The history of the asset-debt macroeconomic world is one of periodic speculative bubbles

where the focus of ‘economic activity’ is shifted from Adam Smith creation of new products useful to living in the real world … to the less work-intensive more profitable (for a time) activity: to the speculative money-gaming of buying and selling derivative virtual assets leveraged by banker and Wall Street created credit.

When the population of small time citizen speculators is TOTALLY depleted… the malinvestment easy-money asset-derivative bubble undergoes valuation collapse – taking with it the real citizen’s useful economy – from which it has sucked and diverted useful citizen credit, useful citizen wealth and useful citizen active engagement in the real economy..

Wall Street and London, et. al.’s speculative stock and debt exchanges and credit creating asset bubble scams ARE the direct causes of the Major Depressions in the Real Citizens’ Economy.

The global speculative stock market and credit creating asset bubble scams ARE the direct causes of Depressions in the real citizen economy and the subsequent wars between citizen nations who are lead to fight each other rather than direct attention exactly to those counterparties who have created the problem and have accumulated more and more transgenerational wealth over the centuries via their money-changer credit scams.

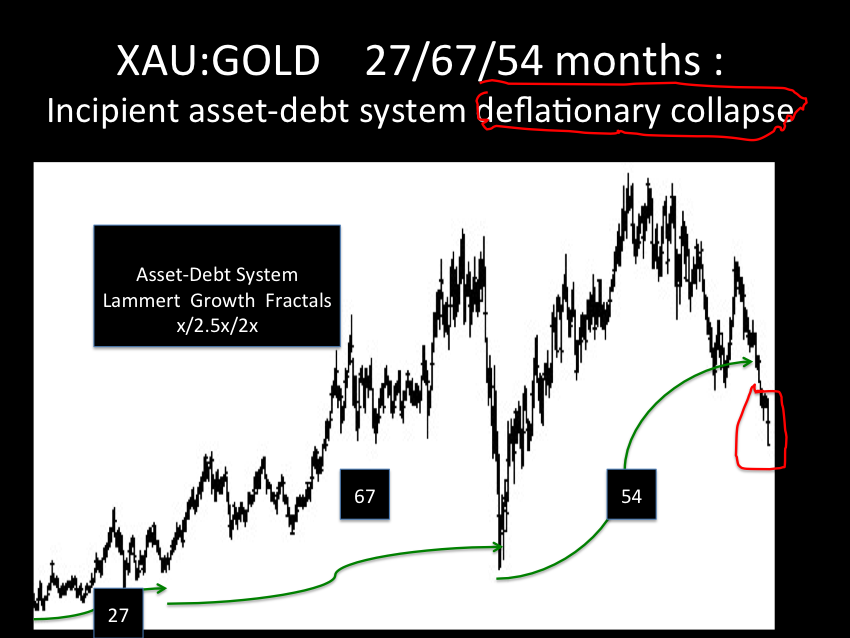

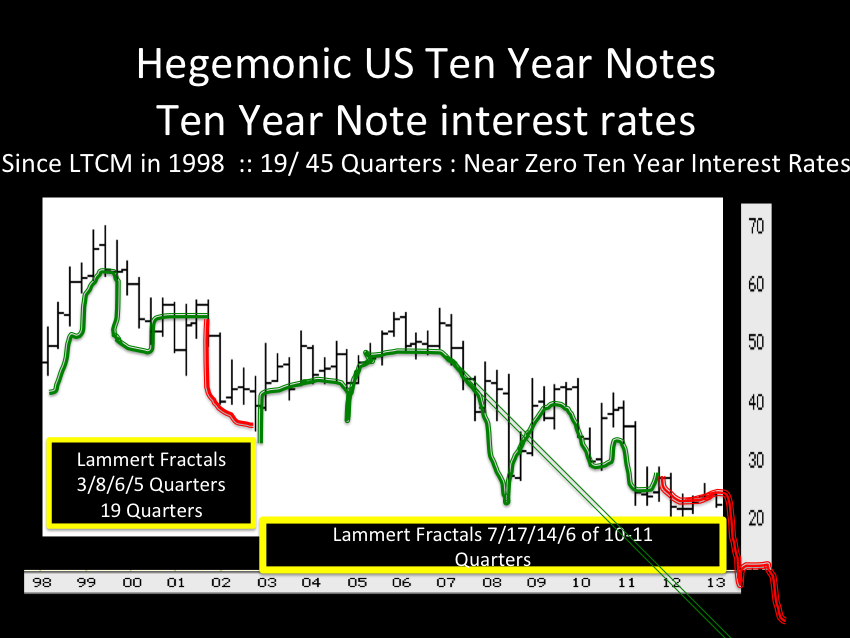

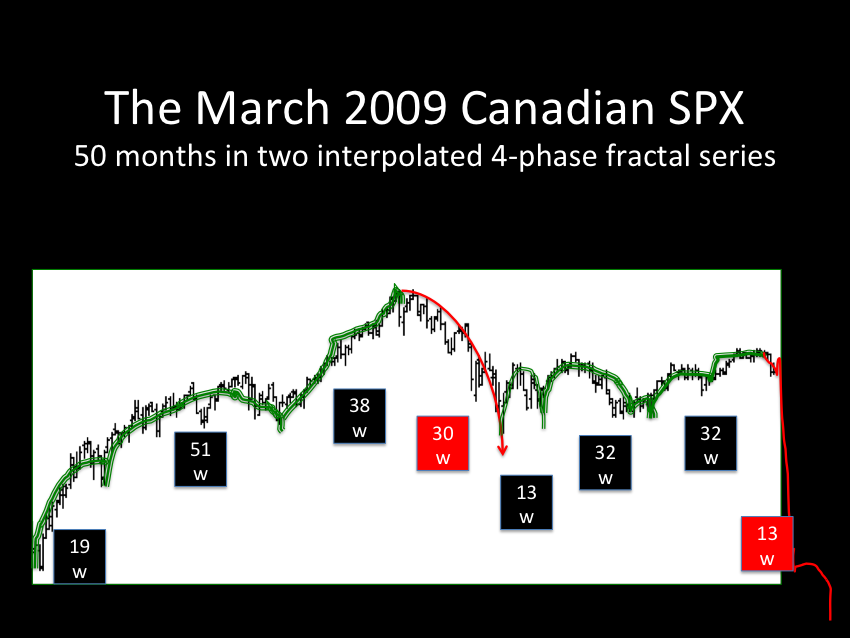

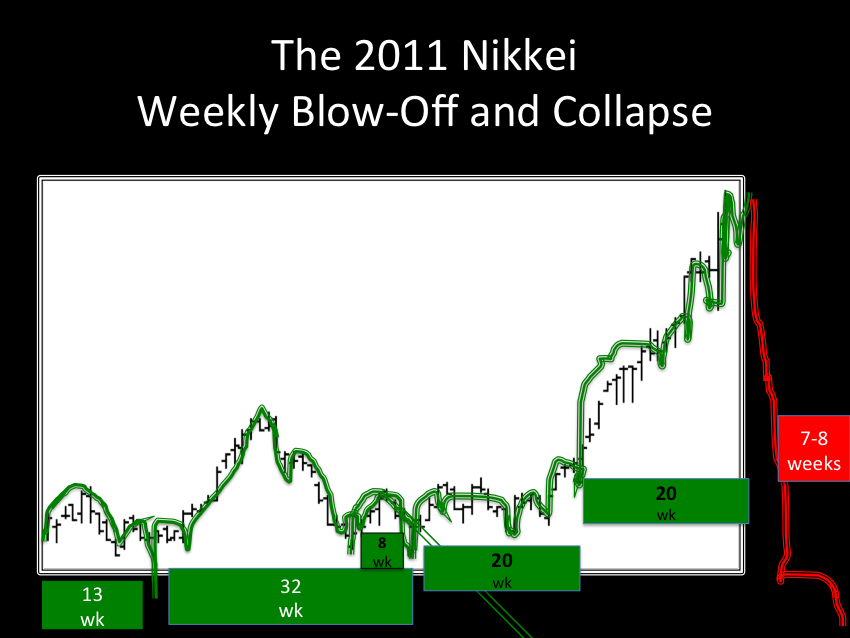

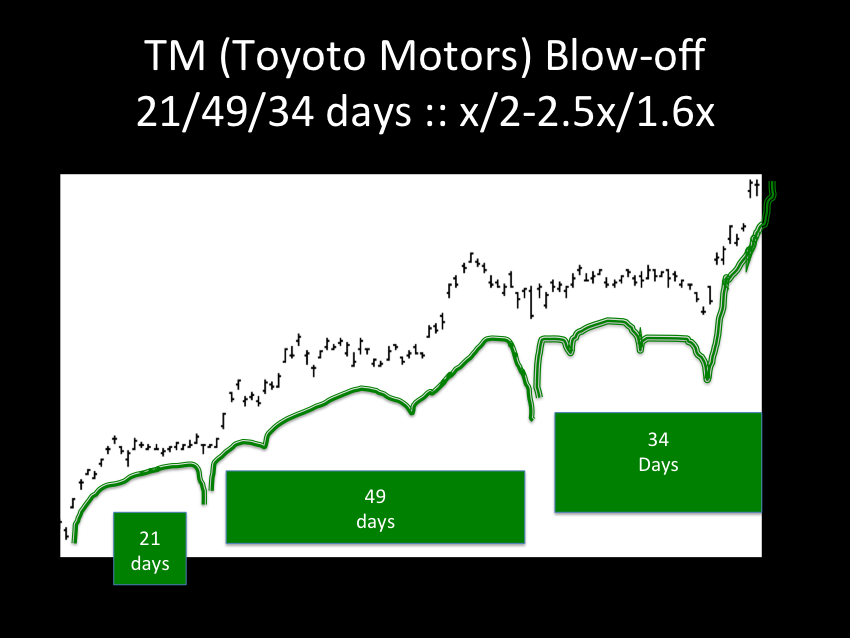

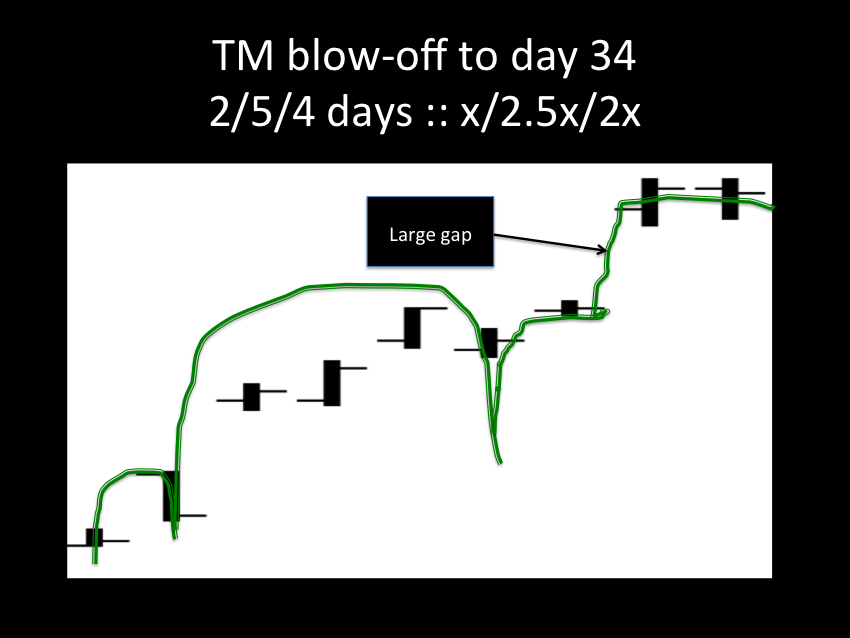

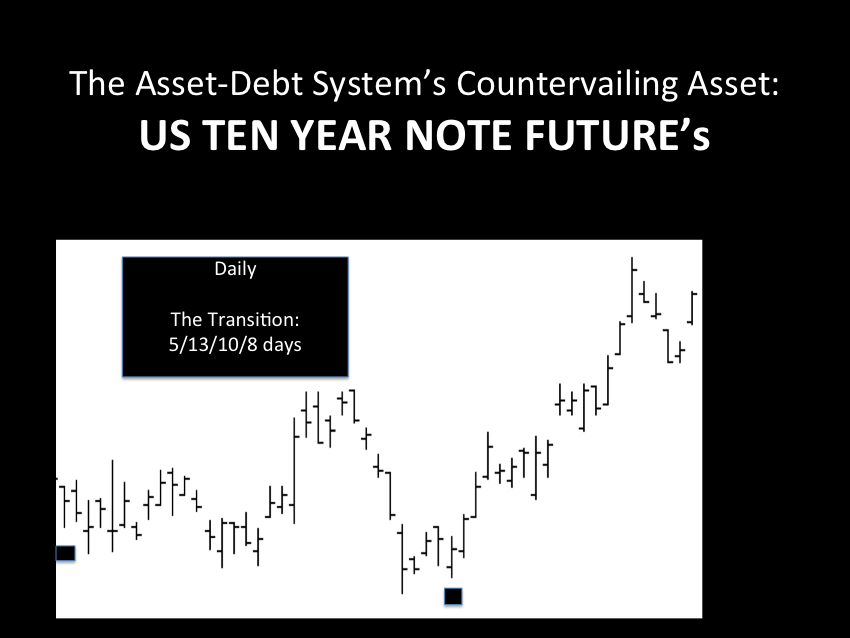

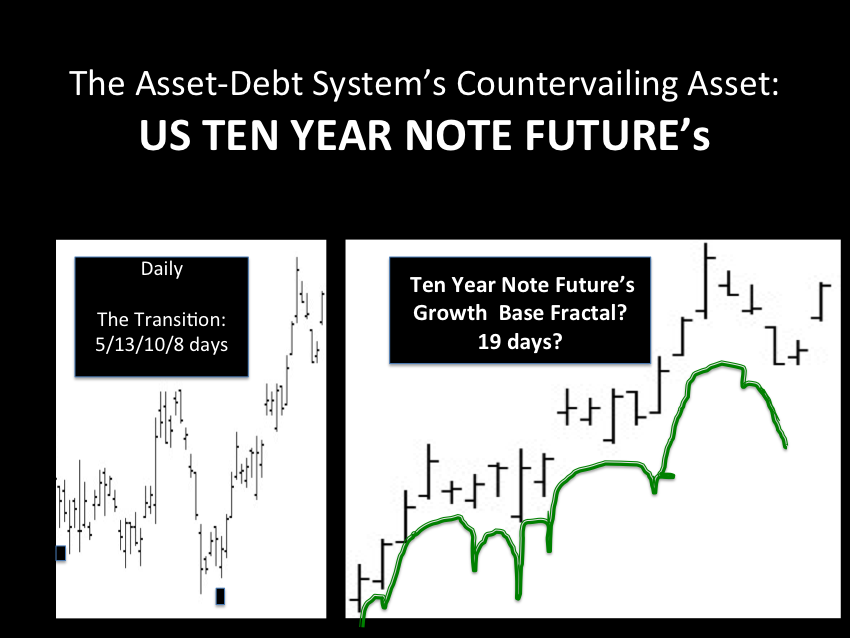

The Asset-Debt system’s timed based Asset and Debt Valuation Curves are a historical record of recurrent asymptotic saturation depletion of the small citizen ‘investor’ speculator population.

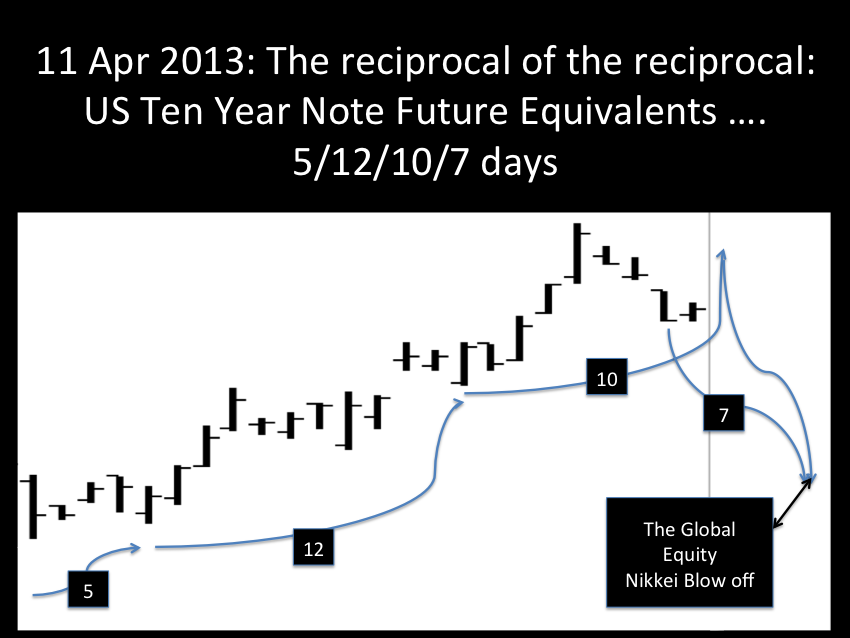

Saturation of the this small speculator population occurs in a Lammert mathematical quantum fractal manner.

Likewise the subsequent devaluation of the derivative asset occurs in a Gompertz-like mathematical quantum fractal manner with necessary fractal counter growth with the larger absolute valuation area of asset valuation decay.

Defacto or otherwise. the current system and its rules represent a societally disruptive generational scam to skim massive amounts of citizen wealth – denominated for the most part in real goods and services – and collusionally perpetrated by those who have the wherewithal to perpetrate.

The height of every speculative asset bubble is defined by complete depletion of the small speculator population. Most of these are citizens in the 99 percent who have been attracted like flies to shit to the seemingly easy way that Wall Street and Wall Street owned political system’s tax laws provide to increase personal wealth.

The big boys get out before the crash. The global Wall Street hedger equivalents sell the market short, put the market, buy cheap low valuation calls, et. al.

When the speculator population is depleted and the derivative assets’ valuation plunge, the asset-debt macroeconomy then undergoes system wide implosion.

Of the one quadrillion Asset-Debt Macroeconomic System, the greatest telescoped effect is on the citizen based real economy, which represents annually less than 5 percent of the system’s total worth..

The Real Citizen Operating Economy sans 99% real citizen wealth, sans demand related labor, and sans work related credit … is devastated and undergoes a rapid transformation with real economic depression conditions and high unemployment.

With the current citizen SSI and Medicare entitlements and current Central Bank Chairman’s understanding of the dire situation, there is a possibility to avoid some of the devastation caused by Wall Street’s scam.