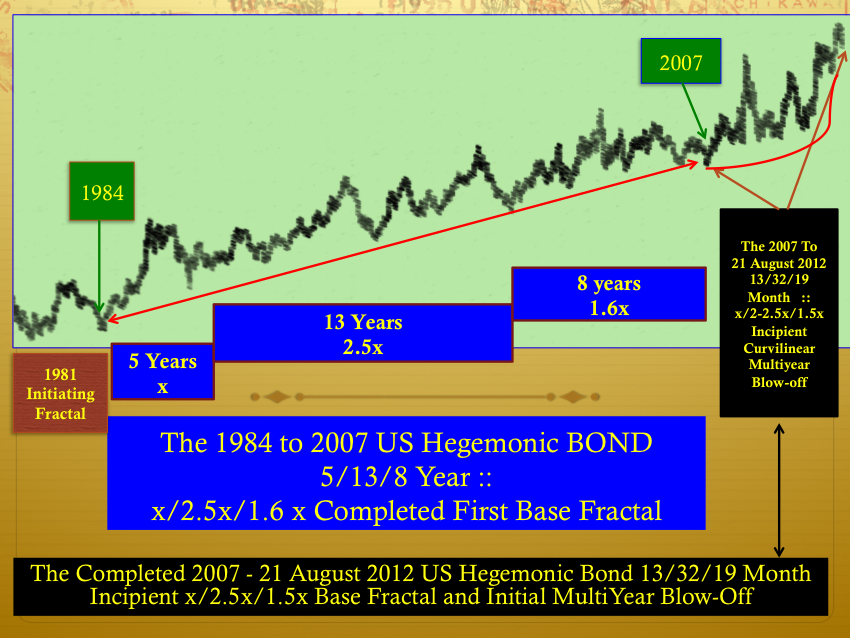

From 1981 the number of US dollars and US dollar denominated sovereign held by the world has exponentialized. US dollar currency and US debt have produced assets – all three of which – have become collateral for secondary bad debt which by definition will not be repaid. In growing mass of US currency, US debt, and collateralized assets, US interests have trended lower and lower with those holding US debt having steady increases in the value of their holdings. After an initiating fractal from 1981 to 1984, a 5/13/8 year base fractal was completed in 2007. This was followed by an initiating curvilinear base blow-off fractal starting in April 2007 and completed on 21 August 2012 , also in the recurrent base fractal form of 13/32/19 months :: x/2.5x/1.5x resulting in multi year lower and lower interest rates going forward.

The long term valuation growth of held US debt is just beginning.

As the hegemonic currency all the world dollar and US sovereign debt holders have a vested interest in maintaining the survival of the dollar as a currency. So many dollars are owned by so many of the world’s population and sovereigns.

And as the US treasury has the authority to issue money, US sovereign debt will always be honored.

US debt is the asset-debt system’s premiere speculator asset as the world in an extremely saturated position of debt, overproduced and overvalued assets undergoing a combimnation of bad debt default and further massive asset valuation decline.

At this operational point of asset debt saturation macroeconomics. the one thing that has high certainty is that US debt will re repaid.

13 September 2012 : The SPX’s 21 August’s 1426.68 Lower High and Commodity-Equity Class Asset-Debt System’s Pre Crash Day

The Hegemonic US’s long term bonds will complete a 21 August 2012 4/9/6 :: x/2-2.5x/1.5x day base fractal on 13 September 2012. This fractal pattern is identical to a 21 August 2012 completed 4/9/6 month US Long term bond fractal series which composed the terminal portion of a 2007 curvi-linear 13/32/19 month :: x/2.5x/1.5x base fractal. The 21 August 2012 completed 4/9/6 month series forms the base for an approximately 32-34 month extension to historically low US long term interest rates. This will match a countervailing similar monthly devaluation pattern for equities which will approximate the time between the high to low valuation devolutions occurring from 1929 to 1932 and from 2000 to 2003. The 21 August to 13 September 2012 4/9/6 day base fractal is the incipient part of that 32-34 month US bond second fractal series.

The US Bond 4/9/6 month :: x/2-2.5x/1.5x monthly first base fractal completion on 21 August 2012 exactly matched the 21 August 2012 SPX’s key reversal day with a minutely gapped high to 1426.68 and ending on the low of the day. 1426.68 exceeds the SPX’s previous highs of 2 April 2012 (but not the composite Wilshire which includes the Nasdaq) and is final lower secondary high to the SPX on 11 October 2007 with a similar minutely gapped high and ending near the low of the day.

11 October 2007 was prospectively predicted as the final asset-debt system Wilshire Equity Class high occurring as the 40th day of a reflexic 20/50/40 day :: x/2.5x/2x Lammert fractal series.

From The Huffington Post …theeconomicfractalist on 10 October 2007

Australian Dollar Hits 23-Year High Against US

Commented Oct 10, 2007 at 22:23:35 in Business

“Generational US Consumer Saturation Macroeconomics – 11 October 2007: the Top Valuation Day for the Wilshire ?; near the final weekly low for the US dollar?

Watch for an opening day trading gap to the all time high for the Wilshire on 11 October with a closing at the low of the day. While the US dollar will likely be lower against other fiats and gold, it is near its multiweekly nadir.”

What is telling about the October 2007 nominal SPX nominal high verses the August 2012 secondary high is that 30 year bond was 200 basis lower in 2012 than 2007. Even so the 31 August 2012 SPX is 150 points lower than it 11 October 2007 nominal high.

This is a weak Equity market in spite of historically low interest rates.

The 4/9/6 month base fractal completes a larger 13/32/(3)+(4/9/6) or 13/32/19 month :: x/2.5x/1.5x US bond blow-off fractal series beginning in 2007.

The Equity Commodity crash is expected to occur within a trading day or two of Friday 14 September 2012.