A new patterned science of the global macroeconomic system is observable for those who do observe.

An understanding of the quantum nature of the asset-debt global macroeconomic system will lead to needed thoughtful changes in the global system’s monetary, lending, and asset advantaged and asset disadvantaged tax rules. Rules will be established curtailing the financial industry’s ability to skim money- and more money than the collective of those involved in useful and real economic activity – by purely manipulation of the monetary system, first use of the system’s money, and selling short and long the valuation derivatives of real assets, evaluation valuations now understood to be part of a mechanical self assembly global one quadrillion asset debt system.

An understanding that central bank created money directly traded for goods and services is an important necessary tool to offset the malinvestments, debt, asset overvaluation, and job depletion now present in the asset-debt saturated environment directly created by the union of financial industry and majority elements of both political parties.

A historical 11 week Nonlinear cataclysmic asset valuation deflation lies immediately ahead with silver eventually at 5-10 US dollars an ounce.

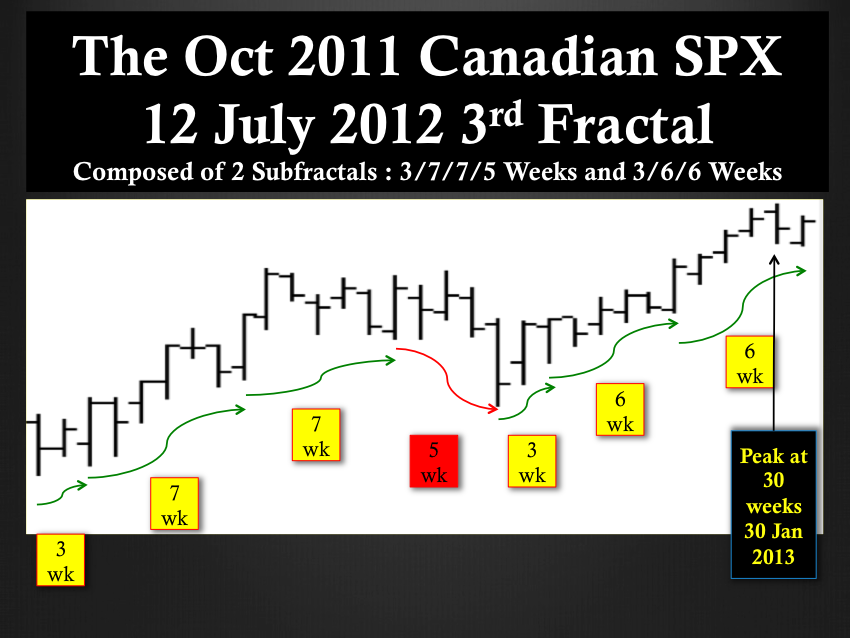

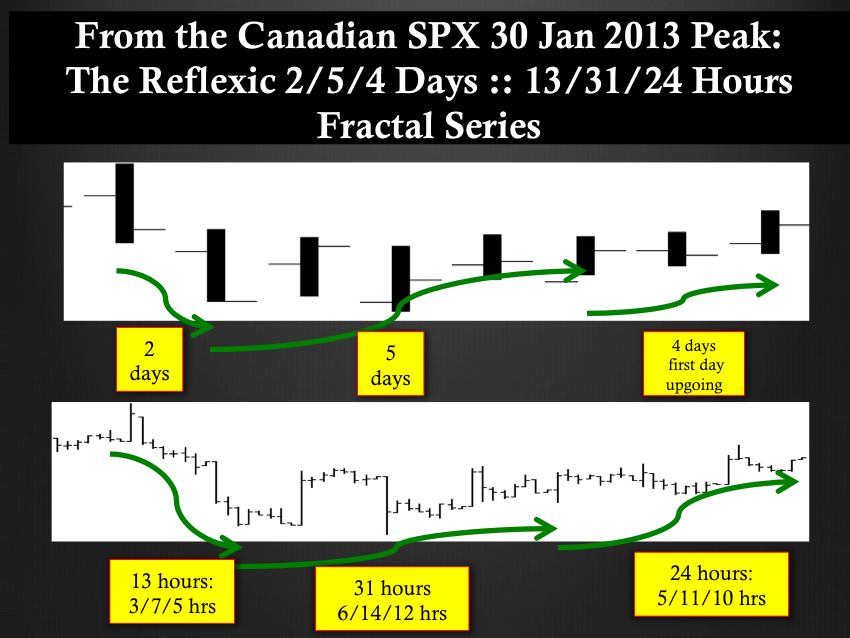

30 January 2012 was the peak valuation day for the Canadian SPX. From 4 October 2011 it self assembled in a 12/30/30 week pattern and from its 16 November 2012 second subfractal of its 12 July February 2012 third 30 week fractal, it self assembled in a 9/22/22 day pattern with an exact peak and reversal day on 30 January 2012 the 22nd day of the 22 third fractal of the 9/22/22 days series.

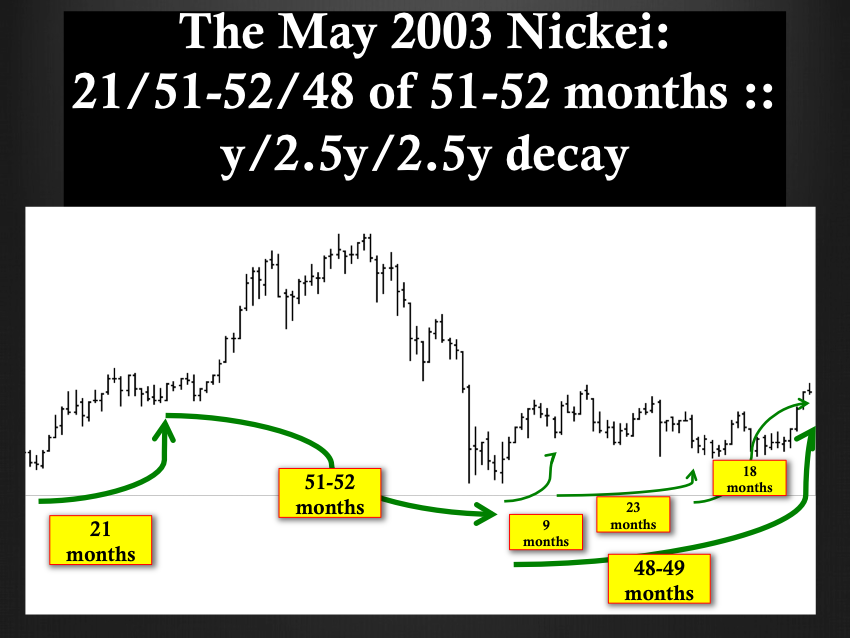

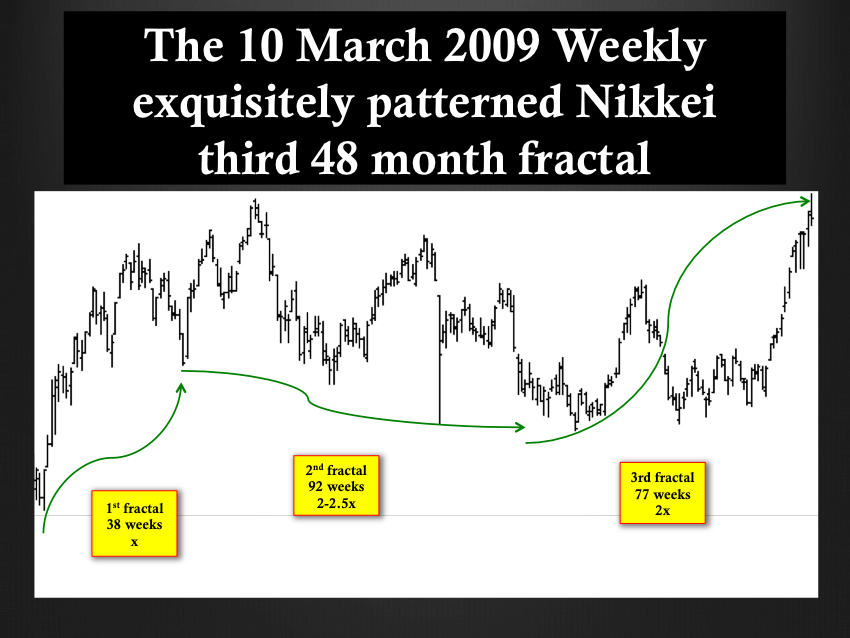

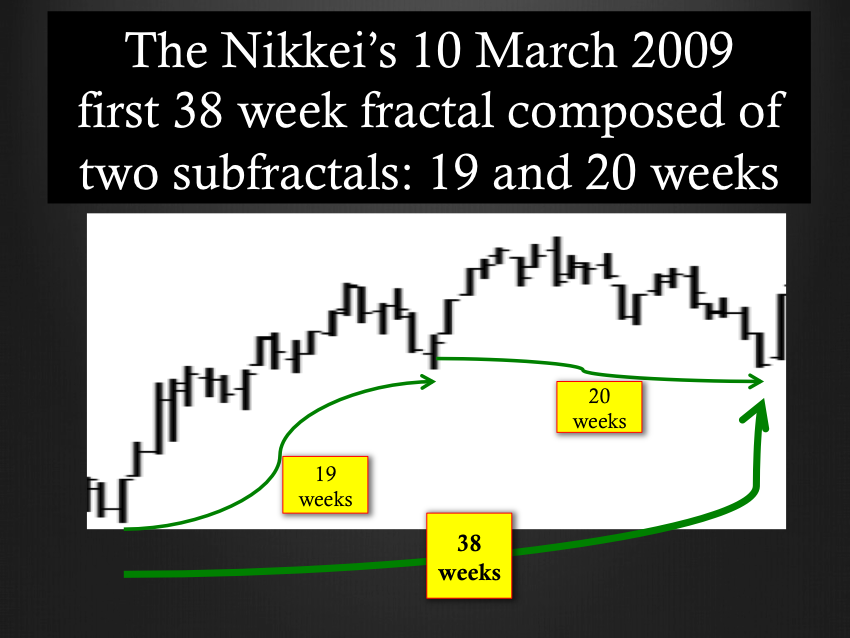

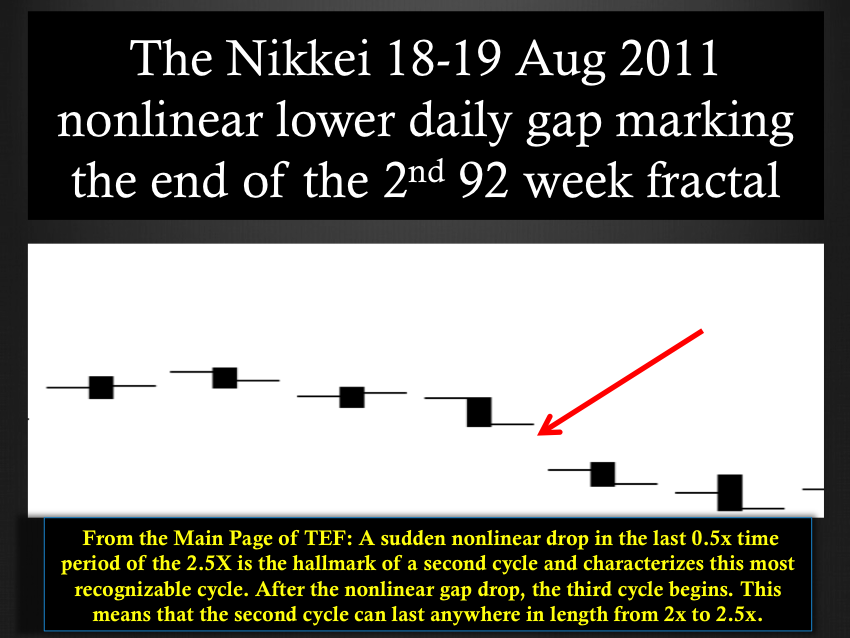

The Nikkei evolving from a 28 April 2003 low will complete a 21/51-52/51-52 month y/2.5y/2.5y decay series in late April 2013. Within this decay series, Nikkei’s third < 51-52 month fractal growth began on 10 March 2009. It has evolved in a 38/92/77 week :: x/2-2.5x/2x decaying growth series within the expected completion of a 38/90/90 week :: y/2-2.5y/2-2.5 week decay fractal series.

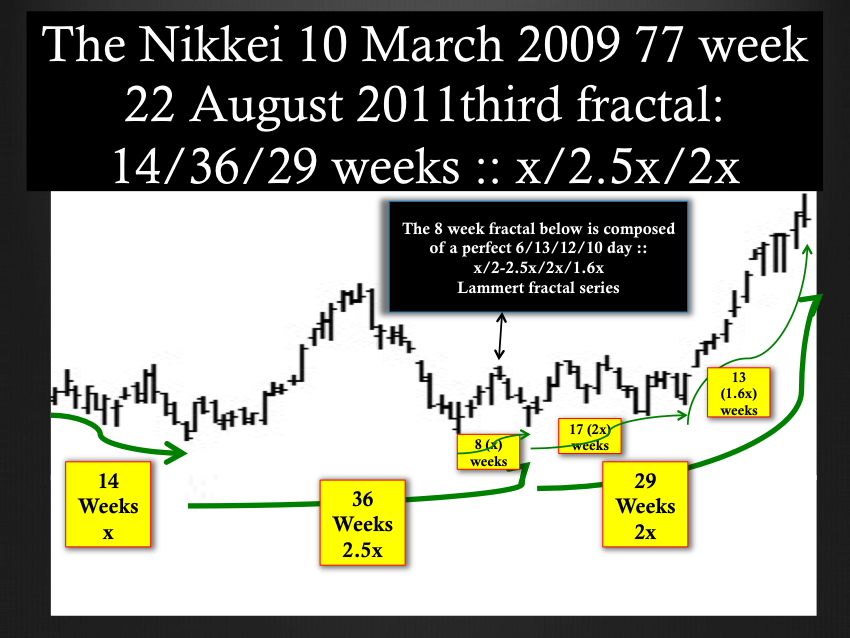

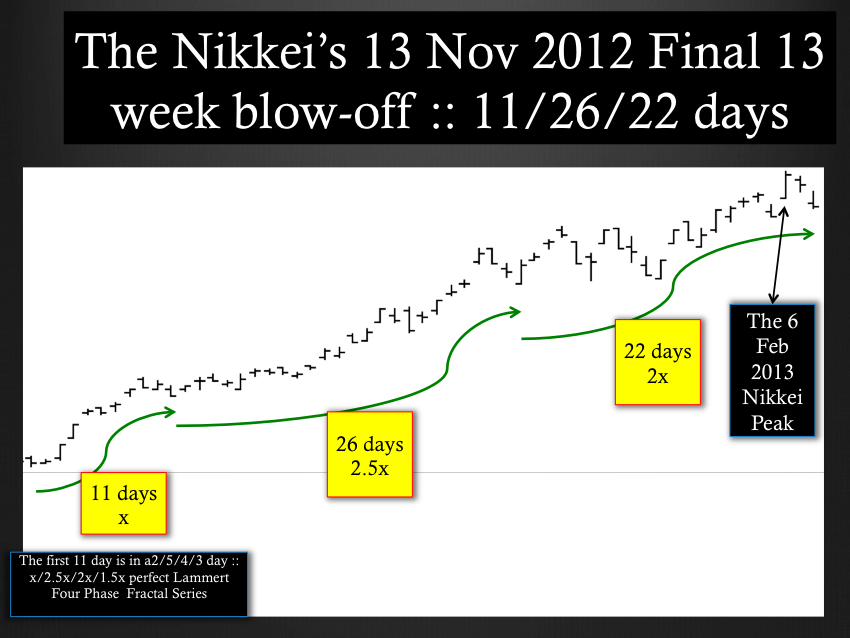

The Nikkei’s final third fractal 77 weeks of growth started on 22 August 2011 and evolved as a 14/36/29 week blow-off fractal. Using the 36 week second fractal as the determinant integrated reference unit, the ideal base would be slightly more than 14 weeks. An ideal third fractal would be 2x or 29 weeks. The second subfractal of the 29 week third fractal started on 13 November 2012 and evolved as a 11/26/22 day fractal series with a peak valuation on day 20 or 6 February 1013 of the 22 day third fractal.

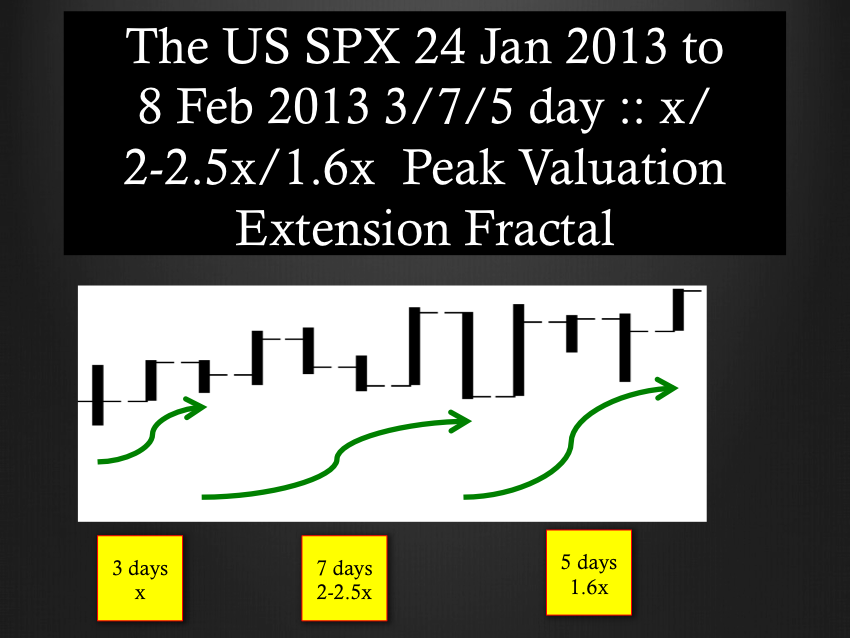

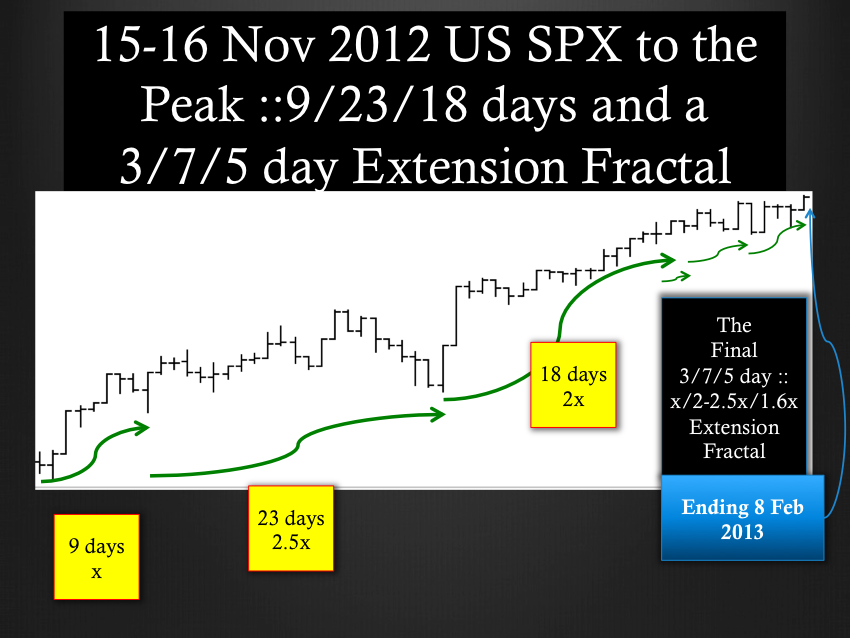

The US SPX has evolved from its 4 October low in a 12/30/31 week extended series with a 15-16 November 2012 9/23/18 day with a 3/7/5 day extension fractal ending on 8 February. Day 18 of the third fractal was the 2nd day of the 3 day base : 3/7/5 days. Like the Nikkei which ended in a 8/17/13 week Fibonacci 3rd fractal growth series :: x/2-2.5x/1.6x , the SPX also reached its peak valuation in a 3/7/5 day :: x/2-2.5x/1.6x Fibonacci third fractal to he base ratio.

Notice that the March 2009 third fractal series has ended at the same point for the Nikkei and Western Equities but in a different fractal fashion. For the Nikkei there was one 9/21/19 month x/2-2.5x/2x fractal series. Fot the US, Canadian, and European Equities there were two subfractal series :: a 5/13/10/7 month :: x/2.5x/2x/1.5x first fractal series and a 12/30/30-31 week second fractal series with a deterministic third fractal blow-off related to the tax advantaged speculative interest in the Equity market and the countervailing competing low yielding interest rates.

With collapsing equity and commodity prices US interest rates will be reduced to historical 150 year lows.

Are the asset debt macroeconomic system’s saturation curve exquisite self assembly quantum valuation patterns a type I error?