The Self Assembly Debt- Asset Macroeconomic System : At the 155 Year Lower High Wilshire Zenith: Decay Begins in Terminal Growth: the Competing and Complimenting 25 July 2012 7/17/14/11 Day Deteriorating Final Four Phase Lammert Growth and Decay Fractal Series and the Complimenting 17 August 2012 6/15/15 day Crash Three Phase Fractal Decay Series

One of the goals of this web site has been to predict the exact daily fractal sequence of the asset debt system’s first nonlinear transitional crash phase of the US Equity 1858 155 year Second Great Fractal.

Proving that the asset debt system is a patterned science may aid those – in a position to legislate necessary really effective counter balancing and regulatory laws – to understand how much damage is done to the real economy by the facilitation of bad debt creation. With a wherewithal of the simple quantum mathematical nature and deterministic mechanics of the asset debt macroeconomy It can be understood with certainty that the Financial Industry’s debt creation schemes in the 1920’s and the corporate raiders, paid for accomplice tax laws, junk bonds, and financial intrinsically fraudulent innovations of the the Financial Industry from 1980 to 2012 have directly caused the leveraged bad debt that currently exists at this macroeconomic debt-asset dysequilibrium saturation area.

Raw Accumulative Greed does not care about communities or people or real economic value or global economic and therefore global political stability. Greed only cares about raw gains most easily accomplished by facilitating schemes to create bad debt and the creation of monetary system manipulated wealth – insider wealth undeserved and gamed – but nevertheless equivalent to that – created by real work and service of regular citizens.

From a nationalistic point of view, NAFTA and similar policies promoted by non proAmerican corporate and political elements have eviscerated the American middle class, which has been the cornerstone of the republic.

On a yearly, monthly, daily, 15 minute time fractal basis (e.g. the 10 June 2012 posting regarding the second to third fractal transitional period ), and minutely basis(the 21 August 2012 SPX’s secondary high to its 11 October 2007 nominal high), Lammert Quantitative Fractal Saturation Asset Debt Macroeconomics has proved the asset debt macroeconomic system to be a patterned science.

This is the Asset-Debt economic system’s simple self assembly fractal math:

The Lammert Ideal Four Phase Growth and Decay Fractal sequence: x/2-2.5x/2x/1.5-1.6x

The Lammert Ideal Fractal Decay Sequence : y/2-2.5y/2-2.5y

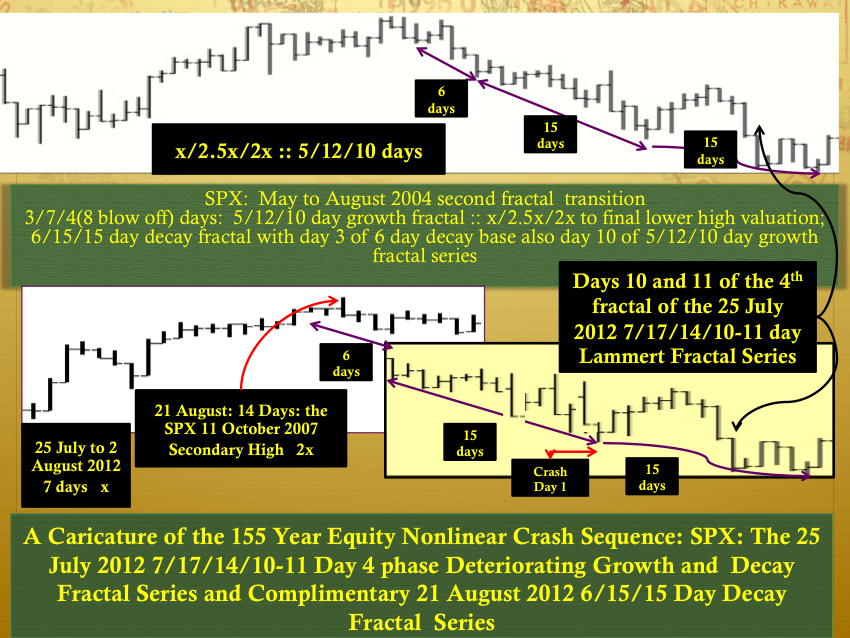

While 24 July was the absolute low for the Wilshire, the integrative average low was on 25 July 2012. A 7 day base fractal occurred from 25 July to 2 August. This can be observed for the CAC.

The final lower high for the Wilshire (and the system’s secondary high to 11 October 2007 for the SPX) occurred on 21 August 2012 or 2x the 14th day of the 7/14 day sequence.

As was the evolution for the SPX on 11 October 2007 5 years earlier, the SPX’s secondary high on 21 August had a minutely gap near the opening of the trading day to its new secondary high and ended on the low of the day.

The expected 25 July 2012 deteriorating four phase Lammert growth and decay fractal is 7/17/14/10-11 days.

The asset-debt macroeconomy is an integrative mathematical system. Just as growth begins in terminal decay, initial valuation decay begins near the terminal valuation saturation growth area.

17 August 2012 occurred in the terminal portion of the 17 day second fractal of 25 July’s 7/17 day :: x/2.5x sequence.

A 6 day base is formed from 17 August to 24 August with an expected 6/15/15 day decay sequence. The system nonlinear crash will ideally occur within the last 15 day 3rd fractal sequence of the 6/15/15 day Lammert decay fractal series and on days 10 and 11 of the 4th fractal of the deteriorating 7/17/14/10-11 day sequence.