Asset-Debt Saturation Macroeconomics : The Patterned Operating Science of the One Quadrillion Dollar Equivalent Global Economic System.

At the exact timing of expected 156 year Asset Debt US Equity Second Fractal deterministic collapse, three sequester are occurring.

THE SEQUESTER DIVERSION SET UP: Shifting Attention to Congress, while the inside Wall Street Financial Industrialites are 50:1 sellers of equities…

“Wall Street Shrugs”

CBS: ” IF WASHINGTON DOESN’T MUCK IT UP, WE’RE (THE US ECONOMY) IN REASONABLY GOOD SHAPE.”

Link via copy/paste

http://www.cbsnews.com/8301-18563_162-57572234/wall-street-shrugs-at-sequesters-economic-effect/

Three automatic sequesters are now transpiring. Two involve fishhead manipulation and directly involve and/or have a large money trail and origination linkage squarely to the Financial Industry. The Third automatic sequester, whose time window is now naturally occurring, involves the time dependent deterministic self correcting self organizing Asset-Debt Macroeconomic System and the inevitable sequester and nonlinear collapse of defaulting bad debt and overvalued equities against the macroeconomy’s real operating dynamics.

Starting backwards,

The 3rd Sequester

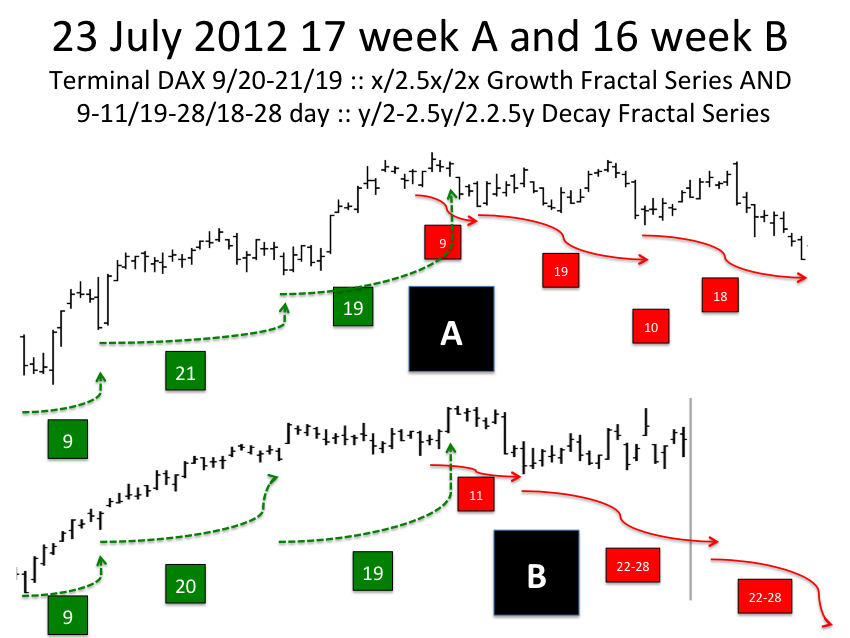

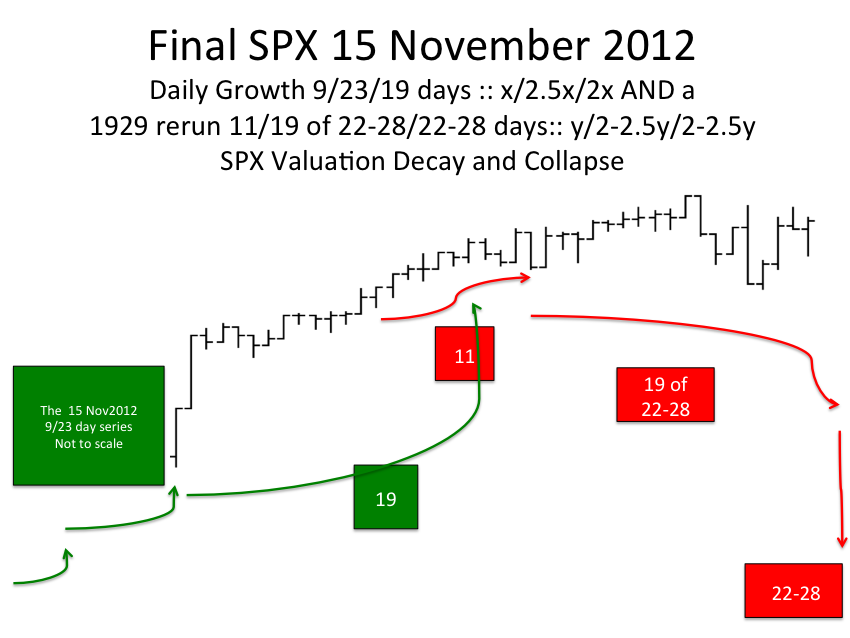

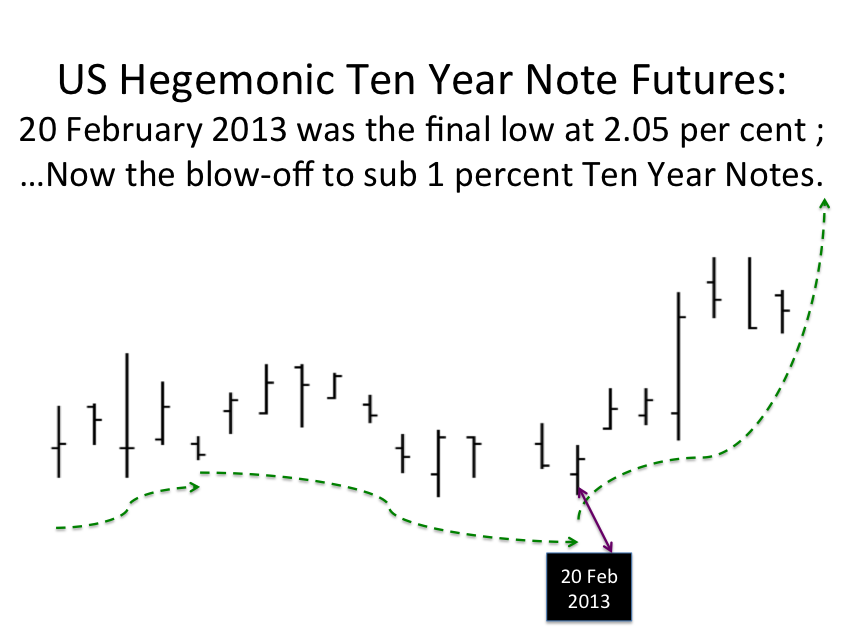

The third sequester is precisely this: the Asset Debt System’ system natural 1858 155 year nonlinear asset valuation collapse time frame and the macroeconomic system’s natural inexorable time dependent implosion sequester of bad debt. It will come in the form a self organizing y/2-2.5y/2-2.5y decay series which has a base of 10-11 days and as of 1 March 2013 was on the 19th day of the second decay fractal. Asset valuation decay begins in terminal asset valuation growth. In other word’s, the asset-debt system’s natural third sequester began 29 trading days before the 1 March Wall Street originated-linked sequester.

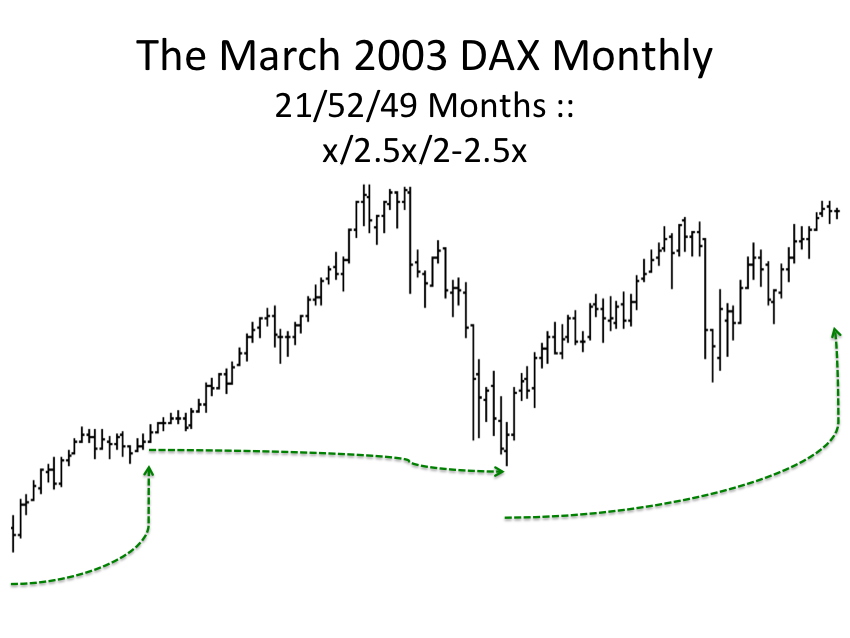

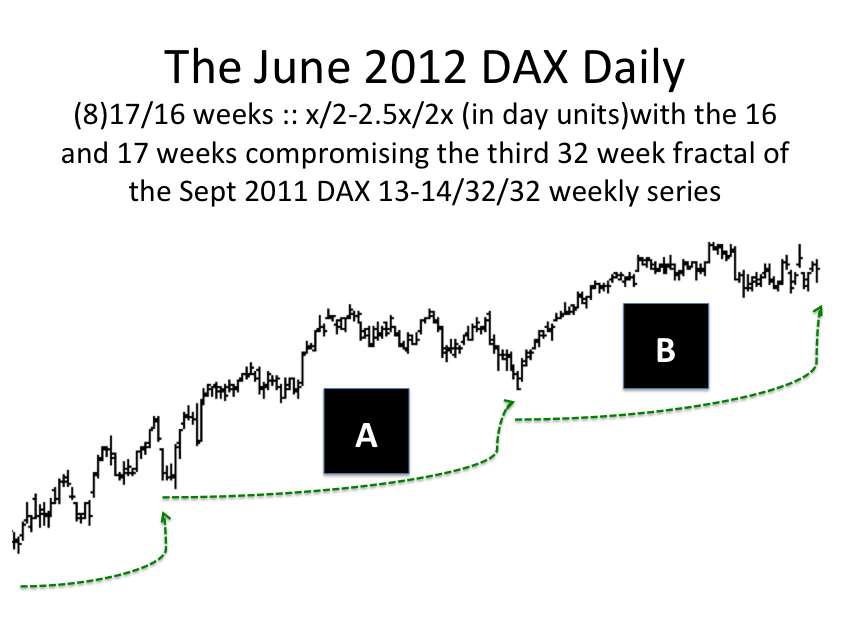

As of one 1 March 2013, the date the Wall Street-linked First Sequester started, the SPX and DAX as proxies for the larger one quadrillion dollar asset-debt global macroeconomic system had reached a maximum x/2.5x/2.5x :: 13/32/32 week growth fractal series which is the terminal portion of a March 2003 21/53/49 month :: x/2.5x/near2.5x maximum equity growth fractal series. The 2003-2013 fractal series forms the terminal portion of a 1982 9/24 year fractal series which is the terminal 32 years of a 1932 15/37/32 year fractal series, which forms the second half terminal portion of a 1789/1858 :: 70/156 year US first and second fractal series.

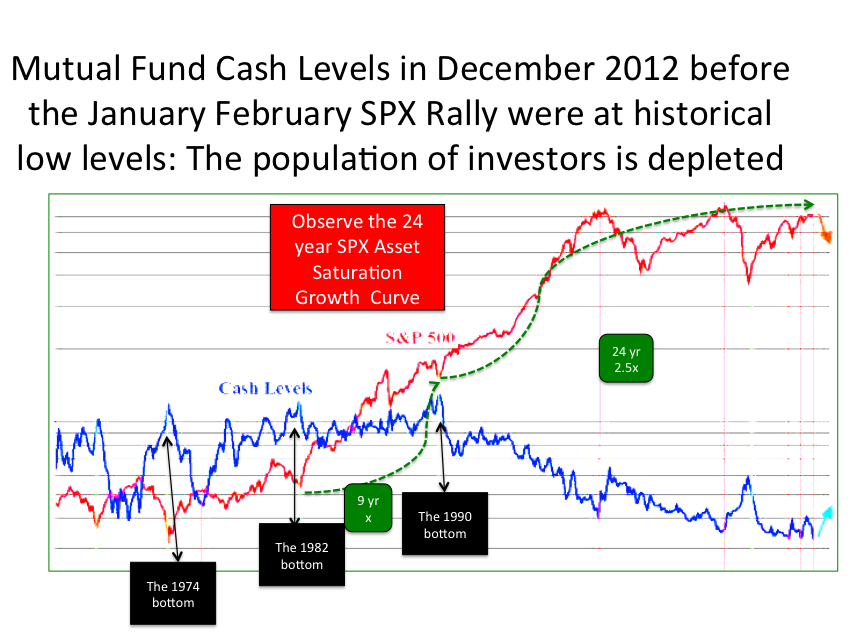

Is the forward consumption usury asset-debt macroeconomic system this regular in its patternicity … whereby natural and imputed excesses of debt elaboration with the directly caused asset over production, asset over consumption, and asset overvaluation collectively integrate into and compose a Asset Debt Macroeconomic System? In this system with its particular existing asset advantaged tax laws , are self organizing timed based quantum Gompertz growth asset valuation saturation curves self-assembly created and with asymptotic limits completely depleting the interested and able investor population – with subsequent natural nonlinear and Gompertz devaluation corrections?

Examine the equity or commodity asset valuation time-based saturation curves. Observe the quantum and fractal growth periodicity of the curves over hours, days, weeks, months, years and decades.

Is the forward consumption usury asset-debt macroeconomic system this regular?

Likely so.

The equity valuation curves and their quantum time based progression are easily amenable to retrospective analysis. That future retrospective analysis, available to all, will show the Asset-Debt system to have the patterned properties of an undeniable self assembly naturally self organizing science .

In this current short term 2013 time window – with the preceding leveraged degree of current debt load and with global governments, now directed by the ruling central banks and ruling financial houses, undergoing austerity measures and preventing the necessary debt expansion to maintain the forward based consumption-debt system – expect the US 1858 155 year second fractal nonlinear asset valuation collapse , to be historically profound.

The 2nd Sequestration

The second sequestration is the electronic dollar credit which will be sequestered from late buyers and long term holders in the equity market so well reassured and encouraged by the central bank and cheer leading former Fed Chairman … and the news casters as the individual above.. The sequester taken be from these trusting counter party individuals and placed directly into the electronic accounts of the financial industry who will make historical electronic gains in the greatest transfer of wealth of all time.

The 1st Sequester

The first sequester is the ‘Diversion Sequester’ considered senseless by both parties and the general citizenry who have a special existing contempt for congress. IF WASHINGTON doesn’t muck it up…. The Diversion Sequester was introduced in July 2011 by Gene Sperling who works with the president but according to Bloomberg received over 880K from GS in 2008 and an additional 150K from the Financial Industry.

As the the deterministic natural Asset Debt system Third Sequester inexorably transpires, as the Financial Industry Second Sequester transpires – with GS and the Financial Industry having their greatest ever transfer of wealth from their unfortunate counterparties – the Diversion First Sequester originated by a financial industry’s 2008 million dollar recipient, will provide the financial industry with some cover as both political parties exhaust themselves in publicly blaming and lambasting each other for ‘causing’ ‘precipitating’ the inevitable, inexorable, and naturally-occurring Asset-Debt Macroeconomic System Third Sequester 155 year US second fractal collapse.

Will the viciousness of the parties attacks on each other be enough diversion cover for the Financial Industry? Will the public allow them to keep their gains? What other events could transpire to sufficiently camouflage and obfuscate the FI’s 2013 historical gains in the midst of general calamity? This is same elite group that leveraged and collapsed the real economy in 2008, sold sub prime CDO’s to customers while shorting the issues, was re bankrolled with sovereign money with impunity, had 144 billion dollars in bonus in 2010, and who paid penalties for criminal activities with created ex nihilo first use money chump change from the central bank. They’ve always got away with it before; can they pull off it off again?

Likely something more than First Sequester Ruse will be needed to sufficiently distract the public attention…

THE REAL ASSET-DEBT MACROECONOMIC SYSTEM 156 YEAR 2nd FRACTAL SEQUESTER