The Science of Asset-Debt Saturation Macroeconomics interprets the system’s evolution in terms of the inevitable long term and short term self assembly asset valuation saturation curves of the Asset Debt System’s countervailing elements: hegemonic (US) sovereign debt futures valuation curves verses equity, commodity, and lesser quantitative but more substantive real estate valuation curves.

The Asset Debt system evolves in a self assembly fashion as it causally must. The system sustains itself as is teleologically optimal for continuation. Bad debt that cannot be repaid in the financial and private sector undergoing default from overvalued assets and greed based leverage is counterbalanced by rapid debt accumulation in the public governmental sector, without which, rapid deflation and system implosion would occur.

This is a forward based consumption global US hegemonic macroeconomy where at the base, the citizen consumer, mostly living at the point of nonlinearity, i.e., paycheck to paycheck, trades today’s labor against debt for past, present, and future debt for consumption of real estate, transportation, education, basic necessities, and luxury items.

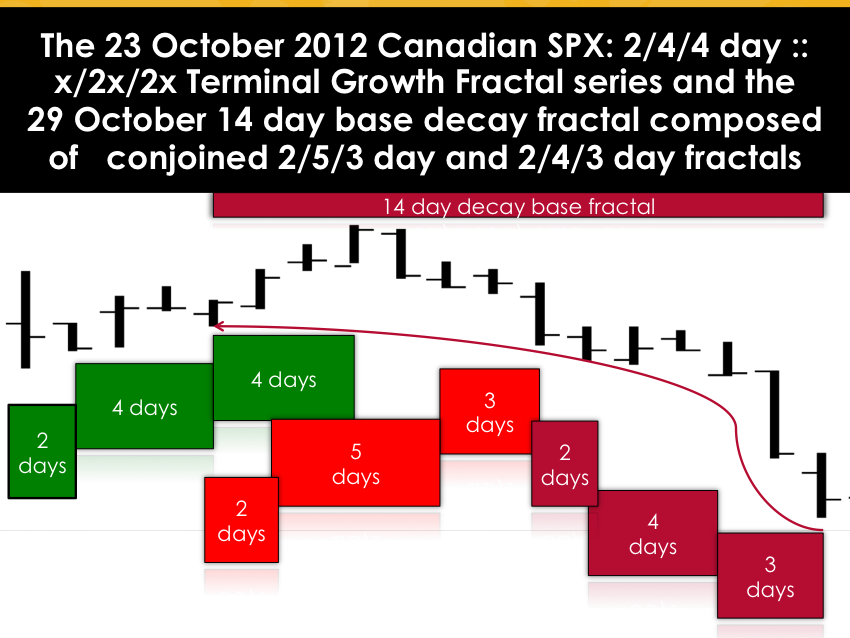

A debt saturated citizen population, an overproduced asset saturated system, and an overhanging overvalued asset system which is out of kilter with citizen consumer demand and citizen wages are the dry kindling needed for deterministic nonlinear spontaneous combustion.

This system has been deterministically pushed on a string. Europe and the Euro, Japan and it’s governmental-GDP deficit, China and its empty cities and recipient demandless nonconsumer US Citizens, and the US and its accumulated nonrepayable private debt and wages and benefits out of balance with the world citizen’s community …all of these are near the point of collective bad debt liquidation.

In this time period of nonlinear spontaneous combustion, it is the Asset-Debt system’s valued asset that is the driving and observable dependent variable for the system. That dependent variable for the global 21st century Macroeconomic System is US sovereign debt (futures).

The debt ceiling discussions between the representatives of the Haves and Have-Nots are but epiphenomena to the deterministic progression of the quadrillion dollar Asset-Debt system’s countervailing asset valuation curves.

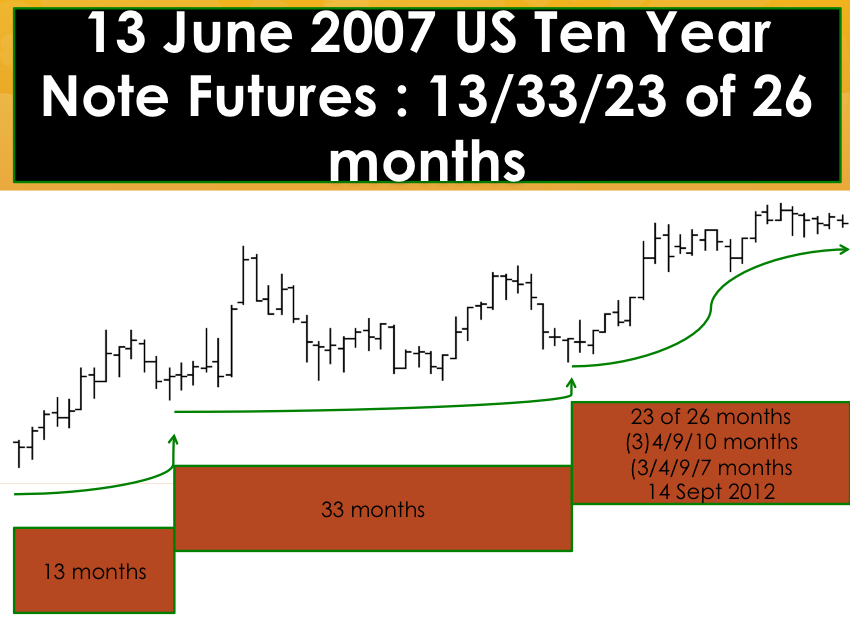

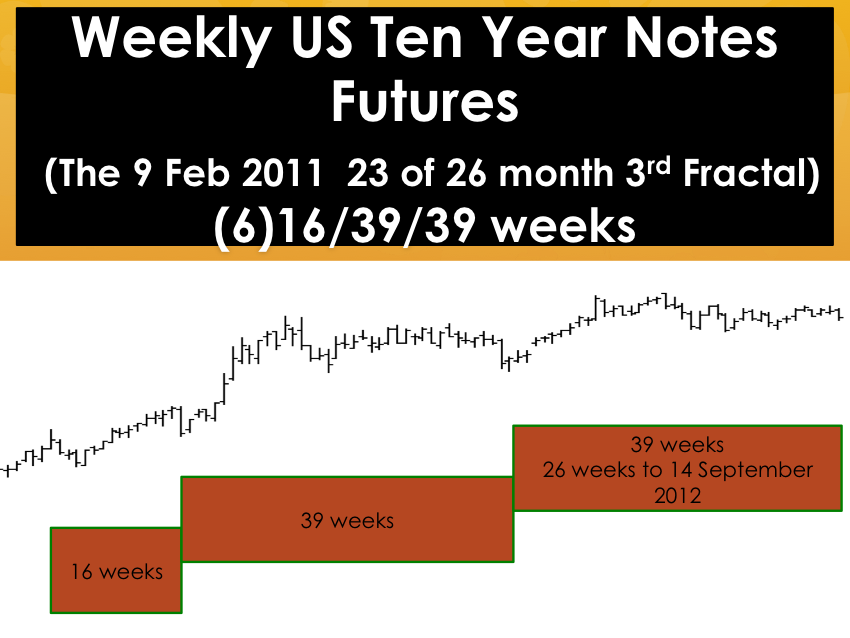

As empirical data from the countervailing evolving curves produces the deterministic valuations pathways, its is now clear that US Ten Year Note Futures will reach about 130 and US Ten year Note interest rates 2.35-2.45 percent before nonlinearity occurs and rates of less than one percent transpire.

US hegemonic sovereign debt is denominated in the world reserve currency US dollar and is the countervailing quality asset

in the Asset-Debt macroeconomic at the time of Macroeconomic Saturation of Bad Debt, Asset Overproduction, and

Asset overvaluation. US sovereign debt will be repaid.

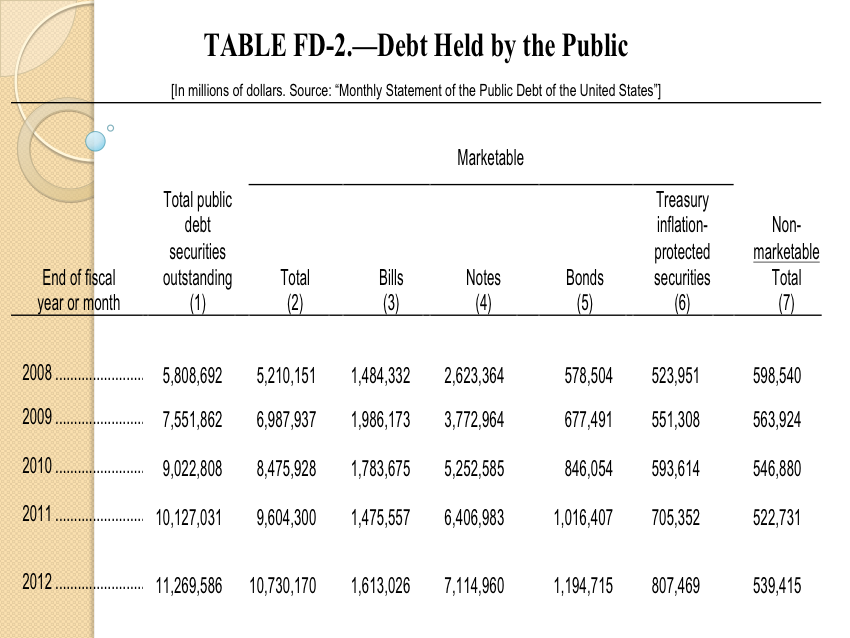

Since 2008 Most of the growth in US debt has occurred in US notes ranging from 2 to 7 years.

Public holdings have increased by over 4 trillion in US Notes which represents nearly 80 percent of new total debt.

This preponderance of US Note sovereign debt is important to appreciate in the quantitative fractal analysis of the Asset-Debt

Macroeconomic system’s countervailing asset valuation saturation curves. It is in the intermediate year US Notes whose underlying slope lines defining fractal units are less likely to be caricatured than the smaller percentage of US Debt longer term US Bonds.