In 1929 a 3-phase 5/10/12 week :: x/2x/2.5x or 25 week Lammert first base crash fractal contained the Sept 1929 SPX peak and the November 1929 SPX crash low valuation. This was the asset-debt macroeconomic system’s mathematically self-assembled first base fractal initiating a decay fractal series for the completion of an US 1807 36/90 year x/2.5x first and second time-based fractal series ending in 1932.

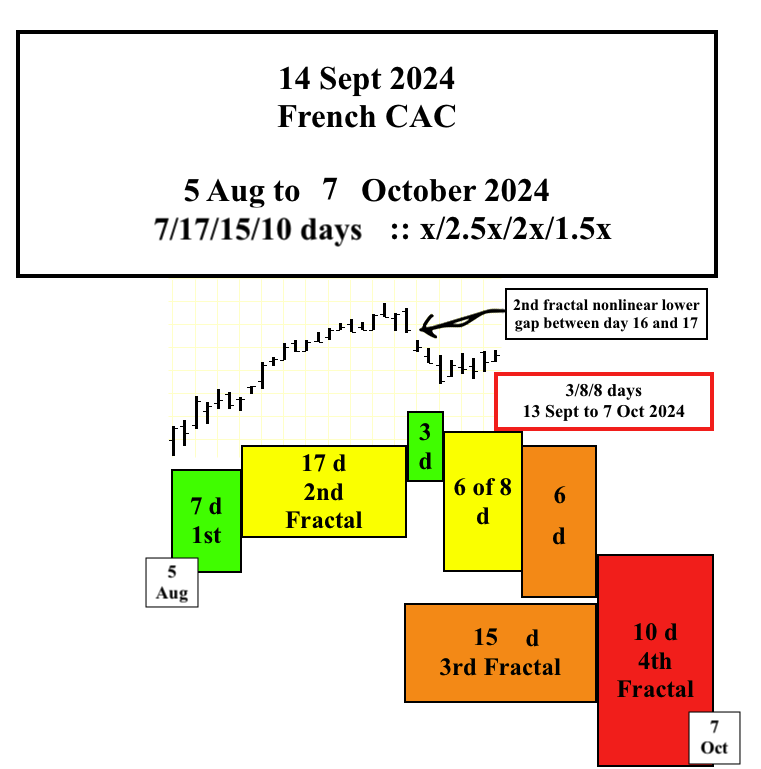

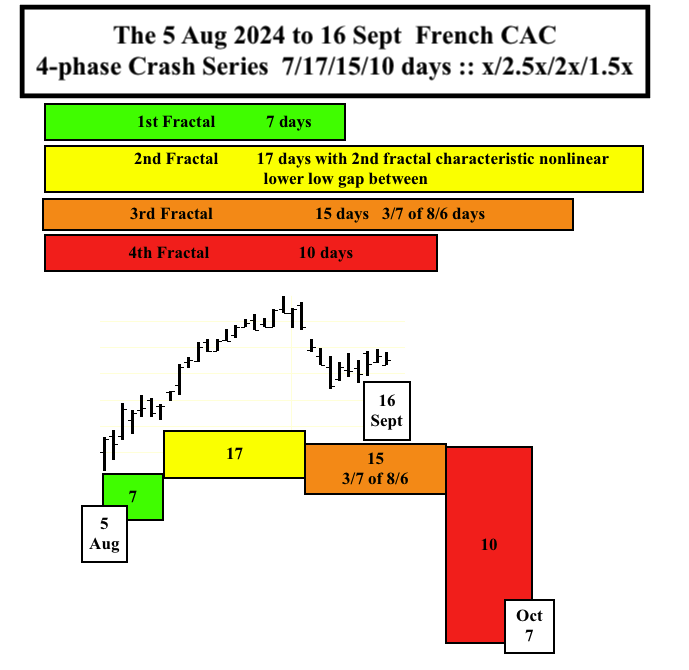

The 5 August to 8 October 2024 2/4/4/3 week or 10 week first base fractal will constitute the mathematically self-assembled first base fractal initiating a decay fractal series for an interpolated 1982 13/32 year first and second fractal series ending in 2025.

ACWI is summation global equity index valued at over 100 trillion dollars. It contains the US Wilshire worth 57.5 trillion dollars and the Shanghai, Nikkei, Indian, HangSeng, and Canadian et. al. exchanges worth 10, 6, 5, 4, and 3 trillion, et. al., respectively.

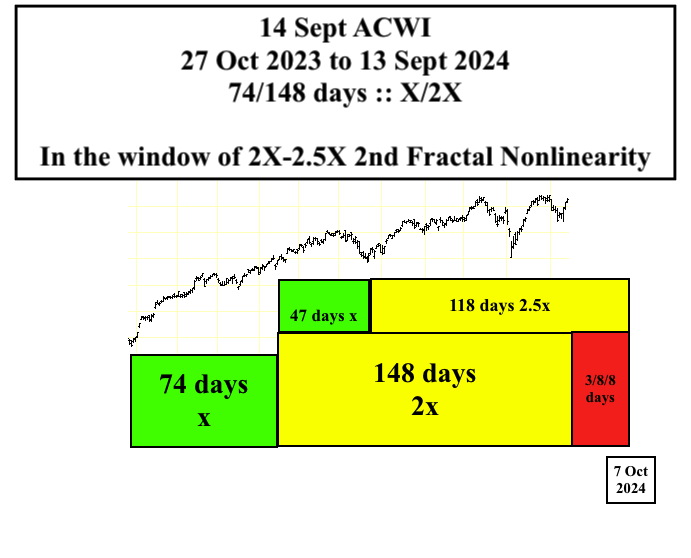

Since October 2023, the ACWI is following (the asset debt macroeconomic system has self-ordered self-assembled) a 17/33** of 36 week first and second series with an interpolated shorter 13/31** week series, the latter ending 5 August 2024 with nonlinear gapped lower lows on the daily charts characterizing the end of the 31** week second fractal.

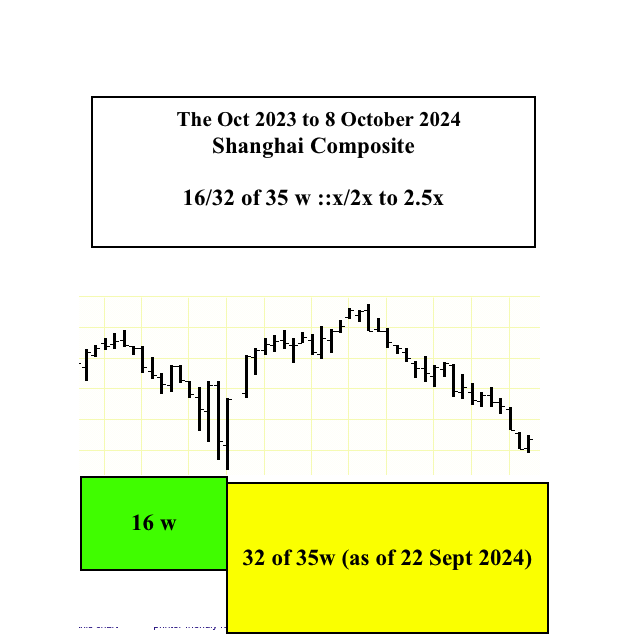

The longer dominant Oct 2023 17 week (74 day) fractal series can be discerned easily via the 10 trillion dollar equivalent Shanghai composite whose 16 week(75 day) first fractal has a negative slope. Its second fractal of current/y 32 weeks is deteriorating and near the low of the 16 week 1st fractal and within 2 % of the Shanghai March 2020 low. The valuations are both consistent with a deflationary collapsing property bubble, the most over-produced, over-valued, and overowned in recorded history. (The HangSeng has a similar profile with a 8 October 2024 expected collapse to 10000)

The ACWI made a record valuation high on 19 Sept 2024 and is expected to make another on 25 September 2024 which is day 14 of a 8/17/14/10 day : x/2-2.5x/2x’/1.5x’ crash fractal series. From Wednesday 25 September 2024 to 8 October 2024 global markets are expected to crash forming the initial Lammert 10 week first base fractal for the decay fractal series to complete the 32 year second fractal of the 1982 13/32 year first and second fractal series, interpolated in the US 1807 36/90/90/54 year :: x/2.5x/2.5x/1.5x fractal series and ending 2074.

Added to original post: end of US trading day 23 September 2024.

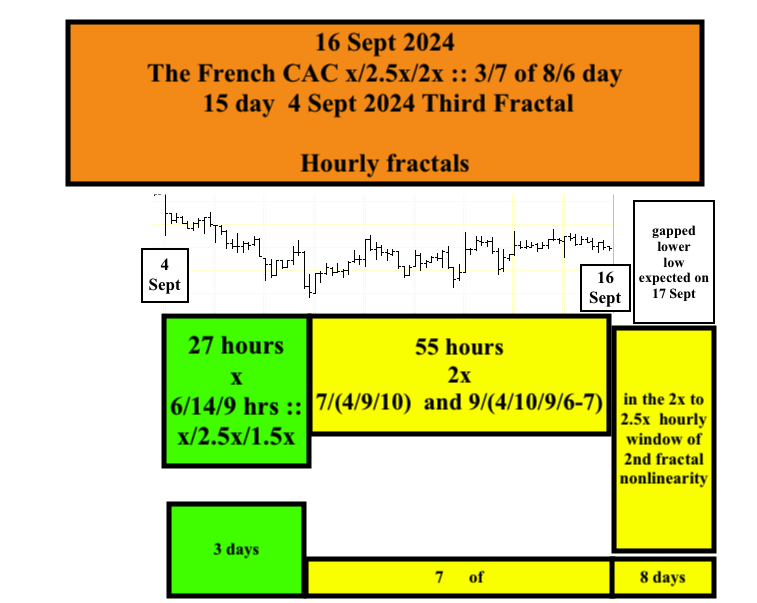

This the asset-debt macroeconomic system’s self-assembly mathematical process for the last 6-7days of the 6 Sept 2024 14 day 3/6-7/7-6 day :: x/2x/2x final peak saturation growth ending 25 September 2024.

Added end of trading day 25 Sept 2024. Initial decay begins in final growth. Time based valuation fractals have the property whereby the last unit of a fractal becomes first unit of the next fractal. (valuation growth starts in final valuation decay and vice versa) In the 5 August to 8 October 8/17/14/10 day :: x/2-2.5x/2x’/1.5x’ 4 phase fractal series, today September 25 was day 14 of the 14 day (and the final day 6 of its composite, a 3/7/6 day subfractal series ) 3rd fractal. September 25 also represented day 1 of the 10 day 4th fractal crash series. There are 78 5-minute units in the trading day. The ACWI global world index made a new (all-time) high in the first 5-minute unit of day 14 and a lower high during the 8th 5-minute unit and ended near the low of the day. That represented a final double top on a 5-minute unit basis. Observe for a lower low valuation gap to start the opening tomorrow, September 26, day 2 of the 10 day crash 4th fractal.

Under the influence of a historically collapsing property bubble affecting nearly all of its citizens, the HangSeng and Shanghai composites started within a few percent of the March 2020 low, 6-10 trading days ago(respectively) and ended their corresponding final 6 days of the 3/7/6 day (14 day) correlative reflexic growth subseries completing the 5 August 8/16-17/14 deteriorating growth series with respective final 6 day 9-12% gains and blow-off gaps upward between days 4 and 5 and days 5 and 6 and ending at the low of the day on day 6.

Watch these two Chinese composites for a gap lower low valuations later this evening Thursday 26 September 2024.