The Human Linear Reasoning Fallacy Of Post Hoc Ergo Propter Hoc …

An equity/commodity crash devolution occurs; the linear thinking masses attribute it to the US election results.

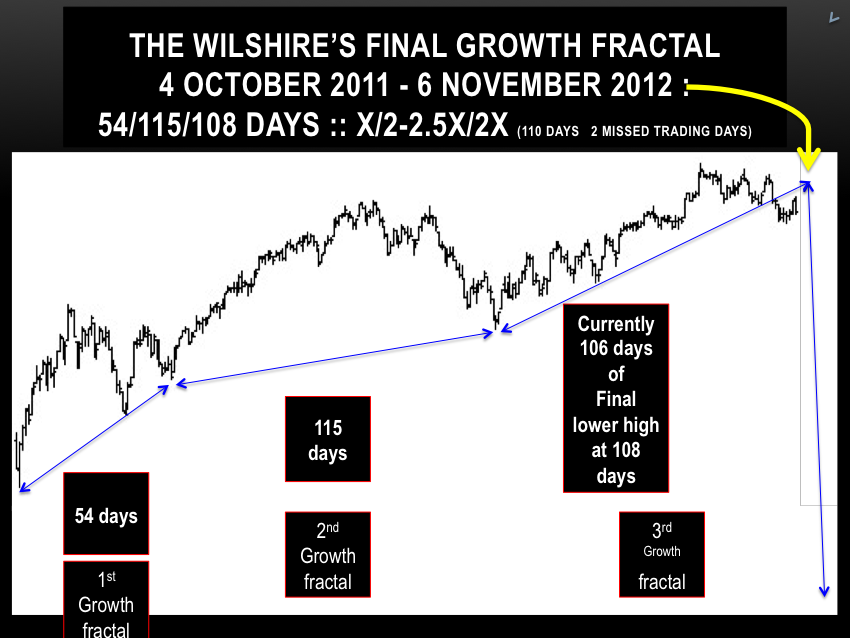

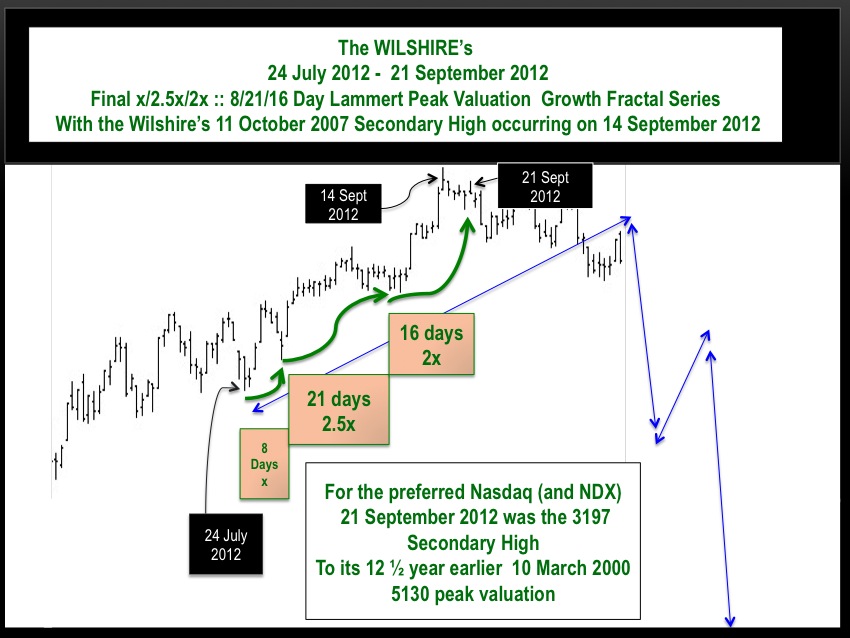

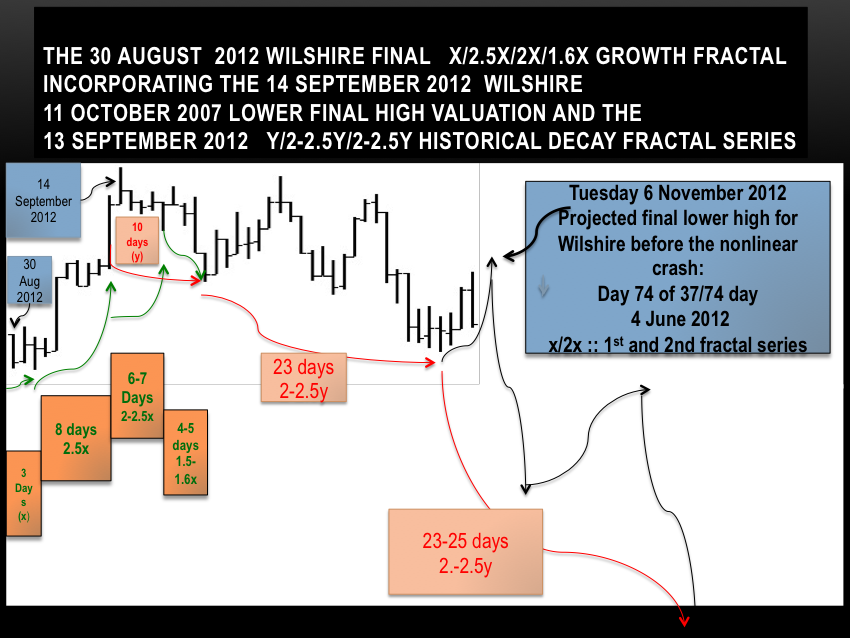

The 6 November US general election’s remarkable timing to the quadrillion dollar valued Global Asset Debt Macroeconomic System’s deterministic final lower high valuation rapidly followed by a nonlinear historical devolution is coincidental: true true and unrelated.

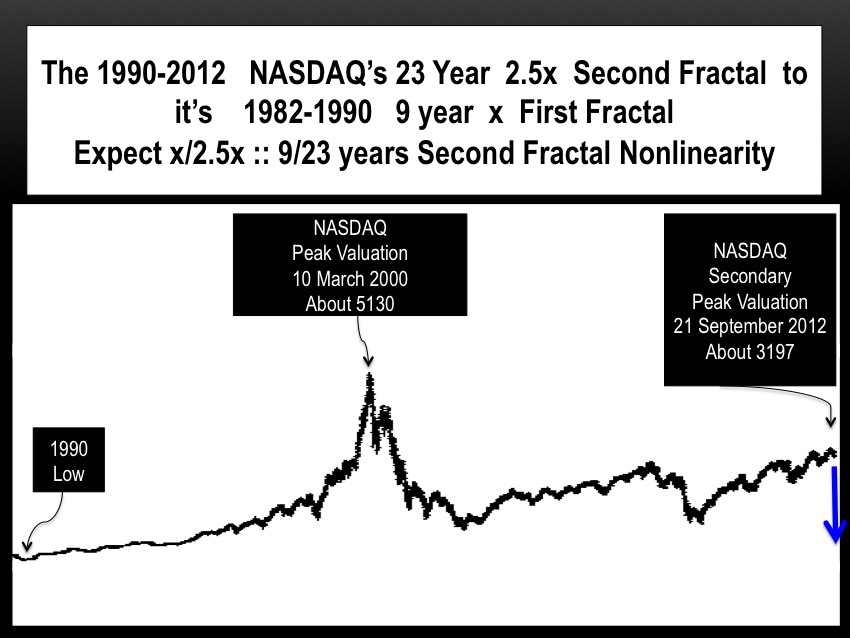

Survey the US measurable asset valuation saturation curves dating from 1788.

What political events, what wartime events are responsible for the periodicity of the equity and progenitor asset valuation saturation curves and the regular nonlinearities of asset valuation collapse?.

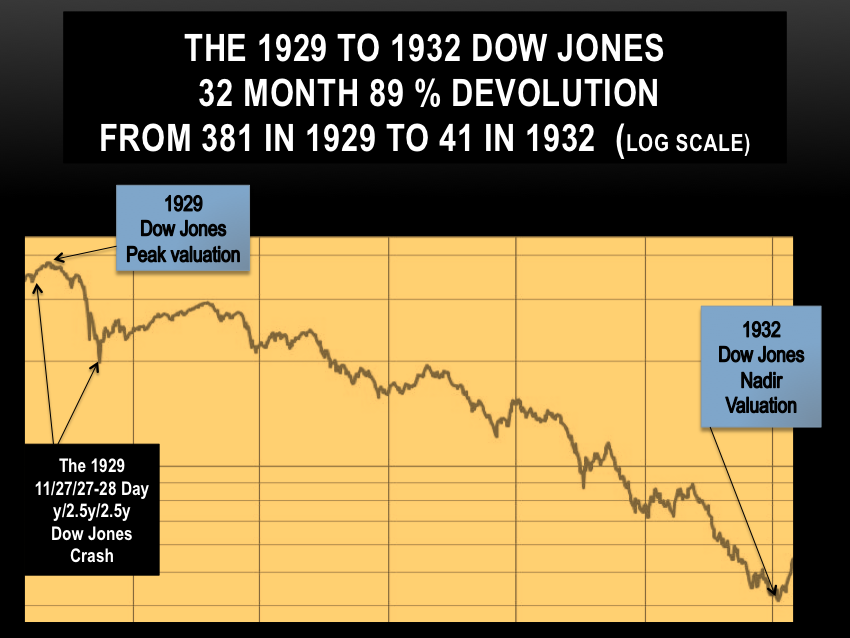

225 years of Gompertz-like asset valuation saturation growth curves to peak valuation levels and their regular periodic nonlinear asset valuation devolutions with slowing Gompertz-like devaluations to an asymptotic low levels are the result of accumulation of bad debt creation via associated (bad) easy lending rules getting ahead of the real economy’s ability to honor bad debt, that which can not be repaid, in conjunction with a system saturated and depleted population of credit worthy new debtors associated with the timing of system accumulation of overproduced and over abundant and collapsing asset valuation collateral that occurs in an accelerating manner after the peaks of the bad debt credit cycles.

Gompertz-like asset devaluations and their asymptotic lows are associated with bad debt liquidation and system wide lower total valuation until prices match demand and remaining system money and credit creation.

What is remarkable is that the regular quantum periodicity of the cycles confer upon the Asset Debt Macroeconomic System the predictabilty and patterned properties of an Exact science.

Good credit creation and good lending rules lead to good results and promote system stability with less profound effects on the real economy during natural nonlinear periodic asset valuations devolutions.

On the other hand, bad credit creation and bad lending rules lead to asset production and asset pricing distortions in the real economy.

Money manipulation, uncontrolled by Sovereign good rules, whereby money and credit is miscreated by counterparty mirroring leads to system-valueless profiting by those who can and do create the bad rules. The real economic system distortion caused by the scamming the Sovereign’s money system, the Elitist use of the Sovereign’s currency, and the Elitist entitlement to borrow at lower interest rates and more accessible credit line and leverage profits from the resulting asset valuation rise and fall in prices – without regards to societal useful or real economic system useful end results causes – directly the extreme distortions and asset bubbles that result in exponentially leveraged damage during the natural perodicity of the Asset-Debt System’s inherent nonlinearities in Asset-Debt System saturation time areas resulting in inevitable and necessary asset valuation collapse.

But for the masses, the winners of the 6 November 2012 election will likely be held accountable for the Asset-Debt System’s natural nonlinearity via the post hoc ergo propter hoc programmed human neural networks of linear thought.