Since its March 2020 Covid low valuation, the Wilshire’s valuation growth has been stimulated by unprecedented global central bank historical QE money and MBS credit creation and followed and limited thereafter by historical QT tightening.

Near annual money supply increased by 25% and thereafter decreased by 4.5 %. These extremes of money/credit creation and contraction caused the self assembly of two sequential fractal series in the global hegemony’s composite Wilshire: a growth series of15/37/31 weeks and a reflexive growth, decay, final growth and decay series of 18/38/40-41 weeks.

This website has attempted to show that global equity and commodity valuations – under the umbrella of supply and demand of property, goods, and credit and more recently of greater central bank influence and manipulation of money and credit supply – grow and decay in elegantly simple well defined optimal self-assembly time based quantitative fractal patterns.

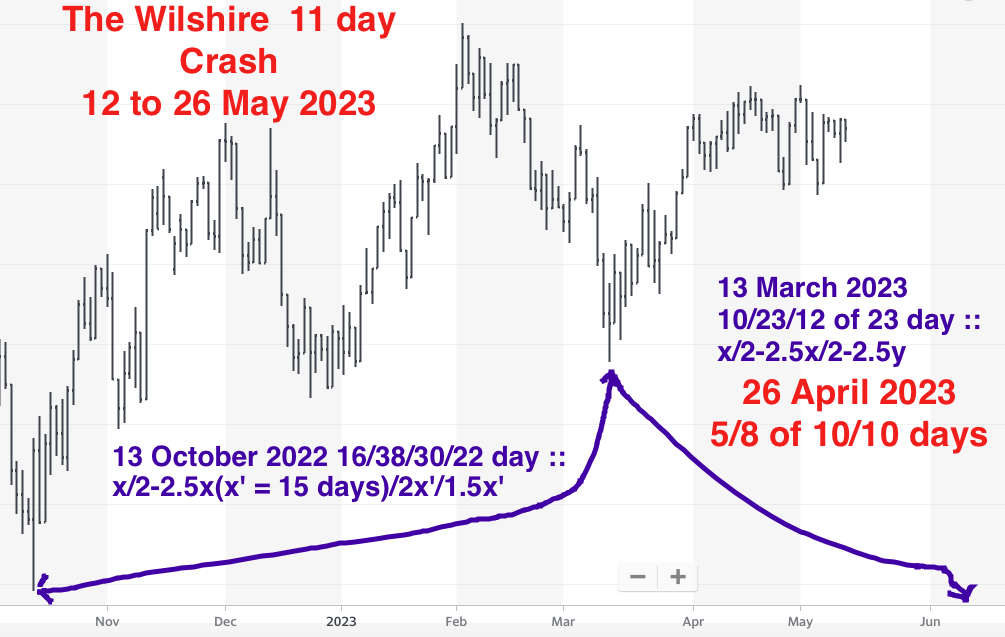

From its March 2020 low valuation, the Wilshire’s valuation grew in a rapid first phase 15/37/31 week :: x/2.5x/2x QE fashion, followed by a second QT phase of final growth, decay, and secondary growth fashion in a September 2021 18/38/35 of 35-36 week to peak secondary growth fractal series of x/2-2.5x.2x , and collapsing in the final 5 weeks of a composite 18/38/40-41 week decay series: y/2-2.5y/2-2.5y.

The September 2021 18 week base fractal was composed of a 3/8/6/4 fractal series. The 38 week second fractal was composed of a 7/15/18 week series. The third 35-36 week fractal to final growth valuation was composed of two growth series 4/8/8/5 weeks and 3/7/6-7 weeks.

The final 1/13/2023 12/27/26-27 day :: x/2.5x/2.5.x growth pattern, composing the 3/7/6-7 week fractal series, matches an 1807 x/2.5x/2.5x :: 36/90/90 year series peaking November 8,2021.

This November 2021 peak was the 37 week of a 37 week third fractal of an interpolated 15/37/37 week :: x/2.5x/2.5x fractal series from the March 2020 low. and week 5 of the second 8 week fractal of the September 2021 18 week base composed of a 3/8/6/4 week series.

The gapped higher high blow-off of the 1/13/2023 final growth series occurred between 5/31/2023 and 6/2/2023 and can currently be seen on a monthly basis between month 9 and 10 (May and June 2023) of an interpolated September 2021 4/10/10 month reflexive growth/decay/final growth series.

A nonlinear second fractal 2x-2.5x valuation decay ending would fit an interpolated 1981-1982 13/29-32 year first and second fractal series :: x/2-2.5x.