The US Hegemonic Asset-Debt System is following a

1807 36/90/90/54 year :: x/2.5x/2.5x/1.5-6x self-assembly 4-phase growth and decay fractal series.

Credit expands, assets are produced and over-produced and overvalued and over-consumed; composite asset valuations reach a singular peak valuation and thereafter undergo decay, recessions occur, excess debt undergoes default and restructuring, and composite asset valuations reach a nadir. The cycle repeats itself.

Empirically the cycles occur in 2 mathematical time- ordered and self-organizing fractal series manners:

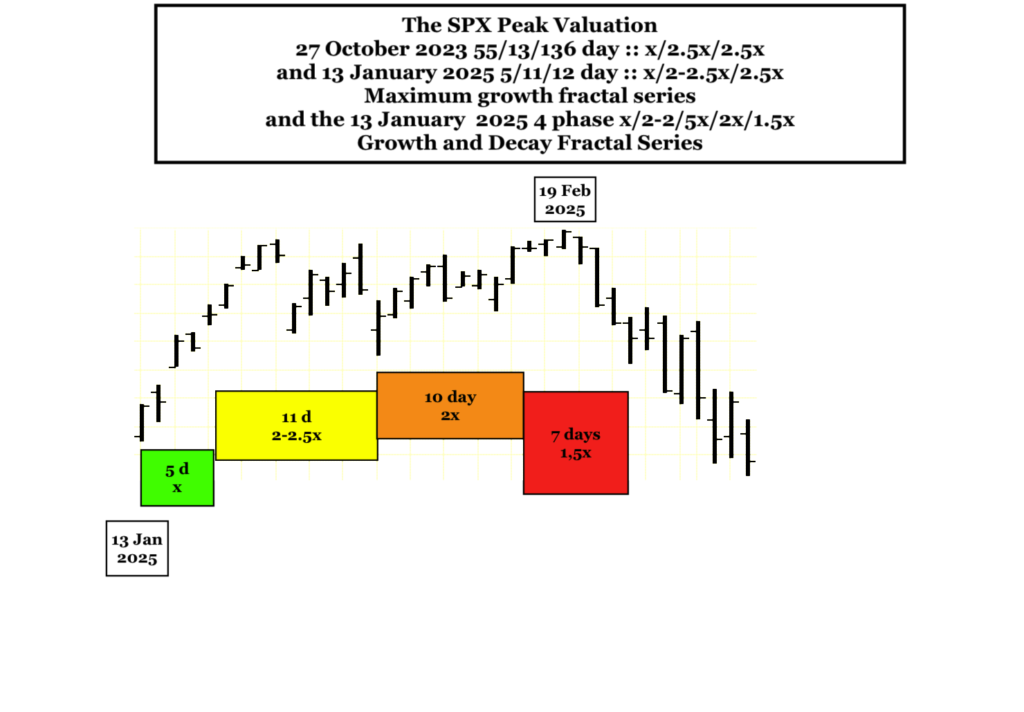

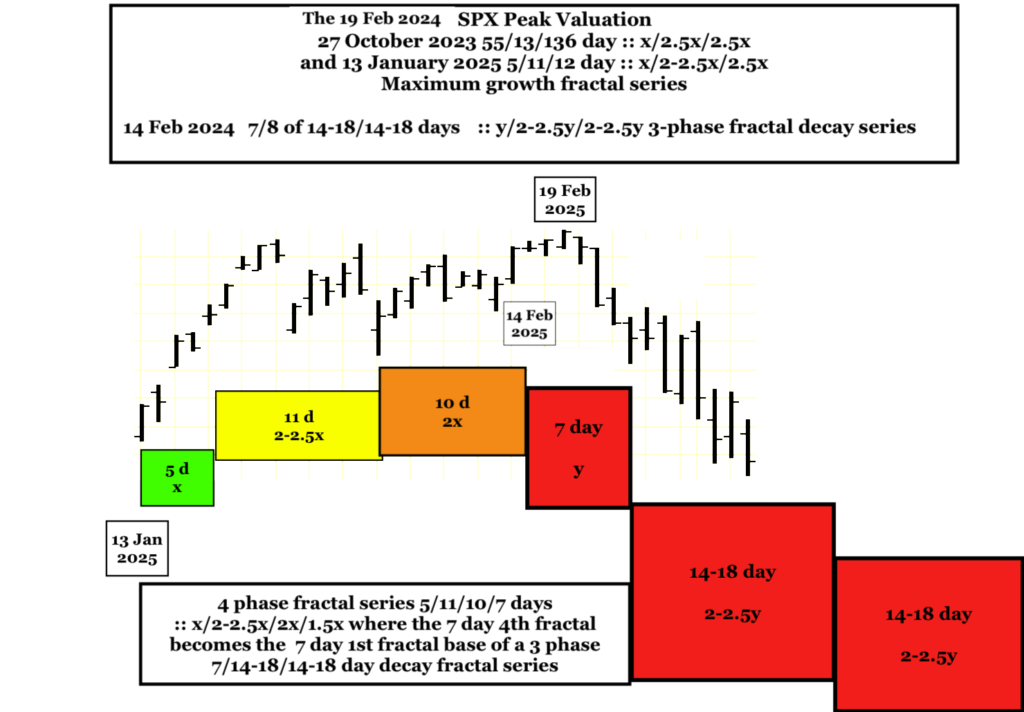

a 4-phase fractal series: x/2-2.5x/2-2.5x/1.5-6x and

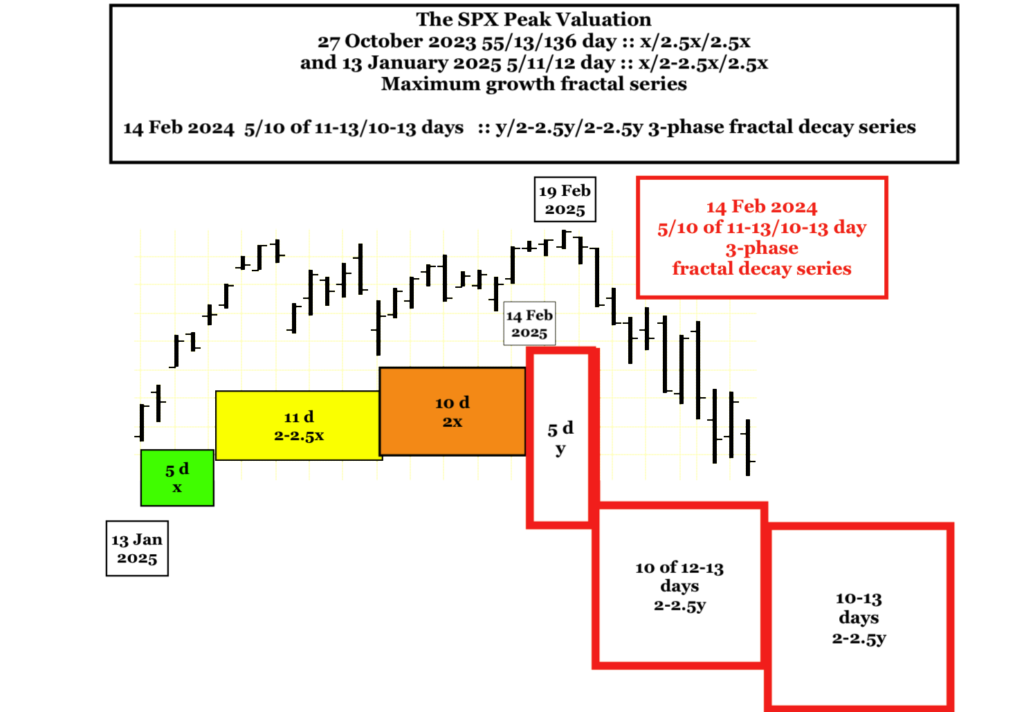

a 3-phase fractal series: x/2-2.5x/1.5-2.5x

In the 4-phase fractal series sequential elements are termed: the 1st, 2nd, 3rd, and 4th fractals and in the 3-phase fractal series: the 1st, 2nd, and 3rd fractals.

The 2nd fractal is characterized by terminal gapped lower lows between the 2x and 2.5x time period. (These gapped lower lows can be seen in weekly units between 1929 and 1932 of the US 90 year 2nd fractal, before the 5 August 2024 139 day 2nd fractal low and can be expected within last few months of the 32-33 year 2nd fractal of the interpolated 1982 13/32-33 year 1st and 2nd fractal series.)

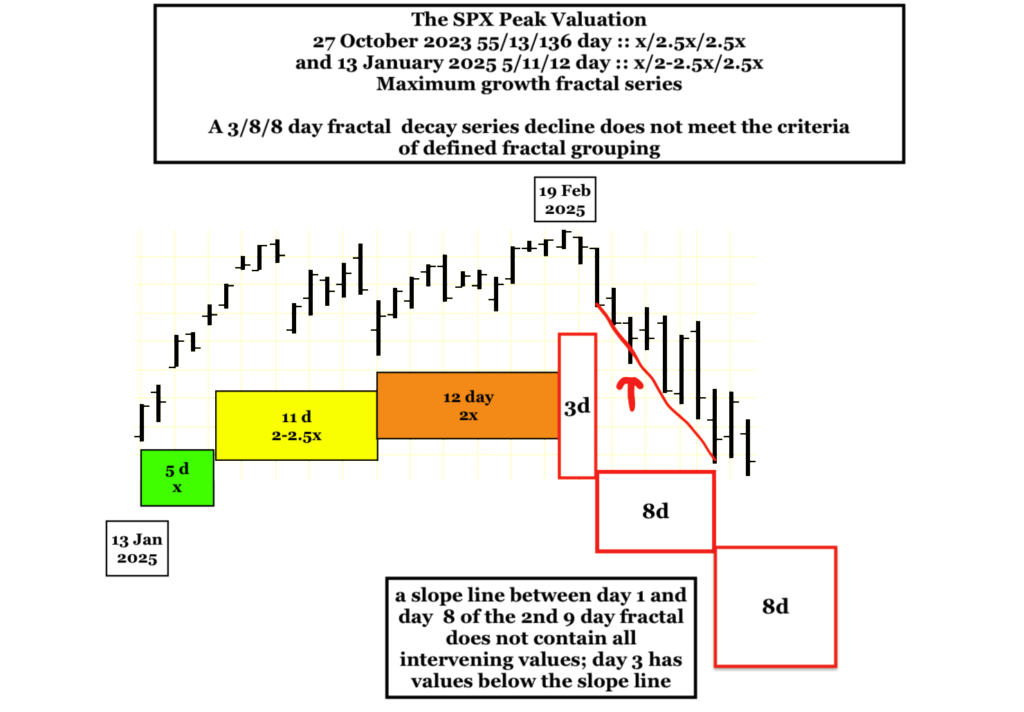

With the exception of the 3rd fractal in the 4-phase series whose fractal grouping is determined by its terminal peak valuation, fractals (fractal groupings) are determined by the nadirs of the first and last time unit in the grouping with intervening valuation above the connecting nadir trend-line.

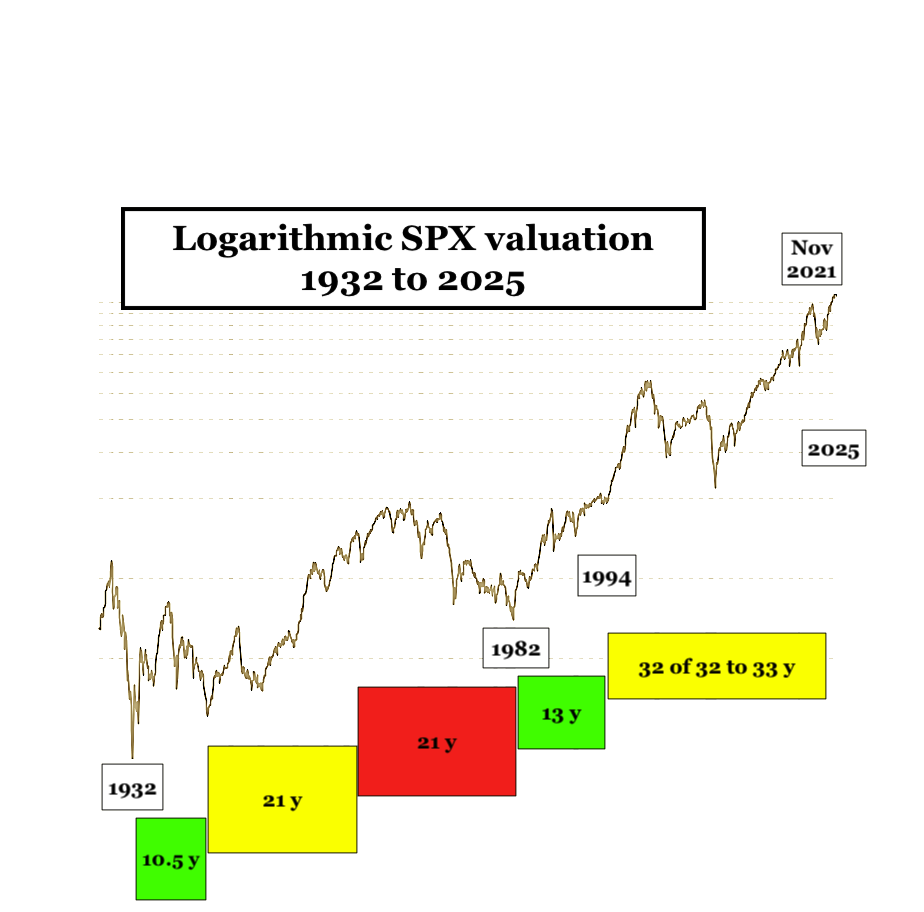

For 1807 36/90/90/54 year fractal series, nadirs occurred in 1807, 1842-43, and July 1932 defining the 1st and 2nd fractals with a 3rd fractal 90 year peak valuation in Nov 2021.

World War 2 and post Breton Woods American dominant manufacturing growth and dominant currency disrupted equity composite nadir valuations from 1932 to 1982 with a resultant 11/21/21 year :: approximate x/2x/2x 3-phase fractal growth series.

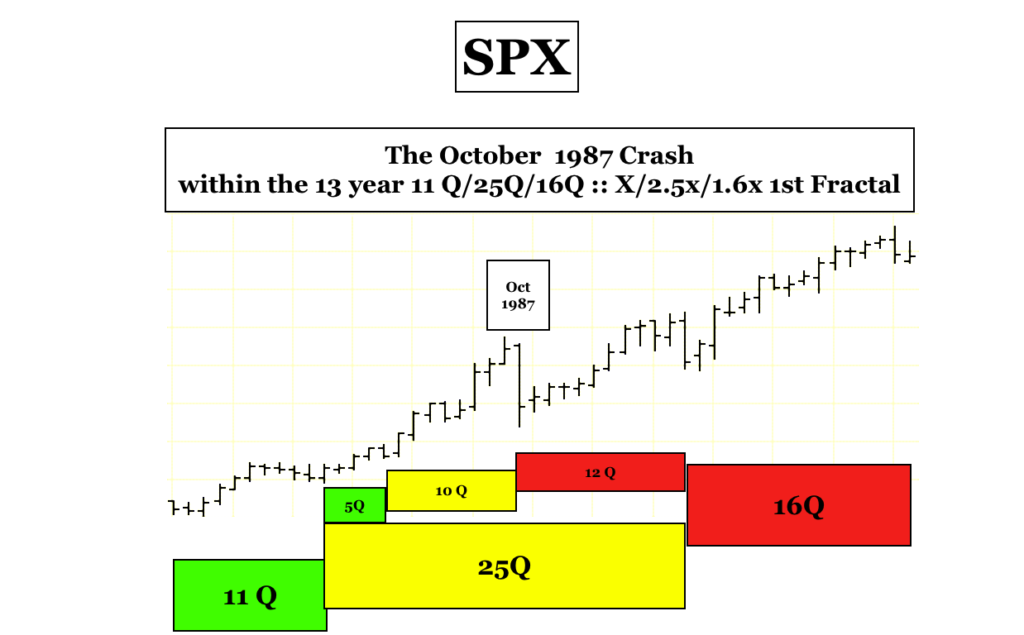

To complete the 1807 36/90/90/54 year US 4-phase fractal series, an interpolated 1982 13/32-33/32-33/20 year x/2.5x/2.5x/1.5-6x 4-phase fractal series is expected.

Credit growth from 1982 has been propelled by cascadingly lower US fed fund interest rates, a 2000 speculative internet bubble and a 2008 housing bubble, post event recession corporate and Covid citizen bailouts, massive governmental deficit spending and credit/money growth accommodation from the US central bank which has allowed relatively low US unemployment levels and service sector incomes to purchase foreign goods made with 10-25% of US labor cost with increased corporate profits, decreasing corporate tax rates and corporate buy-backs of equities vice investment in domestic manufacturing .

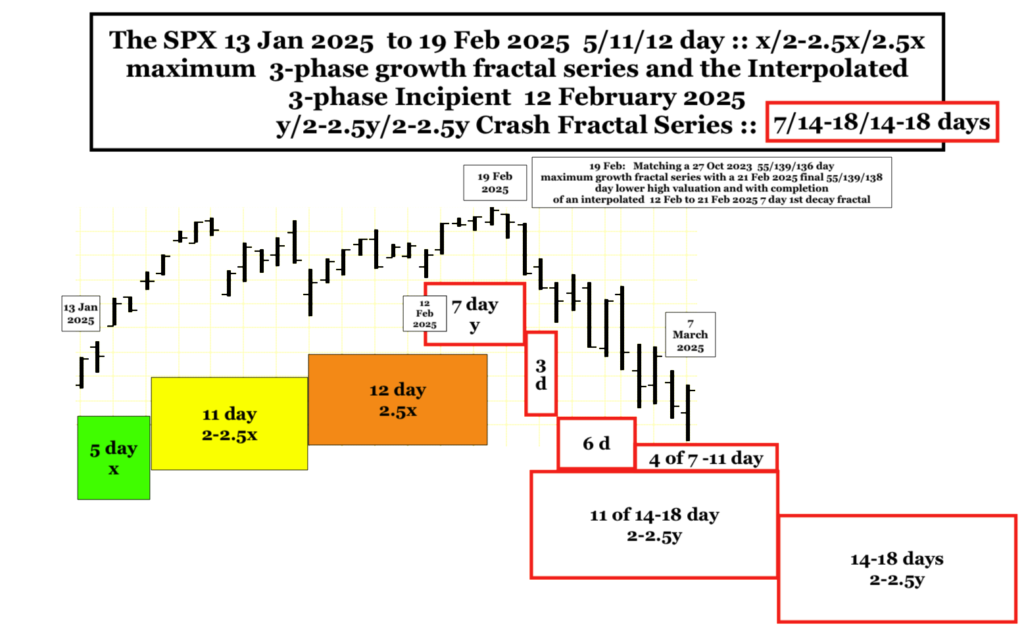

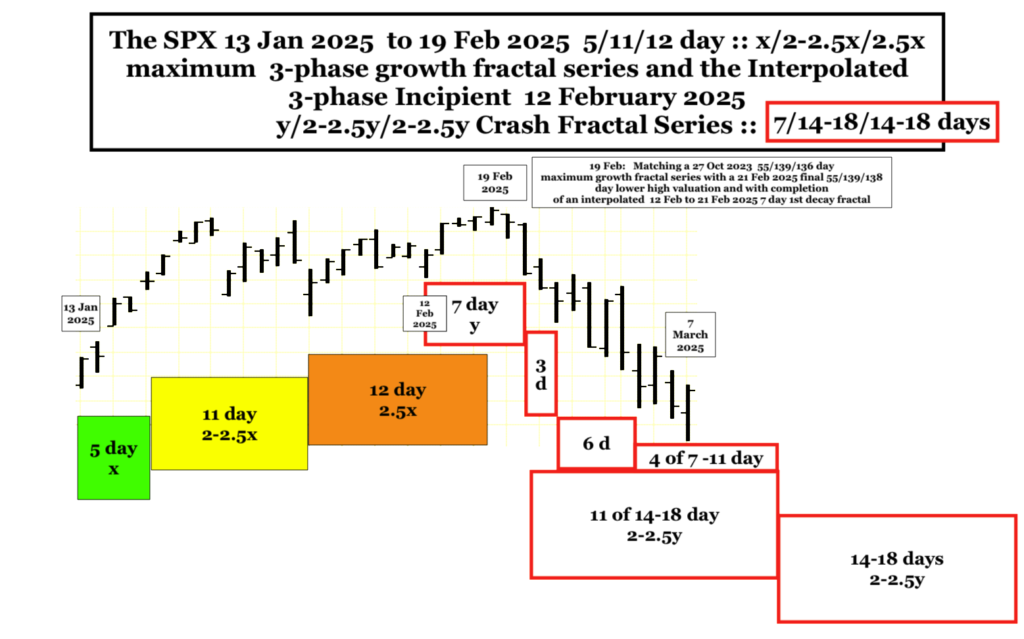

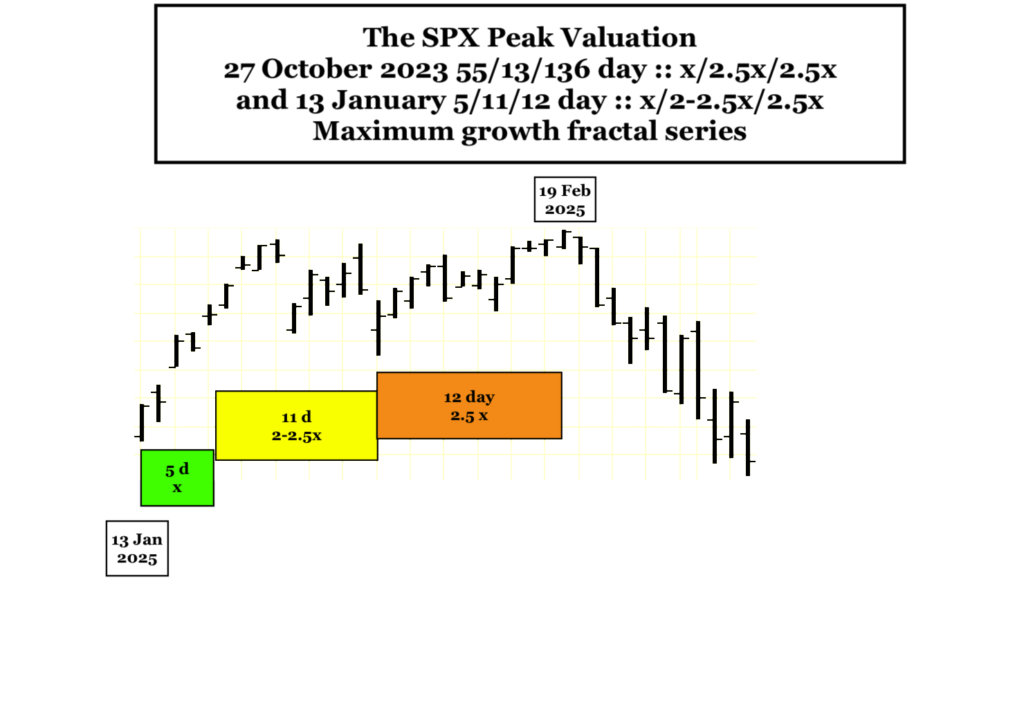

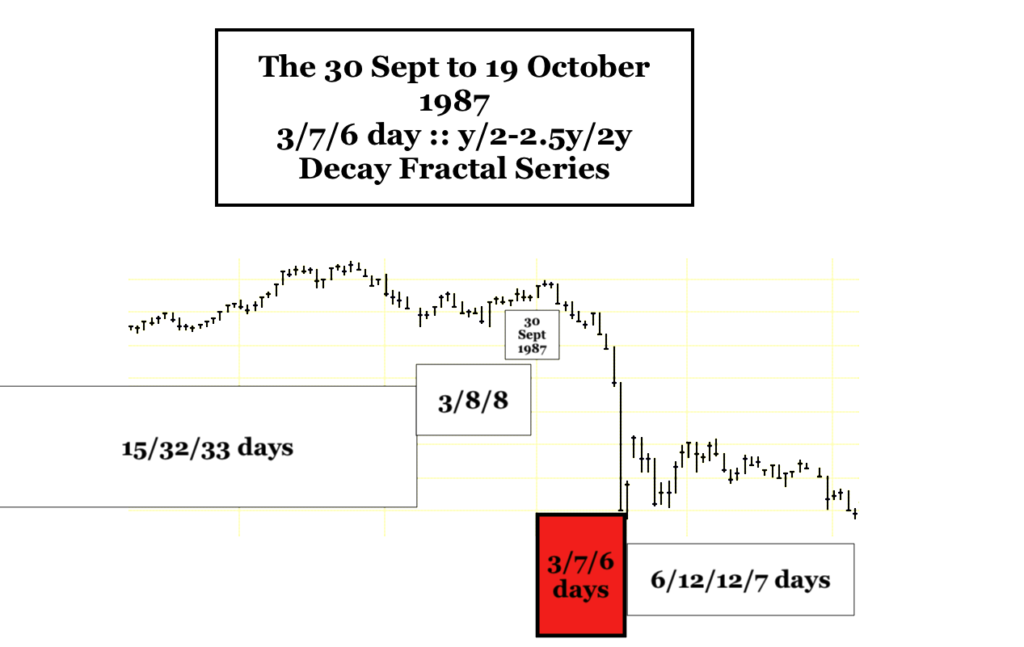

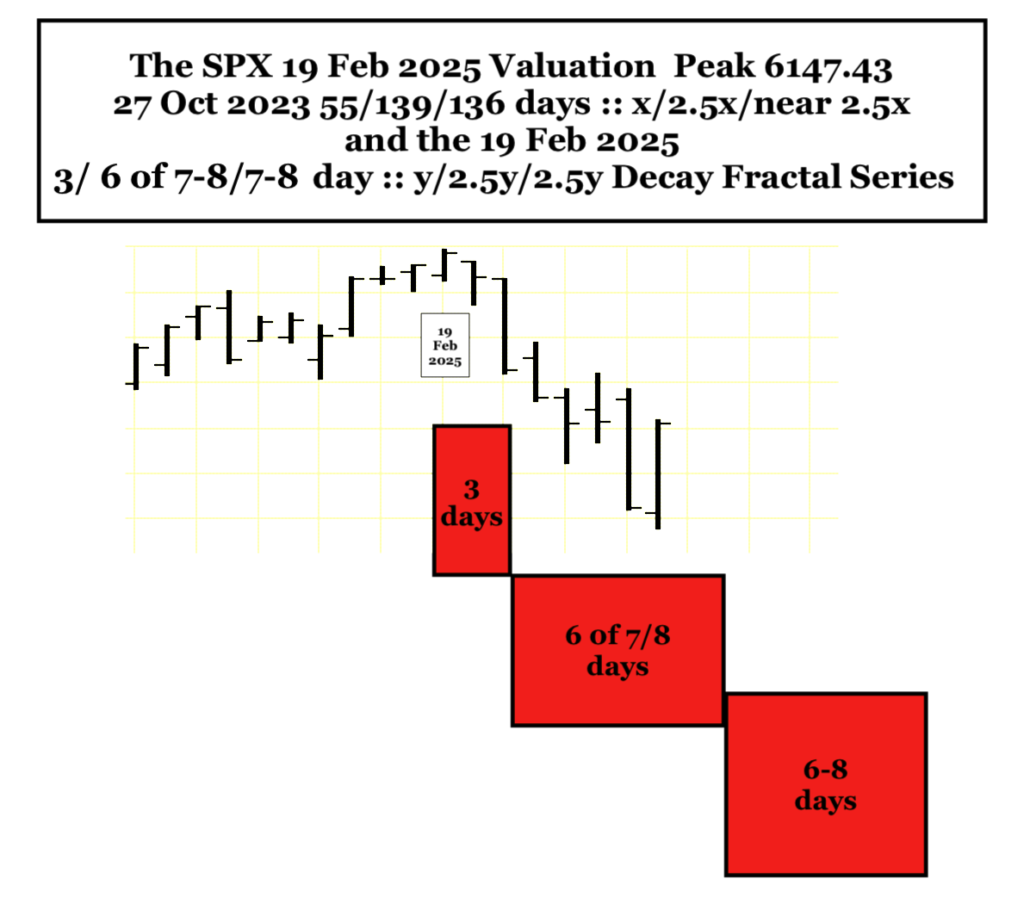

The massive citizen Covid bailout propelled the SPX to its 90 year 3rd fractal high in Nov 2021 and was contained within a March 2020 8+/24/14 :: x/2.5x/1.6x 3 phase growth fractal series followed by a 27 Oct 2023 55/139/138 day :: x/2.5x/2.5x peak valuation fractal series

The last 7 days of the 138 day 3rd fractal contains the SPX 19 Feb 2025 peak valuation which forms a 7 day base for a 7/18/18 day 3-phase crash decay fractal series.