Reflexic x/2.5x/2x Lammert Fractals Leading to Final Highs and Turning Points:

The Great Asset Crash

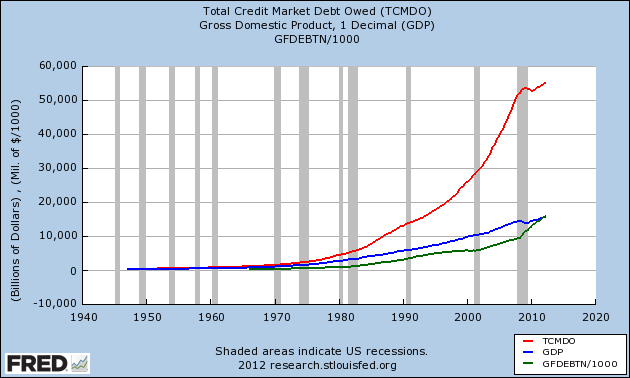

The underlying cause of the countervailing asset valuation saturation curves with the hegemonic US Long term debt occupying one side of Asset Debt System’s dichotomy and real estate, commodities, and equities occupying the other side is the forward consumption and leveraged Economic system’s relatively enormous amount debt compared to yearly GDP – always at risk for undergoing default and depriving the accumulative system’s assets of its current total denominator of valuation.

By way of example, the world’s hegemony, the United States, currently has about 52 trillion dollars of debt compared to its GDP represents about 28 percent of the outstanding debt.

|

Credit market debt by sector and asset class (2010 Q1) owed by the United States in billions USD[16]

|

|

Bonds

|

Loans

|

Mortgages

|

Other

|

Total

|

% GDP

|

|

Financial sector

|

5612.9 |

807.7 |

167.4 |

8375.3[A] |

14963.3 |

104.9% |

|

Households and non-profits

|

266.1 |

335.1 |

10480.1 |

2421.8[B] |

13503.1 |

94.7% |

|

Nonfinancial business

|

4446.6 |

2835.7 |

3552.6 |

74.6[C] |

10909.6 |

76.5% |

|

State and local

|

2369.8 |

13.7 |

|

|

2383.5 |

16.7% |

|

Federal

|

8283.2 |

|

|

|

8283.2 |

58.1% |

|

Total

|

20976.6 |

3992.2 |

14200.1 |

10871.7 |

50042.7 |

351.0% |

Since 1978 sector credit (debt) growth and system leverage and money changing gaming by the Financial Debt Industry has grown in the US from 400 billion in 1978 to 17 trillion in 2008, a forty-three fold – 4300 % increase. This compares to a 13-1400 % debt increase in the household sector and a 1200 % debt increase in the business sector. The US traditional business-household economy has been de facto usurped by the Brussels-London-Wall Street Financial Debt Industries who have used the moneychanging and debt creation properties of the monetary system for leveraged Bain Capital prototype buy-outs and Glass-Steagall illegal financial schemes which have resulted in gross overproduction of assets, gross overvaluation of assets, and debt entrapment and enserfment of a population of citizens who did not have the wage and earning capacity wherewithal to support the long term obligations of easy credit provided.

Moreover, the Financial Debt Industry funds and controls both political parties. There is no hope for a possibility to return to a more reasonable Asset-Debt Economic System sans the dominant valueless added money changing activity of the Financial Debt Industry.

While the Asset Debt System would undergo similar quantum progression between the countervailing asset classes of hegemonic sovereign debt and all other asset classes, the severity of natural nonlinear changes would be significantly lessened without the non value added and harmful leveraged money changing and debt enserfing activity of the Financial Debt Industry who has first use of the citizen’s wage-service-forward consumption trading exchange medium.

In the end at the transition point of Asset Debt Saturation Economic bad debt undergoes an accelerating exponential cascade of bad debt default.

This growing default is something that is occurring within the asset debt economic system that is unrealized – and obfuscated by the traditional linearly occurring economic data that is extracted from the system – e.g., a falling unemployment rate of 6.9 %

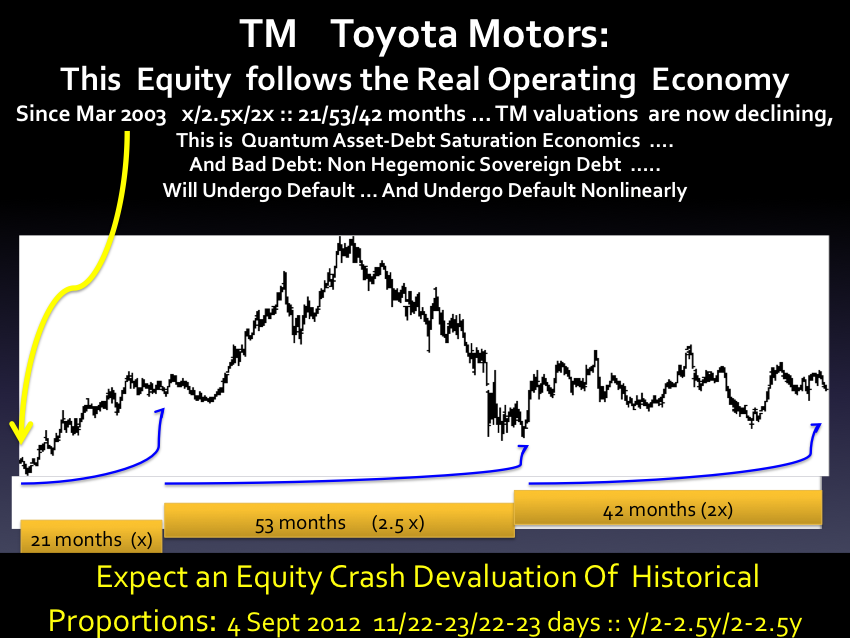

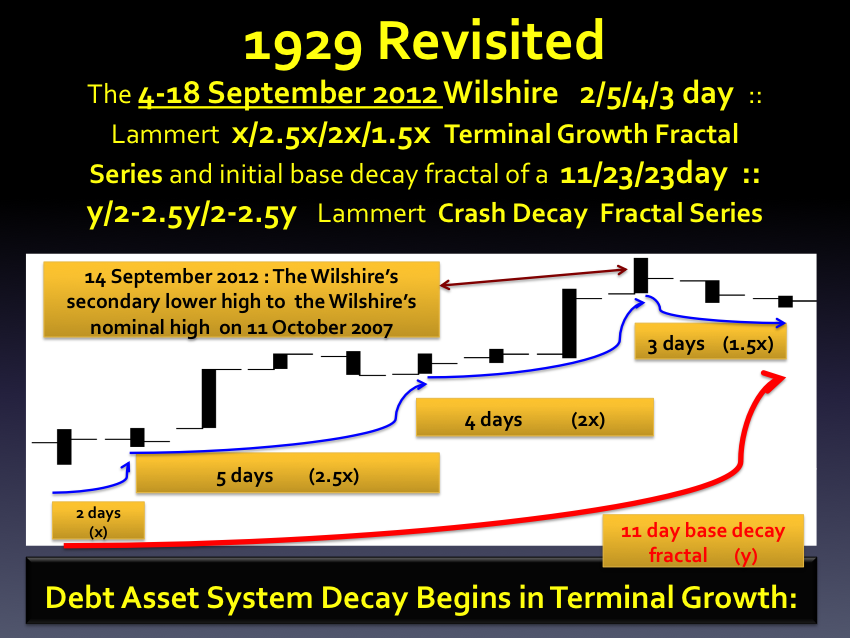

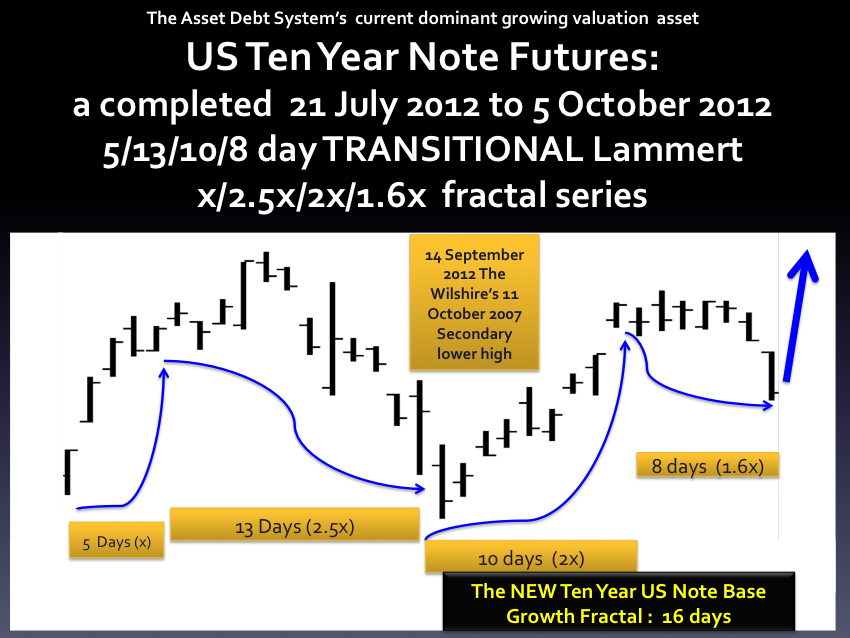

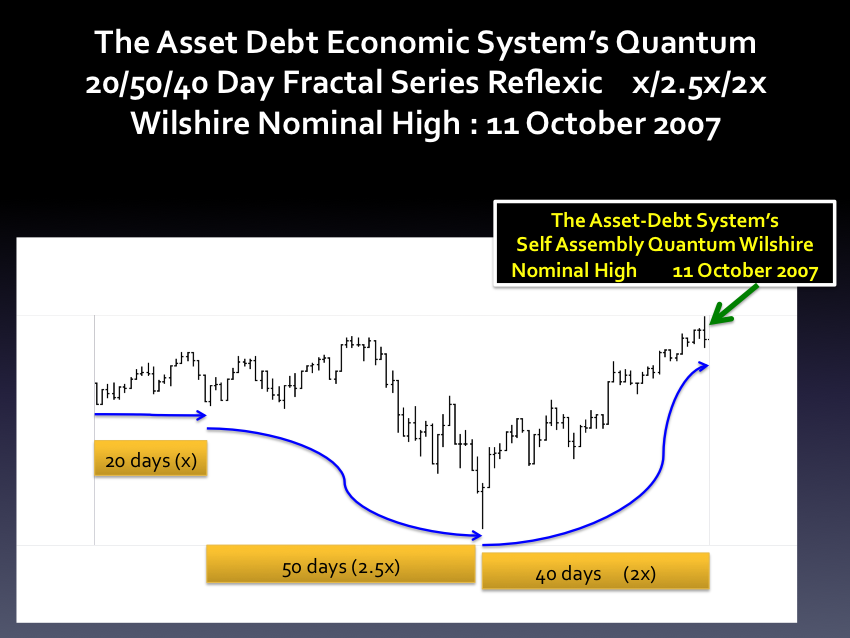

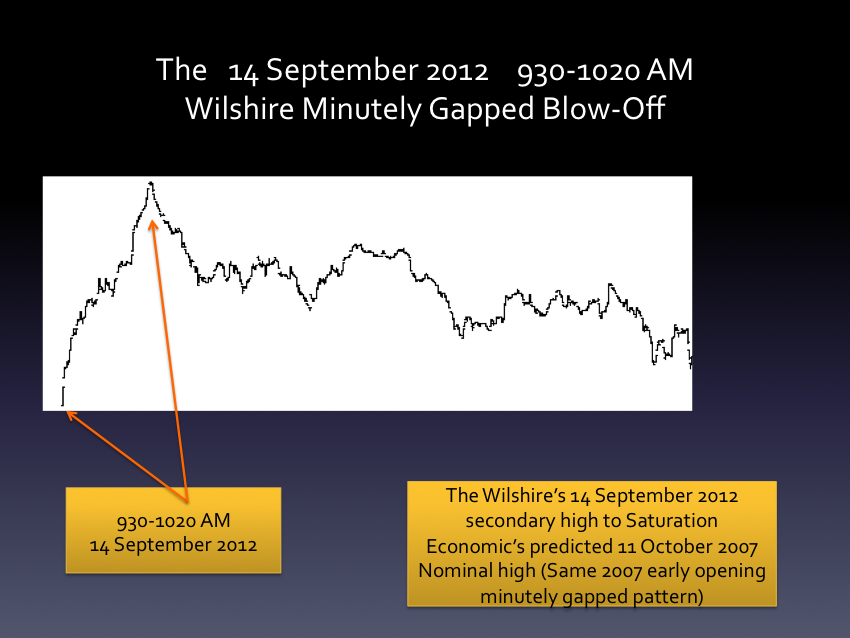

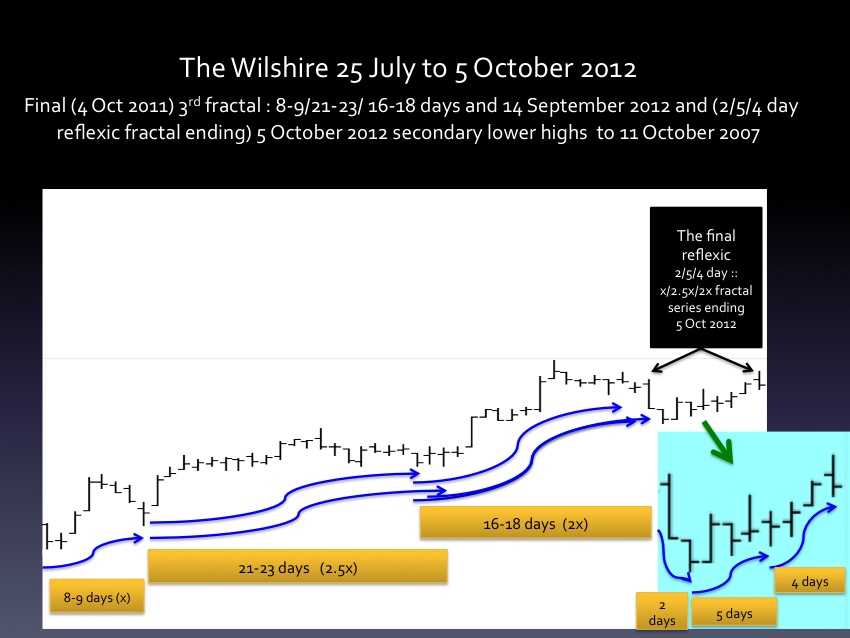

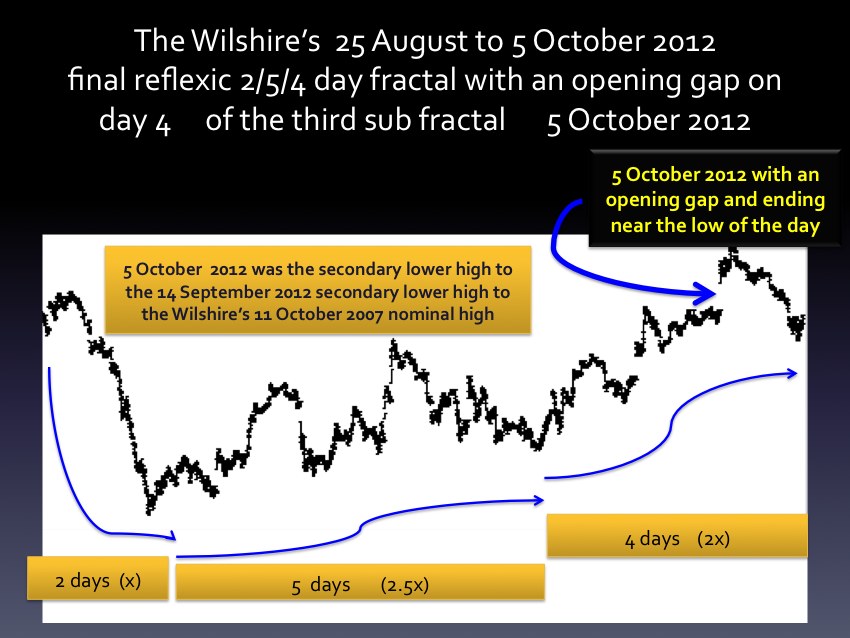

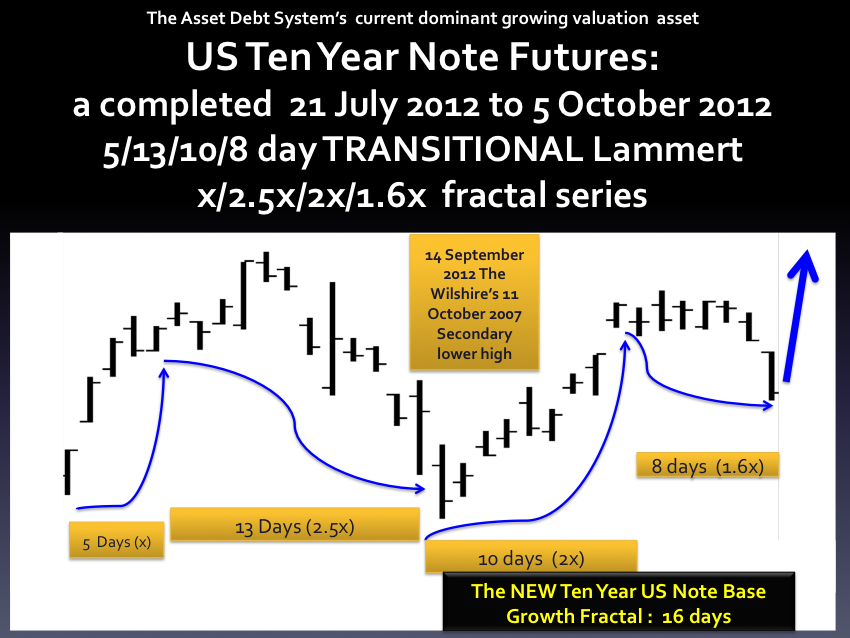

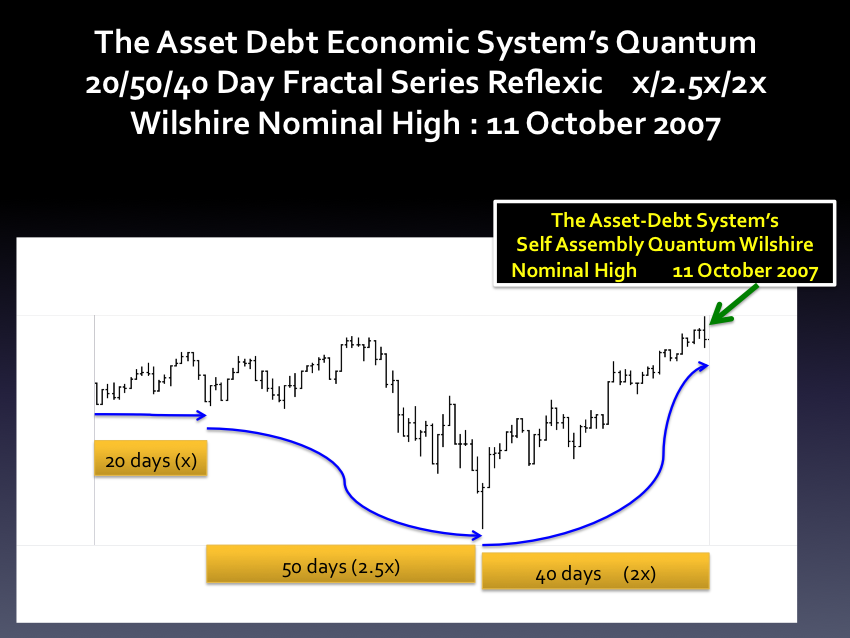

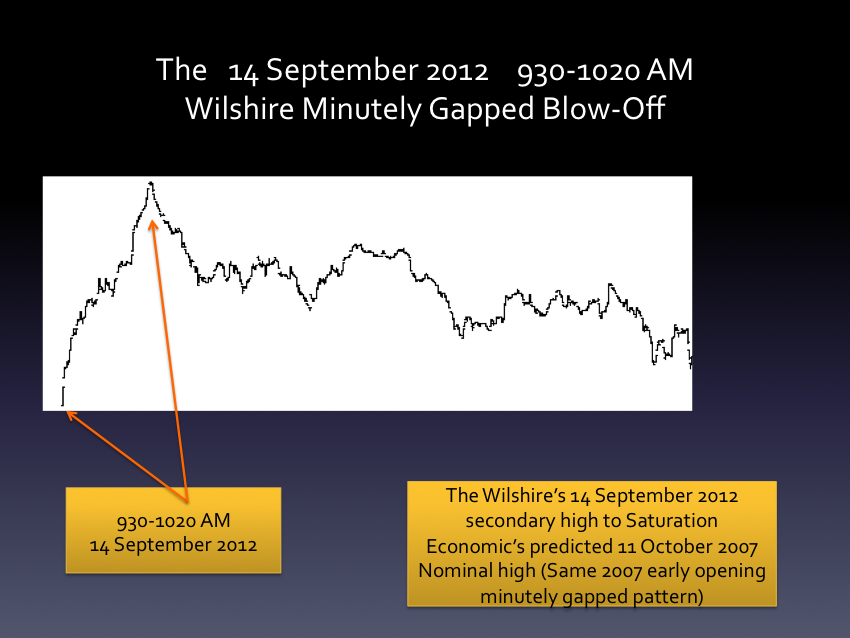

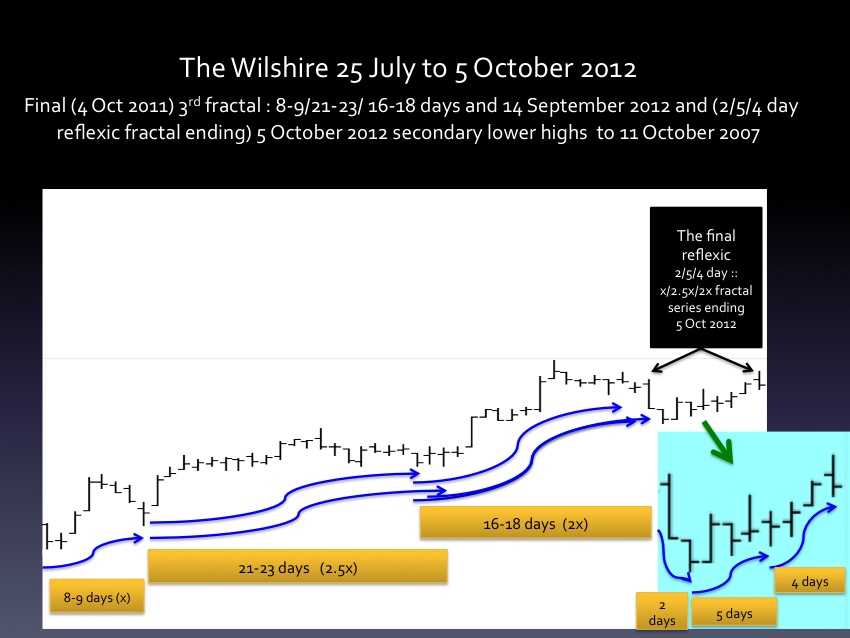

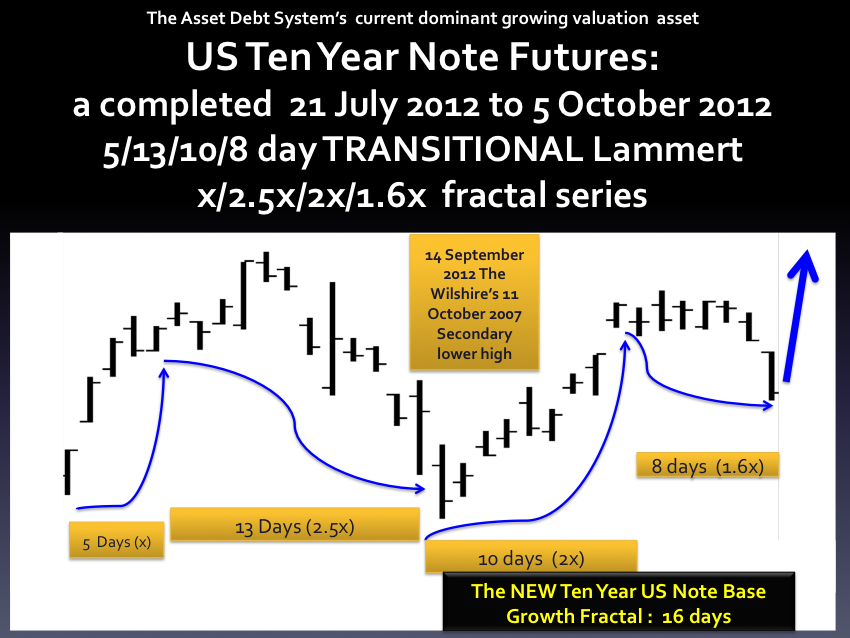

The time dependent evolving quantum Lammert fractals of the two countervailing asset classes represent the Asset-Debt Economic system’s very precise, very simple, self-assembly math which incorporates and integrates the sum total products of the system’s internal complexity and the ongoing balance between good repayable debt and defaulting debt, and produces the deterministic minutely, hourly, daily, weekly, monthly, and year fractal patterned activity that is the science of the macroeconomic system.

At a asset-debt system predetermined time there is transitional point when when bad debt will undergo accelerating exponential collapse and default. Held hegemonic bonds will see their value sharply adjusted upward relative to defaulting bad debt.

The time of transition is dependent on the asset class advantaged rules of the Asset Debt Economic system. The current rules established by the Financial Debt Industry favor equities and speculation over the prudent activity of savings. During nonlinear asset default the Financial Debt Industry has the greatest opportunity for gaming the system and maximally extracting effortless wealth.

Asset classes other than sovereign debt will undergo deflationary collapse as the asset-debt economic system’s denominator of total wealth is lessened by bad debt with prior assumed value that undergoes nonlinear accelerating default.