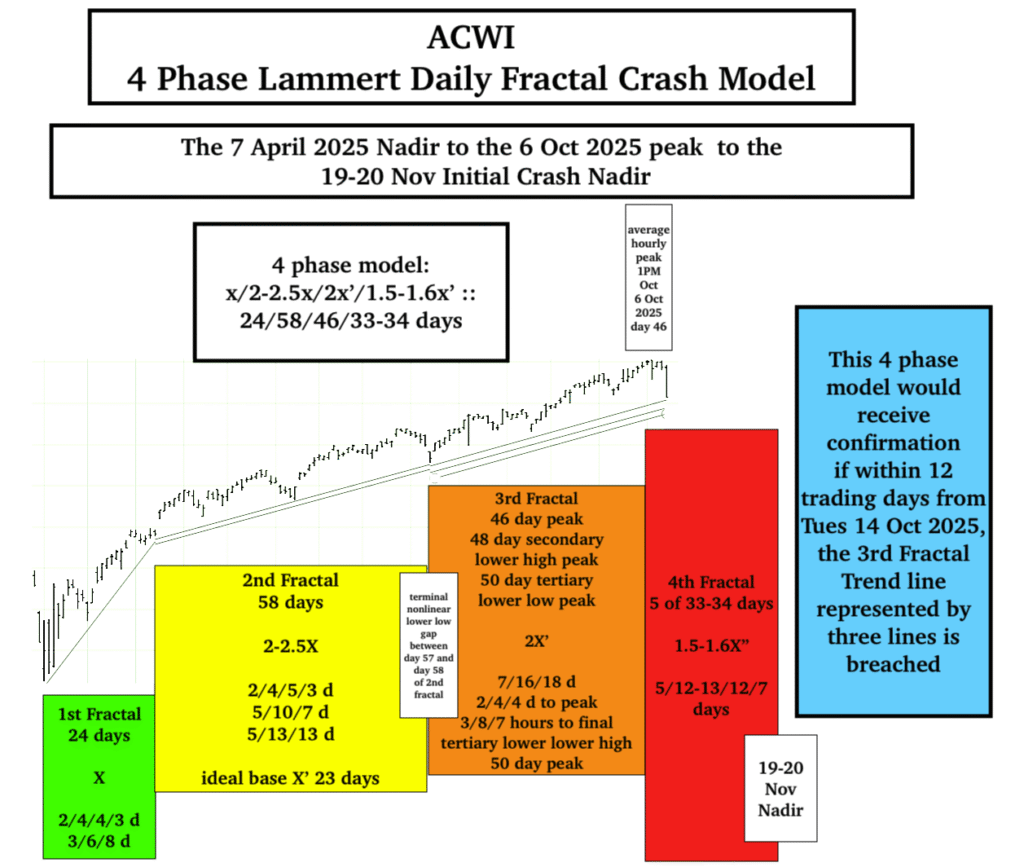

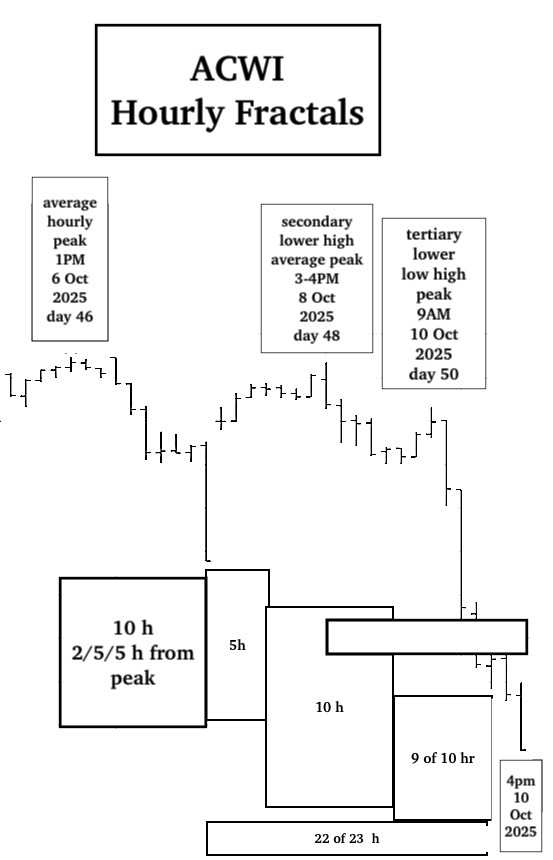

The 4-phase self-ordering time-unit based fractal model for composite equity asset valuation growth and decay was described in the last paragraph of the 2005 single Web page of The Economic Fractalist.

The original 4 phase model of time-unit based fractal cycles was expanded to a x/2x-2.5x/2x -2.5x/1.5-1.6x fractal series which describes the 1807 US 36/90/90/54-58 year large scale fractal cycle ending in the 2070’s. As well, a 3 phase fractal cycle of x/2x-2.5x/1.6x to 2x to 2.5x self assembles for interpolated sub cycle valuation growth and decay.

The operative interpolated fractal series is a 1982 13/32 of 33 year fractal series ending in 2026 which is part of a greater 13/33/33/18-20 years ending in the 2070’s.

All asset valuations including debt as an asset valuation are denominated in the totality of all asset classes. As debt is expanded linearly, growth occurs in a steady, similar linear fashion. As asset classes become overvalued and overproduced relative to owed accumulated debt and total laborers and their total wages needed to support that debt, a nonlinear unraveling of the total asset worth occurs at the asset-debt system’s peak asset valuation intermittent saturation points.

The current 4-phase fractal model appears identical to the originally- described 2005 model.