The Asset Debt Macroeconomic System’s two observationally and empirically derived mathematical time-based self-assembly fractal time based growth and decay patterns are :

a Type 1 4-phase time based fractal pattern: x/2-2.5x/2-2.5x/1.5-1.6x with low nadir valuations ending and defining the first, second, and fourth sub-fractal and a high peak valuation ending and defining the third subfractal at 2-2.5x and

a Type 2 3-phase time-based fractal pattern: x/2-2.5x/1.5-2.5x with low nadir valuations ending and defining all three sub fractals

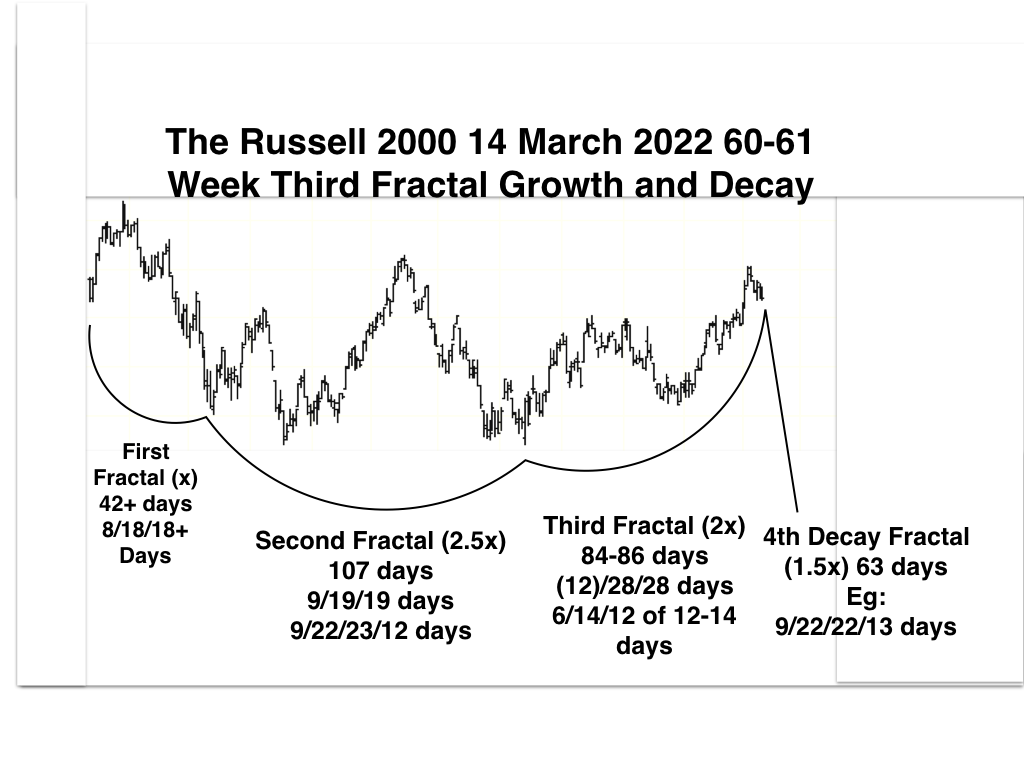

The current mathematical weekly time-based fractal model from the March 2020 low is a type 1 4-phase pattern of 28/71/56/3 of 42 weeks :: x/2.5x/2x/1.5x (The 23-24 Sept 2020 to 24 Jan 2022 second fractal time period contains a disproportionate amount of trading holidays which accounts for the 71 vice ideal 70 week length of the second fractal) The 4 sub-fractals of this 4 phase fractal series are composed of the following sub series.

the 28 (x)week first base sub fractal = 3/7/7 and 3/7/6 weeks;

the 71 (2.5x)week second sub fractal = 7/14/16 and 7/16/17 weeks;

the 56 (2x) week third sub fractal (lower high peak valuation) = 7/15/18 and 4/9/8 weeks.

A 6 week 4th sub-fractal unit decay from the 4/9/8 week lower high peak valuation would complete a 4/9/8/6 week fractal series leaving 37 weeks to complete a final 42 week low.

The observable daily nadir valuation for the Wilshire starting the 4/9/8/6 week pattern was on 13 October 2022 initiating a 16/40/32/12 of 24 day potential Type A series ending 21 March 2023,

Day 32, 15 February 2023, was a lower high valuation for the Wilshire’s third fractal sub series. From the absolute 2 February 2023 peak valuation high of the 32 day (2x) third fractal sub series, a potential type 2 decay fractal sub series is occurring : 7/15 of 18/10 days would likewise end on 21 March 2023, matching the conclusion of a 13 October 16/40/32/24 ::x/2.5x/2x/1.5x series.

The 7/18/10 day three subunits are self-organized as 2/4/3 days, 3/8/6/?4 days, and potentially 2/5/5 days, respectively.

This daily 7/18/10 day three phase daily decay fractal series is occurring in the terminal portion of a 26 to 33 year :: 2x-2.5x second fractal terminal nonlinear time period of a 1981-82 13/32-33 year interpolated fractal series.

The 1981-82 first and second fractal sub-series is potentially part of a larger 1981-82 13/32-33/33/20 year :: x/2.5x/2.5x/1.5x interpolated series ending the US hegemony’s 1807 36/90/90/54 years ending in about 2074.

A hard crash landing ahead for the global equities, whose 3/6/6/5 month valuation fractal decline from the Nov 2021 peak, along with long and short US debt yield inversion, represents the leading indicator of economic recession.

The next 33 year growth cycle from 2023/24 to 2056 will occur during a period of deglobalization; scarcer commodity raw materials, made worse by trade restrictions and resulting in higher consumer prices; and US financial corporations shifting their attention from prior cheap labor globalization profits (during the last 33 years) to domestic rentier capitalism: profits made through domestic real estate corporate ownership and ownership of land and food production via first access to advantaged lower interest rates than available to individual citizens. In such an environment political populism is likely to produce leadership with extreme positions.