Keynesian counter stimulation to the Wall Street London Brussels Debt Industry’s leveraged collapses is necessary to maintain the unbalanced system’s continuation – along with global war – that organize and employ the masses of idle youth – who without paid organized activity – could upset the transgenerational wealth transference system.

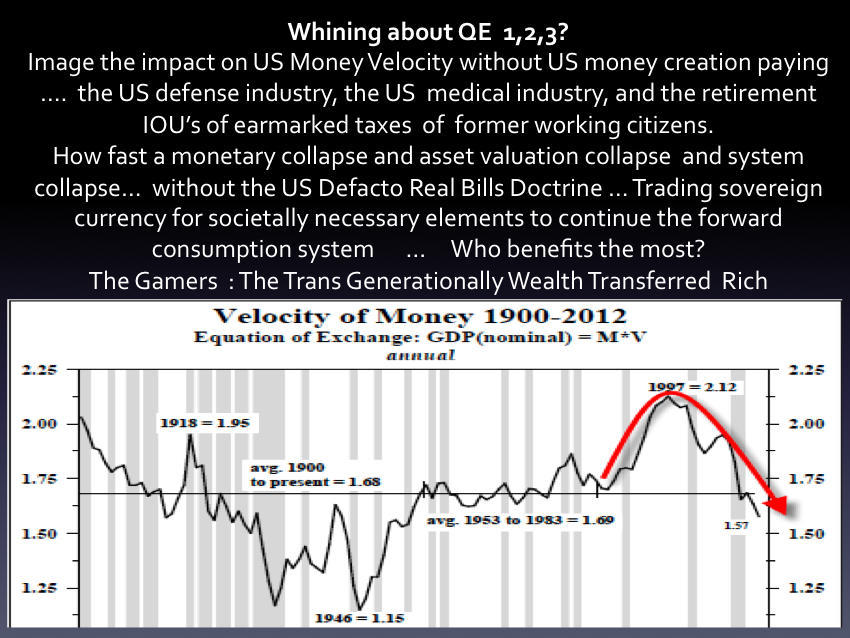

Money acceleration has decreased because demand forward consumption has been and is beyond saturated. The population of credit worthy debtors is exhausted. Lower paying jobs sustained through QE have provided a basis for temporary push back on asset devaluation and continued borrowing for automobiles and very low end housing … and speculators are taking the historically lower interest rates and ‘entering the market’ providing purchasing support for properties targeted at wage slave renters.

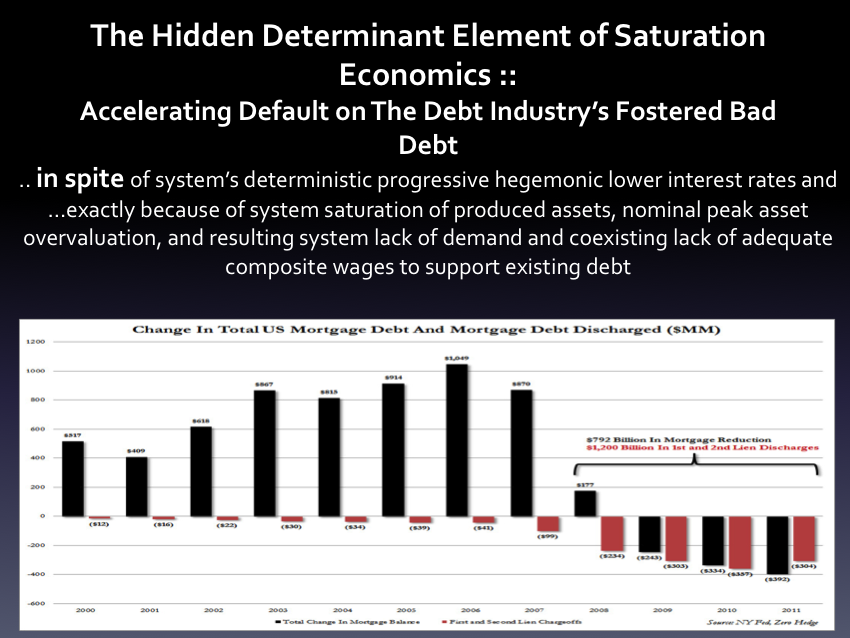

Meanwhile, bad debt, the debt shackled and thrown onto the western citizen wage slaves by the Wall Street, London, Brussels.Debt Industry is undergoing an unobserved and accelerating fractal collapse.

The rules created the Wall Street Debt Industry’s proxys so favor the equity class speculators and seemingly so punish the savers. That is the irony and the paradox.

The greatest wealth transfer occurs during the asset collapses created by preceding debt elaboration and asset overvaluation by the Wall Street debt Industry. And being scott free of fraud investigation and criminal prosecution, the sellers of US sovereign and owners of the system are too big to simply contain…

Expect the expected… For the US dollar: a 5/12/8 day base fractal and for the Euro a reciprocal 5/12/8 apical fractal – with the 8th day a blow-off gapped day for the third fractal of the Euro series … was completed on 16 October 2012.