Global corporate, private, and governmental debt has never been this great percentage of global GDP.

With transient consumer inflation secondary to covid governmental QE stimulation, supply chain interruptions, higher diesel and gas prices, avian flu poultry culling, Covid retiree surges, 7-8 % higher 2022 COLA’s to spend in the US service sector, and secondary transient labor shortages in the service sector to the 7-8% COLA increases, QT measures and interest hikes are smashing against recent European, Japanese, and US equity higher and lower high equity valuations.

Chinese equities and property valuations are at the cliff’s edge of precipitous falling, as Chinese workers over the last 5 months have received lower wages and defaulting on mortgages, reinforcing lower property valuations and building sector corporate defaults. The previous 2014 Chinese real property valuation peak of 101 (relative to wages) was only exceeded in 2021 to 113 with current decreases to 105 in the 4th quarter of 2022. The last 6 months have been terrible have Chinese home owners.

Qualitatively. this is a global asset-debt system of highly leveraged debt-propelled over-produced, over-valued assets – a house of cards synergistically collapsing.

The Asset-Debt Macroeconomic System integrates all of the system’s internal parameters – total debt, asset production numbers, asset ownership pool, asset valuations, ongoing interest rates, QE and QT programs, et. al. – and generates, in a self-assembly manner, the most efficient asset valuation growth and decay progression, in a highly-ordered, elegantly-simple time-based patterned fractal manner.

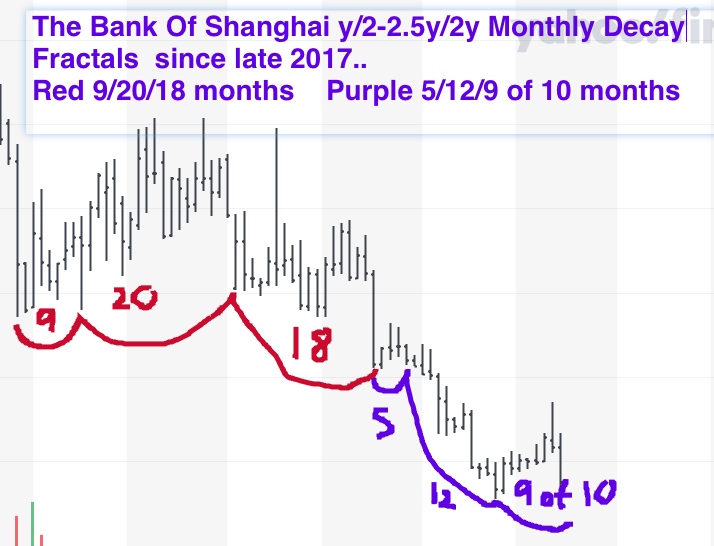

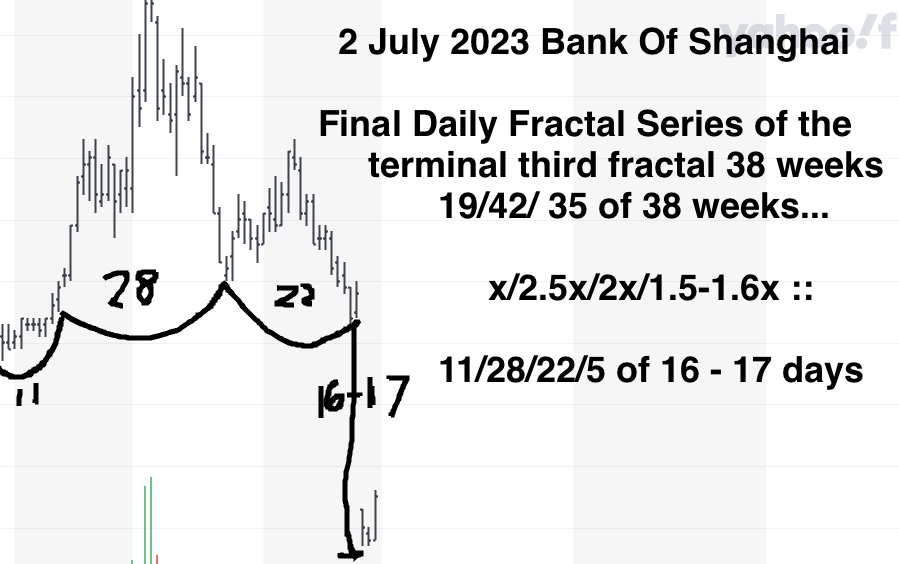

For the Bank of Shanghai the final fractal series is a 28 March 2023 11/28/22-27/4 of 16-17 days.

The Hang Seng Index is the premiere proxy index of the Global asset-debt system. From the March 2020 low 33/72/70 of 73 weeks. It’s final 73 weeks is composed of a reflexive – x. maximal decay 2.5x, maximal growth 2.5x, decay 1.6x – :: 10/25/25/16 week fractal series.

(Updated 10 July 2023: The HSI final daily terminal sequence is an 11 April 2023 reflexive 10/25/25/4 of 16 day :: fractal series, identical to its terminal weekly fractal series.