Is there a (remarkable) mathematical order to the global asset debt macroeconomic system?

Observe the ordered valuation patterns using the underlying asymptotic line defining the low valuations of the grouped Lammert fractals since the March 2009 lows for the hegemonic Wilshire 5000 and the other leading global EuroAsian Equity markets.

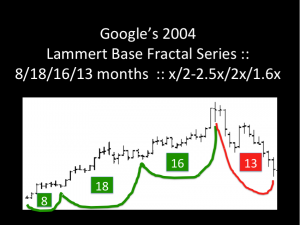

Observe the simple growth and decay fractal patterns described in the 2005 and 2009 postings: 2/2-2.5x/2-2.5x/1.5x and y/2-2.5y/2-2-5y and ask if the observed subsequent patterns have occurred by chance or rather are they transpiring by inexorably deterministic causal mechanisms inherent to natural intrinsic fractal ordering of the asset debt global macroeconomic system?

SATURDAY, MAY 9, 2009

Nonstochastic Saturation Macroeconomics – A New Science

Nonstochastic Saturation Macroeconomics – A New Science

2005 LAMMERT NONSTOCHASTIC SATURATION MACROECONOMICS

THIS BLOG EXPLORES THE NEW SCIENCE OF NONSTOCHASTIC SATURATION MACROECONOMICS, A MAJOR OBSERVATIONAL DISCOVERY. THE MACROECOMONY IS A SELF BALANCING COMPLEX SYSTEM OF ASSETS AND DEBT OPERATING ACCORDING TO SIMPLE MATHEMATICAL LAWS OF GROWTH AND DECAY OF ITS ASSET VALUATION CURVES:: X/2.5X/2X/1.5X AND Y/2-2.5Y/1.5-2.5Y

Now consider a minor aberration in the underlying asymptotic low to low composite equity valuations caused by ex nihilo money printing and near zero interests by the Federal Reserve and in Europe negative interest rates aka quantitative easing, and stimulus programs such as cash for clunkers and created cash for unfunded, nonperforming aliens entering European and American borders lured by social support program and fiat Euro and US dollars.

Now consider the long pattern of the great hegemonic Roman Republic replacement, the United States of America, protected by the expanses of two great oceans from the local ravishes of the effects of World War I and 2 so strongly witnessed by other participating European and Asian winning and losing nations, losing millions of their countrymen and women and children and their infrastructure.

The hegemonic fractals series of the US appears to begin with an initiating fractal of 18 years from 1790 to 1807 nearly concurrent with the ratification of the US constitution.

Since 1807 there has been a 37/90/87 of 90 year blowoff of a x/2.5x/2.5x pattern which would end in 2020-21.

The March 2009 Wilshire pattern is a 5/13/10/7 and 3/7/6 months or 45 months base fractal.

The second is a 8/17/17 or a 40 month fractal,

followed by a 10/25 of 25/1 of 20-25 month blow-off fractal.

For a 10/25/20 month x/2.5x/2x Wilshire fractal , this would represent a 45/92 month :: x/2x fractal beginning in March 2009.

This makes qualitative and quantitative sense under the larger umbrella of a (18)36-37/90/89-90/54 year x/2.5x/2.5x/1.5x United States Hegemonic Fractal Series.

A final 54 year expanding lateral decay fractal (1.5x the 36 year 1807 to 1842/43 base) and ending in about 2073 qualitatively makes sense given the dynamics of global system. There is no limit

to competing money creation and negative interests among intustrialized nations with voters having earned promised retirement entitlements. This will not end in a 1932 global depression scenario. Entitled citizens will recieve their entitlements

through necessary and appropriate money expansion.

The global economy will persist.

A prudent global monetary banking policy would be to raise interest rates to control the final speculative blow-off. With the coutervailing political needs, this likely will not happen.

Anticipate tulip valuations in the final 20 month blow-off period of the 267 year US hegemonic asset debt system.