The 11 October 2007 SPX US peak valuation high was a 20/50/40 day :: x/2.5x/2x Lammert reflexic fractal series. It occurred at countervailing much higher competing interest rates and before the significant anomalous central bank self purchasing of bonds and yet absolutely asset-debt systemnecessary money creation.

The 2009-2013 Federal Reserve’s defacto Real Bill Doctrine placing a 3 trillion dollar infusion into the US economy has kept its unemployment rate at 8 percent as the created money has maintained a stream of funding to the military, military contractors, federal workers, the health care sector, the welfare sector, and has met tax-earmarked and funded obligations to retirees.

What would have been the demultiplier effect on the real citizen’s economy if the US central bank and other world private central banks had not created money ex nihilo to continue the stream of money. In 2008 a financial industry-politician created asymptotic line of malinvestment had been reached and in 2009 and in that and subsequent years there was not simply not enough money profits from the saturated asset-debt system to provide funding via borrowing from the nongovernmental sector.

What was the collateral for the Real Bills created money been traded for?

Ongoing Job Maintenance and Civil Stability.

Instead of having 70-90 million on food stamps and adding to the prison population and disability population, this created money was traded for mostly societally useful activity. The vast portion of Social Security checks were immediately spent on food, rent, real estate taxes, local services with the money immediately plowed back into the real local economy – as was money distributed to the other sectors.

This deficit funding has allowed some but insufficient time for the real citizen based economy time for system reequilibration, partial debt liquidation and default and for real estate price contraction relative to the bubbled overvalued and overproduced assets created by the bad rules authored by the owners of the debt-asset global system: the superrich elite and their financial industry and owned legislatures.

Created jobs in the saturated environment of asymptomatic massive private citizen debt, real estate overvaluation with citizen owned underwater mortgages, and overproduced real estate have been both inflation adjusted lower paying and fewer in number than the middle class jobs of earlier years.

For the financial industry and equity and commodity owners, this Global Real Bill Doctrine infusion has created a caricatured malinvestment valuation bubble in equities and commodities whose current valuations otherwise would not have not reached the current levels.

With high commodity prices fueled by ZIRP financial industry speculation and accompanied with high unemployment in a citizen based saturated asset-debt system environment, the Arab spring unfolded in 2011 collapsing 30 year old dictatorships.

The asset debt system based on the citizen’s money, debt, and asset needs has been taken to its limits and broken by the bad rules of the Financial Industry elite owners. The central bank which is part of the elite system, has the odd role of maintaining the system via the creation of Real Bill doctrine money. While this has sustained system, it has distorted any balance between the role of private US citizens bank savings which the former Fed Reserve Chairman so bemoaned and the low interest rate forced speculation in the equity and commodity markets.

There is another natural Asset-Debt system mathematical collapse of the equity and commodity markets in the ante room.

The top of the US equity market, which is currently at x/2.5x/2.5x :: 9/23/23 days, will likely have a few hours or a day or so of extension. European composites are already at 9/23/24 days.

The top of the S and P composite will be marked with a minutely exhaustion gap as it was on 11 October 2007.

The negative US GDP of the 4th quarter of 2012 is a marker of real dwindling US citizen based economic activity – even as supplemented by the past three trillion dollar Real Bill doctrine infusion and the new ongoing 50 billion dollars/month ‘purchases’ of US debt by the central bank representing a continuation of that real bill doctrine.

The coming equity collapse will receive a qualitative assist by the misdirection of austerity and fiscal responsibility measures created exactly by those most irresponsible and most imprudent and most unjailed ideologues who have hawked and have expanded the bubble- the Wall Street criminals and their political proxies in the majority HOR party,

The September 2011 silver chart is shown: 14/29/30 weeks :: x/2-2.5x/2-2.5x with the 30 week third fractal composed of 6/12/12 weeks :: x/2x/2x. Silver is a proxy for the CRB. Both are at asymptotic quantum growth levels with maximum speculator population participation saturation and reciprocal interested population depletion and alll dependent on the real money available among speculators and the interest in speculative borrowing via the ZIRP interest rate environment.

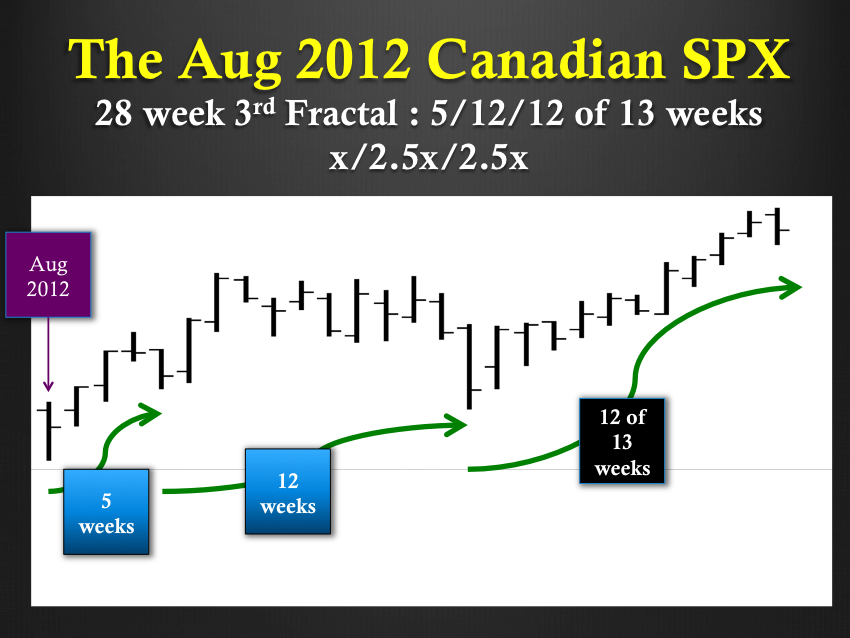

The SPX Sept 2011 chart is also shown: 14/32/28 of 29 weeks with the 29 weeks composed of a reflexic 5/13/13 of 13 week fractal.

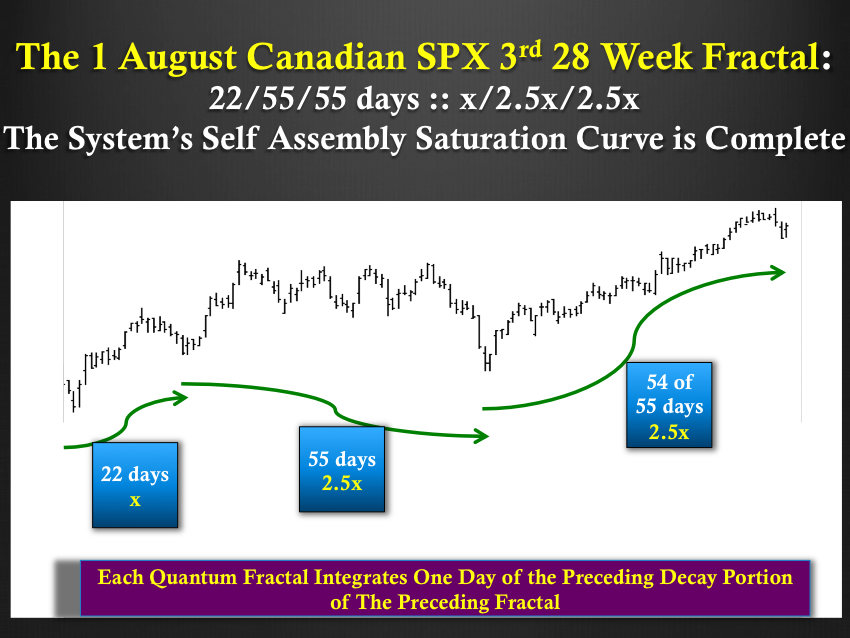

The Canadian SPX is shown with a Sept 2011 pattern of 14/32/29 weeks. The terminal portion of the 32 week second fractal is composed of 11/28/16 days x/2.5x/1.5x with a nonlinear break between day 23 and 24 of the 28 day second fractal, consistent with the characterization of second fractals. The final sequence is a 5/13/13 week reflexic fractal series with a 22/55/55 day :: x/2.5x/2.5x maximal pattern ending on 4 February 2013. For each subfractal one day from the preceding declining fractal is integrated into the next fractal. The daily series of 22/55/55 days starts on 1 August 2012 and ends on 4 February 2013.

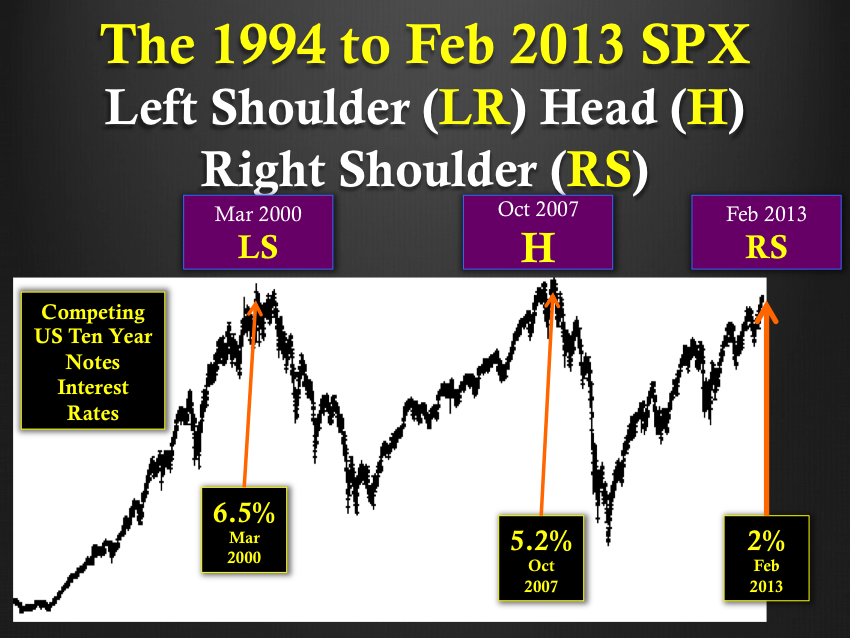

For the technicians: SPX valuation:

24 March 2000 1553 left shoulder

11 October 2007 1576 head

4 February 2013 1520-1545 (speculator-depleted ZIRP-augmented saturated) right shoulder

The global asset debt macroeconomic system is a self assembly self organizing entity with natural saturation curve boundaries and has the quantum time based asset valuation curve evolution properties of a highly patterned science.