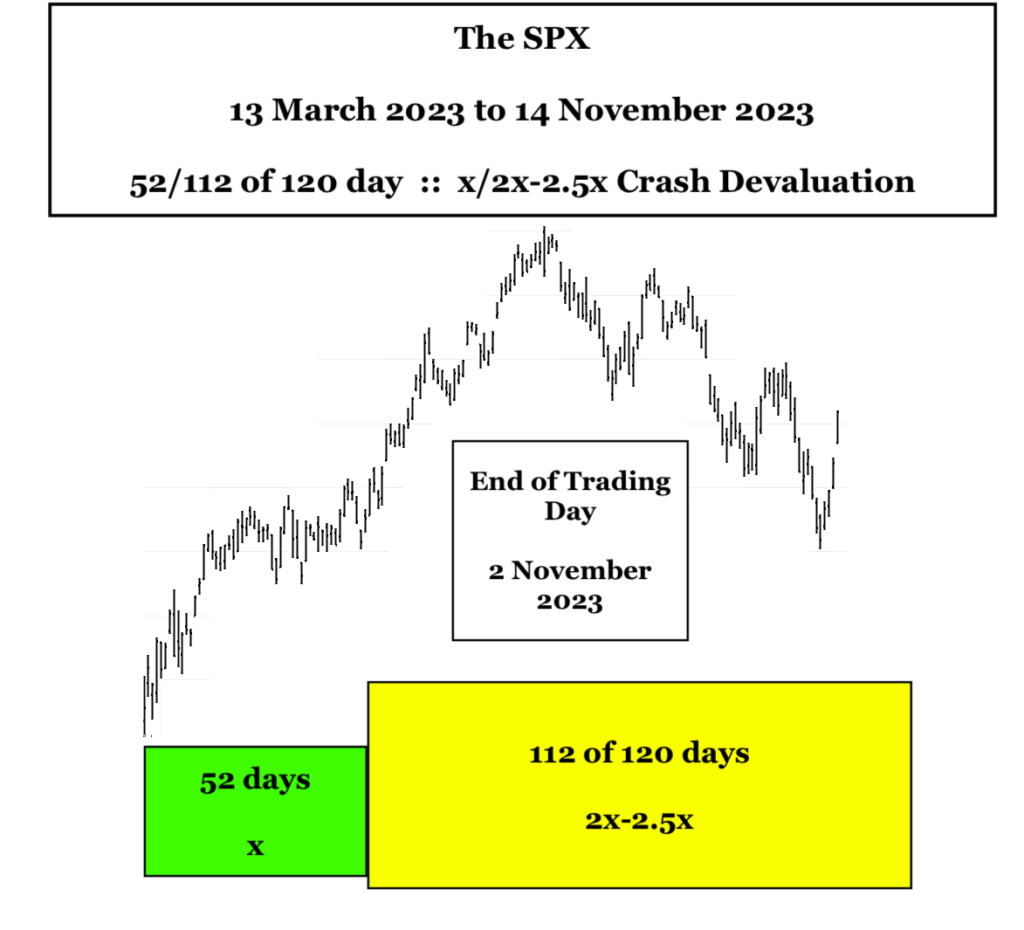

The current fractal target date for the global intermediate crash low for equities, crypto, gold and commodities is 14 November 2023. This intermediate target date is based on two sequential monthly declining Bank of Shanghai equity 3-phase Lammert decay fractal series starting November 2017: 9/20/18 months and 9/21 of 21/12-18 months. A 27 June 2023 daily 4-phase Lammert fractal series of 14/34/28/21 days (ending 14 November 2023 ) completes a July 2021 9/21 month subfractal (1) and subfractal (2) series of a projected 9/21/12-18 month 3 phase decay fractal series.

With its collapsing overproduced by 100 % and grossly overvalued property sector, China has the overproduced and overproduced manufacturing position that the the United Staes had in 1929.

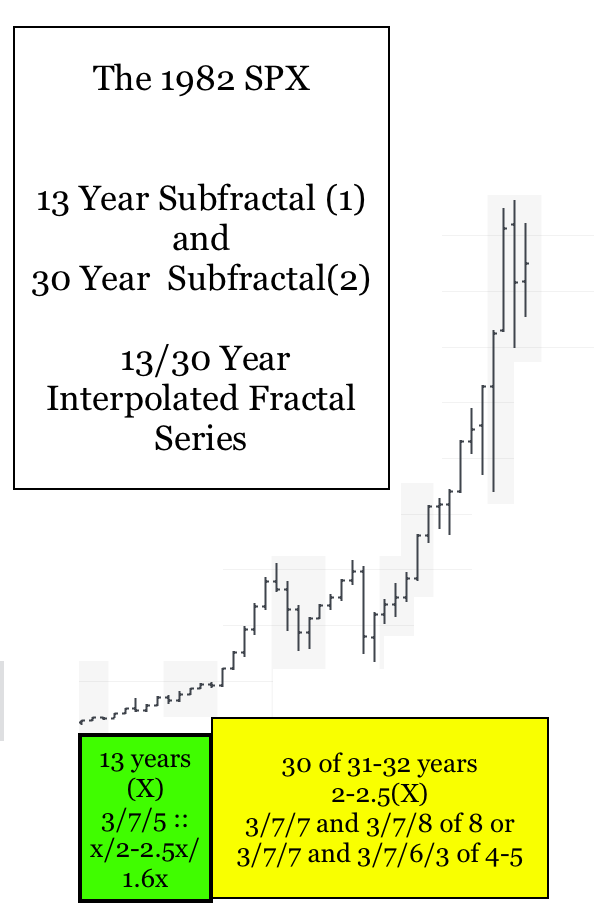

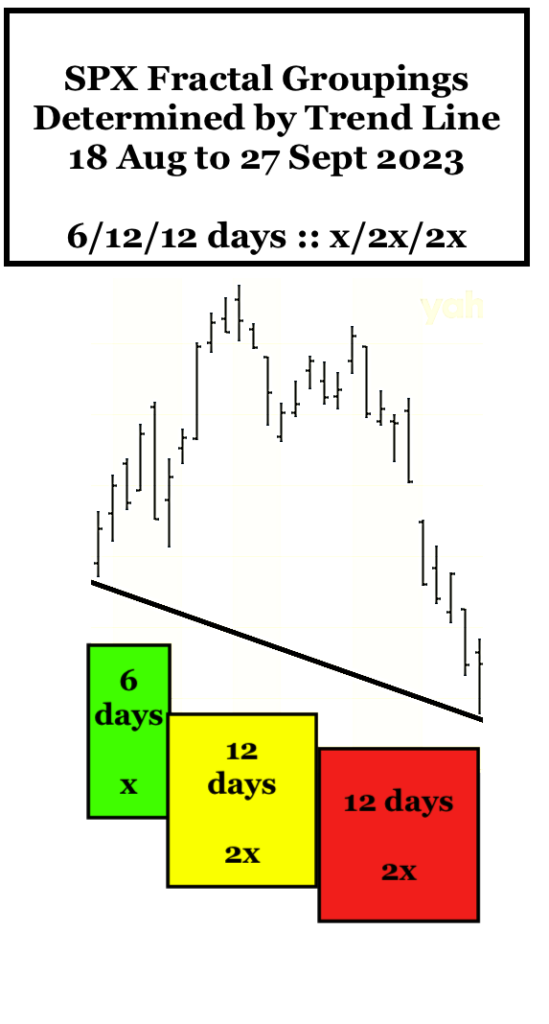

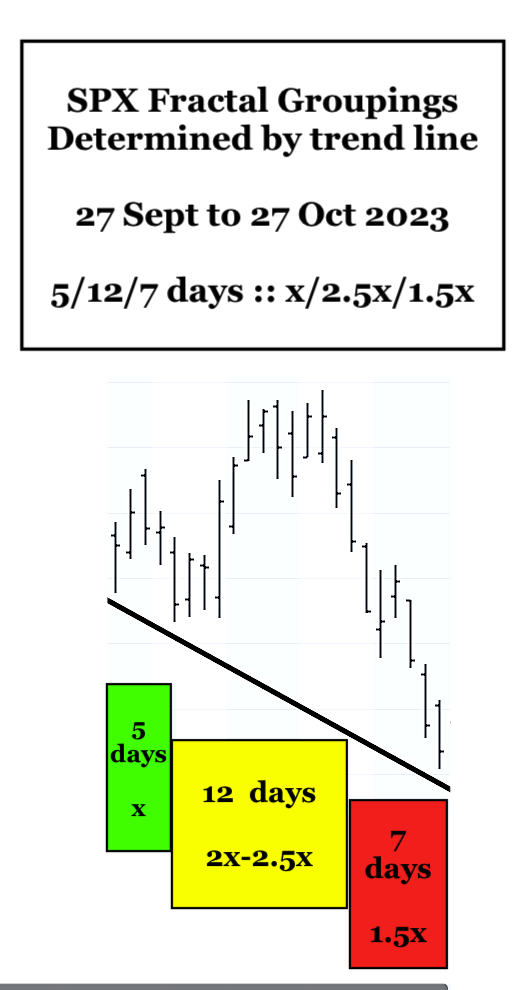

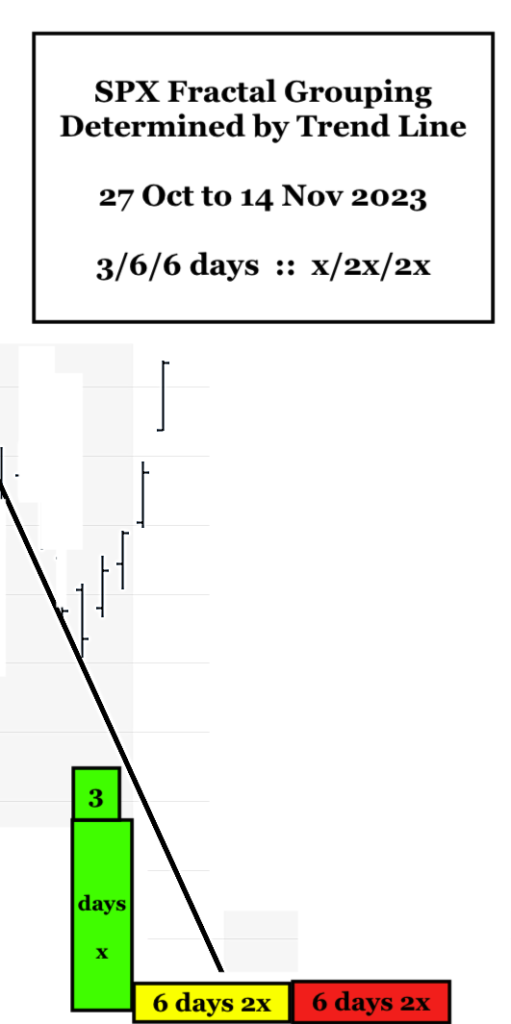

Lammert Fractals are deterministically self-ordered in the most elegantly efficient manner by the global asset-debt macroeconomic system and have two simple mathematical fractal grouping patterns: a 3-phase time-based fractal pattern of x/2-2.5x/1.5-2.5x and a 4-phase time-base fractal pattern of x/2-2.5x/2-2.5x/1.5-1.6x. Self similar fractal time units can be in minutes, hours, days, weeks, months and years. The 2-2.5x subfractal (3) of the 4-phase fractal pattern can be a peak such as the 90 year 8 November 2021 peak for the US 1807 36/90/90/54 year great fractal series or a nadir in a declining series. The fractal groupings are determined by the underlying trend line from the first and last time unit of the fractal grouping which means that the nadir valuations determine fractal groupings. the nadir valuation point for the 90 year subfractal (2) of the 1807 36/90/90/54 year Lammert 4-phase great US fractal series occurred on 8 July 1932.

On 2 November 2023, selling and buying were conducted by the “smartest” speculators or AI programs. Equities were sold to those occupying the last musical chairs with gapped higher highs on 1 and 2 November. Conversely for the smart sellers of equities, long term US Notes and Bonds were purchased with exiting equity money with a gapped nonlinear low for Notes and Bonds on 2 November 2023 which was the trading day after the completion of a 31 August 2023 9/20/16 day lower high peak interest rate and an 11 October 2023 16 day subfractal (3) 3/8/7 day lower high peak interest rate. A gapped low occurred on day 17 of the 11 October subfractal (3) ending 2.5% lower of a projected 25 day lower low interest rate series.