The velocity of money creation in the US is plummeting in spite of the defacto Real Bill Doctrine of the Federal Reserve.

Money in a healthy asset-debt system is created by private consumer and business new debt creation based on private demand and the wherewithal to borrow money based on wages and produced products or services.

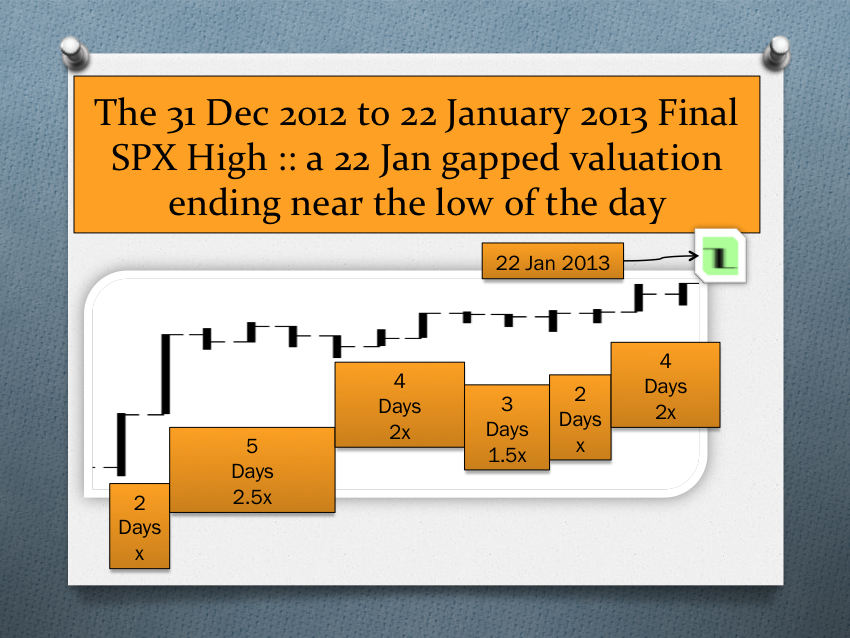

2013, as in 1929, represents a saturated asset debt system with too many produced assets, too many over owned overvalued assets, too much debt saturation of the potential borrowing population, and not enough system demand to go forward without the assistance of deficit federal spending via money creation by the private central bank.