Monthly September 2014 Bitcoin Fractal Series and Recent 9 March 2020 Monthly Ten Year Note Fractal series in the Asset Debt QE/QT 21st Century Macroeconomic System and in the Longer US Hegemony 19th century 1807 36/90/90/54 Year 4 Phase Lammert Fractal Series.

I. Current Monthly Model for the Wilshire March 2020 low fractal series: 8/20/16/12 months :: x/2.5x/2x/1.5x.

II. For System Simple Fractal laws, see 31 August 2023 section on A Primer on Fractal Series.

The Wilshire 13 August 2023 52/130/130 day fractal series mathematical model still holds with an 18 August 2023 6/15/4 of 15 day low on 5 October 2023 and further low near the end of November 2023 completing the 130 day subfractal 2.

Ten Year Note interest rates likely reached a peak yesterday rising from 0.4 % on 9 March 2020 to 4.62 % on 19 Sept 2023, a relative increase of 1150 %. From the 9 March 2020 low the ten year note followed a 7/16/17 month fractal growth series followed by a 5/11/10 week fractal growth series of 21/52/44 days.

Money exiting from stocks will drive interest rates lower.

Bitcoin in USD, traded 7 days a week, is following a 17 August 5/11/11 day fractal series followed by a 10 September 5/5 of 11/11 day series ending on 5 October.

The long term Bitcoin in USD monthly fractal series starting in Sept 2014 began as a complex initiating fractal series of (2)/4/8/6 months ending in January 2016. Why initiating? The trading market was just beginning with the Jan 2016 low valuation was below the initial Sept 2014 low. The last 6 months of this complex 17 month series served as an initiating base fractal (6 months) for a 15 month subfractal 1 of a 15/37/33 month series ending in November 2022. A 22 month lower low would complete a 15/37/33/22 month 4 phase fractal series.

For the 22 months a November 2022 3/6/4 of 6 month series ending in November 2023 could be followed by a 2/5/5 month series ending in August 2024 to complete a self-assembled four phase Jan 2016 15/37/33/22 month :: x/2.5x/2-2.5x/1.5x fractal series.

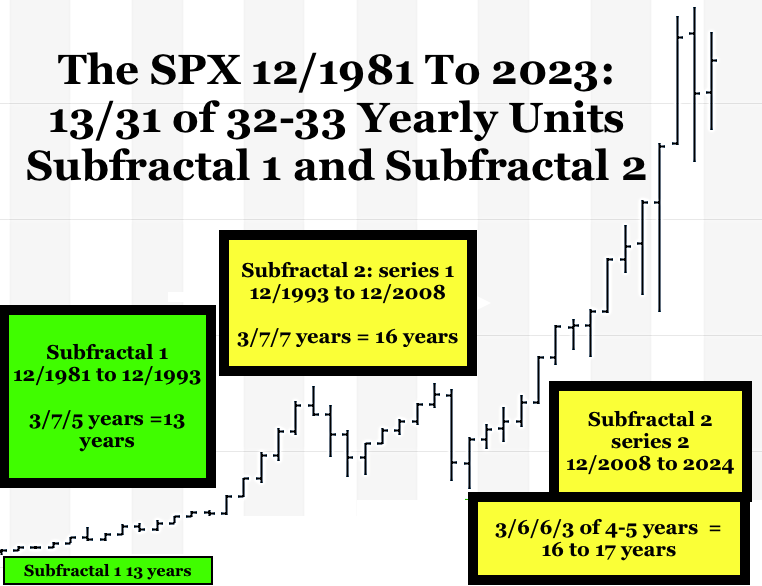

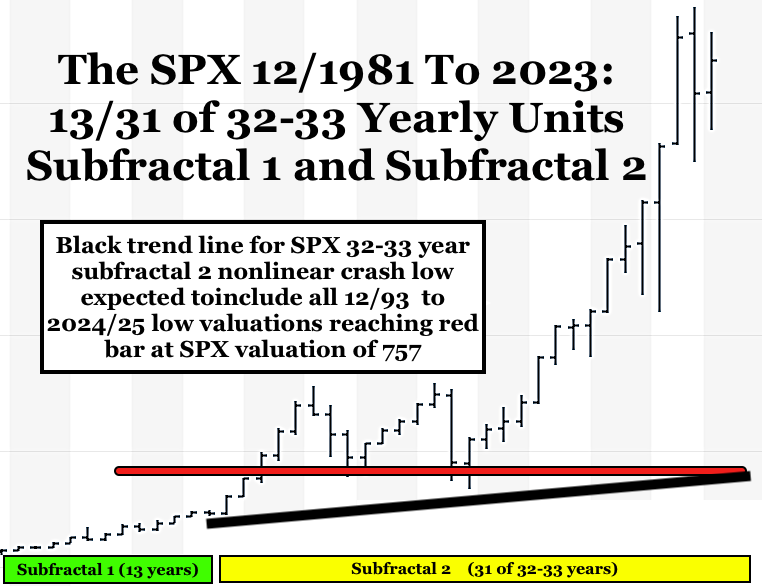

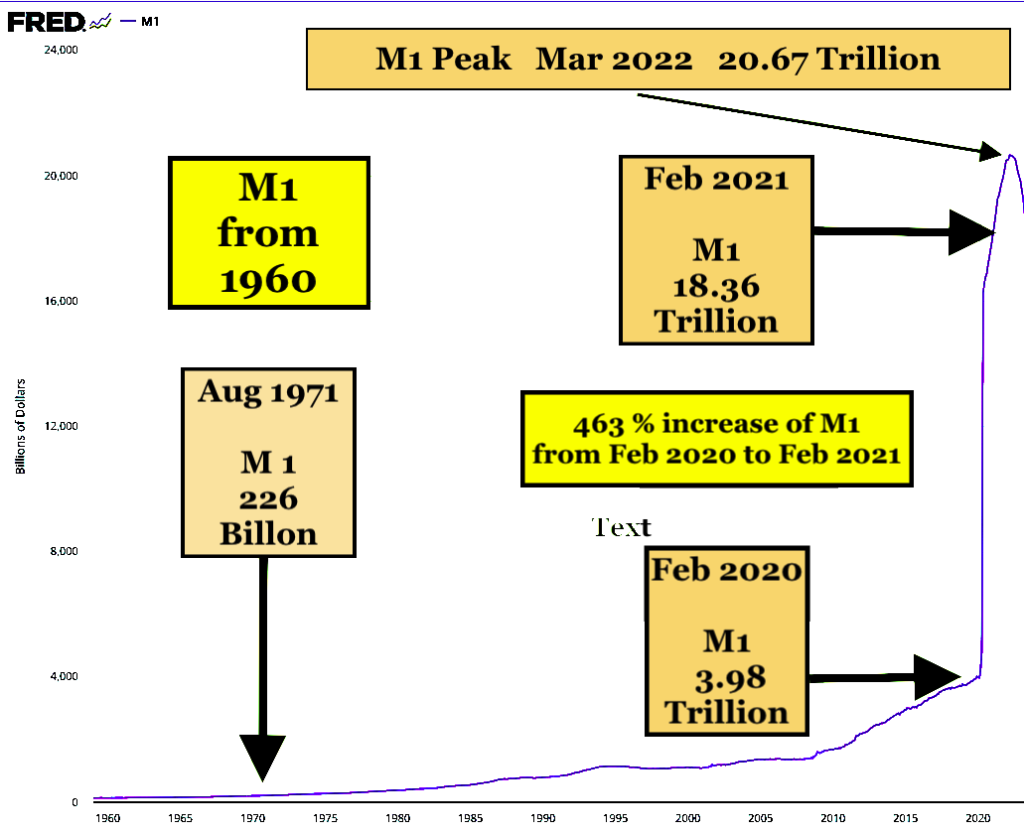

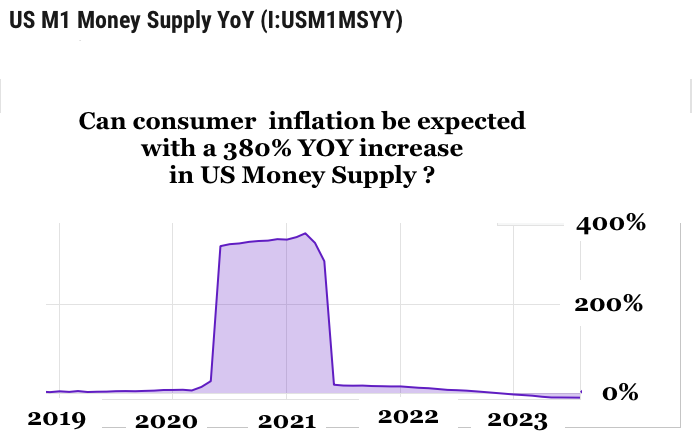

With residential and equity assets inflated and with easy loose money lending created by a 380%-460% one year M1 money supply increase from Feb 2020 to April 2021, a very hard deleveraging landing is expected with the completion of an composite equity 12/1981 to 8/2024 13/32 year :: x/2-2.5x subfractal 1 and subfractal 2 fractal series and an expected 32 year subfractal 2 trend line low valuation of 750 to 800 value on the SPX.