Will both US political parties realize that necessary QE program implementation to maintain essential services and US employment will only serve to stem the severity of the coming system collapse as rapidly as they supported the financial industry in 2008?

Will they make an American emergency coalition for a national treasury real bills doctrine and program where US currency is traded for peaceful US citizen valued labor. Will other countries follow suit and use their currency for similar peaceful purposes in this generational debt-asset macroeconomic collapse.

Time will soon tell.

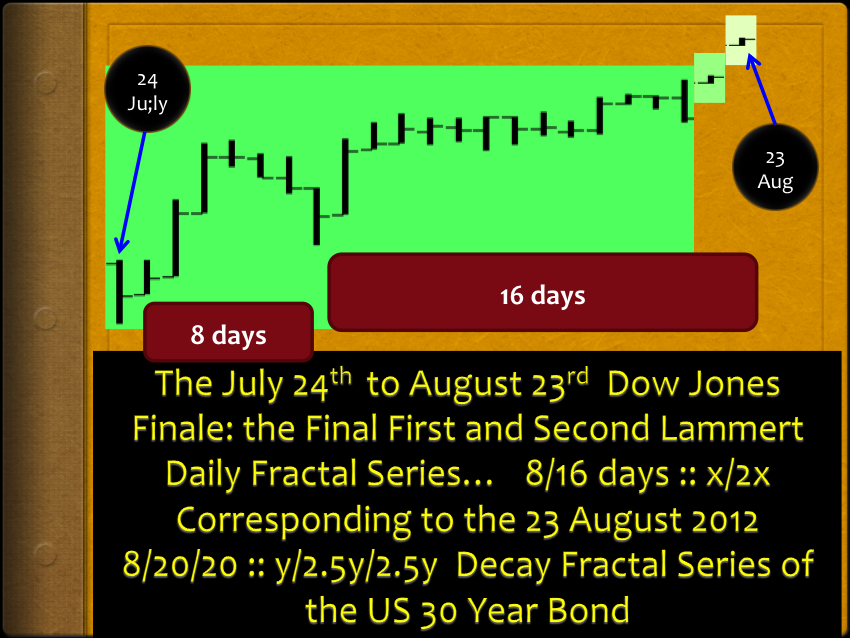

And why is it that the equity composites will not make a final high in its third final growth fractal of a 24 July 2012 series of 8/17-20/11-16 days?

It is because at the very end of the 1982 9/23 year equity first and second fractal series and at the precipice of global debt default as evidence by the US bond’s 8/20/20 day :: y/2.5y/2.5y decay fractal ending on 23 August 2012, the US hegemonic 30 year bond will then assume a (nonlinear) role of the global asset-debt system’s preferred asset for money equivalent placement.