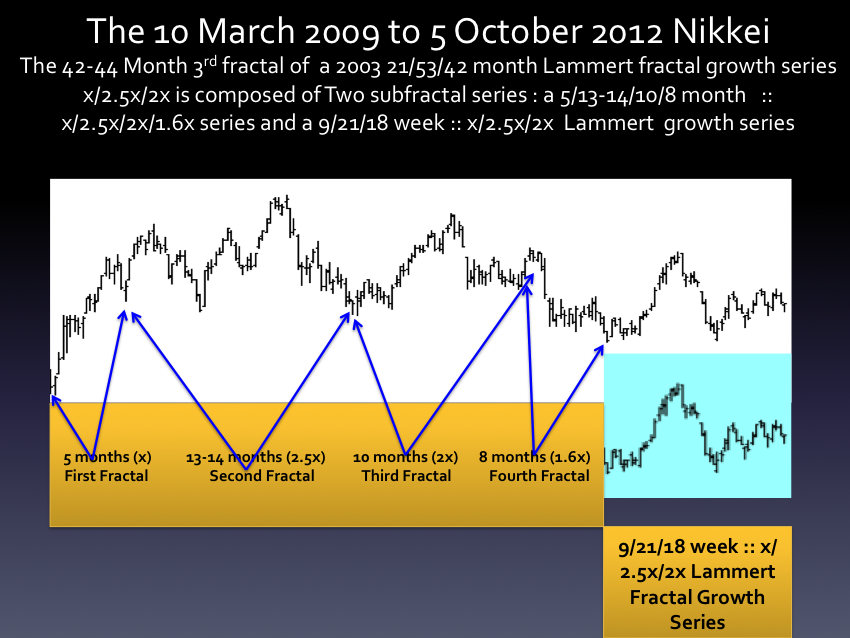

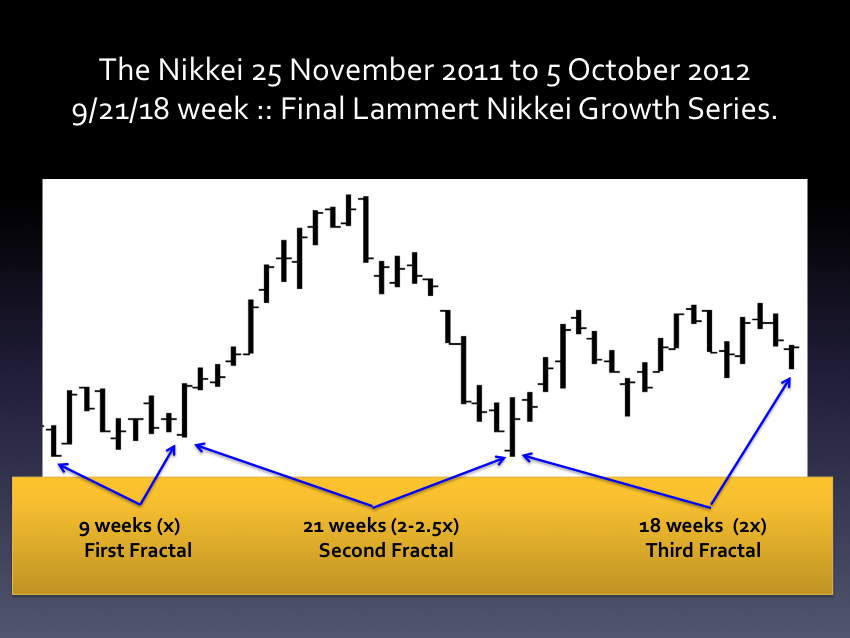

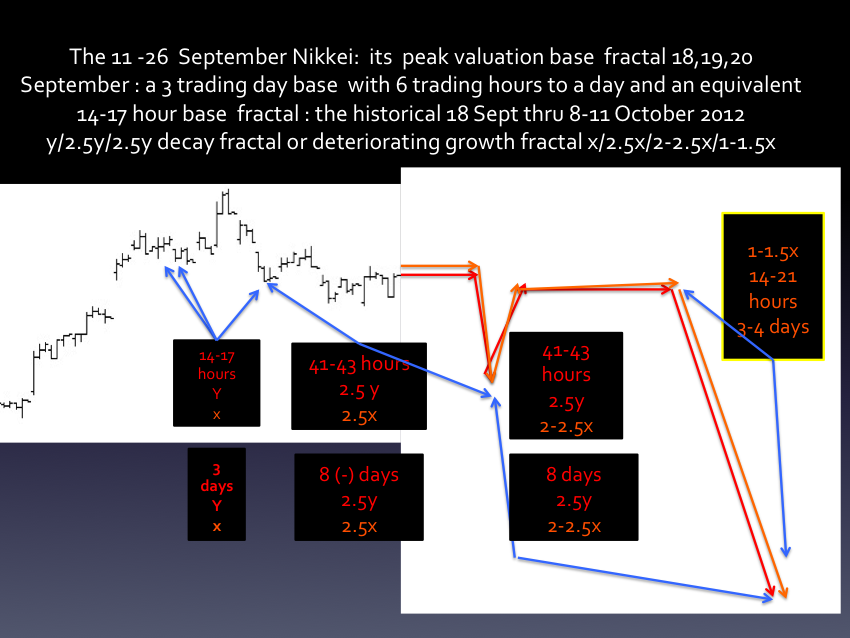

The ideal growth fractal time sequence is X, 2.5X, 2X and 1.5-1.6X. The first two cycles include a saturation transitional point and decay process in the terminal portion of the cycles. A sudden nonlinear drop in the last 0.5x time period of the 2.5X is the hallmark of a second cycle and characterizes this most recognizable cycle. After the nonlinear gap drop, the third cycle begins. This means that the second cycle can last anywhere in length from 2x to 2.5x. The third cycle 2X is primarily a growth cycle with a lower saturation point and decay process followed by a higher saturation point. The last 1.5-1.6X cycle is primarily a decay cycle interrupted with a mid area growth period. Near ideal fractal cycles can be seen in the trading valuations of many commodities and individual stocks. Most of the cycles are caricatures of the ideal and conform to Gompertz mathematical type saturation and decay curves.

G. Lammert

This page was last updated on 15-May-2005 01:21:59 PM .

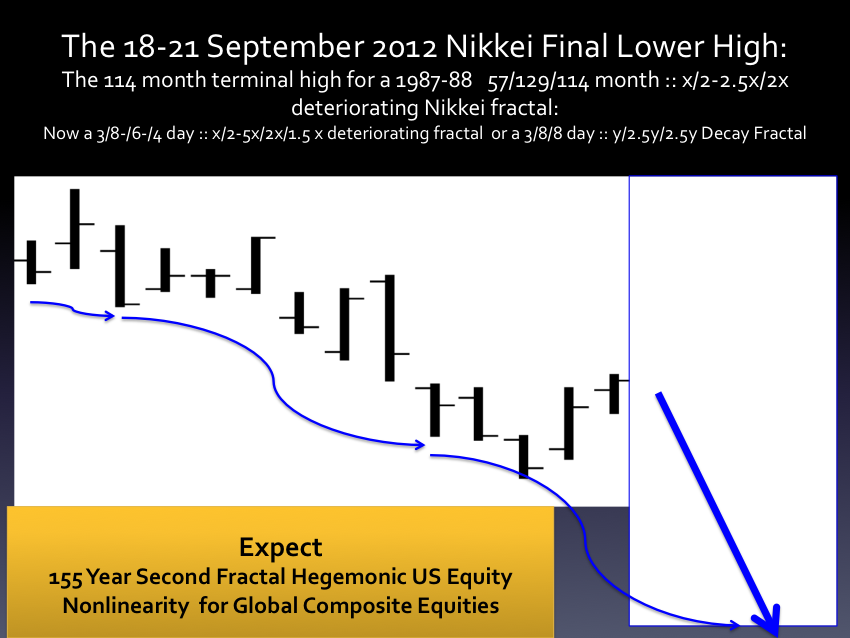

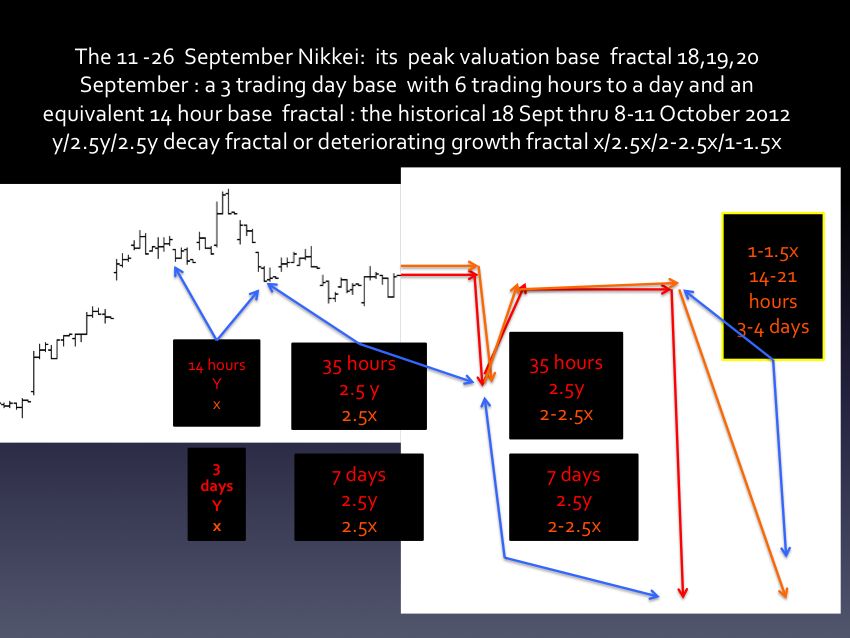

The September -October 2012 deteriorating lower high final growth valuation of the Nikkei lies at the terminal time region of a 155 year 1858 US hegemonic Second Fractal and at the end of a Financial Debt Industry’s take over of the the Global real economy creating unrepayable bad debt that has resulted and will result in enormous profits for the Debt Industry and at the expense of the rational borrowing and paying and theoretically tax advantaged interest rate ideal forward consumption real economy. The asset debt economic system’s current profit and tax rules have been authored by those who own the the system and by the owners’ of system’s politicians and rule writing legislatures…

Expect 158 year US hegemonic second fractal nonlinearity and collapse of equity, commodity, and real estate valuations.

The hegemonic superpower US bond shall be repaid … and in a naturally occurring and collapsing deflationary environment … will naturally evolve to 150 year historically low US long term interest rates.