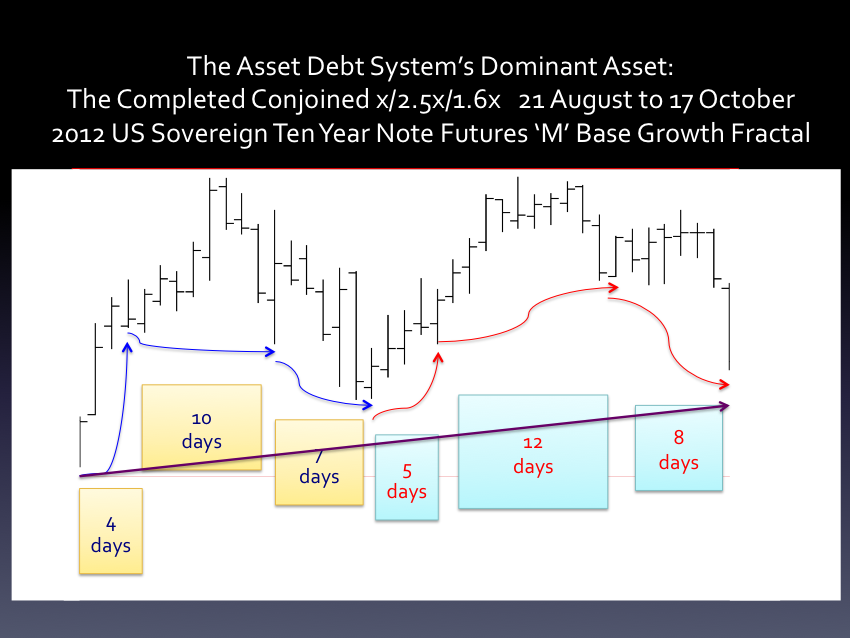

At the beginning of massive global bad debt default, the redeemable US long term debt future’s has completed it base growth blow-off fractal and the Wilshire has reached it’s 17 October 2012 tertiary lower high to 14 September 2012, the lower secondary high to the Wilshire’s predicted 11 October 2007 nominal high.

In spite of the terminal spiked growth in housing starts, the base real economy, the US consumer forward consumption current labor traded for acquired future debt dependent economy is saturated – saturated in unrepayable debt, in over valued asset, and in lower paying and fewer total jobs to support unsustainable asset valuations – a plurality microcosm of the global macroeconomy and misfortune that is the current Eurozone and the chokingly uncomfortable and untenable yoke that is the Euro.

The Euro fractal pattern is an inverse projection of the dominant Ten Year US Futures Fractal series. The Euro/dollar ratio gapped to a close secondary high to its previous near term 14-17 September high and endied near the low of the day.

Expect the expected:

Asset growth in a asset that will not be defaulted on as bad debt undergoes default and all other asset classes – losing the support of vanishing bad debt, formerly considered to be an actual asset – undergo nonliner devaluation.