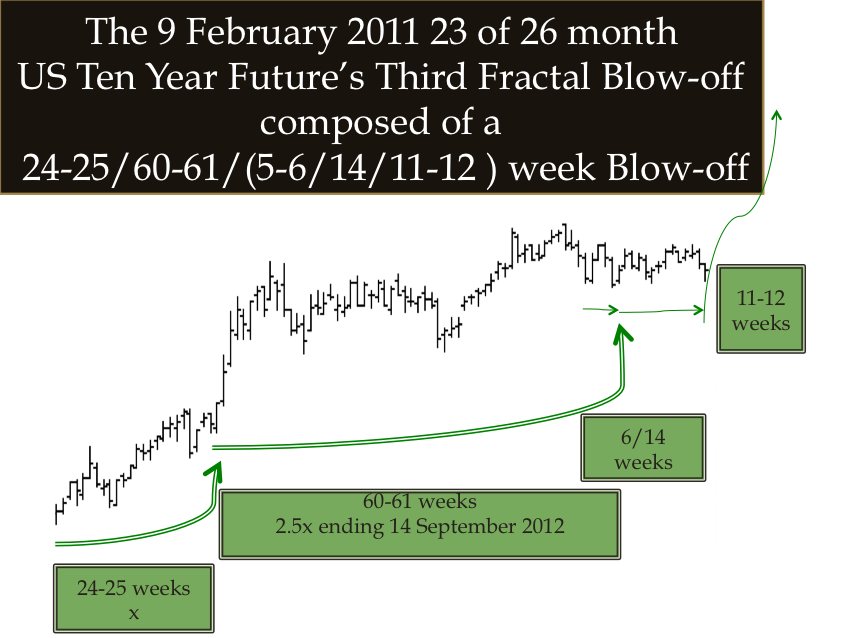

The final third 26+ month fractal pattern is composed of 6/15/7-12 month fractal series with the 6/15 months composed of a 9 February 2011 24-25/60-61 weeks first and second fractal series and ending on 14 September 2012.

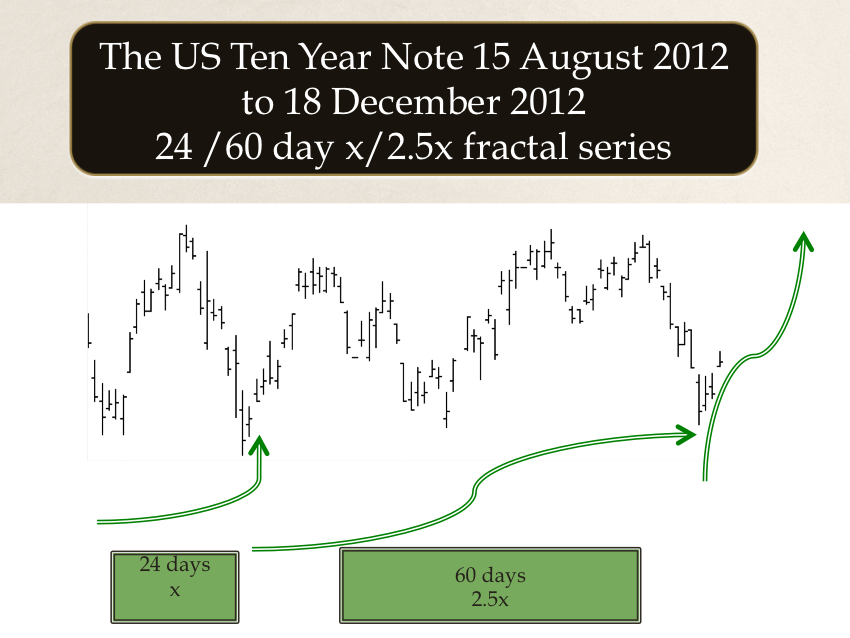

The blowoff is composed of a proportional 15 August 2012 24/60 day fractal series with the first base ending on 14 September 2012 and the second fractal on 18 December 2012. The blow-off would be expected to be 48 to 60 days in length completing the larger 13/33/26 month fractal series.

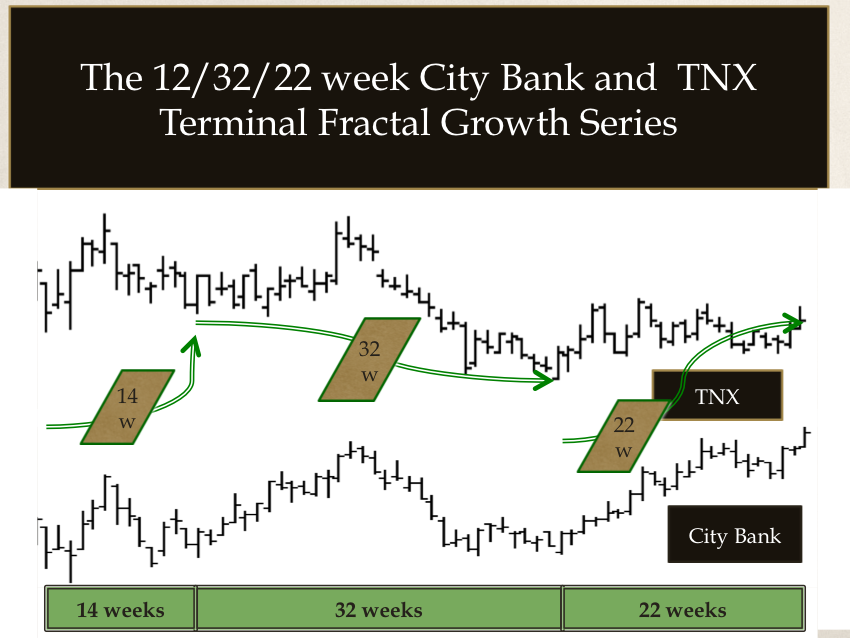

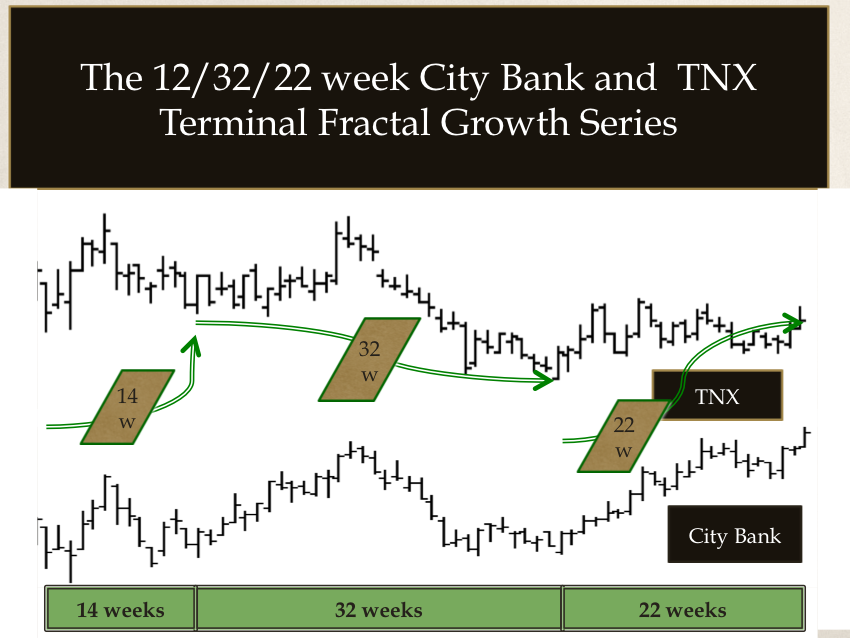

As goes the reciprocal of the Ten Year Futures TNX so goes City Bank Corporation.

There is elegance and beauty to the quantum fractal self assembly of the countervailing Equity/Commodity class and the US hegemonic debt class.

Behind the countervailing asset class time dependent fractal evolution is the greater and greater accumulation of bad debt.

This is the Real Nonlinear Cliff of the Asset Debt Macroeconomic System.

The Asset-Debt System whose countervailing asset valuation curves evolve in a quantum highly patterned fashion that confers on the Asset-Debt system the quality of a deterministic science, has at its rate limiting core bad debt.

Good debt is characterized a down payment, an 8-12 percent interest rate to prevent excessive borrowing, and the a real assessment on the lenders part regarding the present and future wherewithal of the debtor to repay.

Even with good debt, the system has natural points of saturation and decay.

With current tax laws so favoring speculation in the equity and commodity markets and so relatively punishing savers, a maximal x/2.5x/2.5x Equity extension is natural point of Asset-Debt terminal growth and initial decay.

The height of bad debt accumulation caused by bad asset-debt system rules have created the monstrous dysequilibrium that is December 2012.

US Equity and Equity Progenitor 155 Year Second Fractal Real Cliff Nonlinearity

First fractal: First Fractal base 1789-1858 Second Fractal: 1858 to present composed of two fractal series: 1858-1932 and 1932 to present

The second 1932 fractal series is composed of a 15/37/31 year series with the second fractal ending in 1982. The 31 year current fractal is composed of a 9/23 year first and second fractal series.