Is there an underlying time-based self-assembly fractal order to the growth and decay of equity valuations in the asset-debt macroeconomic system?

It is the 2005 hypothesis of this website that the asset-debt system self-orders equity valuation growth and decay by two simple time-unit based fractal equations : a 4-phase fractal series: x/2-2.5x/2-2.5x/1.5-1.6x with respective units termed the 1st, 2nd, 3rd and 4th Fractal, and a 3-phase fractal series: x/2-2.5x/1.5-2.5x with respective units termed 1st, 2nd, and 3rd Fractals. In the 4-phase fractal series, the 3rd 2-2.5x fractal represents peak valuation growth, all other end points in the 4-phase series and all end points the 3 phase fractal series represent nadir valuations. Fractal groupings are defined by underlying trendlines from the beginning to the end of the grouping. 2nd Fractals of both 3 and 4 phase fractals are characterized by a nonlinear lower low gap valuation in the terminal 2x to 2.5x portion of the 2nd fractal. The inception of fractal valuation decay is conjoined and interpolated with end fractal peak growth and vice versa. In terminal blow-off valuation growth, the first fractal can end on an aberrant additional unit high above the slope line and in terminal blow-off series, the 3rd fractal peak of a 4 phase series can end at a near fibonacci 1.5-1.6x time range.

After the Buttonwood agreement in 1792 and an initiating 4 phase fractal series of 16years, an 1807 4-phase US hegemonic fractal series of 36/90/90/54-57 years commenced with lows in 1842-43, 1932, a 90 year high in 2021, and an expected low in 2074-77.

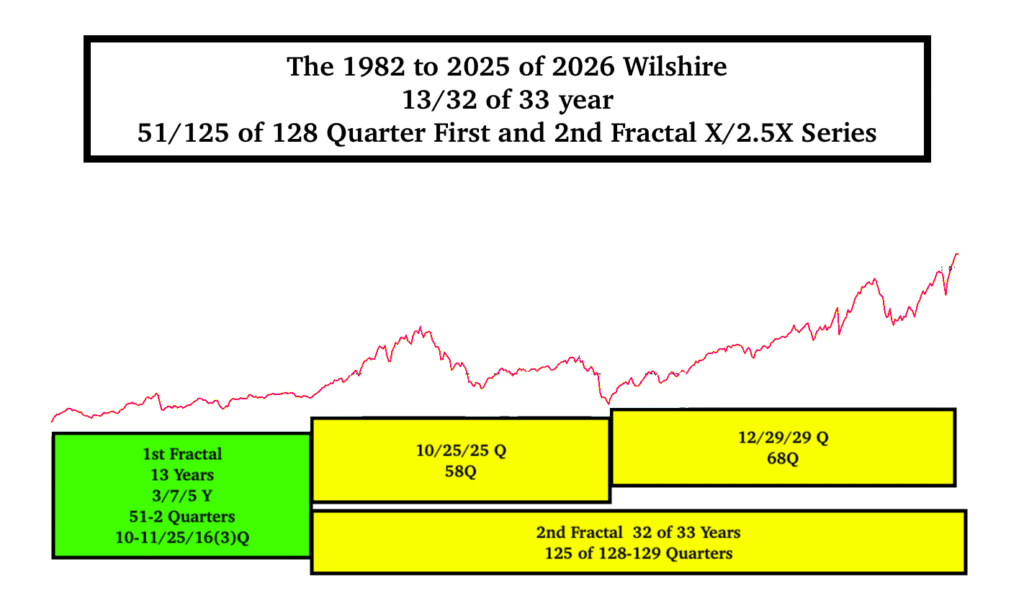

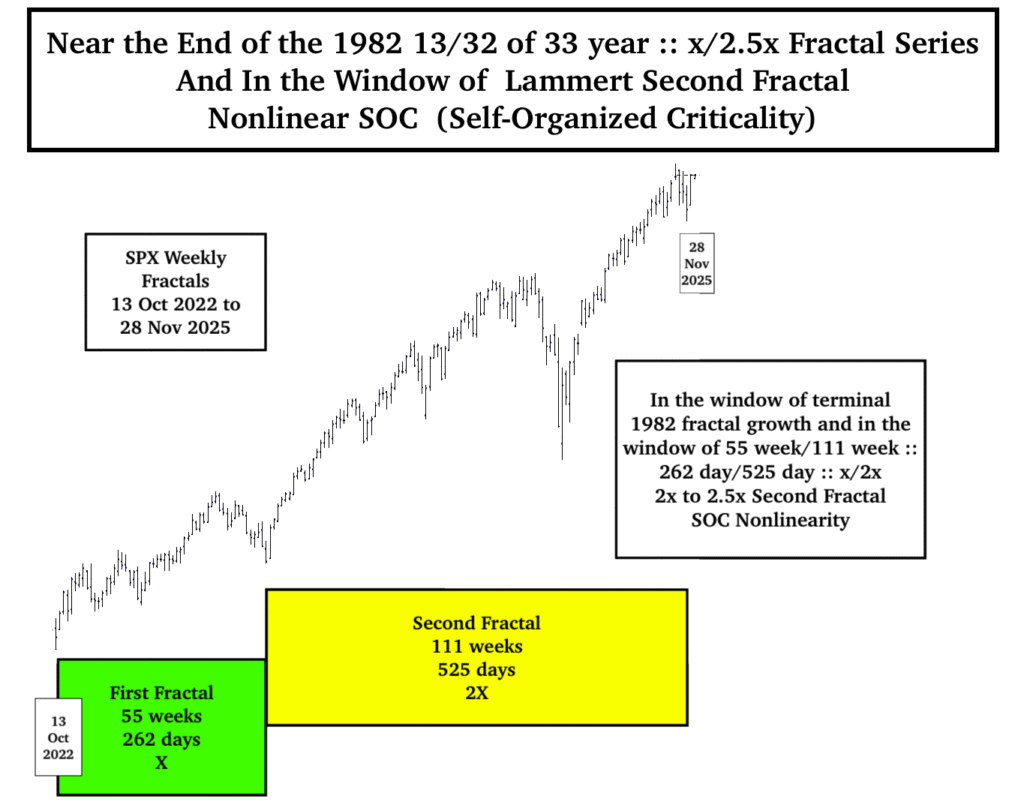

The 90 year 3rd and the 54-57 year 4th Fractals of this series starting in 1932, are composed of two fractal series: a 3-phase 10-11/20-21/20-21 year :: x/2x/2x series ending in 1982 and a 1982 13/currently 32 of 33/33/20 year series :: x/2.5x/2.5x/1.5-1.6x ending in 2076.

The 90 year 3rd fractal peaking Nov 2021 is interpolated in the 1982 13/33 :: x/2.5x first and second fractal series as shown below.

The 90 year 2.5x Nov 2021 valuation peak was later exceeded because of average annual US deficit to GDP governmental spending from 2020-2025 of 8.4%. This deficit to GDP spending compares to the long average from 1948 to 2020 of 2.6%. The 2020-2025 deficit spending generated an average GDP growth of 2.9% vice a long term 3.15% which includes a negative 7% in 2009 of the great recession. Covid 2020 and 2021 15% and 12% deficit to GDP spending , supply chain disruptions, build back better spending , and the recent tax breaks for billionaires have contributed to the peacetime massive deficit spending.

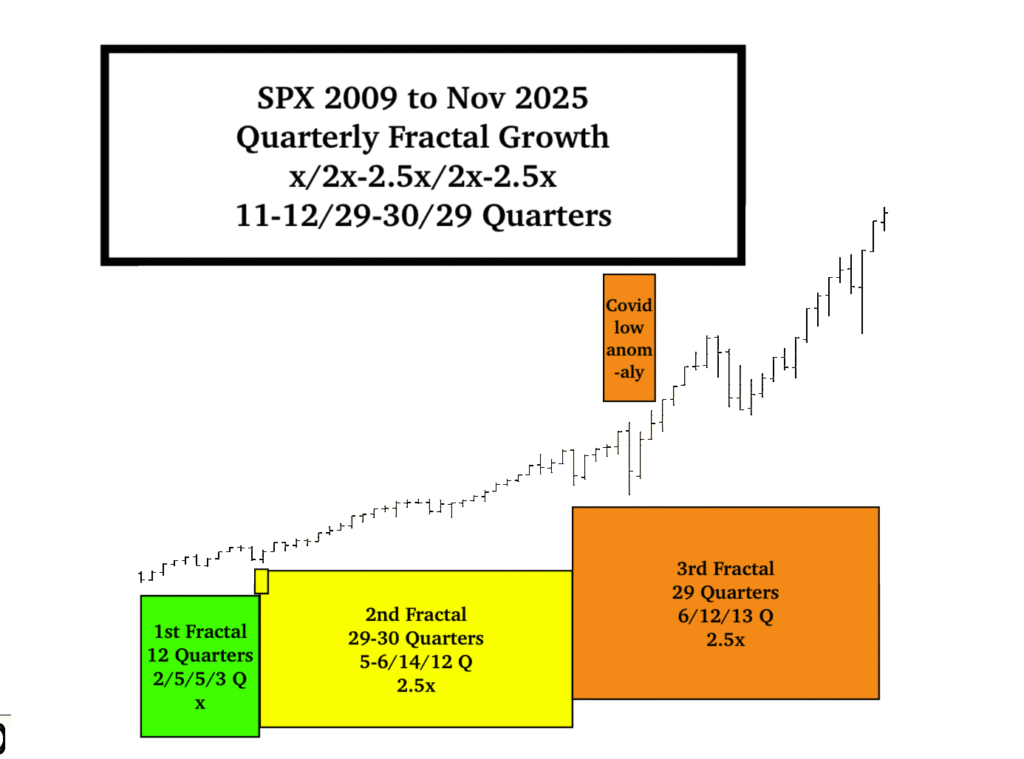

US Equity (and the global equity composite) valuations peaked on 28/29 Oct 2025 at over 220% of US GDP – an all time historical high. What causes the timing of peak equity valuation? Equities are the most taxed advantaged asset within the asset debt system and their valuations grow to the longest possible fractal growth. Accompanying this tax advantage, fractal length to peak is ultimately determined by ongoing credit expansion produced by a residual sufficient population of governmental, corporate, and consumers, willing and able to go into further debt – given the cost of ongoing ADL’s (activities of daily living including insurance premiums), job and wage expectations, payments on accumulated debt, perceived business opportunities, and concurrent asset valuation prices and expectations of asset future valuations. The October 2025 peak valuation ended the 11-12/29/29 Quarterly :: x/2.5x/2.5x maximum growth of the 3-phase fractal series starting March 2009. (This was preceded by a 10/25/25 Quarter :: x/2.5x/2.5x 3 phase series starting 1994. (see above graph)

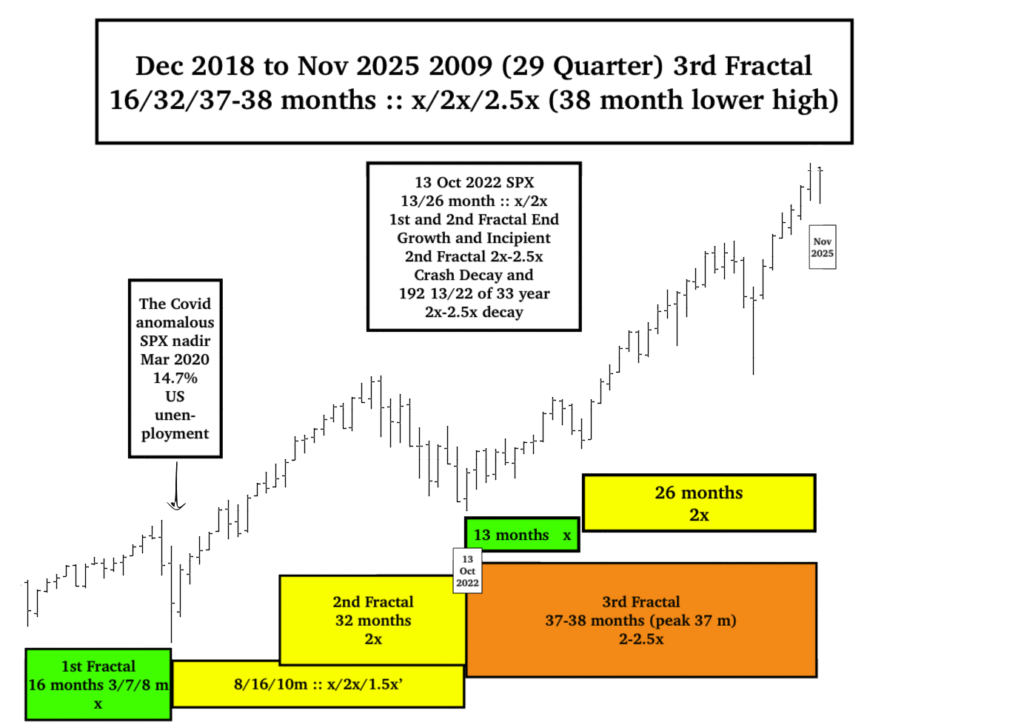

The 3rd 29 Quarter Fractal of the SPX ‘s current 2009 12/29/29 quarter :: x/2.5x/2.5x 3-phase fractal growth series -started with a nadir in December 2018 and is composed of a 6/12/13 quarter :: 16/32/38 month :: x/2x/2.5 fractal subseries (as of Nov 2025). The Global Covid shock anomaly with unemployment spiking from 3.9% in late 2019 to 14.7% in April 2020 produced an anomaly in fractal equity valuation with Q6 of the 1st Fractal 6Q subseries having a lower valuation nadir than Q1. A lower valuation fits with the associated credit contraction, offset in April 2020 with stimulus checks and later MBS credit expansion.

The final 13Q 3rd Fractal of the 2018 6/12/13 Q 3-phase series is composed of a 2/4/5/3 or 11 Q 4-phase series and 3 quarter fragment starting 7 April 2025.

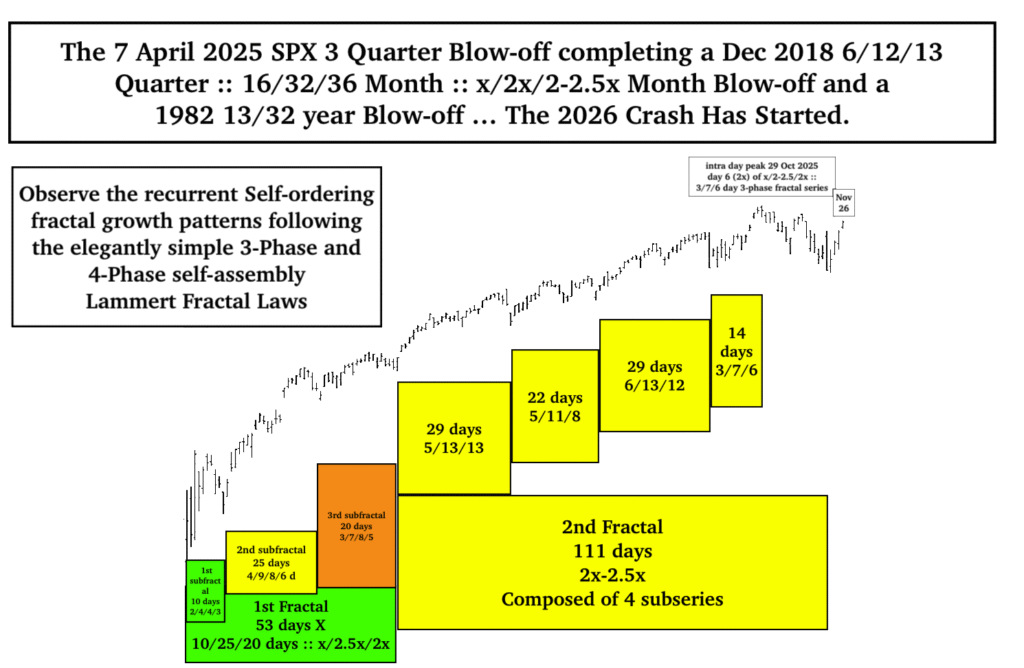

The 3 quarter fragment is either composed of a 53 /111 day :: x/2- 2.5x First and 2nd Fractal series …

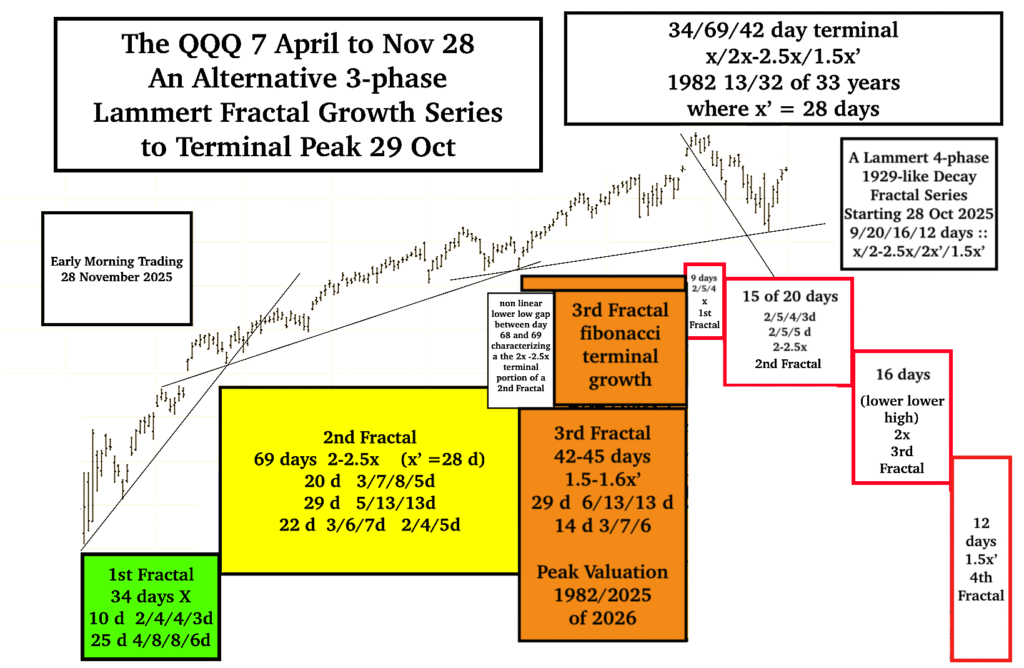

… or alternatively, this is an interpolated 2-phase fractal series within the actual terminal 3- phase fractal series of 34/69/42-44 days :: x/2-2.5x/1.5-1.6x’ as depicted below. A nonlinear lower low gap exist between day 68 and 69 of the 69 day second fractal, which was noted in the 2005 original web page, to be the terminal hallmark of a second fractal. The 1.5 to 1.6x represents a near Fibonacci terminal maximum growth ratio of the 28 day ideal base x’ (69 days divided by 2.5x)

Fractal subseries self-ordering growth of both the likely interpolated 53/111day :: x/2.5x first and second fractal series and the more probable and actual 3-phase terminal fractal growth series of 34/69/42 days :: x/2-2.5x/1.5-1.6x reside in the terminal portion of the 1982 13/32 of 33 of 33 year :: x/2-2.5x first and second fractal growth series and have exquisitely followed the above cited 3-phase and 4-phase fractal growth self-assembly laws.

1929 and 2025 Initial Crash Decay

1932 concluded an 1807 36/90 year :: x/2.5x first and second fractal series; 2026 will conclude a 1982 13/33 year :: x/2.5x first and second fractal series. In 1932 the peak to nadir devaluation of 90% occurred over 32 months with a definable pattern of fractal decay, fractal counter rally growth and further fractal decay.

In 1929 peak growth on 3 Sept 1929 which transpired during the 8 day 3rd fractal of a 5/11/8 day :: x/2-2.5x/1.6x 3 phase terminal fractal growth series. The 8 day 3rd fractal containing the 3 Sept 1929 peak growth the became the interpolated incipient 1st fractal of a 8/19/16/12 day :: x/2.5x/2x/1.5x day 4-phase decay fractal series taking the DJIA to its initial Nov 1929 low with a loss of 50% of its value.

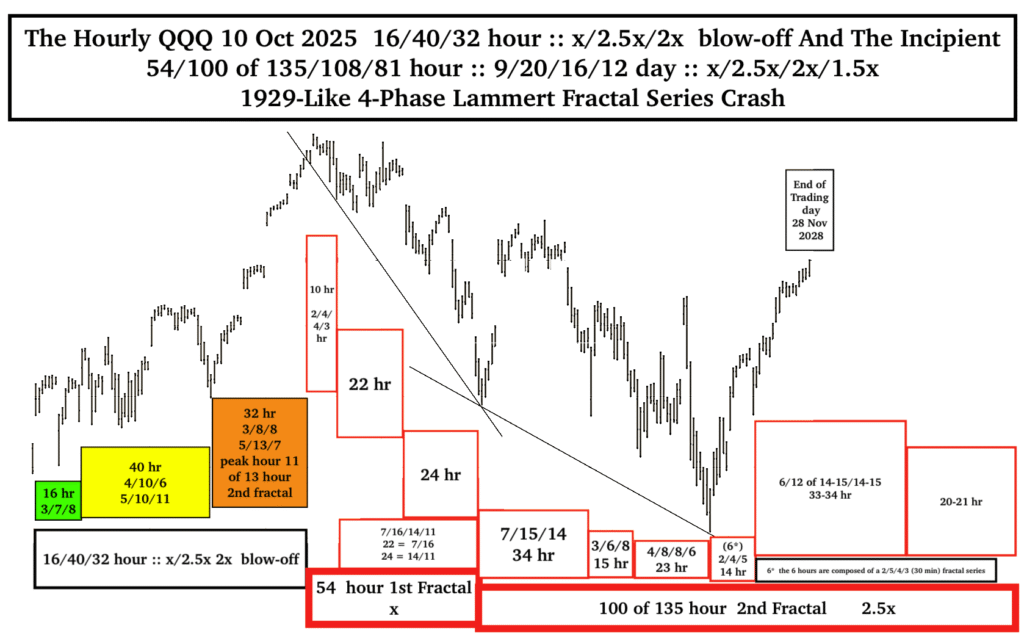

The 1982 13/32 of 33 year terminal Oct 2025 growth fractal series for the SPX is a 3-phase 10 Oct 3/7/6 day series :: x/2-2.5x/2x peaking 29 October, the terminal day of a 7 April 2025 34/69/42 day :: x/2-2.5x/1.5x’ 3-phase fibonacci-like growth fractal series with lesser peaks on days 43, 44,and 45 (1.6x’). The 29 Oct peak growth is then included in a 28 Oct 9 day :: 2/5/4 day :: 55 hour :: 10/22/24 hour :: x/2-2.5x/2-2.5x 3-phase decay fractal series ending 7 Nov 2025, which becomes the base First Decay Fractal .

A 28 Oct 2025 9/20/16/12 day :: 54/135/108/81 hour x/2-2.5x/2x’/1.5x’ 4 phase x/2x/2x’/1.5x’ fractal crash decay series where x’ = 8 days is nearly identical to the 4-phase 1929 8/19/17/12 day fractal decay series with 2 days of fractal overlap in 3rd fractal 6 day terminal peak valuation (3/7/6 days) on 29 Oct 2025 and initial 28 October 2025 9 day crash base first fractal of the 9/20/16/12 day Lammert 4-phase fractal crash decay series.

Added 29 Nov 2025:

2x to 2.5x Terminal Second Fractal Self-organized Criticality

Like major earthquakes, major forest fires, and major solar flares as compared to smaller and very contained quakes, fires, and flares – the smaller time scale empirically observed nonlinear lower low gap ‘crash’ devaluations in the terminal 2x to 2.5x time frame of Lammert Asset-Debt Macroeconomic Valuation Equity 2nd Fractals represent ‘small contained nonlinear crashes’ and also appear to follow a power-law distribution, a characteristic signature of systems in a state of fractal Self-Organized Criticality (SOC). The asset debt system is now in the window of an 1982 major SOC and a major crash.

The 1982-2026 13/32 of 33 year :: x/2-2.5x 1st and 2nd Fractal series is temporally far into the 2x-2.5x :: 26-33 year terminal portion of the 33 year 2nd Fractal with a 2009 maximal fractal growth series of x/2.5x/2.5x :: 12/29/29 Quarters with the 3rd 29 quarters represented by 16/32/38 months :: x/2x/2.5x peaking at the 37 month in Oct 2025 with a lower high in the 38th month Nov 2025. The terminal 38 months is composed of a 13/26 month first and second fractal series starting 13 Oct 2022.

As 28 Nov 2025 the 13/26 month :: x/2x first and second fractals are composed of 55/111 weeks :: x/2x and 262/525 days :: x/2x.

After 29 Oct 2025 global peak (SPX/ACWI) equity valuation fractal growth, the 1982 asset-debt macroeconomic system, following a power law distribution, is in the extreme terminal 1982 2x-2.5x – and the terminal 13 Oct 2022 2x-2.5x – Second Fractal window of nonlinearity and major crash SOC (Self-Organized Criticality.)