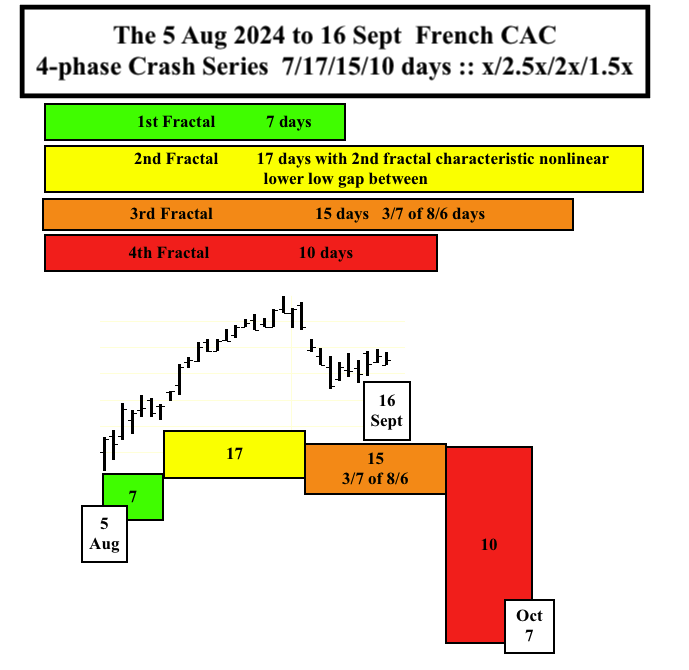

Fed Cuts Fed Funds Rates… The French CAC and European STOXX top 50 SX5P 5 August to 25 September 2024 7/17/16 day blow-off gapped higher high lower valuation and the 5 August to 8 October 2024 global equity 7/17/16/10 day initial crash devaluation constituting a base of a crash base first fractal of 10 weeks: 2/4/4/3 weeks …

Monthly Archives: September 2024

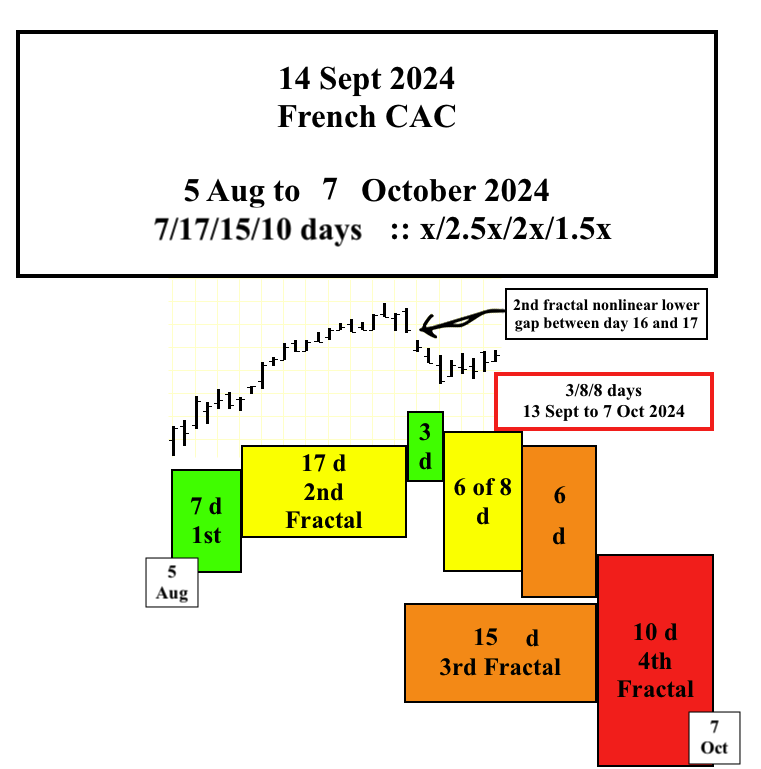

Interpolated Fractal Series to the 7 October 2024 low: 5 August 7/17/15/10 days and 13 September 3/8/8 days

While the US Wilshire 5000 on 13 Sept 2024 was within 1 % of its 16 July 2024 high valuation and over 125% above its March 2020 low, the 13 Sept 2024 Chinese Shanghai composite was within 2% of its March 2020 nadir low with a breach of that low expected within two trading days.

The Chinese markets are under severe deflationary pressure from the collapsed and further collapsing property bubble with grossly excessive supply and two residential units available for every potential occupant.

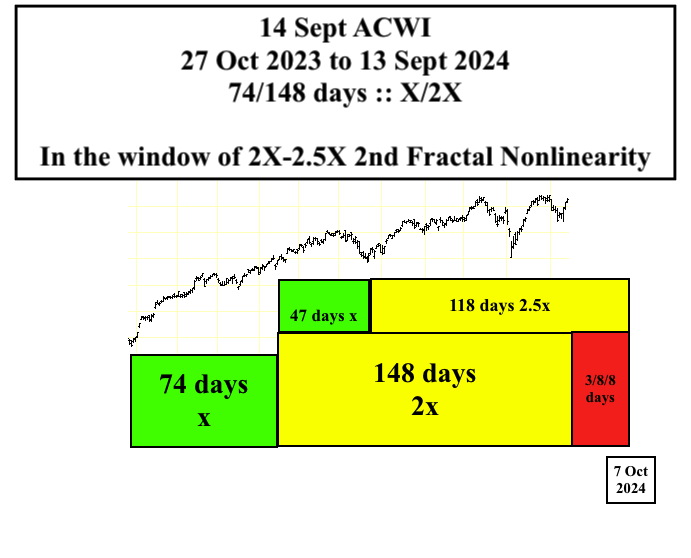

For the ACWI world index two interpolated larger length fractal series are evident: a 27 October 2023 74/148 day :: x/2x 1st and 2nd fractal (with the 148 day second fractal starting 13 February 2023) and a 13 Feb 2023 47/102 of 118 day :: x/2.5x series ending 7 October 2024.

5 August 2024 was the end date of yet another 1st and 2nd fractal starting 27 October 2023 54/139 days :: x/2.5x with the characteristic 2nd fractal gapped lower low nonlinearity between days 137 and 138 and between days 138 and 139.

From 5 August 2024, using as a global proxy the French CAC composite, an ongoing 7/17/8 of 15/10 day ::x/2.5x/2x/1.5x 4-phase fractal series and ending 7 October 2024 can be observed and modeled. 13 Sept 2024 is day 148 or 2x of the 27 October 74/148 day :: x/2x 1st and 2nd fractal which places the 2nd fractal in the window of 2nd fractal nonlinearity. A 13 Sept 2024 3/8/8 day :: y/2.5y/2.5y 3-phase fractal decay series would coincide with the terminal portion of the 5 August 2024 7/17/15/10 4-phase decay series and ending with both ending on 7 October 2024.

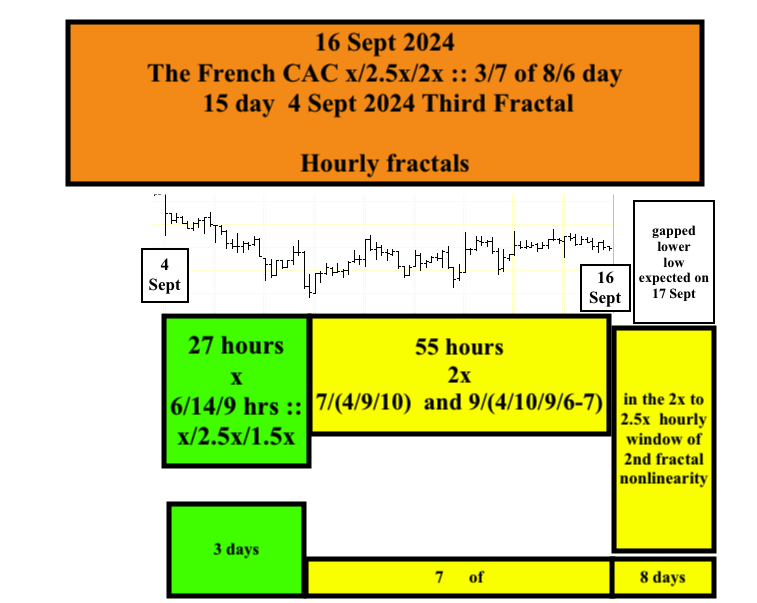

End of French CAC Trading Day 16 Sept 2024. Hourly subfractals of the orange 15 day 3rd Fractal 3/7 of 8/6 day valuation growth are 27/55 of 54-67/54 hours. 2nd subfractal nonlinearity is expected 17 Sept between day 7 and day 8 and between hour 54 and hour 67 of the 2nd subfractal

Occam’s Razor and the 5 August 2024 to 7 October 2024 y/2.5y/2.5y 3-Phase Lammert Ideal Crash Decay Fractal Pathway

In the Asset Debt Macroeconomic System, the self-assembly growth and decay of asset valuations occur in the simplest and most efficient manner possible, following the principal of Occam’s razor and following only two elegantly simple mathematical 4-phase and 3-phase time-based growth and decay fractal series.

The 7 October 2024 date is the end date for a 13 February 2024 47/118 day :: x/2.5x interpolated 1st and 2nd fractal series. The 27 October 2023 to 5 August 2024 55/139 day :: x/2.5x fractal series lasted one more day than the expected ideal 138 day second fractal but ended with characteristic 2nd fractal nonlinear lower low gaps between days 137 and 138 and days 138 and 139. The 47/118 day series will end an interpolated 27 October 2023 74/164 day :: x/2-2.5x 1st and 2nd fractal series with 13 February 2024 day 74 of the 1st fractal. (see previous posting and graphs)

The Nikkei, the ACWI, and US Ten Year Note Interest Rates (the latter which is the ongoing inverse of the valuation of held ten year notes) are following 5 August 2024 to 7 October 2024 3-phase y/2.5y/2.5y :: 8/20/20 day Lammert decay fractal patterns.

‘Smart’ Money is existing equities and entering US debt instruments, driving US sovereign interest rates lower. With the ten year note interest rate in steep market decline from increased supply, the Federal Reserve will have ample coverage to lower the fed funds rate to catch up with the market.

After the low on 7 October 2024 there will be observable lower high valuation growth and lower low decay patterns taking the global system to a final low between June and October 2025 and completing an observable March 2020 Nikkei 9/23/23/12-14 month x/2.5x/2.5x/1.5x 4-phase fractal series.

Money and debt expansion is following an incipient Volcker and Reagan 1982 interpolated 13/32/32-33/20 year US hegemonic :: x/2.5x/2.5x/1.5x 4-phase fractal series, which is part of a greater 1807 36/90/90/54 year x/2.5x/2.5x/1.5x US hegemonic 4-phase fractal series ending in 2074. The next 32-33 year commencing in 2025 will be hallmarked by unprecedented historical QE measures and marked wage, money, and asset inflation.