The effective closure of the Strait of Hormuz affecting 20% of global oil and 20% of global LNG occurred 4 trading days after the 25 February 2026 peak valuation of ACWI, the global equity composite ETF.

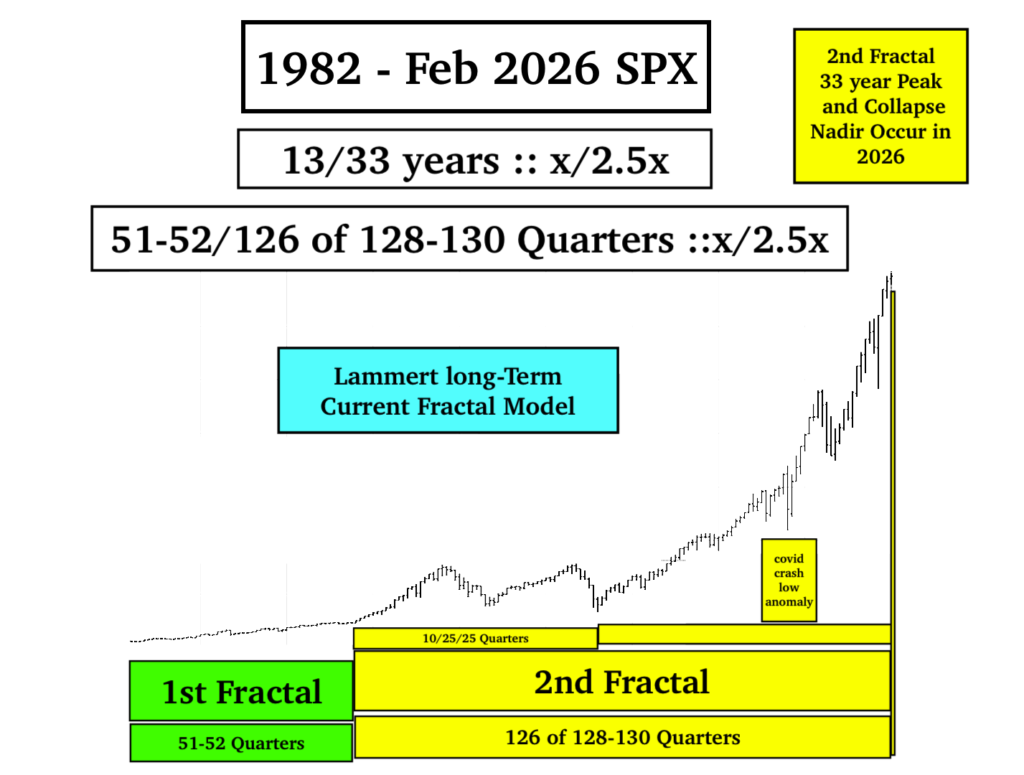

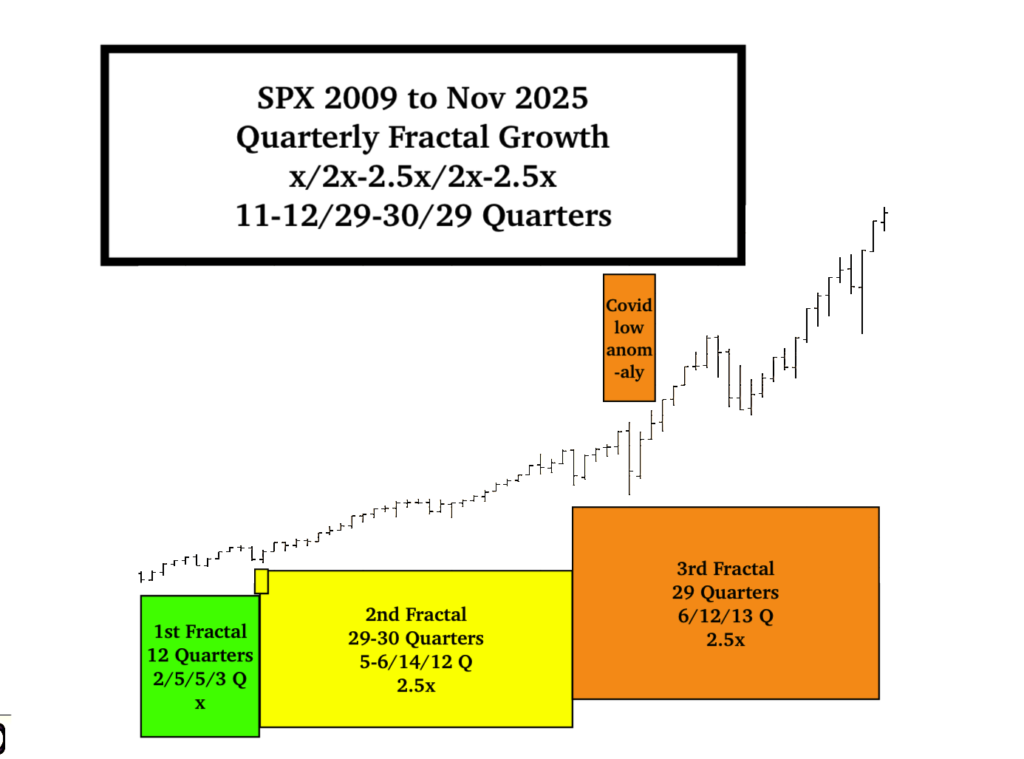

It is the opinion of this website that asset valuations grow and decay in a time based fractal manner which occur in a deterministic fashion based on 1. for smaller times scales, (minutes, hours, days, weeks, months) saturation buying and selling and on 2. large time scales (quarters, years and decades) the limitations of private debt accumulation, private debt servicing, asset quantities and (overvaluation) prices, and business cycles involving the consumers at pyramid base of the asset debt macroeconomic system. The integrated/summation valuations of all asset classes (including debt) are both interdependent and provide the collective denominator for a particular asset class numerator.

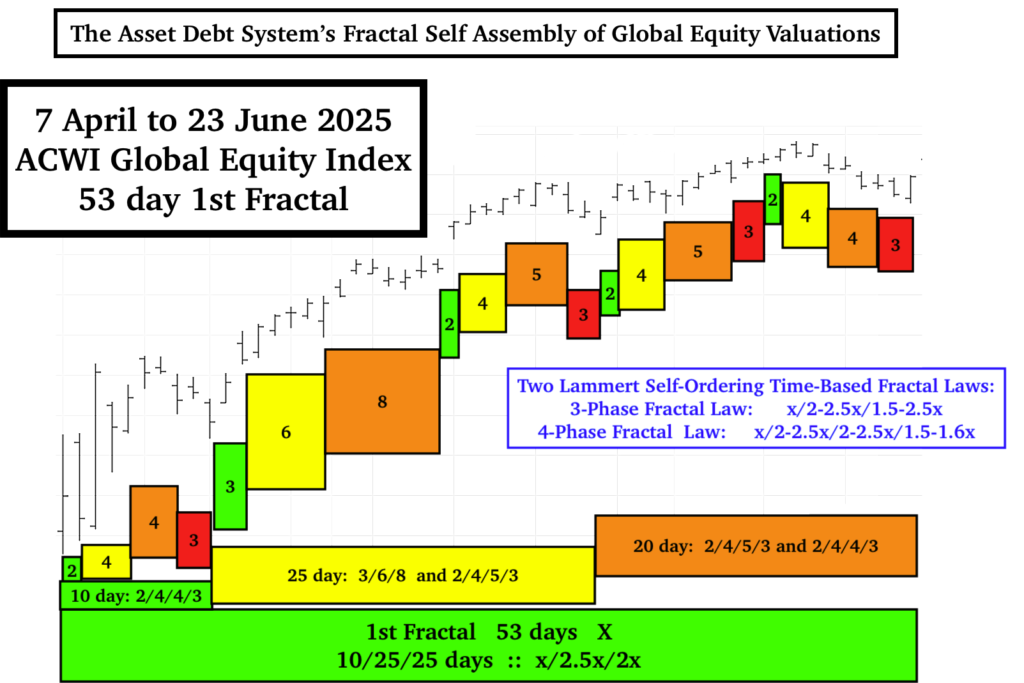

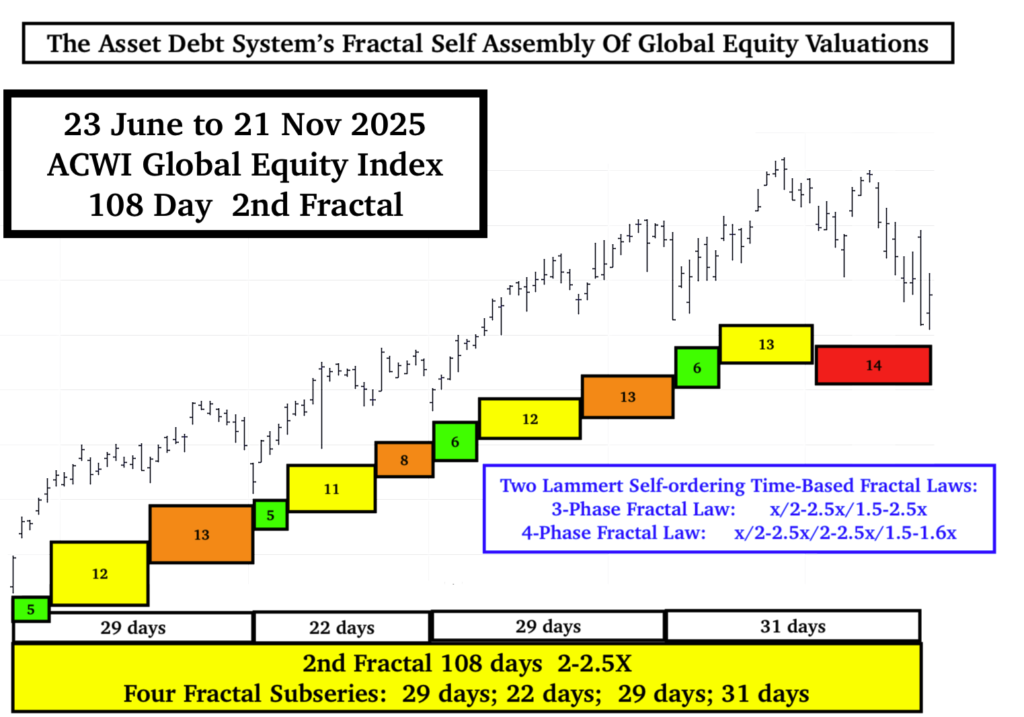

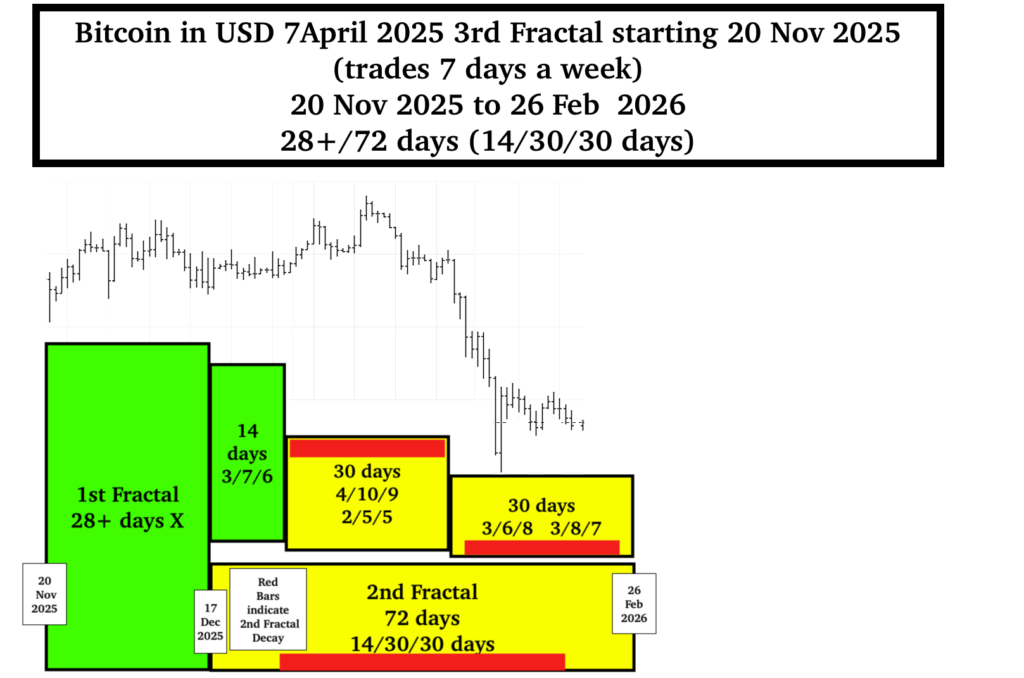

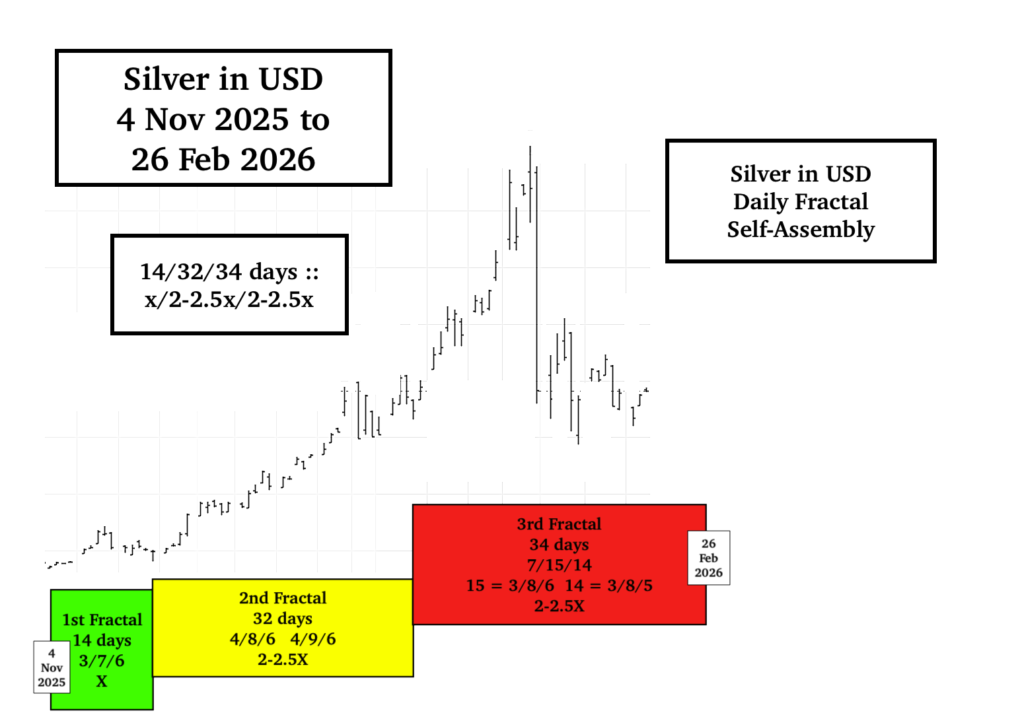

The 3 and 4 phase Lammert fractal growth and decay laws for the asset/debt system are elegantly simple: 1. x/2-2.5x/1.5-2.5x and 2. x/2-2.5x/2-2.5x/1.5-1.6x.

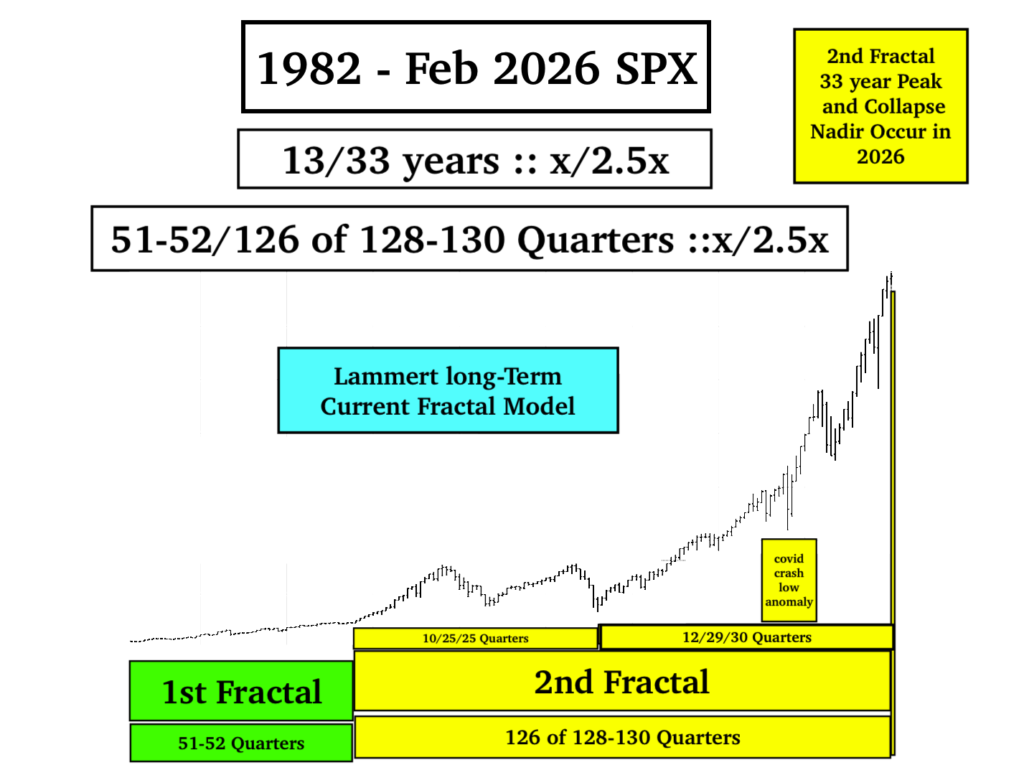

The 2-2.5x 2nd fractals of the above two series are characterized by nonlinear lower lows in the 2x-2.5x terminal growth time periods. (see 2005 main page of the Economic Fractalist. A historical nonlinear 2nd fractal crash of the above 1982 13/33 year :: x/2.5x 1st and 2nd fractal series is expected to occur in a fractal manner over the next 8-10 months

Fractal decay begins at peak saturation growth.

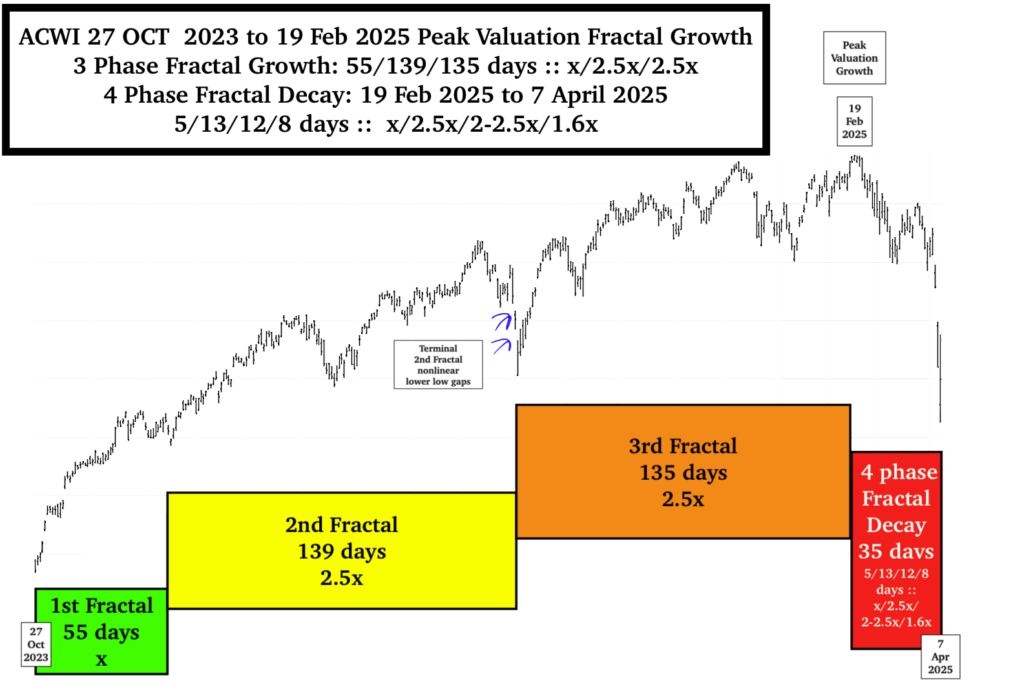

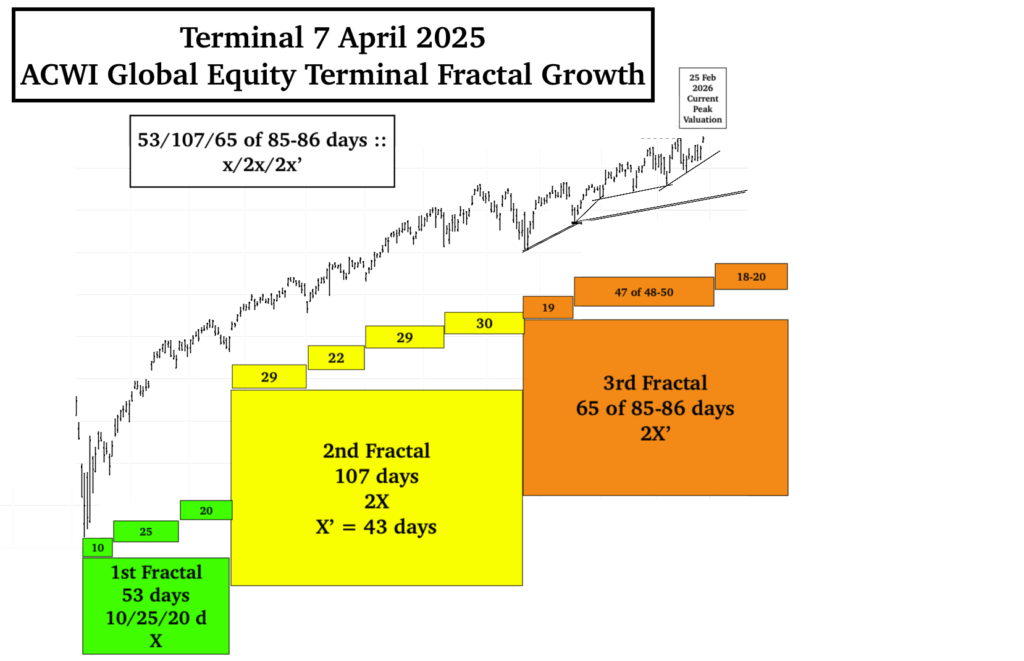

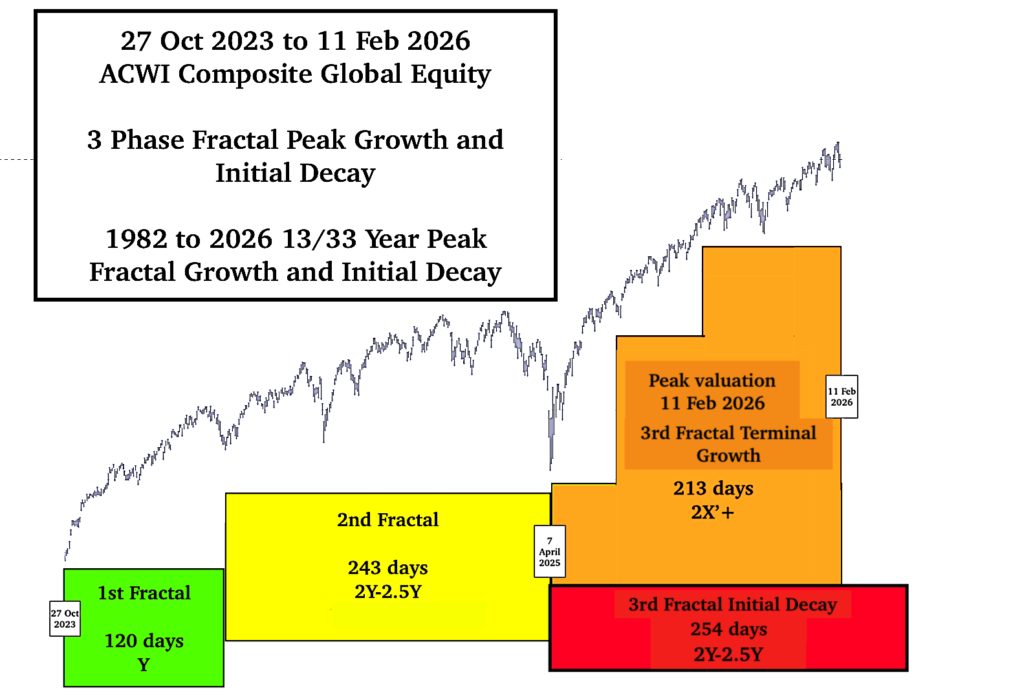

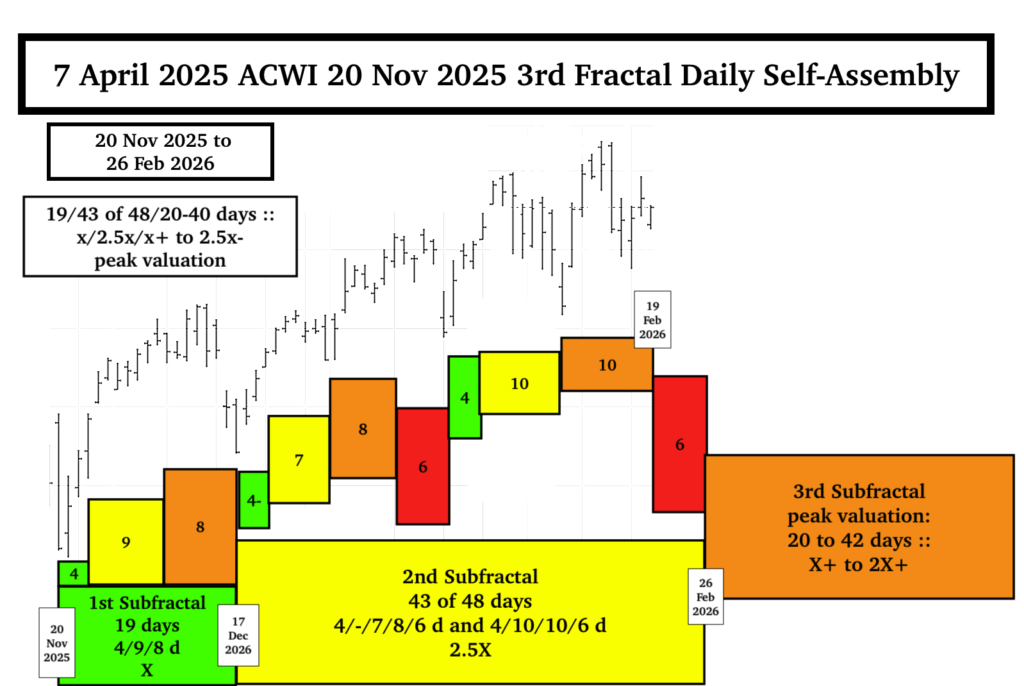

The 27 Oct 2023 to 7 April 2025 fractal valuation growth and decay occurred in a x/2.5x/2.5x 3 phase growth fashion of 55/139/135 days to the 19 Feb 2025 peak valuation and decayed thereafter from that peak in a 5/13/12/8 day :: x/2.5x/2.5x/1.6x 4-phase fractal pattern to a 7 April 2025 nadir.

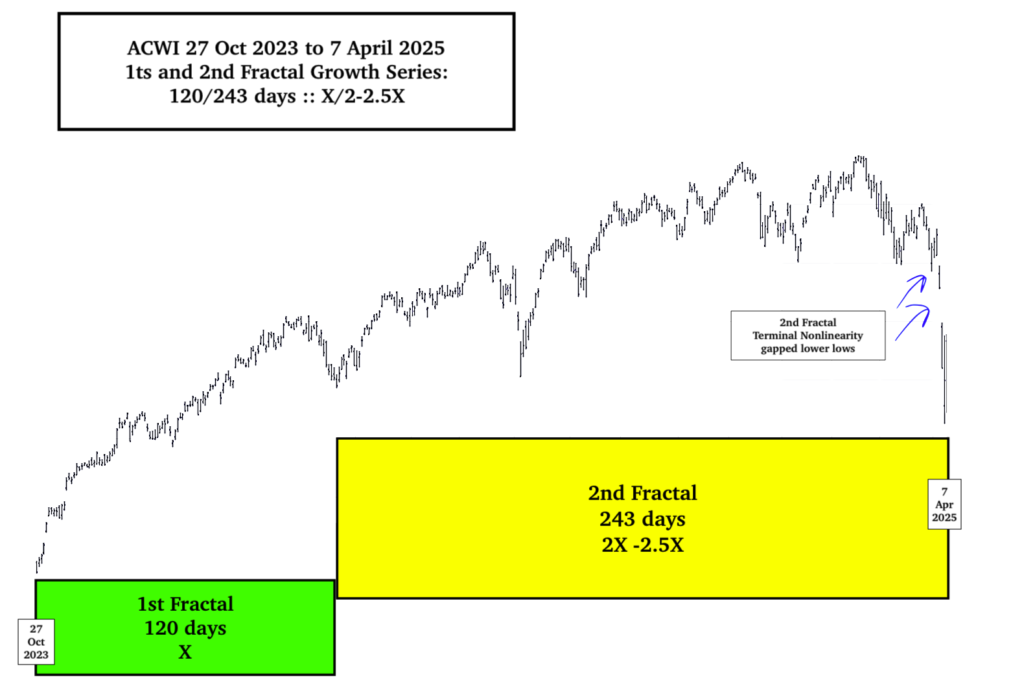

The above fractal growth and fractal decay is an interpolated fractal series of a larger 27 October 2023 120/243 day :: x/2x 1st and 2nd fractal series with characteristic gapped 2nd fractal lower low non linearity in the terminal 2x-2.5x area (days 240 to 243) with observable non linearity between days 240 and 241 and days 241 and 242).

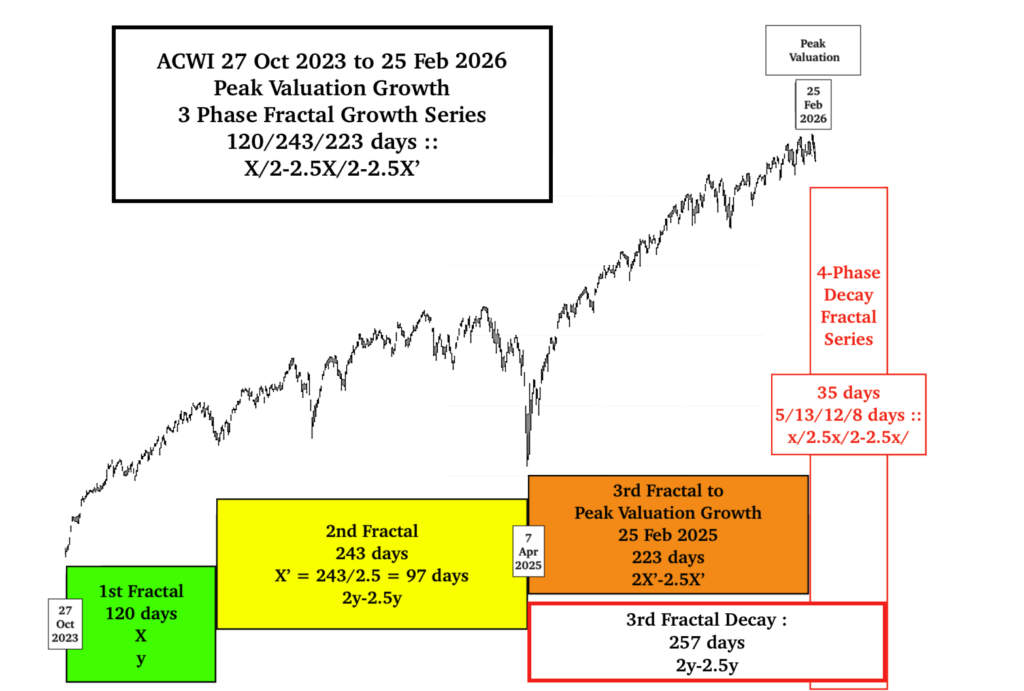

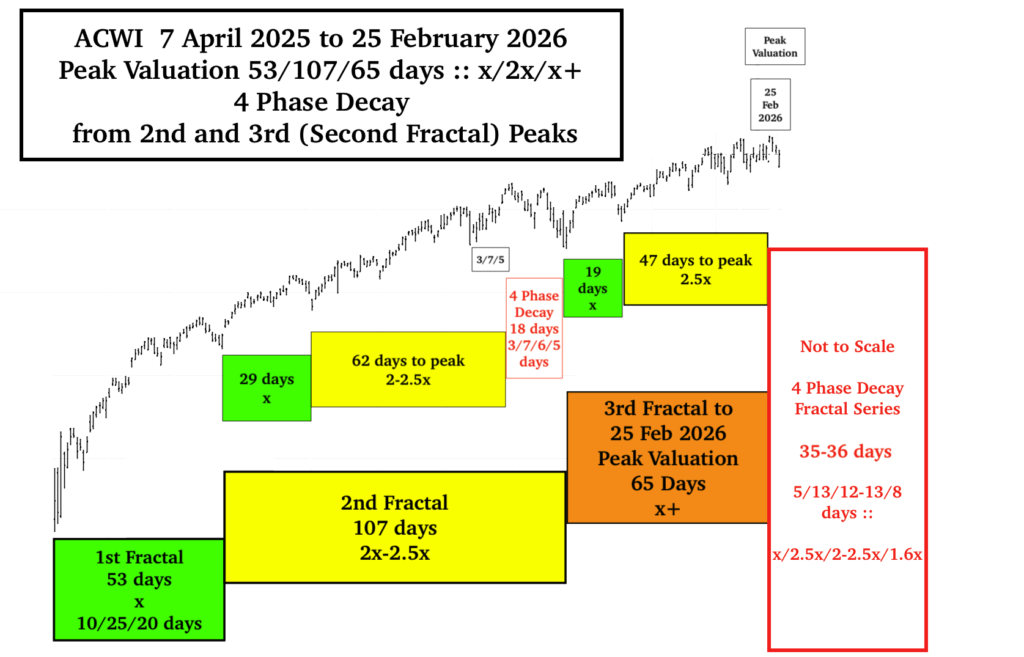

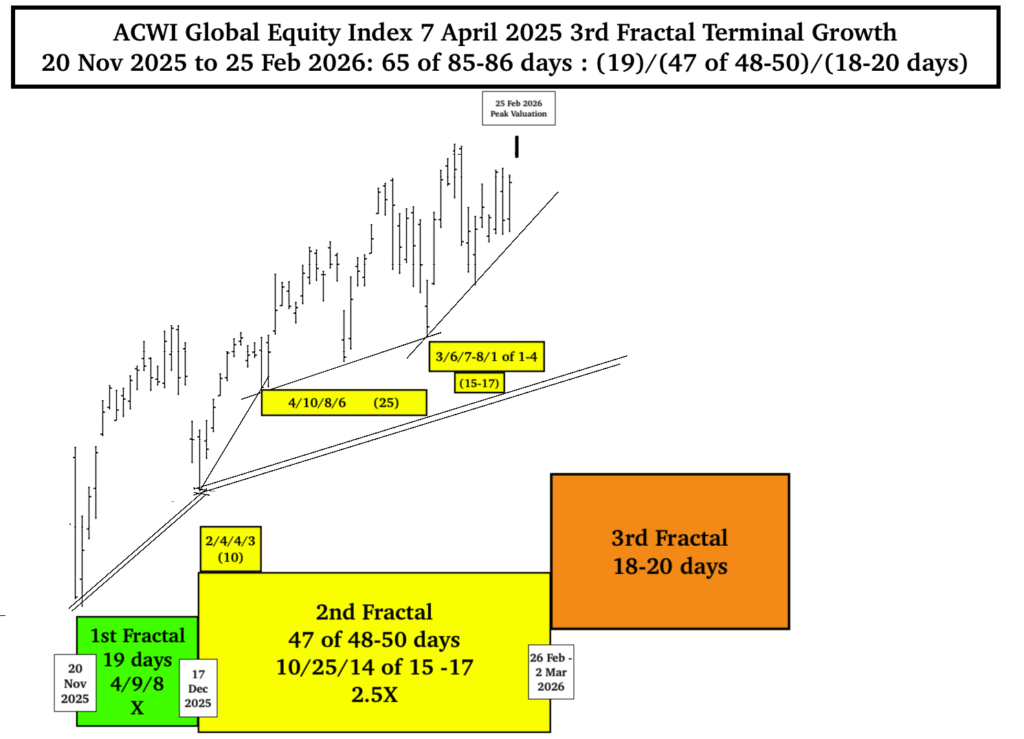

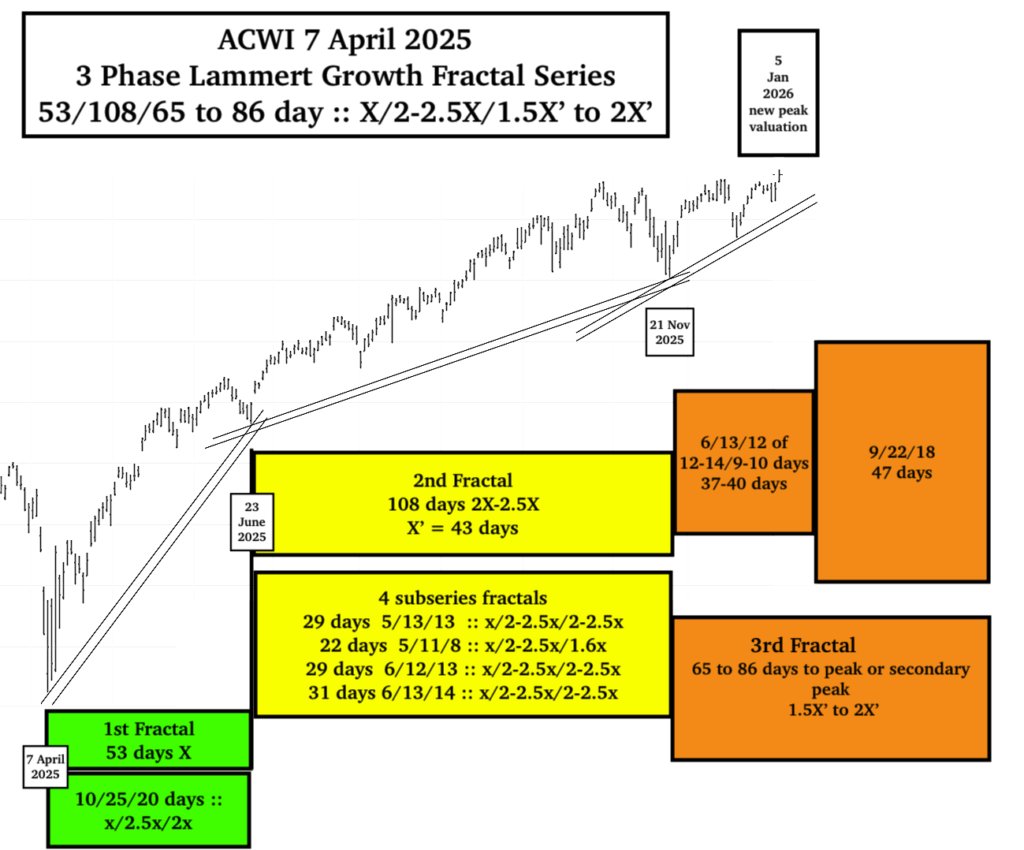

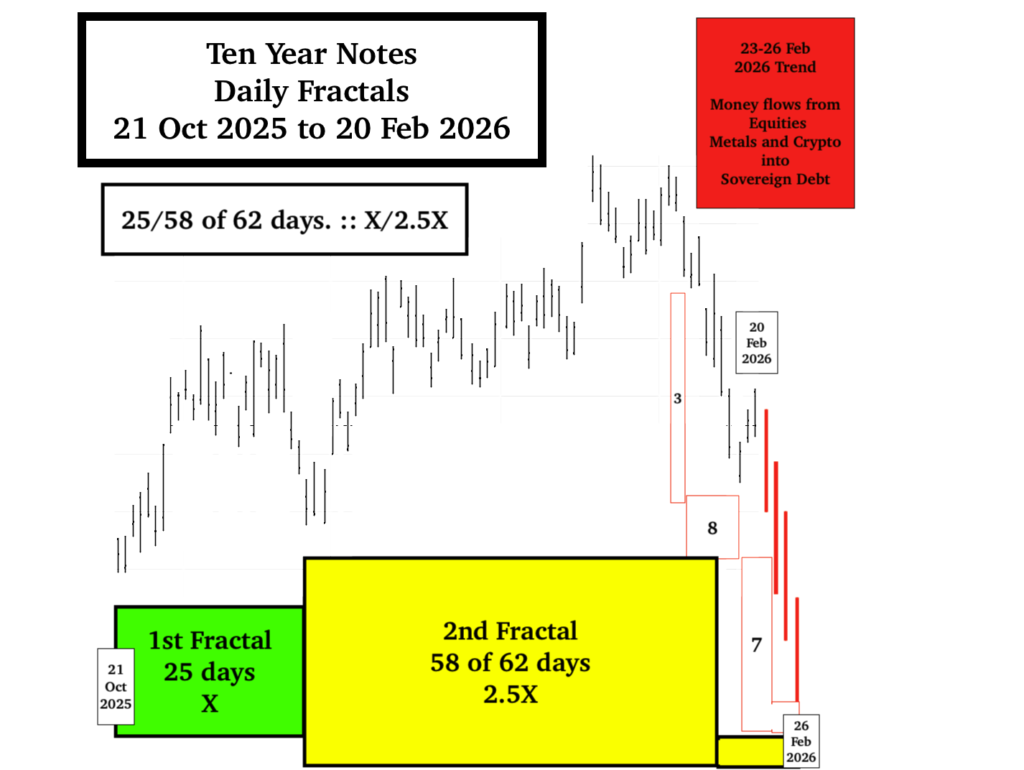

From the 7 April 2025 nadir, a 3-phase 53/107/65 day :: x/2-2.5x/x + growth series is observable with a 25 Feb 2026 peak valuation. This completes a 3 Phase 27 Oct 2023 120/243/223 day :: X/2-2.5X/2-2.5X’ growth series where X’ represents the ideal 1st fractal time period of 243 divided by 2.5 or 97 days. A 4 phase fractal decay series of 33-34 days from the ACWI 25 Feb 2026 peak valuation similar to its 19 Feb 2025 peak valuation decay series of 5/13/12/8 days :: x/2.5x/2-2.5x/1.6X ends in its 1st fractal crash nadir. The 25 Feb 2026 peak growth is efficiently contained in a larger 27 Oct 2023 120/243/257 day :: y/2-2.5y/2-2.5y decay fractal series as shown below.

In the above 3rd 223 day 7 April 2025 to 25 Feb 2026 fractal (of the 27 Oct 2023 120/143/223 day 3 phase fractal growth series), a 4 phase decay series occurs from peak 2nd subfractal growth in the 62 day and 47 day respective 107 and 65 day 2nd and 3rd fractal series. See below:

The above Not to (time) Scale 33-34 day 4 phase Decay Fractal series represents the initial 1st fractal crash series of the 1982 to 2026 13/33 year :: 1st and 2nd fractal series which is an interpolated series within a larger US hegemonic 4 phase 1807 36/90/90/ 54-57 year :: x/2.5x/2.5x/1.5-1.6x fractal series with commodity/equity valuation 1st 2nd and 4th fractal nadirs in 1842-43, 1932, and 2074-77 and a 90 year 3rd fractal peak valuation peak in Nov 2021. US 15%,11%, and 5-8% peacetime deficit to GDP annual spending in 2020- 2026 and recent AI private debt investment have propelled global composite equity valuations to a 25 Feb 2026 peak valuation.

The Iran war and its ramifications will exacerbate the asset debt system’s natural deterministic collapse.