Extension system asset valuations: composite equities, commodities, and sovereign debt instruments of the interlinked Global Asset Debt MacroEconomic System(MES)) follow defined quantum fractal temporal patterns based on saturation of both extension markets and the underlying operative real citizen-based economy.

The state of saturation of extension markets and real markets are congruent and reinforcing … Saturated debt-based markets in the real citizen based economy control the extension markets and saturation in extension markets control and cause real citizen based economic corrections. The citizen based and extension markets are conjoined.

In Musings about an Economic Fractalist ( http://angrybearblog.com/2008/10/musings-about-economic-fractalist-and.html) the 2008 global equity-debt valuation collapse was transpiring and in its nonlinear phase.

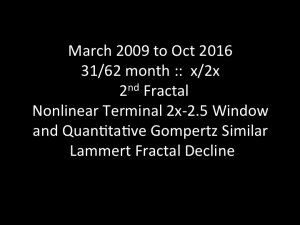

From a qualitative fractal perspective, this time period was interpreted as the nonlinear 150 year 2-2.5x window 2nd fractal correction of a 70/150 year US equity(and analogous precursors) first and second fractal series.

Fractal groupings by their (fractal)nature are interpolative and intrinsically subject to mis-grouping.

A statement in Stormy’s 2008 Angry Bear piece is instructive to the true state of the long term US and Global Asset Debt MES going forward…

” … debt that cannot be repaid, cannot be rolled over, cannot be remedied by further federal government debt…”

The Emergency Stabilization Act of 3 October 2008 conceived and passed within the time span of a few days by the US Congress’s panicked solid consensus proved the above statement to be exactly incorrect: debt was exactly rolled over by further sovereign debt. This money-debt expansion was replicated by the other sovereigns and their central banks on a global scale …

Since 3 October 2008, a new Asset Debt MES paradigm is solidly entrenched whereby operating sovereigns with real citizen based economies can and will expand debt (efficiently placing 1’s and 0’s in electronic accounting ledgers) to meet the contingencies caused by citizen and market debt based saturation and sequential nonlinear Gompertz declines and to provide the necessary debt-ledger based monies for periodic infrastructure reestablishment, other consensus useful societal endeavors(particularly useful after natural saturated market nonlinear fractal declines) and for reasonable social entitlement programs.

All sovereigns and sovereign collaboratives with national or collaborative central banks and currencies have the 3 October 2008 mandated QE and facile financial engineering ability to create unlimited money-debt to support the MES. The strength of relative currencies qualitatively is/will be based on the amount of the particular currency in global circulation(a current US solid advantage ) and the periodic and sovereign relative expansion of debt-money to produce consensus societal useful items {solar energy, LENR energy (if commercially developed), infrastructure and transportation innovation, mass (home-based) quality education, cultural divergence cooperation, and reasonable and fair citizen entitlement programs – the latter as free of gaming and fraud as possible and ideally based on the individual’s societal useful and work history contributions.

Additionally and significantly, going forward, sovereign and collaborative military expenditures will be a substantial part of the sovereign money-debt expansion and jobs creation.

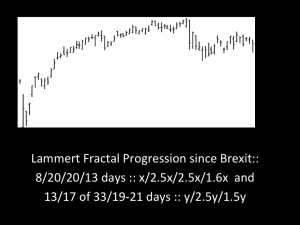

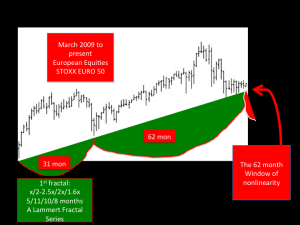

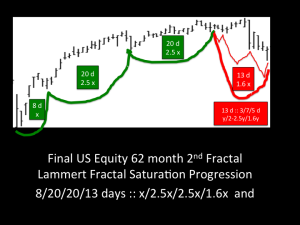

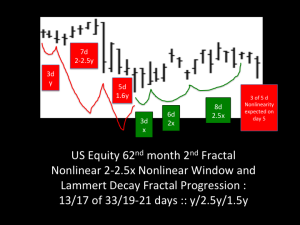

The overall Lammert final 62nd month 2nd fractal saturation quantitative saturation daily pattern for US and European equities(a extension asset market and marker for the global Asset Debt MES)for the March 2009 31/62 month 1st and 2nd fractal series is a Lammert x/2.5x/2.5x/1.5-1.6x series or

8-9/20-21/20-21/13 days :: x/2.5x/2.5x/1.6x

and a conjoined extension partial growth and incipient decay fractal: (decay begins in terminal growth)

The current quantitative fractal Gompertz US and European Composite Equity decline appears to be composed of a y/2.5y/1.5y decay fractal series with the current completion of a first fractal (13 days) and a partial completion of a second fractal of 33 days: 13(3/7/5)// 15 (3/6/8) with a final lower high of composite US and European Equities on the 8th day of a x/2x/2.5x (3/6/8) growth fractal series occurring on 5 Oct 2016 for US equities and 6 Oct 2016 for European equities.

Incipient second fractal nonlinearity will occur(is predicted) on the final 5th day of a 3/6/8/5 day :: x/2x/2.5x/1.6x fractal series which will occur on Tuesday 11 October 2016 for US equities and 12 October 2016 for European equities.

Tracing backward from 11 and 12 October and starting on 4 October 2016 for US equities and 5 October 2016 for European equities, the final Gompertz quantitative fractal decay pattern will be 6/15/12-15/9-10 days

where the 13 days of the 1.5-1.6x 4th subfractal becomes a base for a 13/33/19-21 day: y/2.5y/1.5y quantitative Gompertz decay fractal series with an expected low on the 19 trading day and secondary higher low valuation on the 21 trading day.

Time will tell if this precise mathematical Asset Debt MES expectation is correct …

Does the patterned behavior represent an exact science for the Global MES?

Final saturation for US equity composite SPX: 8/20/20/12 days :: x/2.5x/2.5x/1.5x.

The final 12 days of this series becomes the base for a y/2-2.5y/1.5-2.5y decay fractal series or a Lammert decay fractal series of 12/24-30/18-30 days.

The first 19 days of the second 24-30 day subfractal was a 4/9/8 day growth fractal: x/2-2.5x/2-2.5x fractal series. 62 month second fractal nonlinearity of a March 2009 31/62 month first and second fractal series is immediately ahead.