A Primer on Fractal series

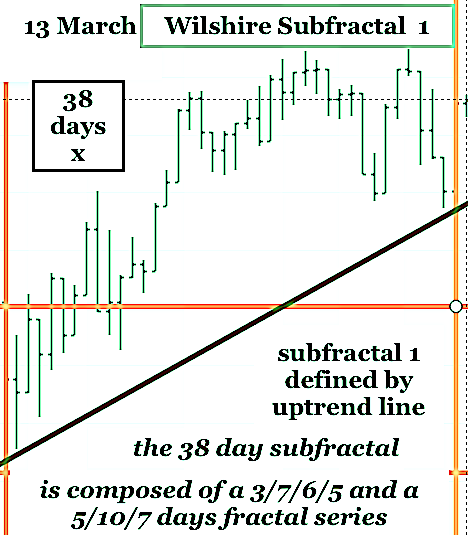

The beginning and ending boundaries of time based fractal series are defined by uptrend and downtrend lines with positive and negative slopes, respectively, that are formed by connecting the two low points at the beginning and the end of the fractal series.

In a bar chart, unit bars can be minutes, hours, days, weeks, months, and years. It is the hypothesis of this website that the asset debt macroeconomic system is deterministic and the growth and decay of the ongoing unit time valuations of its asset classes automatically self assembly in the most efficient manner with self similar fractal patterns of the unit time based bars.

There are only two elegantly simple laws of self-assembly time-based fractal asset-debt valuation growth and decay macroeconomics:

While money and credit growth (and contraction)by central banks and government spending is periodically irregular, equity and commodity composite valuations grow and decay by only two distinct time-based fractal patterns(mathematical laws):

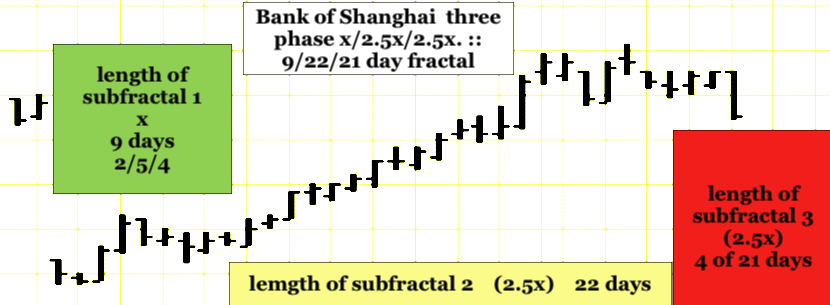

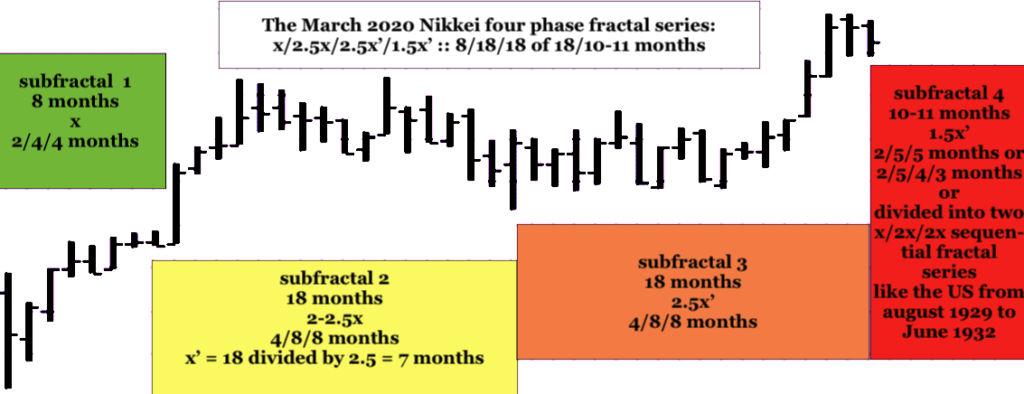

a three phase pattern: composed of three subfractals:1/2/ and 3 :: x/2-2.5x/1.5-2.5x – where x is the base first fractal time length in days, weeks, months, and years.

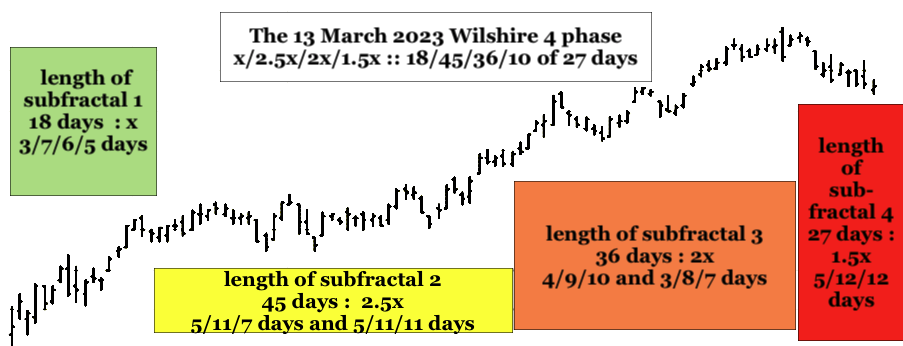

and a four phase pattern: composed of 4 subfractals: 1/2/3/ and 4 :: x/2-2.5x/2-2.5x/1.5-1.6x, where x is the base first fractal time length in days, weeks, months, and years. In a four phase fractal series the sum of the length of subfractal 1 and 2 may be exceeded by the sum of the length of subfractal 3 and 4 by 0.1x.

The time length of subfractal 2 (2-2.5x) of the 3 and 4 phase fractal series often determines the ideal time length of subfractal 1 : (x’) upon which the lengths of sub-fractals 3 and 4 are based: e.g., the 4 phase fractal pattern’s time lengths become x/(2-2.5x divided by 2.5 = x’)/2-2.5x’/1.5-1.6x’.

The US Hegemony macroeconomic system is following an 1807 4 phase fractal series of 36/90/90/54 years with a 90 year Subfractal 3 high on 8 November 2021 for for the Wilshire and Bitcoin/USD. Smaller unit time based fractal series make up the 36,90,90 and upcoming 54 years.

Previously, this post had defined a 13 March 18/45/36 day growth fractal series with an expected Subfractal 4 decline of 27 days. This model violated the uptrend line definition defining fractal units.

The current model is based on a 13 March 4 phase 38/93-95/76-95/54-58 day fractal series.