Asset-Countervailing-Debt Saturation Macroeconomics: Before the Global System’s June-July-August Third Fractal Blow-Off: The Nikkei’s 97 Day 4 June Second Fractal Nonlinear Low

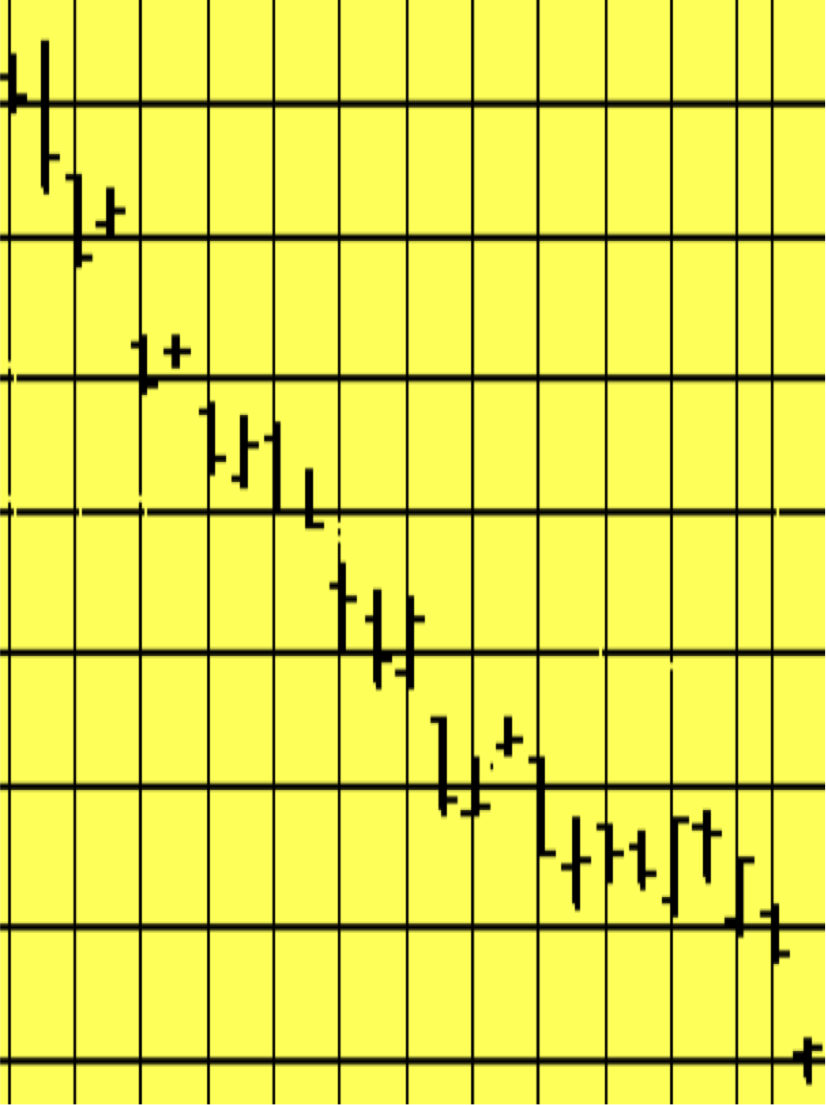

The Nikkei 26 April to 4 June 2012 Gompertz Lammert Decay Fractal of 5/11/11 days :: y/2-2.5y/2-2.5y … clearly shows, on a daily basis, the second fractal characteristic lower low nonlinear daily gap (see the main page of TEF) – ending the 97 day second fractal with a 17 November 2011 7/17/17 day or 39 day base.

Japanese debt and countervailing assets are part of the global self assembly debt -asset valuation system. The Nikkei’s valuation is restricted by its relatively proportionally greater parochial debt.

The 4 June 2012 Nikkei second fractal low came within a 1/8 of a percent of its 25 November 2011 first fractal low.

What is remarkable about this new patterned mathematical science of countervailing debt-asset self assembly saturation macroeconomics is that the one quadrillion equivalent system in its entirety can be understood with surprising clarity.