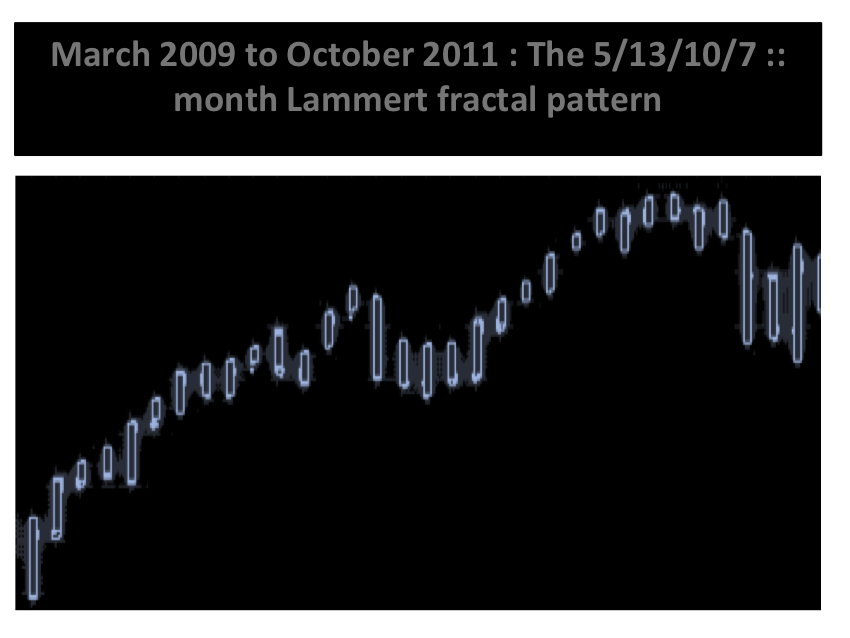

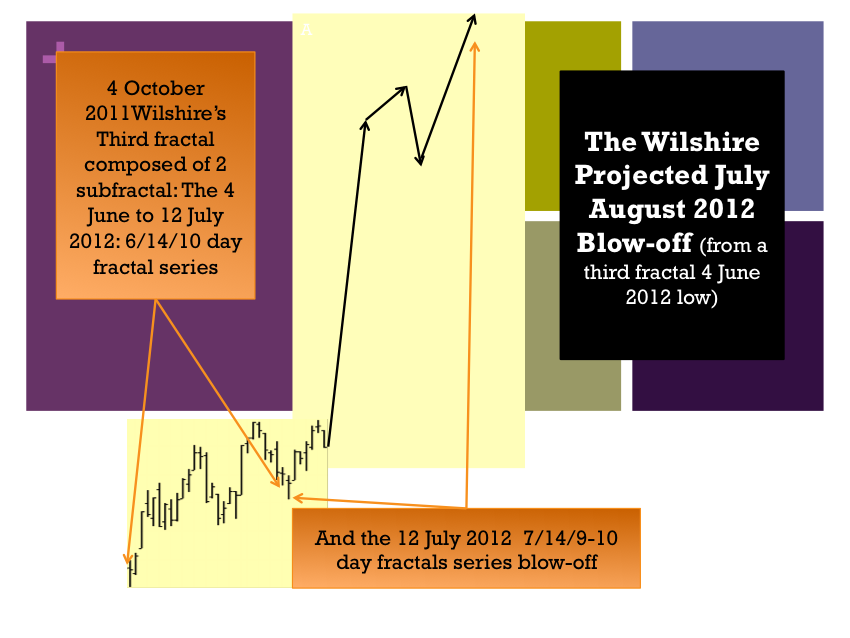

The Ubiguitous Lammert growth and decay valuation four phase patterned fractal series.12 July 2012 began the Wilshire’s second subfractal series (second to the 4 June 2012 first subfractal series of 6/14/10 days). These two subfractal series compose the 4 October 2011 54/115/?55 day 55 day Wilshire’s third fractal series. The 7 day 12 July to 20 July 2012 ubiquitous self assembly 4 phase Lammert fractal pattern of x/2-2.5x/2x/1.6x is apparent in the hour fractal time units :: 8/19/19/13hours.. Note that there is a time extension to nearly 2.5x of the 19 hour third fractal high, consistent with an expected future Wilshire higher valuation blow-off pattern.

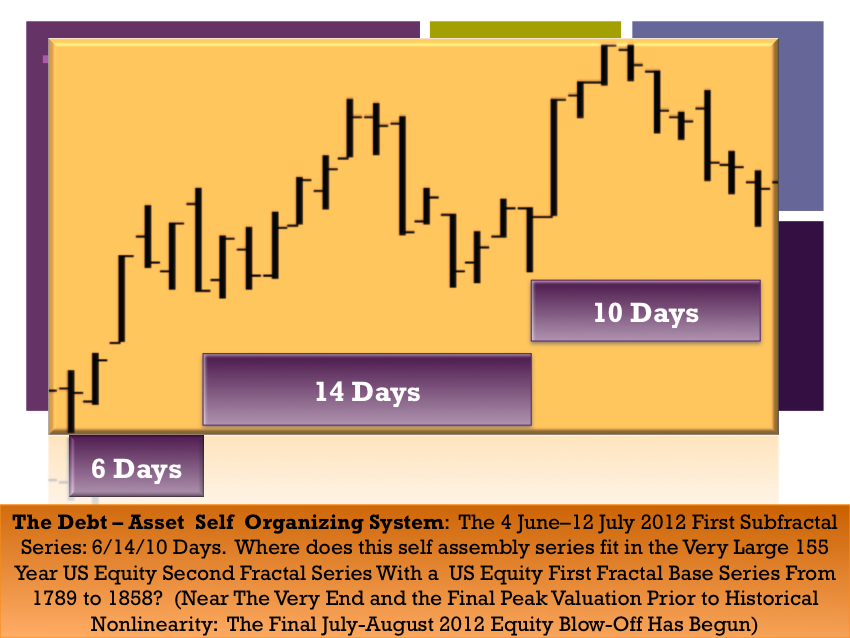

The Wlshire’s 4 October 2011 third fractal on 4 June 2012 begins. The 4 October 2011’s ? 55 day third fractal beginning on 4 June 2012 is composed of two subfractals. The 7 day12-20 July 2012 first subfractal of the second subfractal series (7/14-15/9-10 days projected) is shown in relation to the completed 4 June to 12 July 6/14/10 day first subfractal series.

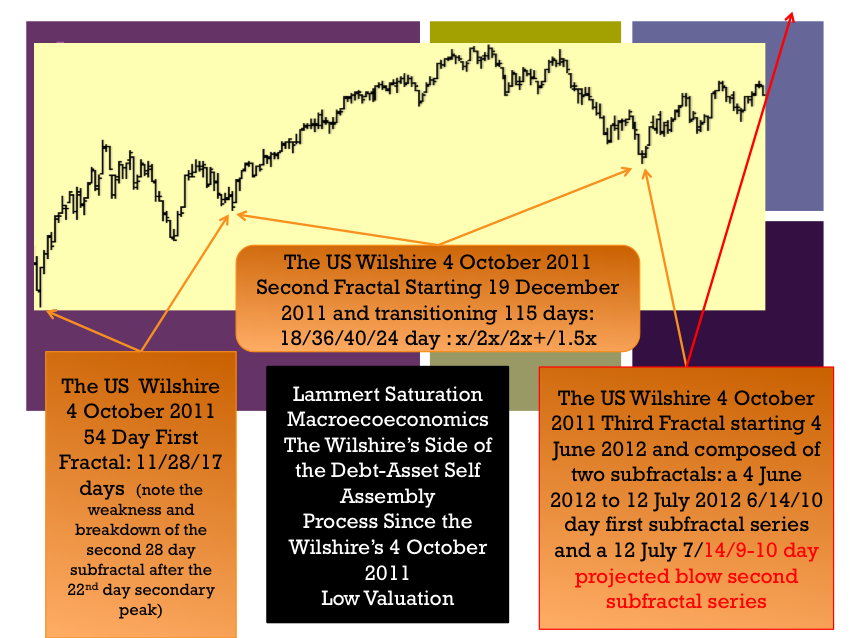

This is the relatively short 4 October 2011 three phase Lammert fractal growth series of 54/115/?55 days for the Wilshire. The Wilshire as an asset class shows telltale weakness in the first 54 day base fractal composed of a 11/28/17 day :: x/2.5x/1.5x base subfractal series. The final low of the 28 day second fractal is below the underlying slope line extending between the 1st and 54th day of the 11/28/17 day 54 day subfractal series. In the self assembly asset-debt macroeconomic system the world’s unrepayable bad debt problem has reached a critical level in late November of 2011 as the system’s favored equity class can maintain interval continuous positive valuation relative to the underlying first fractal slope line..

The Self Assembly Asset-Debt Macroeconomic Longer Fractal Pattern: the Big Picture.

The total wealth of the world expands by debt and asset creation. Debt is borrowed against the value of the asset manufactured or purchased and against the value of future labor and entitlements. The system has the capacity to overproduce both debt and assets. Good system rules limit excessive production of debt and assets. The system is self regulatory and self correcting. Excesses are eliminated and expansion and contraction of the wealth of the system which includes debt occur in a nonlinear fractal manner empirically observable in the system’s asset-debt valuation curves.

The Wilshire’s 4 October 2011 54/115/?55 day fractal series is the second (very short subfractal series)of two subfractals series which compose an extended third fractal series dating from March 2003. This March 2003 extended fractal is the 2x+ third fractal of a 1990 Wilshire x/2x/2x+ series which a the three phase mathematical asset-debt system growth series composing the second fractal series to the 9 year 1982-1990 first fractal.

The 1982 to 2012 31 year composite fractal series composes the third fractal of a 1932 SPX 17/35/31 year :: x/2x/2x- series. This 1932 81 year fractal series is the second subfractal series composing a US debt-asset self assembly second fractal series beginning in in 1858. The US equities first subfractal series spanned 1858 to 1932.

The two subfractal series composing the US second fractal series starting in 1858 have a US base progenitor equity series of 70-71 years starting in 1788-1789. After the final Wilshire blow-off in August 2012, a historical nonlinear 155 year 1858 US hegemonic second fractal valuation collapse of non US-soveign-debt assets is expected.

” From the main page of TEF:

This site has been constructed because of the expected inevitability of a major sudden phase transition to occur at the conclusion of a grand 140 plus-year second fractal cycle starting in 1858. For the masses this phase transition will occur both very unexpectedly and very suddenly. Approaching the global macro economy from such a causal and fractal Weltanschauung may help those considering further debt obligation and those in position of formulating future interest rate and monetary policy.