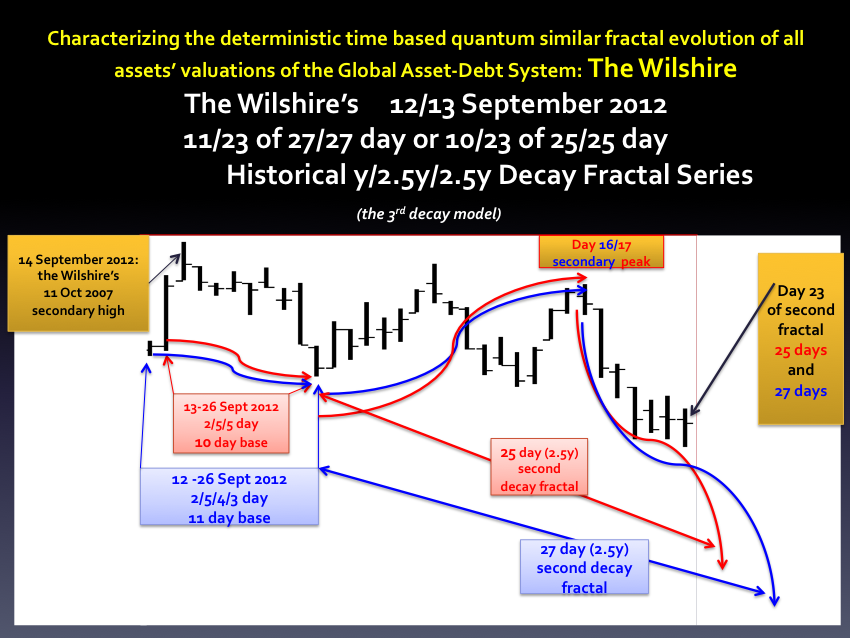

14 September 2012 was the Wilshire’s secondary valuation high to its 11 October 2007 predicted nominal high.

As the hidden and accelerating Asset-Debt System’s Bad Debt Default and Bad Debt Valuation Collapse begins, and as net credit expansion velocity slows and turns negative, the asset-debt system’s easily observable asset valuations begin to undergo mathematical quantum fractal decay … which begins in mathematical simple fractal quantum terminal growth.

The Third x/2.5x/2x/1.5x or y/2.5y/2.5y Element Mathematical Model Possibility for Asset-Debt System Bad-Debt-Dependent-Default Asset Valuation Quantum Decay (Growth for Countervailing US Sovereign Debt Futures)

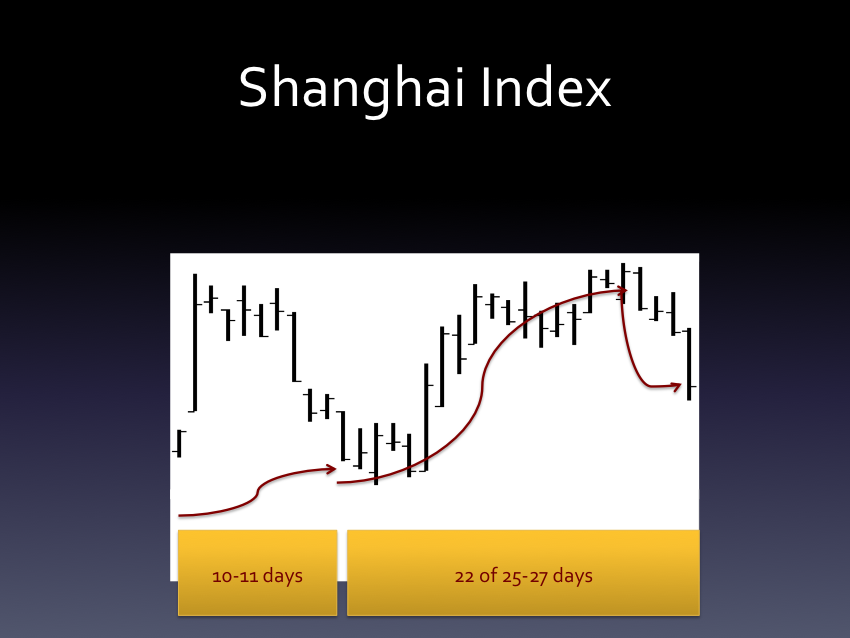

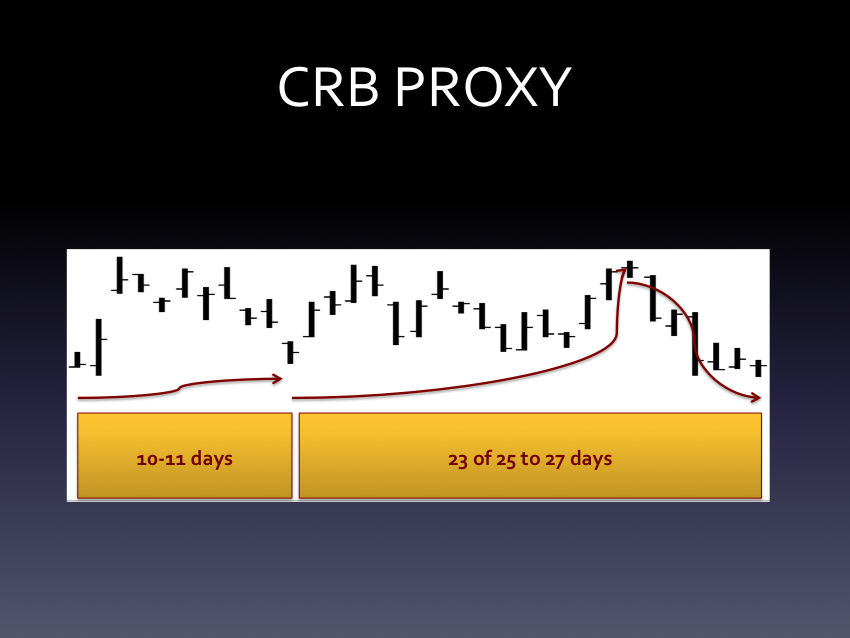

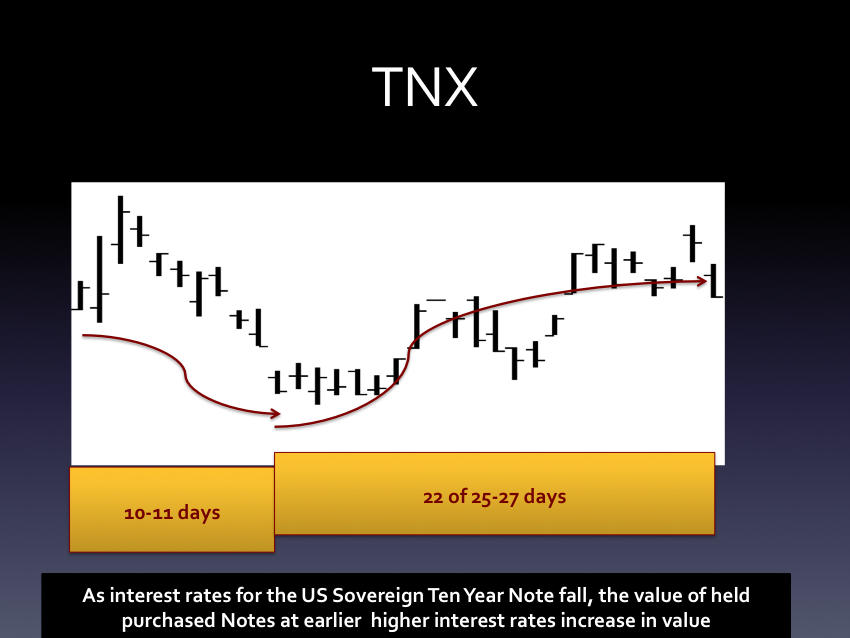

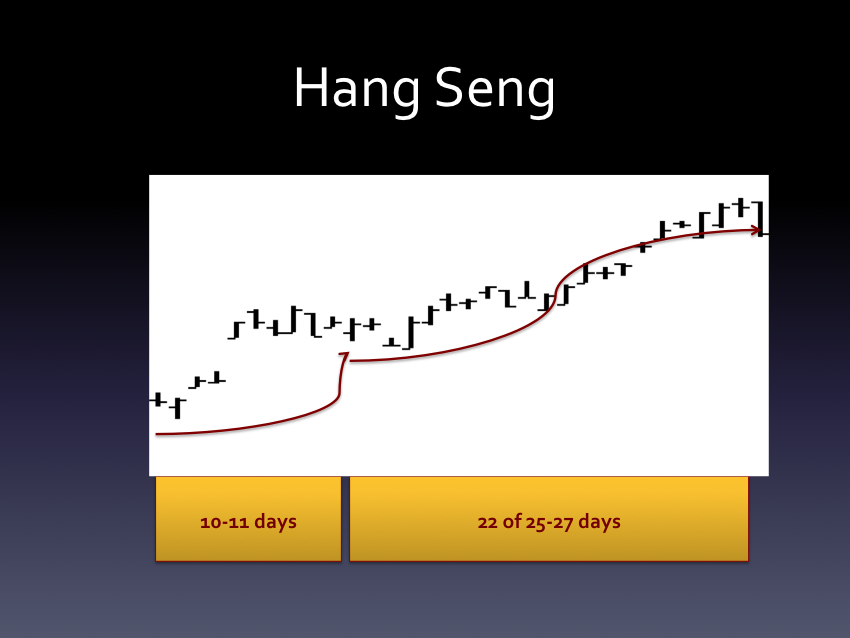

On 12 September 2012 the asset debt system evolved an eleven day 2/5/4/3 day :: x/2.5x/2x/1.5 growth fractal ending on 26 September 2012. Alternatively a13 September 2012 2/5/5 day Integrated Growth and Decay Fractal evolved ending on 26 September 2012. The second 5 day fractal of each series had its peak valuation on 14 September 2012.

Day 16 of the 24 July 2012 8/21/16 day :: x/2.5x/2x fractal series was occurred on 21 September 2012 in the terminal half of both the eleven day and ten day fractal series.

The 11 day base 12 September 2012 fractal series is on day 23 of the second 2.5y decay fractal: 11/23 of 27/27 day :: y/2.5y/2.5y

The 10 day base 13 September 2012 fractal series is on day 23 of the second 2.5y decay fractal: 10/23 of 25/25 days :: y/2.5y/2.5y

With these 10 and 11 day base decay models starting on 12 September and 11 September 2012 respectively, lower valuations are expected next week with an underlying slope line containing all valuations from September 26 or day 1 of the second 2.5y decay fractal to day 25 or day 27, corresponding to 10 day and 11 day bases respectively.