From the 17 February 2013 posting ….

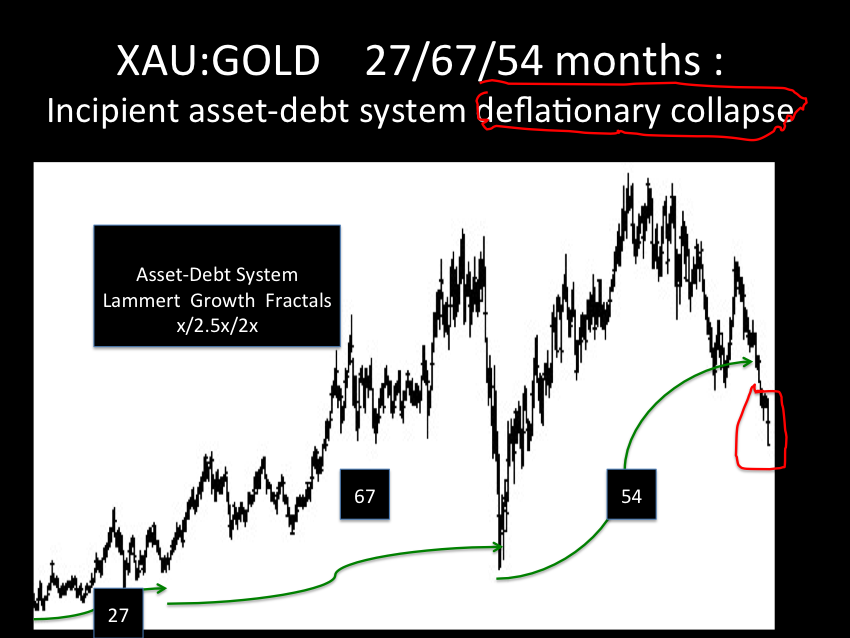

After the 54th month of growth of the third fractal, all global small speculators were fully invested in gold, the small speculator buying population was depleted.

Who were the counterparties who have an understanding of the asset-debt system? The money-changers of Wall Street…

Does the timing of the global depletion of small buying speculators in the global gold market have a correlation to the timing of the global depletion of global small speculators in global equity markets?

Who will be the gaining counterparties of the losing global small speculators in the global equity markets?

From the main page…..

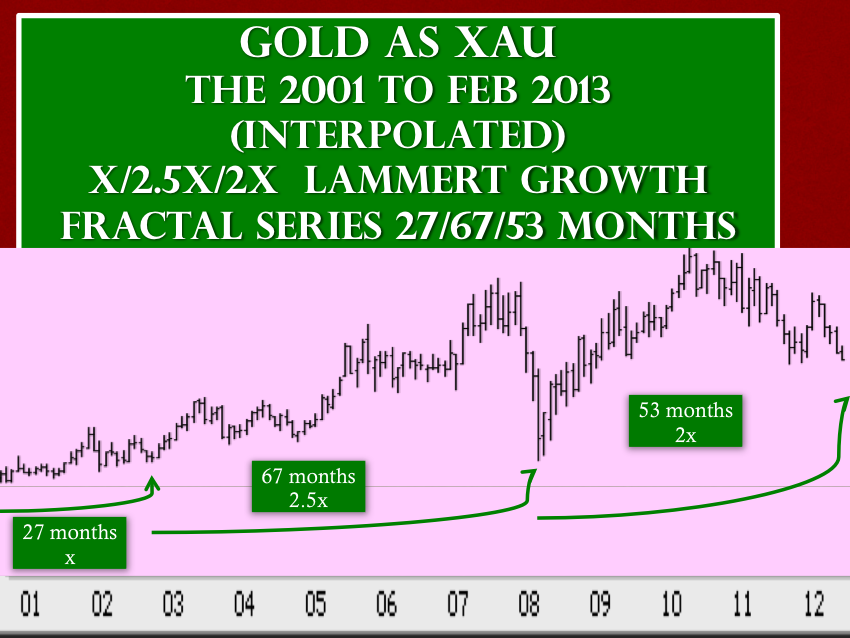

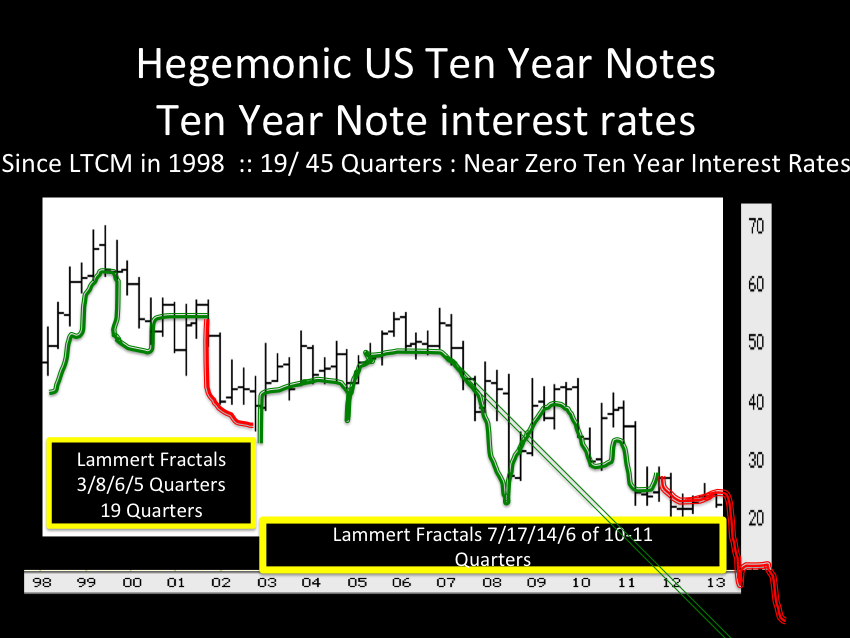

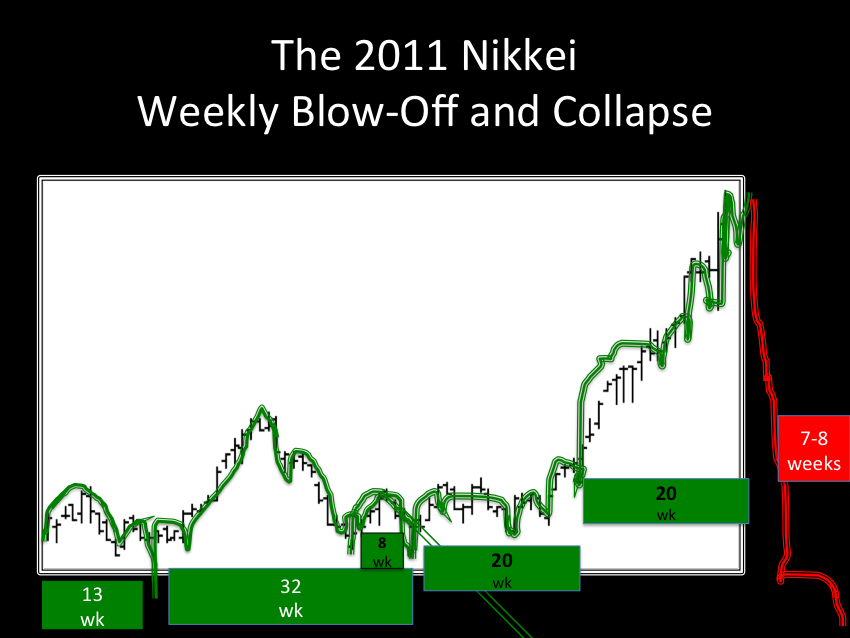

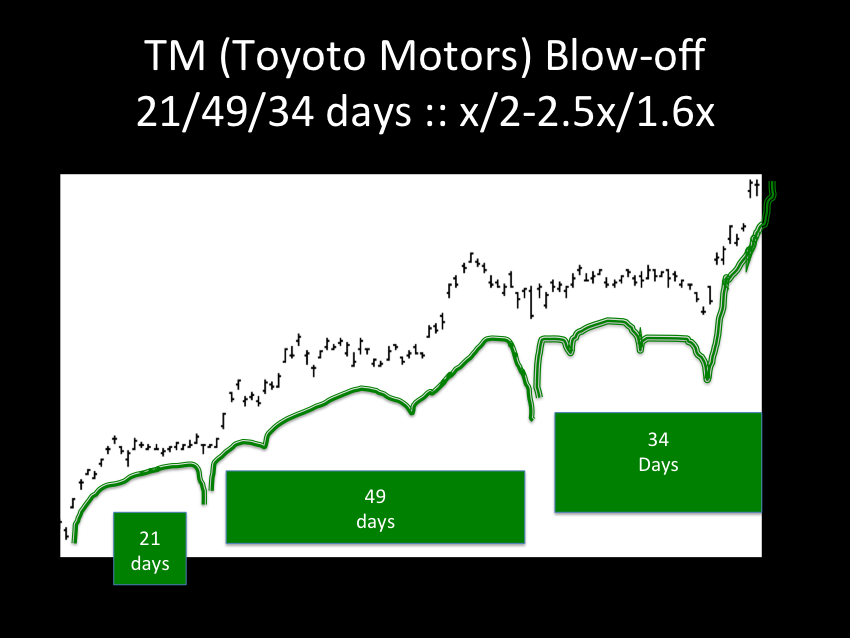

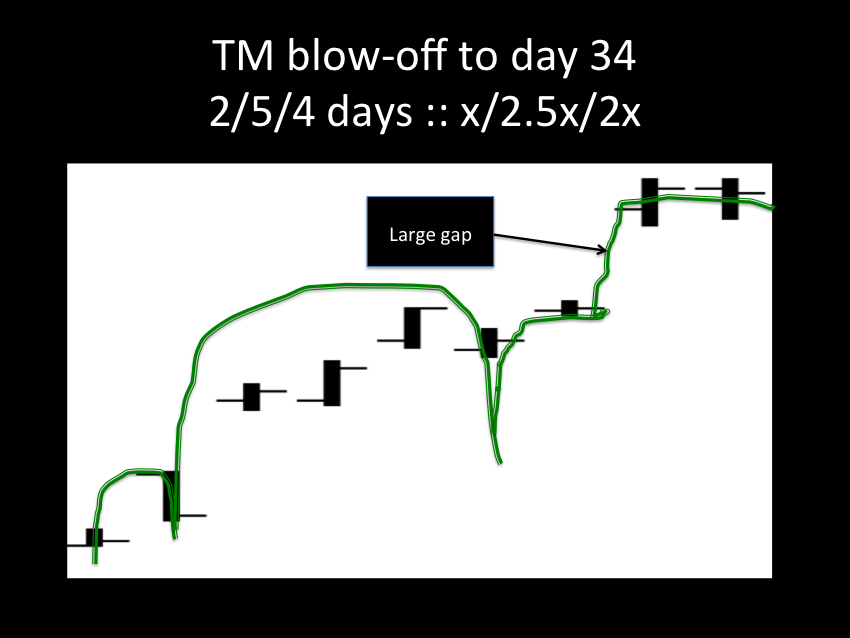

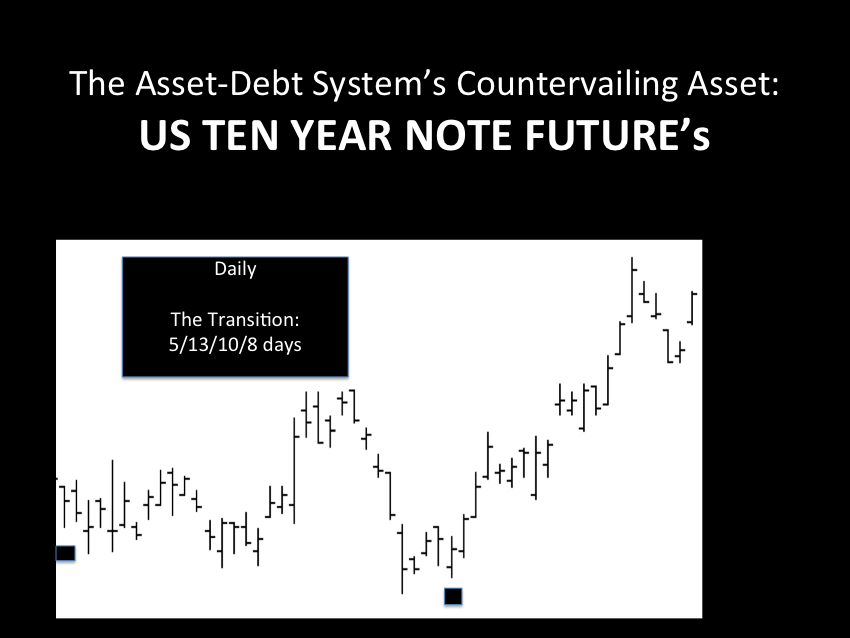

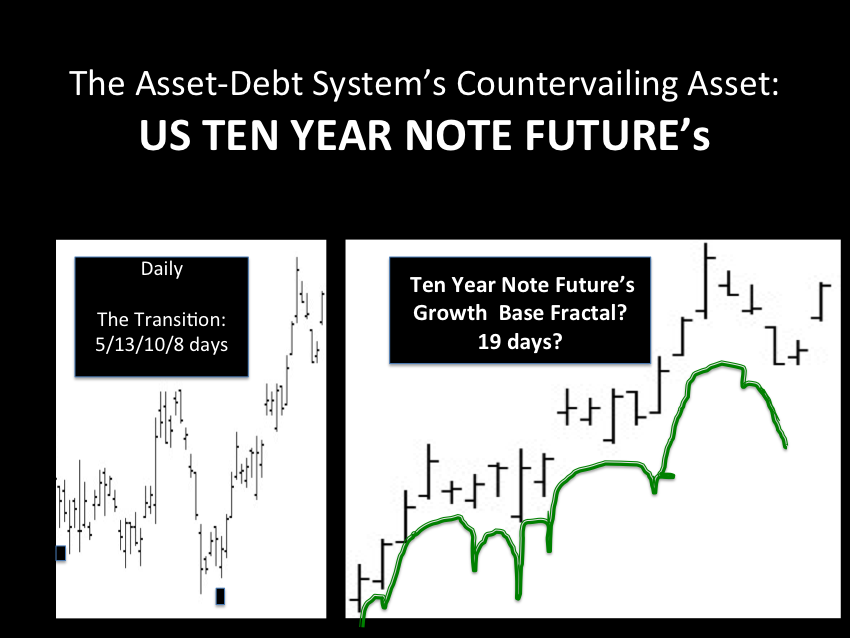

The ideal (Lammert) growth fractal time sequence is X, 2.5X, 2X and 1.5-1.6X. The first two cycles include a saturation transitional point and decay process in the terminal portion of the cycles. A sudden nonlinear drop in the last 0.5x time period of the 2.5X is the hallmark of a second cycle and characterizes this most recognizable cycle. After the nonlinear gap drop, the third cycle begins. This means that the second cycle can last anywhere in length from 2x to 2.5x. The third cycle 2X is primarily a growth cycle with a lower saturation point and decay process followed by a higher saturation point. The last 1.5-1.6X cycle is primarily a decay cycle interrupted with a mid area growth period. Near ideal fractal cycles can be seen in the trading valuations of many commodities and individual stocks. Most of the cycles are caricatures of the ideal and conform to Gompertz mathematical type saturation and decay curves.

G. Lammert

This page was last updated on 15-May-2005 01:21:59 PM .

http://www.youtube.com/watch?feature=player_detailpage&v=7VOWnnEphjI#t=737s

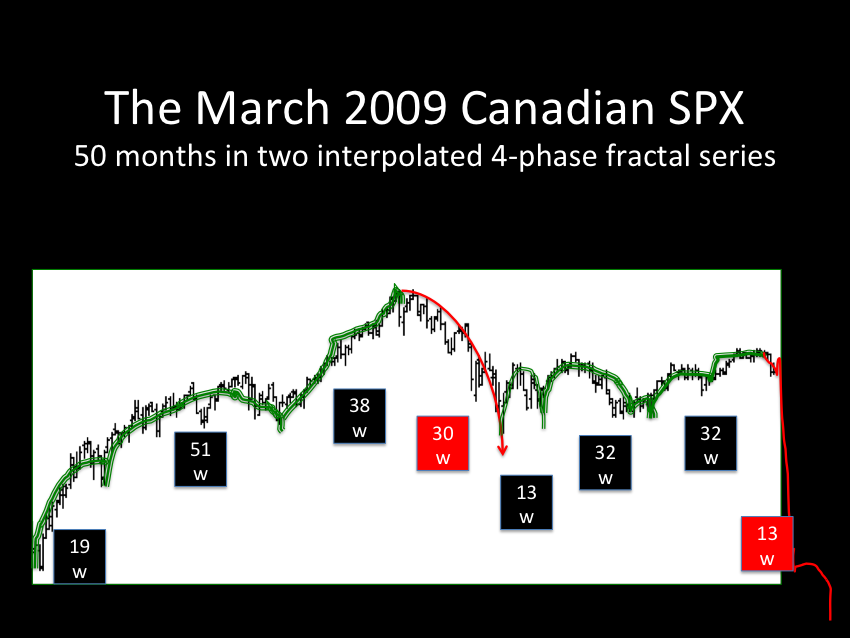

24 April 2013 is the 48th day of a 24/61/48 day Nikkei fractal series and the 40th day of a 20/50/40 Nikkei fractal series … How exquisitely precise is the timing of the global exhaustion of the global pool of small speculators in the global equity market?

(Imagine if all equity trading was halted for five years on 24 April 2013 and all trading leveraged positions were cancelled as part of an Equity Price Stabilization Act…. Imagine if the government then purchased equity frozen in value on 24 April 2013 and owned by individuals for up to 300,000 dollars in value with payment in T-bills funded(printed, accounted for) by the Federal Reserve. That stabilization act would protect the ongoing purchasing power of the citizen economy (consider 1929 to 1940) and really do a job on the counter parties of Wall Street.)