The greatest amount of system skimming by the financial industry occurs during the Asset-Debt Macroeconomic system’s natural nonlinear events. Even at the lowest interest rates, the population of investors in an asset class becomes depleted near the top of a timed based asset valuation saturation curve.

While billions can be scammed (legally) in a very short time span, the zero sum gain math of the exchange requires the shearing of counterparties- especially those who are conned into the asset market near peak valuation – by those who have the wherewithal to con…

In 2004-2007, it was counterparty sheep who were sold real estate CDO’s and CDS’s and in a real economy the new owners of grossly overvalued real estate.

The Global Asset-Debt Macroeconomic is currently at a natural historical nonlinear asset collapse time frame which can be traced to 1858 in its current Hegemonic US equity markets.

Growth of debt and corollary asset valuations and asset numbers have expanded together in a long more natural pattern from 1858 to 1913 and more recently in very superleveraged and less natural manner by fractional reserve banking and the financial industry’s new extremely leveraged debt and bet vehicles.

While the timing of the collapse is inevitable and deterministic, the amount of debt creation by the financial houses and asset overvaluation and asset overproduction has reached unprecedented levels and subsequent asset price deleveraging and debt collapse will be proportional to the current extreme dysequilibrium.

The financial houses and ‘insiders’ will make record ‘profits’ as asset valuations collapse in a relatively short span time.

While collecting this money and while the counterparties and individual citizens are suffering, a distraction, a diversion, a ruse was/is needed to shift blame and displace anger onto a third party.

Who would that third party be?

Apparently the financial industry’s target is both US political parties and the executive office.

As the Asset-Debt system’s asset valuations suddenly collapse, Congress and the president will provide the cover and distraction as they vehemently and non elegantly blame their reciprocal opposition for not getting off their asses.

The wicked congress held currently in such low esteem by the public will serves as the diversionary Fall Guys providing the cover for the Financial Industry as electronic wealth is transferred into their accounts.

The same opposing congressional group that rescued the financial industry with 750 billion in 2 weeks bipartisanship, apparently could not reach a decision over 18 months about 85 billion dollars a year needed for ordinary citizen job maintenance.

The financial industry is counting on the publicity and political war rhetoric of the counterblaming parties and the simple post hoc ergo propter hoc logic that is the general public’s modus operandi.

Just who came up with the idea of sequester and its timing?

Where leads the money trail?

The idea of sequester as incorporated into the 2011 Budget Control Act was introduced by National Economic Council Director Gene Sperling. on 12 July, 2011. As a solution to the ever present debt ceiling crisis he proposed a compulsory trigger that would go into effect if agreement was not reached on tax increases and/or budget cuts equal to or greater than the the debt ceiling increase by a future date. (1 March 2013)

According to Bloomberg News, Sperling earned $887,727 from Goldman Sachs in 2008 for advice on its charitable giving and $158,000 for speeches mostly to financial companies. That is a million dollar money trail.

And now Sperling is possibly the source for Bob Woodward, who has placed the sequestration origination concept squarely in the president’s house much to the glee of the president’s congressional counter party.

The salivating republicans and salivating democrats are prepared for battle and have their press releases and video’s readied providing evidence of sequestration’s ownership.

Will the intracongressional-executive Sequestration Blame War be enough public distraction to cover the financial industry as it legally rapes the system and fills it accounts with electronic ones and zero’s during the deterministic quadrillion dollar equivalent Global Asset-Debt nonlinear collapse?

Likely not.

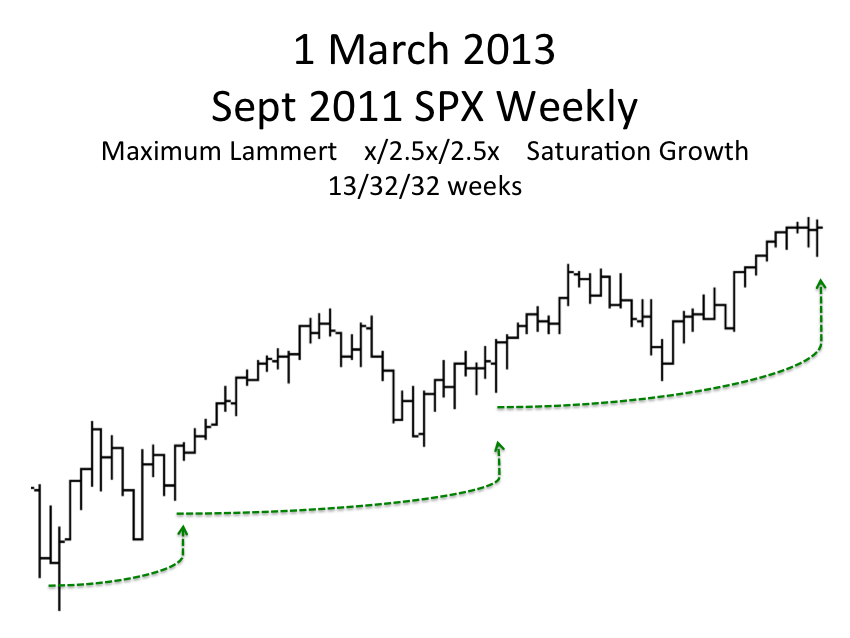

SPX Sept 2011 :: 13/32/32 weeks Maximum Asset-Debt System Growth

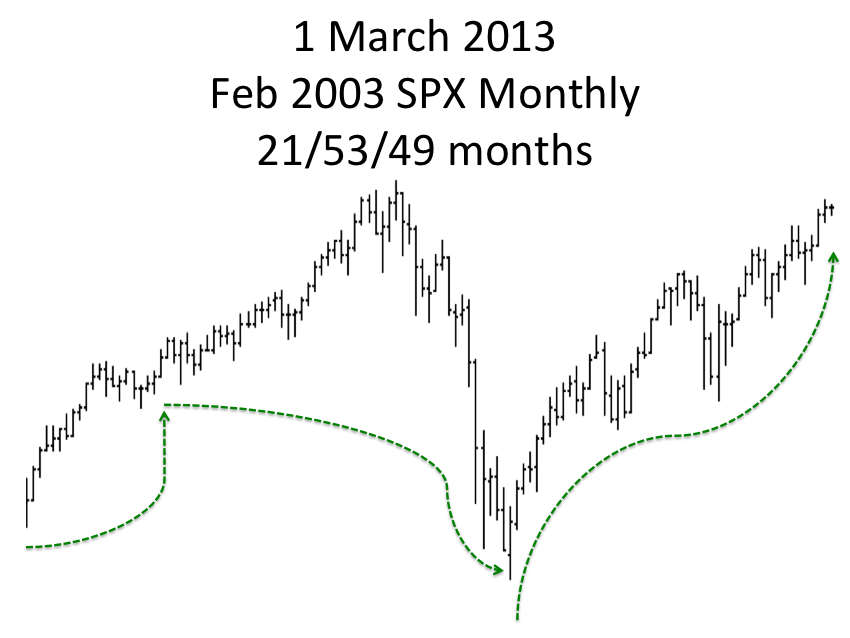

March 2003 :: 20/52/49 months :: x/2.5x/near 2.5x and proceeding to y/2.5y/2.5y 21/53/49 months