The Global macroeconomy is tightly interwoven with the use of central bank debt to create job growth and maintain forward prosperty. The Japanese Nikkei has expanded in valuation since the global banks’ unprecedented QE program following the Covid pandemic.

Nikkei valuation growth since March 2020 has followed a perfect self-assembly Lammert fractal growth pattern first described in the 2005 face page of this web site. A three phase growth fractal series of x/2-2.5x/2x :: 33/72/66 weeks is easily observable in the above Nikkei March 2020 to June 2023 weekly charts with the 3 fractal series delineated by green curvilinear lines.

The three fractals making up this series are a series of sub fractals:

33 week first fractal: composed of a 6/15/14 week: x/2.5x/2-2.5x fractal series

72 week second fractal : composed of 14/30/30 week: x/2-2.5x/2-2.5x fractal series with a second fractal characteristic nonlinear lower low gap between week 71 and 72, corresponding to between week 29 and week 30 of the third subfractal and described in the 2005 face page.

66 week third fractal composed of a 15/30/23 week fractal series; the 23 week final third fractal is composed of two weekly subseries: 3/6/4 weeks and 3/7/6 weeks.

A 7 week crash devaluation would complete a 15/30/30 week third fractal and result in a 33/72/73 week decay series dating from the March 2020 low. A final 42 week self assembly would complete a 33/72/73/42 week :: x/2-25x/2-2.5x/1.5x’ fractal series and complete the Global QT equity phase ( as interest rates are lowered during the phase of job loss, macroeconomic recession, equity and commodity decline)

The Nikkei’s final 23 weeks of growth of 3/6/4 and 3/7/6 weeks correspond to 11/25/16 days :: x/2.5x/1.5x and 11/27/27 days :: x/2.5x/2.5x.

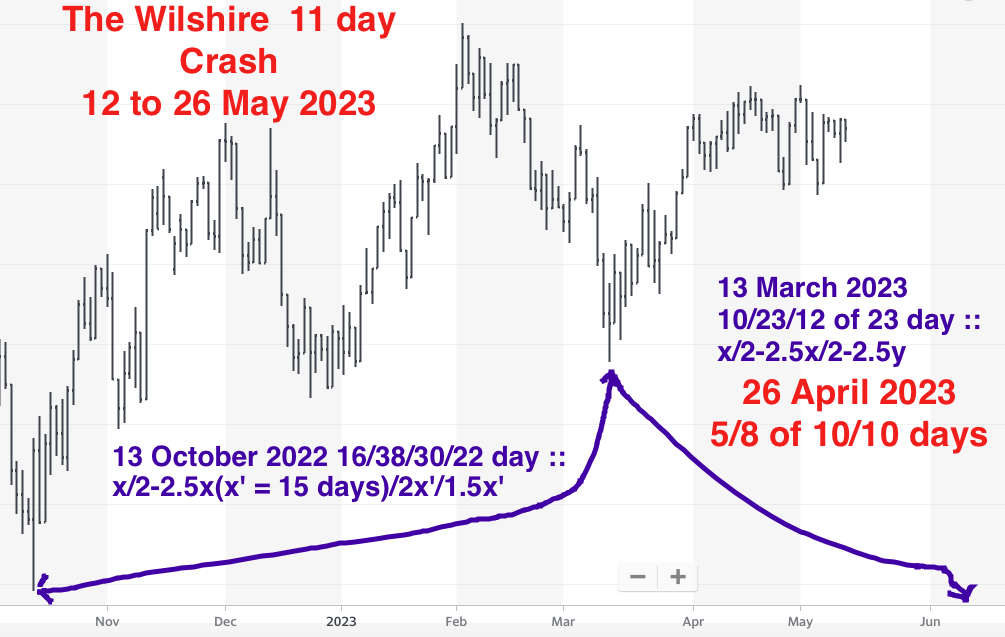

The Nikkei’s final 3/15/2023 11/27/27 day blow-off growth fractal corresponds to a 3/13/2023 Wilshire 12/27/30 day :: x/2-2.5x/2.5x final growth fractal.

From its March 2020 low the Wilshire grew in a QE 15/37/38 week x/2.5x/2.5x maximum fractal fashion to its November 8 2021 1807 36/90/90 year :: x/2.5x/2.5x fractal series maximum growth high valuation. Consumer-inflation- fighting QT began 4 October 2021 with an 18/38/36 week :: x/2-2.5x/2x reflexive second fractal decay and third fractal high matching the Nikkei June 15/16 2023 high. A wilshire subsequent decay fractal of 18/38/43 weeks :: y/2-2.5y/2-2.5y would match the intermediate ending of a Nikkei 33/72/73 week decay series, the third 73 week fractal made of a 15/30/30 week :: y/2y/2y fractal series.

Global equities can be expected to collapse over the next 7 weeks and in a fractal manner. Fractal decay possibilities include a 7/15-17/17-15 day decay series :: y/2-2.5y/2-2.5y or a 8/18-20/12 day decay series :: y/2-2.5y/1.5y. Chinese, US and European real estate valuations and equity valuations are grossly overpriced compared to ongoing mortgage rates, US ten year bonds, wages, and outstanding composite private, corporate, and individual debt to GDP ratio’s.

Be prepared for a 1981-1982 13/30 year first and second fractal x/2-2.5x nonlinear second fractal corrective nonlinear devaluation reckoning.