Undeserved euphoria is present as it was in early October 2007.

For Japan’s Nikkei, September 2012 is the 114th month of a declining 1987 57/129/114 month ::x/2-2.5x/2x deteriorating growth fractal which has seen a greater than 95 percent inflation adjusted valuation collapse of the excessively GDP to debt ratio debt-burdened Nikkei.

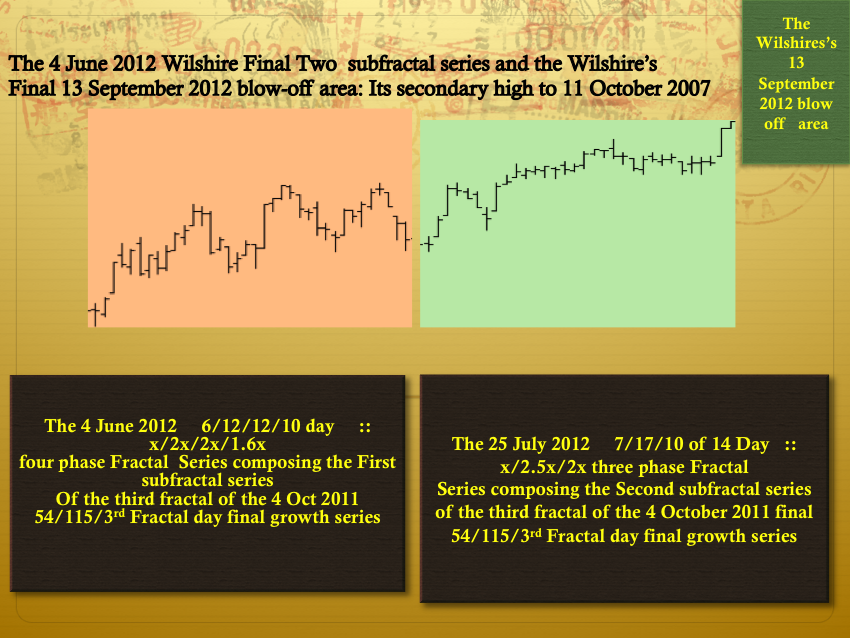

The Wilshire is at secondary high valuation levels to its nominal 11 October 2007 high which was the 40th day of the third fractal a 20/50/40 reflexic Lammert self assembly growth fractal series.

The 2012 Wilshire’s current secondary high levels (to 2007) are still 945 billion below its 2007 valuation level and its valuation level is now competing against a US ten year note that is offering 300 basis points less than the October 2007 level.

This is an incredibly weak equity market associated and dependent on countervailing historically aberrantly low US sovereign interest rates.

What now?

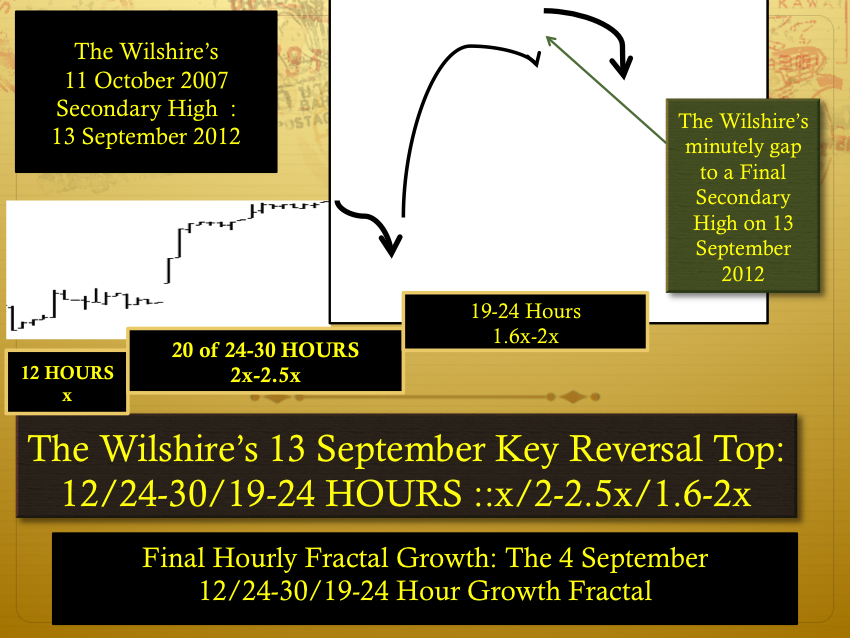

What now is the final self assembly 2012 blow-off of the Wilshire following an elegant x/2.5x/2x quantum Lammert growth fractal series :: 7/17/14 days – starting on 25 July and peaking on the 14th day of the third 14 day fractal of a 7/17/14 day fractal growth series on 13 September 2012.

13 September 2012 was the final equity peak valuation day picked earlier on the basis of the US long term debt fractal patterns.

The world is saturated with bad debt which will not be repaid.

The world is saturated with asset oversupply created by The Financial Industry’s 30 years of serial leveraged debt schemes.

The world is saturated with greatly overvalued assets relative to decreasing demand, decreasing real economy jobs to repay outstanding debt, and a historically massive bad debt burden – that is currently counted as an asset against overvalued collateral.

The bad debt burden soon will undergo nonlinear default as teleologically the quantum fractal progression of the system’s asset valuation saturation curves of the patterned new science of Lammert asset debt saturation economics predicts.

For the Wilshire on 13 September 2012 …

expect minutely valuation gaps to a final secondary high valuation – secondary to the Wilshire’s 11 October 2007 nominal high valuation – with a closing near the low of the day.