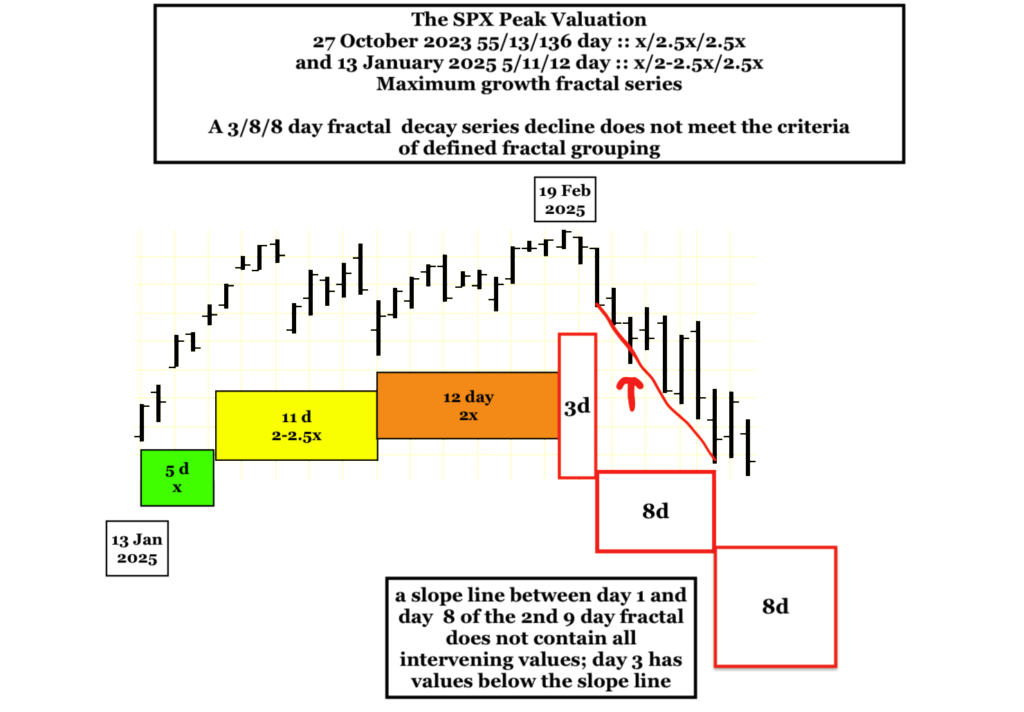

Fractal groupings are determined by a slope line between the nadir of first time unit and the nadir of the last time unit of the grouping with all intervening valuations above the two nadir points. The 1929, the 1987, and the 2020 incipient 3-phase decay fractal series and fractal groupings all have shared this commonality.

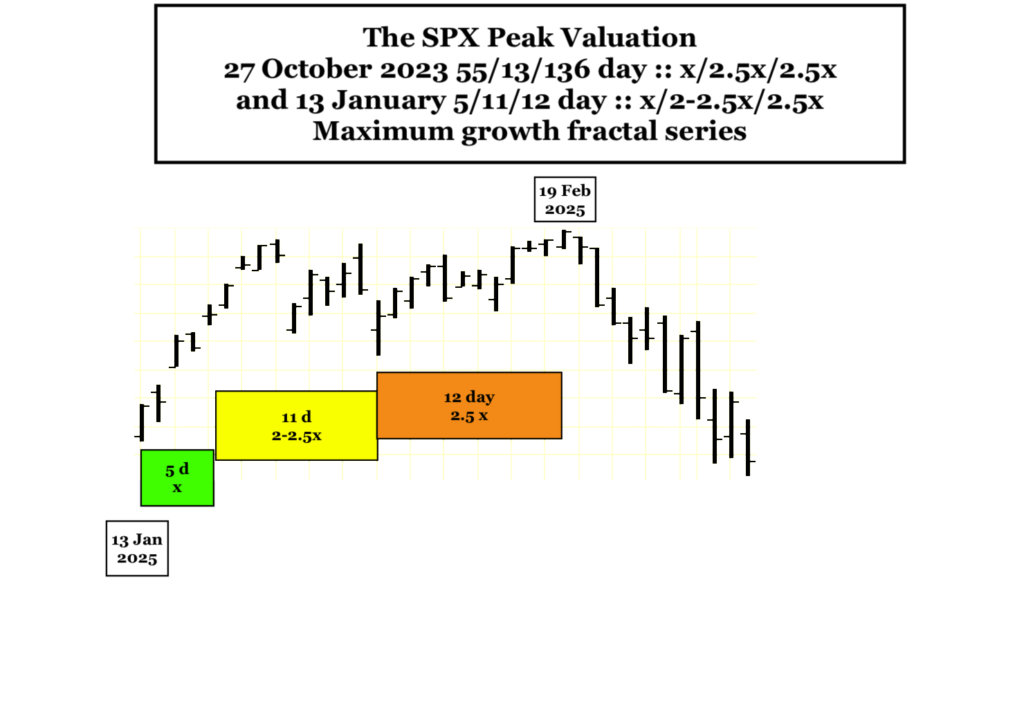

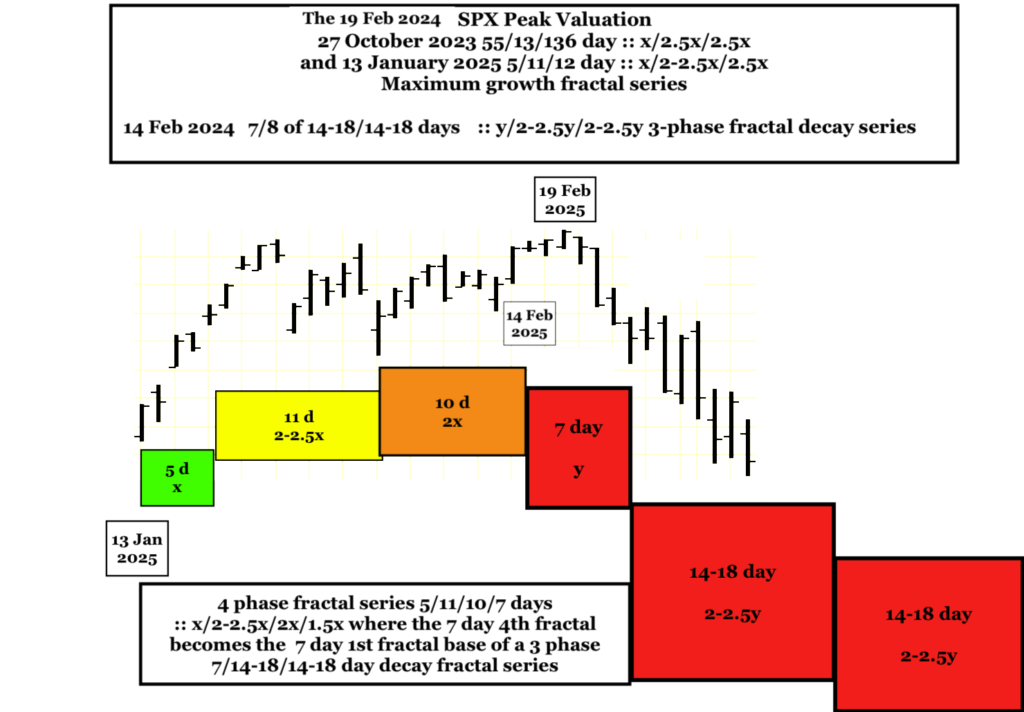

The SPX reached an interpolated 27 October 2023 55/139/136 day :: x/2.5x/2.5x valuation zenith on 19 February 2025. This 136 3rd fractal peak valuation coincided with a 5/11/12 day :: x/2-2.5x/2-2.5x fractal growth series starting on 13 Jan 2025.

A 19 February 2025 3/8/8 day decay fractal series was initially proposed but does not meet the definition of fractal groupings as defined above. Day 3 of the 2nd 8-day fractal has values below slope line between the nadirs of day 1 and day 8. (Below)

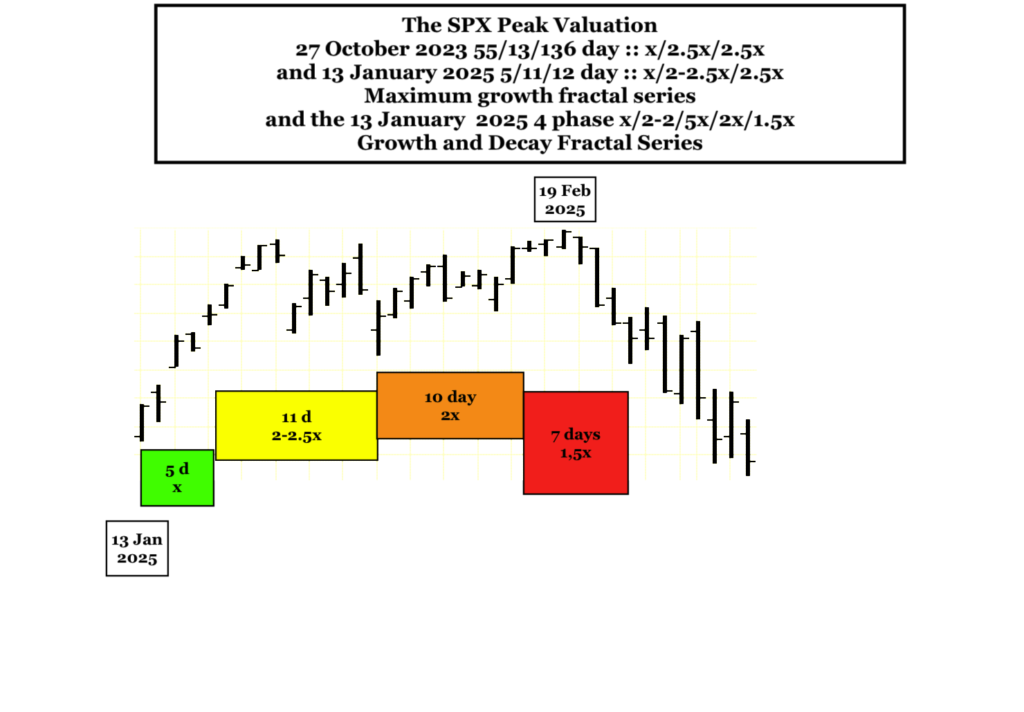

A 13 January 2025 5/11/10/7 day :: x/2-2.5x/2x/1.5x 4 phase fractal series (below) contains the 19 February 2025 high …

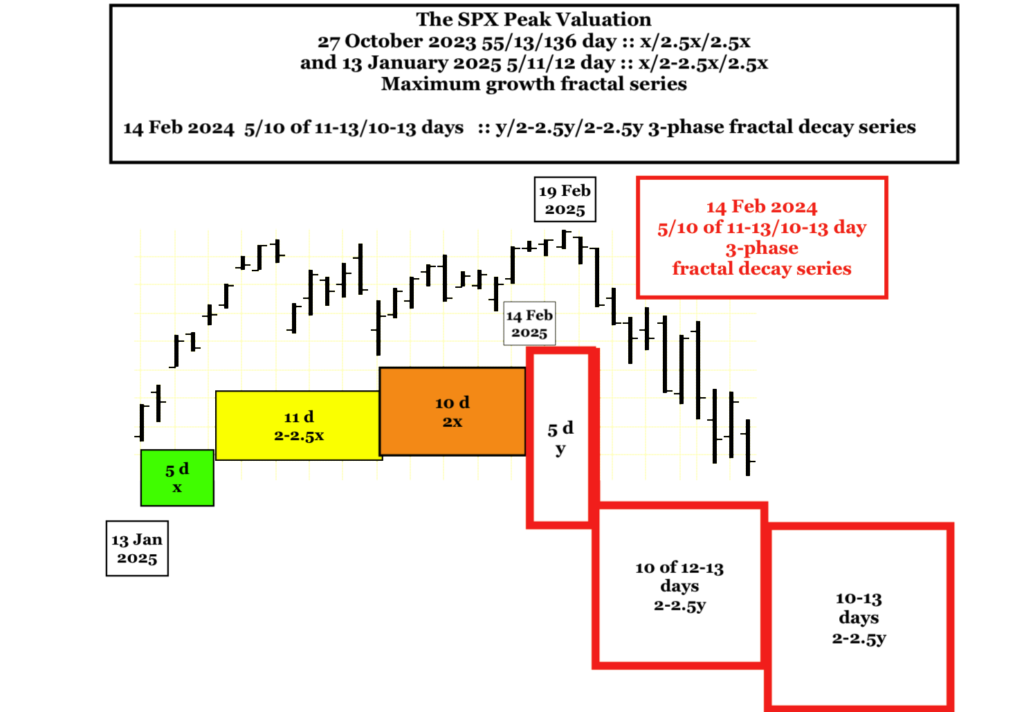

and has two alternative possible interpolated 3-phase fractal decay series: a 14 February 2025 5/10 of11-13/10-13 day decay series (below)and …

… a more probable 14 Feb 2025 7/8 of 14-18/14-18 day fractal decay series below – both in accordance with a 3-phase y/2-2.5y/2.5y fractal decay series. In the latter series the 7 day 4th fractal of the 13 Jan 5/11/10/7 day 4-phase series becomes the first 7 day fractal or ‘y’ of the y/2-2.5y/2-2.5y 3-phase fractal decay series.

The 14 February 2025 7/8 of 14-18/14-18 day fractal crash decay series is also consistent with fractal patterns in the HangSeng, Shanghai Composite, the Nikkei, and the European composite stocks.

While this valuation collapse is a naturally occurring asset-debt macroeconomic deterministic self-assembly deterioration process after maximum fractal growth (1982 13/32 years and terminal 31-32 year 27 Oct 2023 55/139/136 day :: x/2.5x/2.5x maximum growth(below), the chaos that has cornerstoned the 180 degree reversal policies of the current administration will likely receive just reward and be deemed as causative of the collapse especially after the very recent positive US ISM services numbers and the recent European equity blow-off.