1 May 2024: The March 2020 to April 2024 Global Equity 8/24/20 Month Fractal Growth Series; Why the 24 Month Second Fractal Had An Extended length: A 1929-like Three Phase Series Daily Fractal Collapse Ongoing and Ahead?

Historically large US annual percentage deficit federal spending /GDP ratios in 2020 and 2021 caused a prolonged 24 month second fractal in the March 2020 to April 2024 8/24/20 month three phase QE/QT three phase fractal growth series for global equities.

The annual new US debt/GDP deficit ratio in 1942 post Pearl Harbor was 13.88%. This was only exceeded in 1943-45 until President’s Trump’s last year in office in 2020 at 14.71%. In President Biden’s first year the ratio was 12.1 % with the last two years at 5.4% and 6.3%. In addition to the 2020 and 2021 large % GDP/deficit spending, March 2020 fed funds interest rates were rapidly lowered to near zero with 2.7-3.5 % mortgage rates. The Federal Reserve bought an additional March 2020 to June 2022 1.4 trillion dollars of MBS’s. This facilitation inflated real estate prices which created an additional wealth effect among homeowners and the owners of rental residentials, which contributed to the inflation of other asset classes. Offsetting the accelerated QT rate increases to combat this inflation and initiated in early 2022, was another smaller Federal Reserve QE program instituted in March 2023 to prop up the banking system after Silicon Valley Bank et. al. failures.

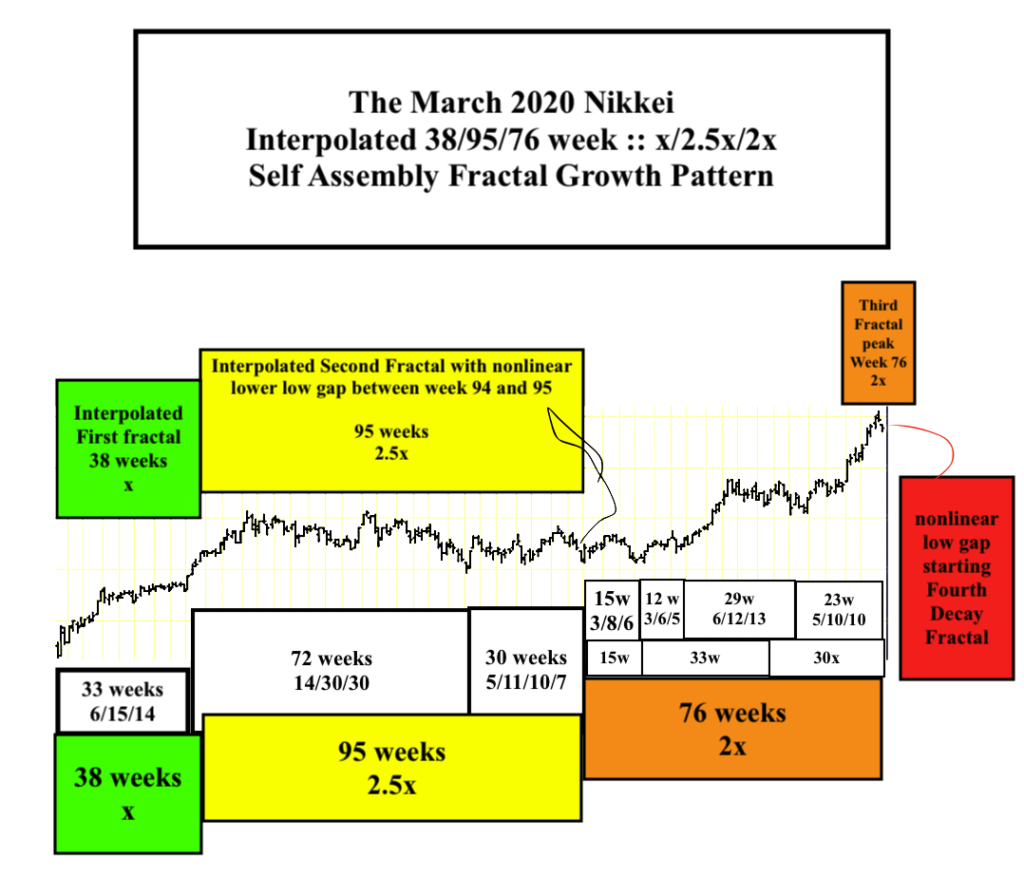

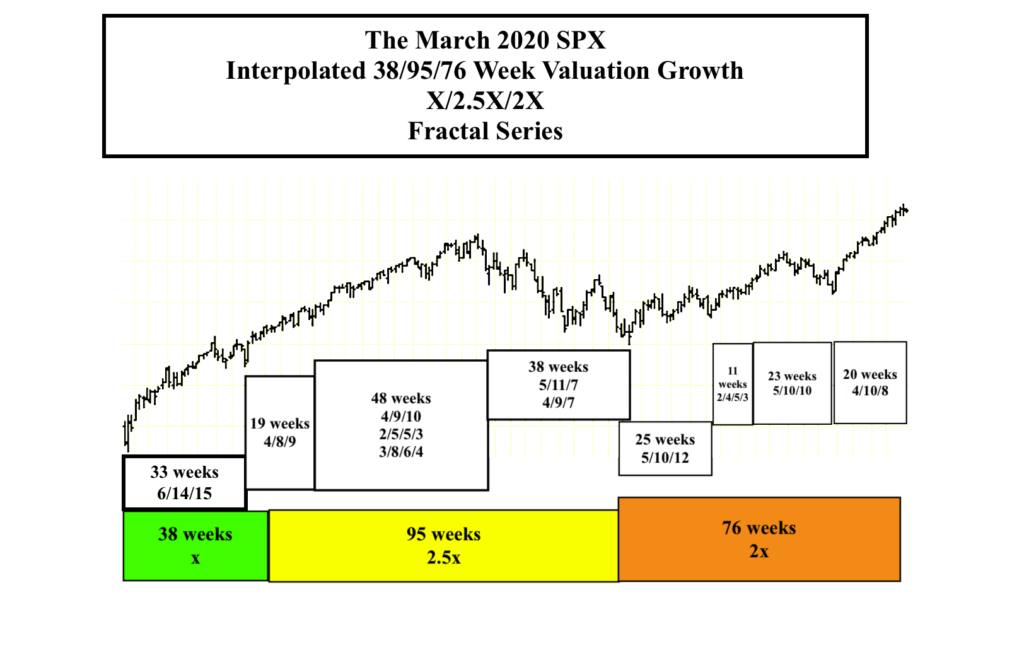

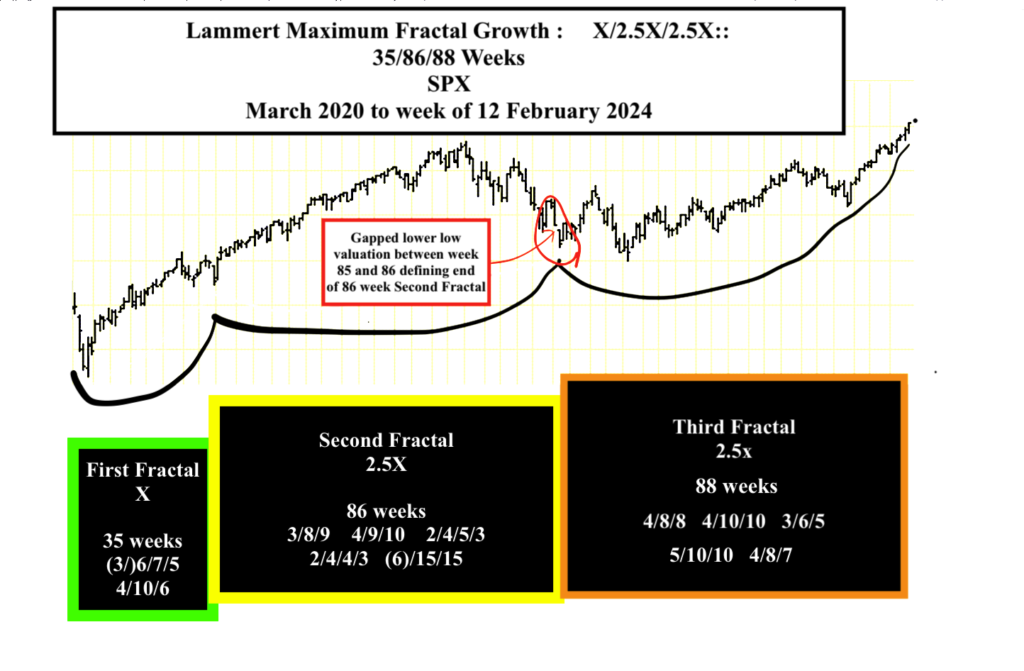

The massive US QE program and historic federal deficit spending in 2020 and 2021 (matched by Western and Eastern central banks) prolonged the 8 month March 2020 global composite equities’ second fractals, which started in October 2020 and ended in Sept 2022 with a duration of 24 months: 4/9/8/6 months :: x/2-2.5x/2x/1.5x or two combined fractal series: 2/5/4/3 months and 3/6/7 months :: a/2x/2.5x/1.5x and x/2x/2-2.5x, respectively. (see below) The current fractal series from March 2020 to April 2024 is 8/24/20 months with the 20 month April 2024 peak valuation occurring in a 5/10/7 month :: x/2x/1.5x fashion.

The March 2020 to April 2024 STOXX Europe 600 Index XX:SXPP and Nikkei monthly fractal series best exemplifies this 8-9/24/20 monthly three phase fractal growth pattern marked by nadir valuations between the first and second and the second and third fractals.

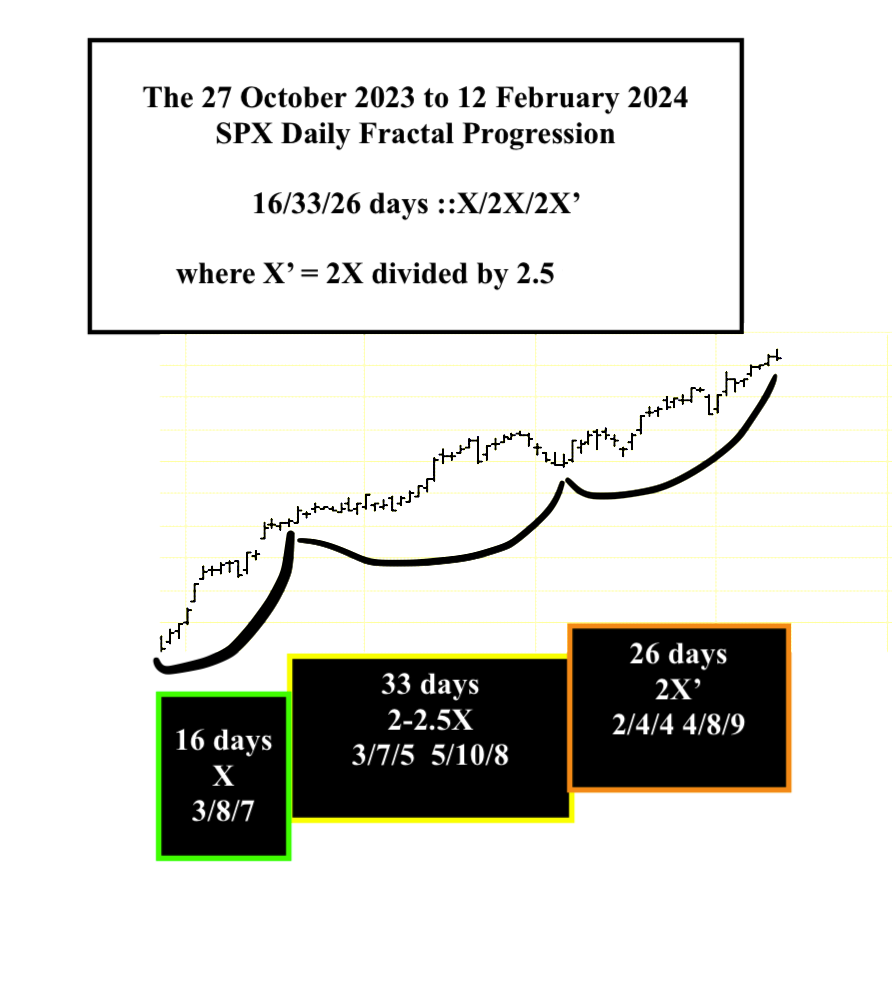

A potential 1929-like SPX primary daily decay fractal series of 11+/27-29/27-29 days is observable starting 20 March 2024. First fractal: 2/4/5/3 days (11 +days) ending 4 April. Second fractal (starting 4 April 2024)8 (2/4/4 days) //(5/8 of 10-12/7-8) (27-30 days) // and third fractal of 27-30 days. A significant drop in US global equity valuations could precipitate an expected fed funds rate cut. A lower high rebound might then extend beyond the US 2024 November elections.