The Global Asset Debt Self Assembly Macroeconomic System

Asset-debt macroeconomic system saturation growth fractal patterns of the current US hegemony dating from1789 show a 70/156 year first and second fractal pattern with asset nonlinear devaluation expected between 1998 and 2033.

The global macroeconomic system is a forward consumption integrated asset-debt system based on debt creation for real time asset ownership, or use, against ongoing and future earnings, wages, and profits. It is a self organizing and self correcting system.

The Asset Debt Macroeconomic system’s asset entities, defined by ownership and trade-ability , have relative values to each other based on system asset entity supply and specific asset entity subpopulation demand which is further based on a particular entity’s tax advantages and/or liabilties, appreciation/depreciation potential , and, if any, debt-backed liabilities.

Debt itself is both an asset for the lender and liability for both the debtor and the lender – with extreme possible valuation positions: accelerated valuation with increased buying power on the one hand (for hegemonic sovereign debt during system saturation produced depression)) and, on the other hand, complete valuation evaporation and loss with default on bad private or bad sovereign debt.

Because of the debt element and the large percentage of GDP consumer-produced demand growth – increasing wages, increasing number of jobs, asset inflation, progressively lower interest rates, government ‘deficit spending’ or a net positive combination thereof are needed for sustained positive GDP growth.

US GDP growth has been positive for all but about 3 years since 1940 on the net positive value of the preceding elements.

The asset debt macroeconomic system has as its natural and inevitable rate limiting barriers: asset saturation and oversupply, asset overvaluation, population debt saturation, and consumer sub population ownership saturation for one or more particular asset among the system’s assets.

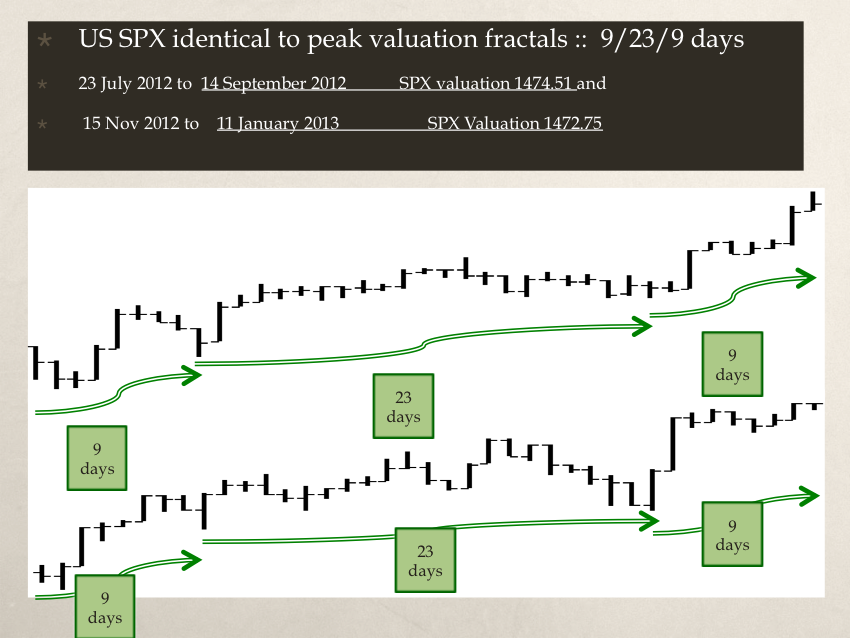

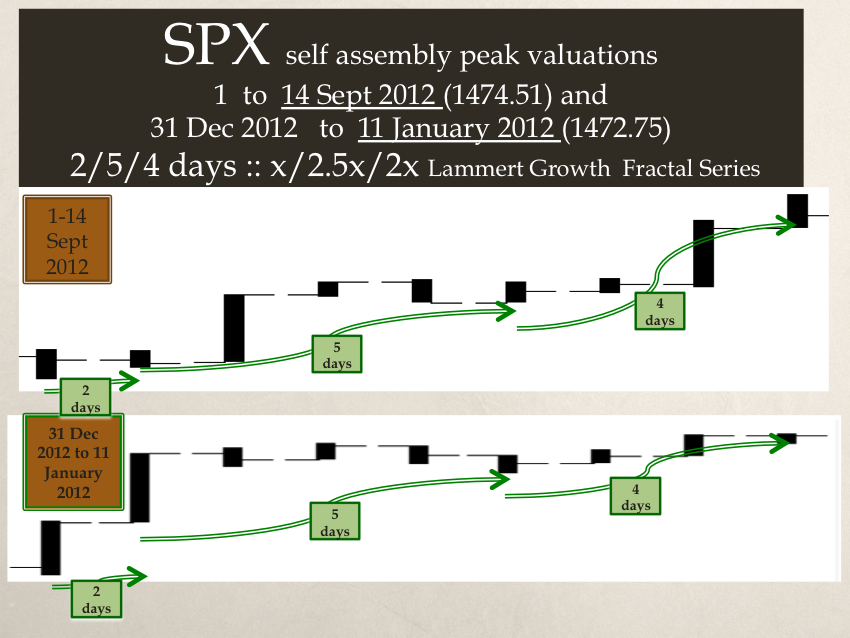

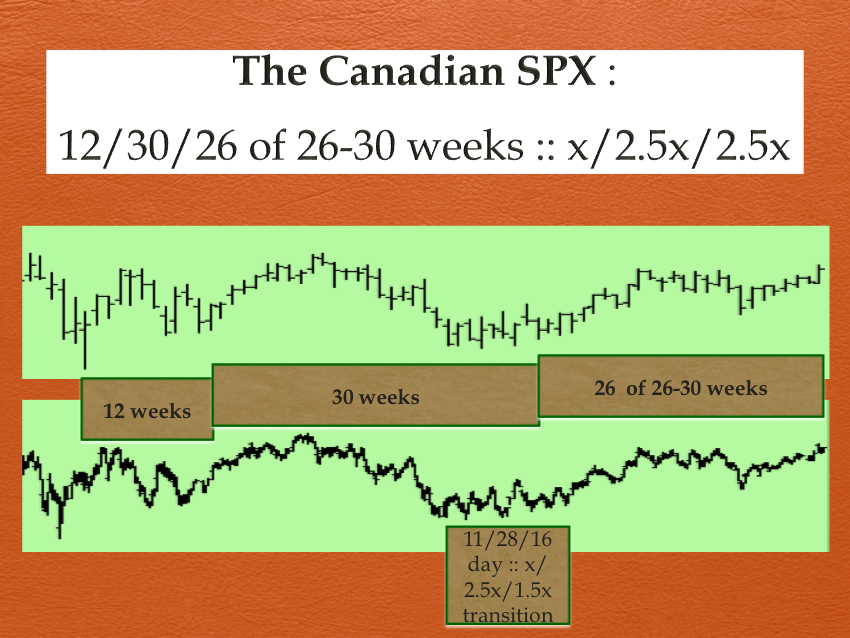

On the small time scale of days and weeks, favored tax advantaged assets will proceed to their maximum saturation valuation depleting the population of interested speculators and self assembling in a quantitative time based Gompertz saturation fractal trading pattern and fall in a reverse Gompertz pattern to a level where selling is depleted and buying resumes.

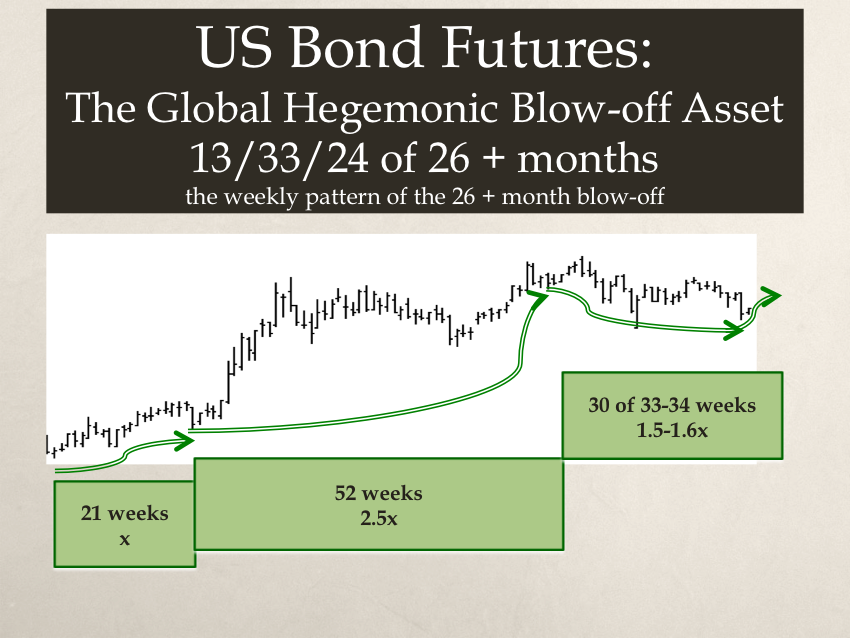

The recurrent easily observable daily and weekly self assembly quantum saturation growth and decay fractal patterns of valuations of equity, commodity, currency, and debt instruments that this web site identifies, correlates to maximum saturation population involvement with higher valuations and extended time based growth in the tax advantaged equity market.

On the larger monthly quarterly yearly time scale, the asset-debt system itself becomes super saturated with assets, with overvalued assets, with retrospective malinvestments, with bad debt that cannot be repaid, and with a depleted population of new capable debtors. While easy credit exacerbates the malinvestment and asset valuation peak and subsequent low values, the asset debt macroeconomic system will naturally proceed to system saturation areas and thereafter undergo retrenchment with asset devaluation, asset production deceleration or reduction, job loss from decrease demand, wage growth deceleration or actual reduction, and bad debt liquidation which undergoes default in a naturally contracting asset-debt system.

The larger time scale picture qualitatively appears to be the current window of the asset debt system with many home owners underwater with their most valuable asset; with US college graduates owing an expensive diploma asset associated with relatively enormous debt but decreased job opportunities, with the Euro’s decade roll-out of easy credit, massive (housing/Greek Olympic stadium)asset over production, and asset overvaluation; with Europe’s subsequent 20-25 % unemployment in its poorer country members, huge unpayable debt, and with austerity measures and without the ability to increase GDP via new debt creation, and with China’s uninhabited new cities and over produced real estate assets.

Within the US hegemonic 1998 to 2033 asset devolution nonlinear window, the asset-debt system’s malinvestment, asset over valuations and over production, and bad debt load have been made extreme by the union of the financial industry with both political parties of the US.

By 1998 the financial industry who had the key position of selling US debt, had orchestrated a de facto coup d’etat of the US government regularly placing US Treasury secretaries and insider deciders within both parties’ cabinets. With the de facto government takeover, 1930’s deregulation and too big to fail or punish occurred: starting with the LTCM bailout and later with the repeal of Glass Steagall and the dismantlement of controls over the financial houses’ leverage ratio’s used in the commodity and exchange markets.

Financial house CEO’s, who had 17 trillion of leveraged debt in 2009, have produced the Tea Party movement for redirection of the nation’s attention from their own gross criminality and lack of punishment to the paring down tax earmarked and tax funded social security and medicare societally useful programs.

With 2013 global bad debt default enhanced by the Wall Street and Financial Houses’ calls for austerity, reduced SSI benefits, and new found debt responsibility , this is the qualitative natural timing of the US dollar’s and US Debt Future’s nonlinear rise in value against weaker currencies and sovereign debt and countervailing global equity and commodity valuation devolution.

The essential moderating counter force against global asset deflation and depression for the world is 70 years of tax paid for hegemonic US social security payments which will be honored, 47 years of tax payments into Medicare to sustain the US medical pharmaceutical industry, and the US private central bank’s understanding and willingness to both honor SSI and Medicare payments and to provide deficit spending to sustain a lesser degree of GDP growth including new QE programs which represent a defacto New Real Bill Doctrine where US currency is directly traded for US labor and for US defense, farm, et. al. production.

Ultimately US long term interest could be set by the US Central Bank to less than one percent with the knowledge that all US sovereign debt will be repaid.

The ability of the US private central bank to cushion the large demultiplier effect of global bad debt default will moderate negative US GDP in the natural time window historical deflationary collapse of the asset debt system.