It has been the goal of this website to prove that the Global Asset-Debt Macroeconomic system is deterministic and operates to simple mathematical valuation growth and decay fractal laws with enough precision to confer on Macroeconomics the characteristics of a patterned science.

The Great Crash: 3 August 2020 Day 85 of 90 days. The Deterministic Great Global Equity and Commodity Crash:

The 3 October 2019 :: 36/90/85 of 90 day :: x/2.5x/2.5x series is fractally self similar to the 1807 US Hegemonic Great Fractal series of 36/91/89 years.

The Global Asset Debt Macroeconomic System, characterized by the valuations of all its assets, including sovereign debt is quantitatively deterministic.

Trillions of dollar-equivalents have been borrowed globally building over capacity and creating assets whose characteristics will not repay the debt on the ledgers.

Asset valuations are elevated by that excessive debt creation.

Excessive debt creation leads to overproduction, over investment, excessive ownership, and over valuation of assets.

Valuations self correct in a deterministic nonlinear mathematical fractal manner determined by low nodal valuations.

The current 89 year US Third fractal beginning in 1932 is composed of two yearly subfractal series: starting in 1932: 10-11/21-22/21-22 years

and starting in 1982: 9/20/12 years

The final 12 year third fractal of the 1982 9/20/12 year final fractal beginning in 2009 is composed of three subfractals. The third subfractal of this 12 year subfractal series began on 11 February 2016

and is composed of a 10/26/currently (as of August 3) 21 month fractals series.

This current 21 month third subfractal starting 24 December 2018 is composed of two weekly subfractal series: 7/18/18 weeks and 8/19/19 of 20/12-13 weeks …

The second 8/19/19/12-13 week subfractal series began on 3 October 2019 and on a daily basis is self similar to the 1807 US Hegemonic yearly fractal series of 36/91/89 years. This daily self-similar fractal series starting on

3 October 2019 is composed of 36/90/85 of 90 days with a low point on 1 April 2020 ending the second 90 day subfractal.

The self similarity of 3 October 2019 36/90/85 of 90 day series to the US Hegemonic 1807 36/91/89 year series serves to validate the simple mathematical fractal nature of the global macroeconomic system.

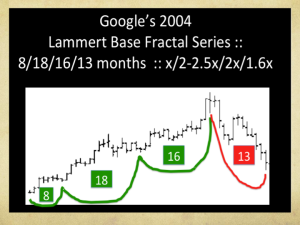

Palladium in US dollars is also a strong marker for the validation of the Lammert x/2.5x/2x/1.6x mathematical fractal series.

3 August 2020 is the 24th week in a 16 August 2018 15/38/30/24 of 24 week :: x/2.5x/2x/1.6x fractal series. Expect palladium to undergo nonlinear devaluation.

This 15/38/20/24 week fractal composes 25 months which is the third subfractal of a 12 January 2016 10/23/25 month subfractal series.

For the DJIA the daily fractal series from 3 October 2019 are:

3 October 2019

first fractal series 7/15/16 days = 36 days

the 90 day second fractal series is composed of two fractal subseries series:

8//(6/15//13/10) = 48 days {(8//20//22) = 48 days}

and

6/15/15/10 = 43 days ending 1 April 2020

The 90 day third fractal series

uses a 13 day base interpolated in the last 13 days of the second 90 day fractal

(a 3/6/6 day) fractal series ending on 1 April 2020)

(13)/31/31 days

and 9//4/10/5 of 10 days or 9/17 of 22 days

Global crash devaluations of commodity valuations and equity valuations will occur over the equivalent next 5 trading days.