The initial phase of the 1982 13/32 0f 33 year global equity crash will occur over the next 6-8 trading days.

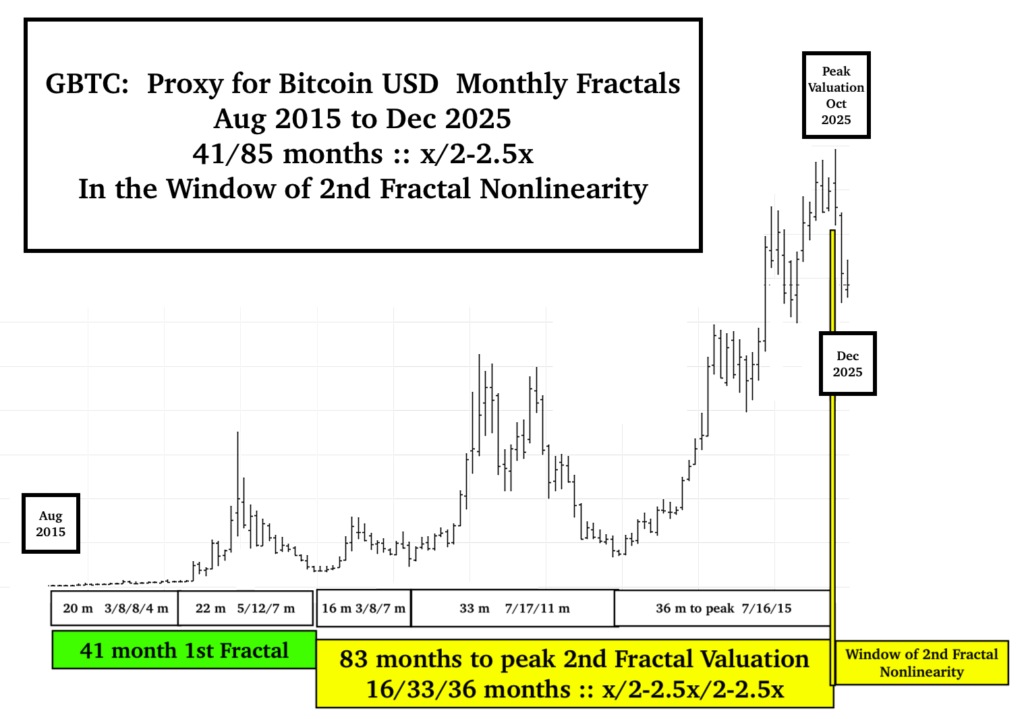

Bitcoin in US dollars has preceded the equity crash with a greater than 30% loss since its peak in Oct 2025, following a GBTC proxy Bitcoin in USD first and second fractal series initiated in August 2015 of 41/85 months :: x/2-2.5x to date The peak valuation and incipient second fractal crash occurred in October 2025 on the 83th month of the 2ndd fractal and is ongoing.

Why are gold and silver in US dollars at their zenith valuations, while Bitcoin in US dollars has fallen 30% from its high valuation?

Other countries who have witnessed the current failing of the successful 75 year American institutional alliances and trade policies – yet still utilize America’s Bitcoin,(not China) have deleveraged their positions. Gold and silver in collapsing US dollars have always been highly valued in all Asian and most European countries. Hence, near the terminal peak of the 1982 13/ 32 of 33 global equity bubble, there has been a weakening-dollar-denominated rise in gold and silver valuations vice a non paradoxical decline in Bitcoin dollars.